In two more days, EPF’s Account 3 will go live.

Everyone below the age of 55 will have their funds restructured.

There is no opting out.

Here are a few things you should know about.

Everyone below the age of 55 will have their funds restructured.

There is no opting out.

Here are a few things you should know about.

1. Can I choose not to have any money credited to Account 3?

No.

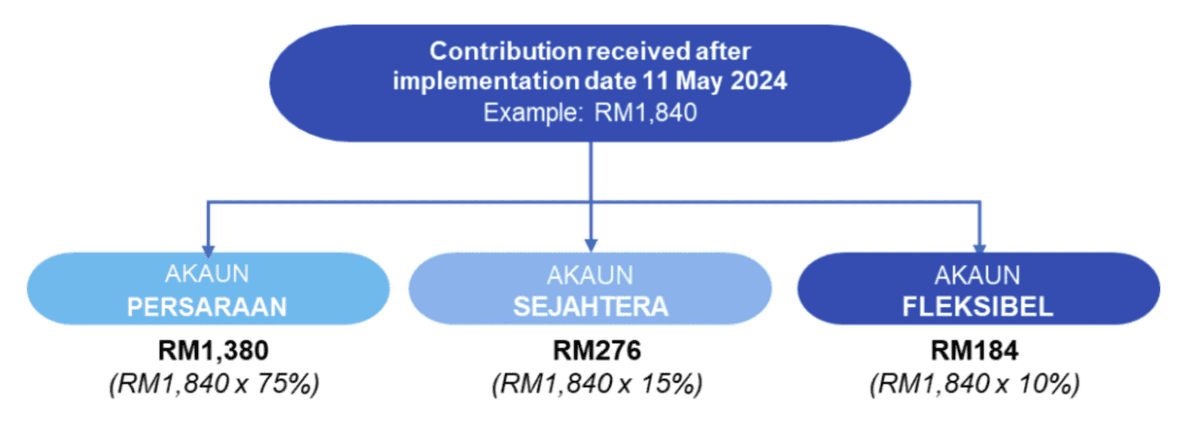

Starting 11 May, 10% of your monthly contributions will be distributed to Akaun Fleksibel.

This is regardless of whether you choose to do so or not.

No.

Starting 11 May, 10% of your monthly contributions will be distributed to Akaun Fleksibel.

This is regardless of whether you choose to do so or not.

2. Will Account 3 start from zero?

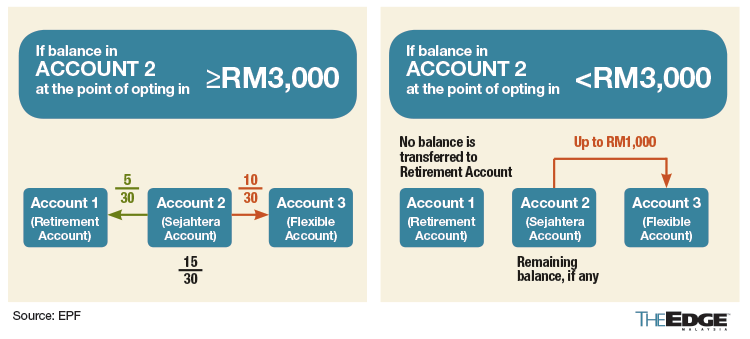

It depends on what you choose.

From 12 May to 31 Aug, you will have a one-time option to transfer some savings from Acc 2 to Acc 3.

This action cannot be cancelled once completed.

The transferrable amount depends on the balance in Account 2.

If you choose not to transfer, then Acc 3 will start from zero.

It depends on what you choose.

From 12 May to 31 Aug, you will have a one-time option to transfer some savings from Acc 2 to Acc 3.

This action cannot be cancelled once completed.

The transferrable amount depends on the balance in Account 2.

If you choose not to transfer, then Acc 3 will start from zero.

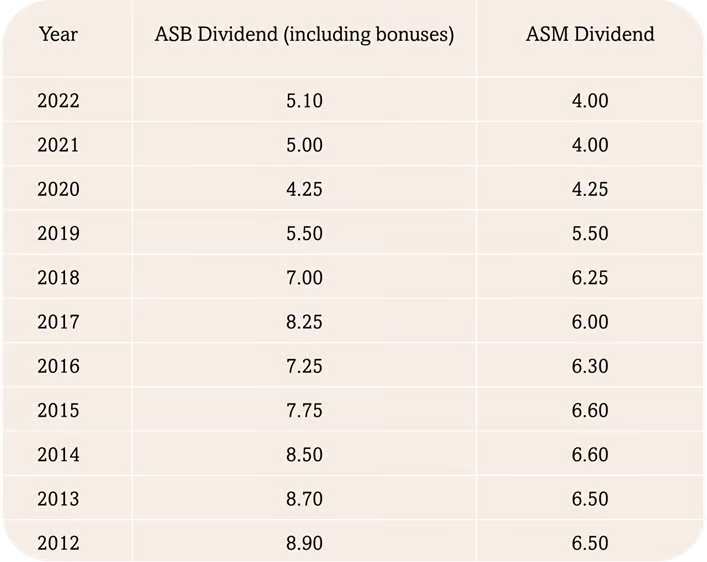

3. Will Account 3’s dividend rate be lower?

No.

EPF has confirmed that the dividend will be the same across all accounts.

No.

EPF has confirmed that the dividend will be the same across all accounts.

https://x.com/TheFuturizts/status/1783691549794341202

4. Are there any conditions to withdraw from Account 3?

No.

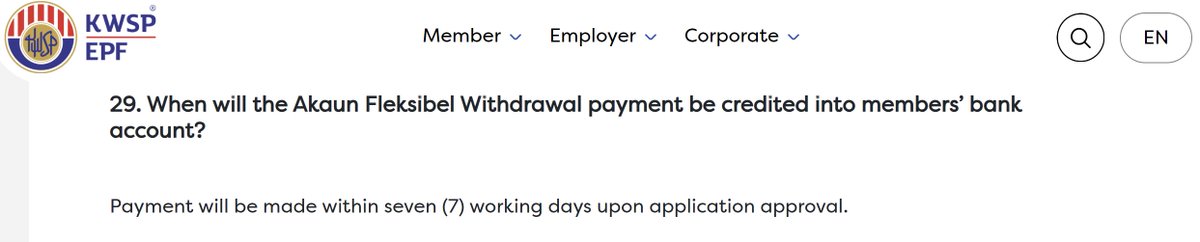

You can withdraw from this account any time, with the minimum amount at RM50.

No supporting documents are required.

Funds will arrive in your specified bank account within 7 business days.

No.

You can withdraw from this account any time, with the minimum amount at RM50.

No supporting documents are required.

Funds will arrive in your specified bank account within 7 business days.

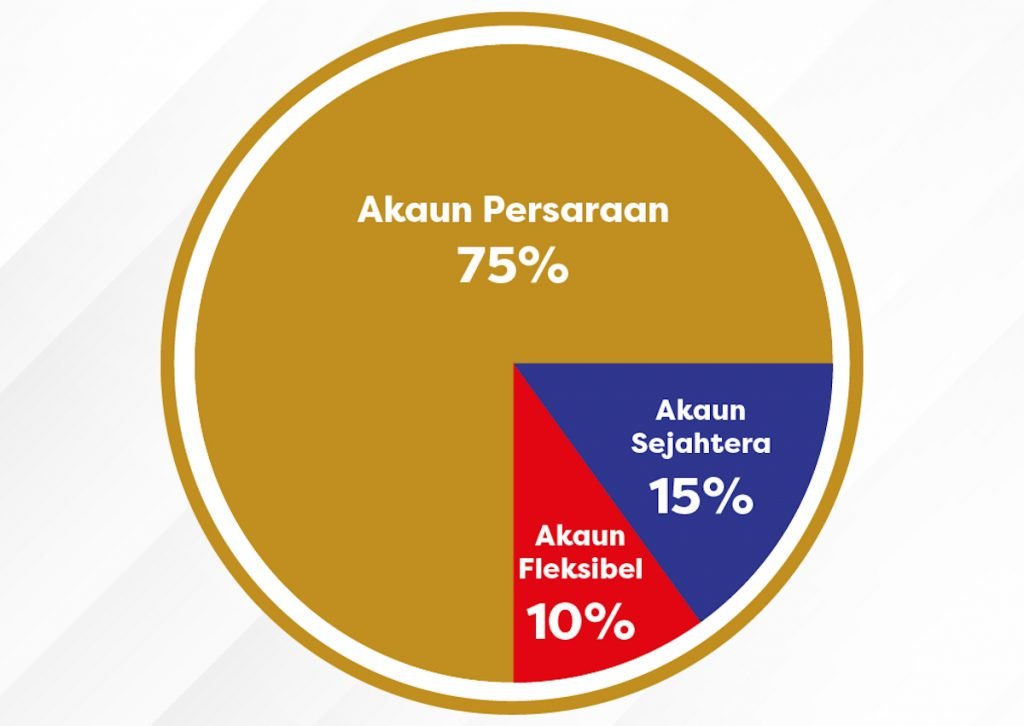

5. Can I choose a specific account to voluntarily contribute?

Nope.

Voluntary contributions will be split into the 75/15/10 ratio.

Eg. You decide to add an extra RM1,000 to your EPF savings this year:

• RM750 ➡️ Account 1 (cannot be withdrawn until 55).

• RM150 ➡️ Account 2 (can be withdrawn for education, housing loan, etc.).

• RM100 ➡️ Account 3 (can be withdrawn anytime).

Nope.

Voluntary contributions will be split into the 75/15/10 ratio.

Eg. You decide to add an extra RM1,000 to your EPF savings this year:

• RM750 ➡️ Account 1 (cannot be withdrawn until 55).

• RM150 ➡️ Account 2 (can be withdrawn for education, housing loan, etc.).

• RM100 ➡️ Account 3 (can be withdrawn anytime).

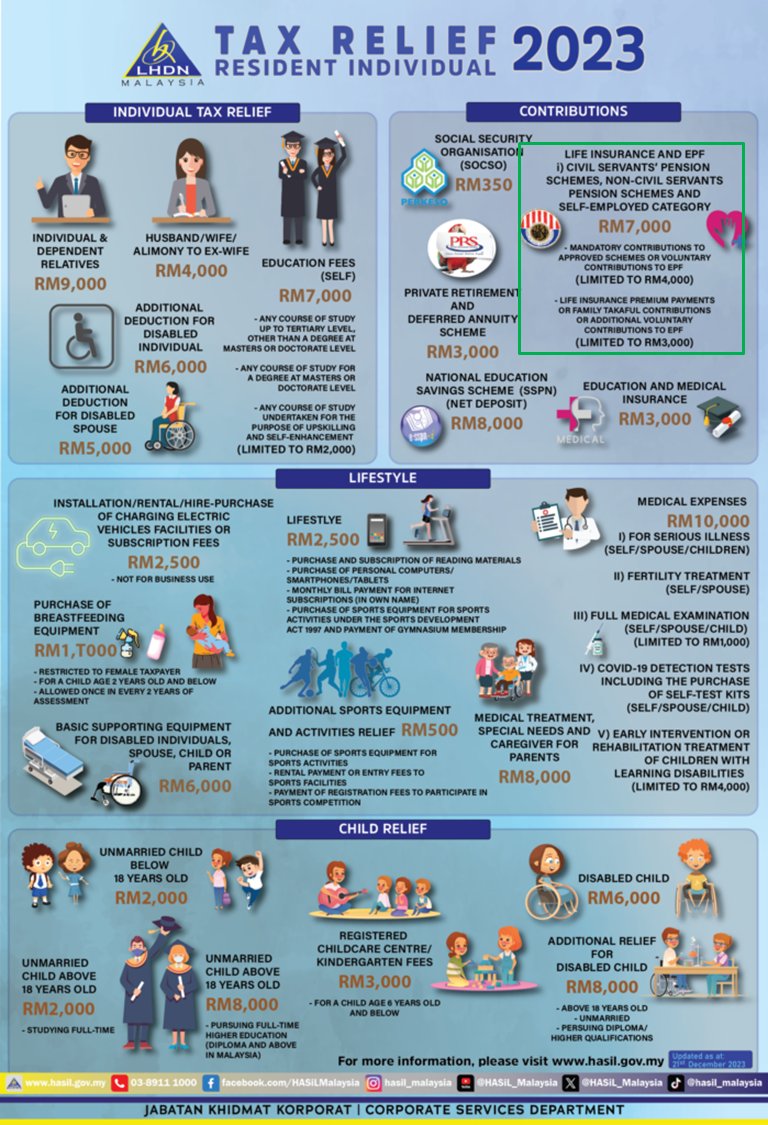

FYI, you can voluntarily contribute up to RM100,000 to EPF every year.

Contributions (up to a certain limit) are also tax deductible.

This is assuming LHDN extends this relief for YA2024.

Contributions (up to a certain limit) are also tax deductible.

This is assuming LHDN extends this relief for YA2024.

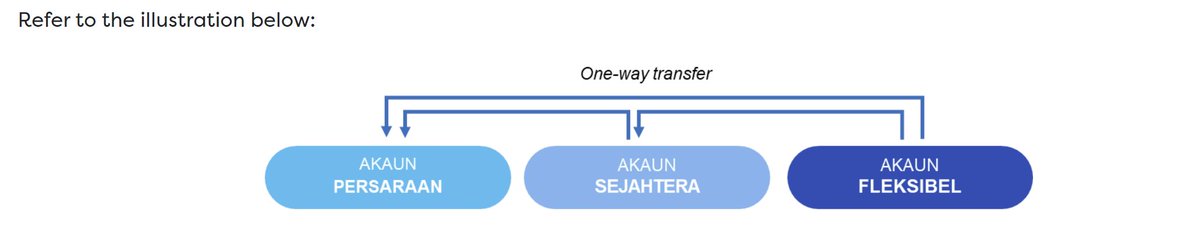

6. Can I transfer my savings from Account 3 to Account 1 and 2?

Yes, but this is a one way transfer.

Once completed, the funds and cannot be reversed back into the original account.

There is no limit on the amount that can be transferred between accounts.

Yes, but this is a one way transfer.

Once completed, the funds and cannot be reversed back into the original account.

There is no limit on the amount that can be transferred between accounts.

Refer to EPF's in-depth FAQs for more info:

kwsp.gov.my/account-restru…

kwsp.gov.my/account-restru…

How will Account 3 impact your retirement?

Along with financial experts Hann and Sani, we discuss what it really means for you.

Listen to the full discussion on Spotify:

open.spotify.com/episode/1fkOmR…

Along with financial experts Hann and Sani, we discuss what it really means for you.

Listen to the full discussion on Spotify:

open.spotify.com/episode/1fkOmR…

Thanks for reading!

If you learned something, follow us @TheFuturizts to stay updated on all things finance.

Something else that may interest you:

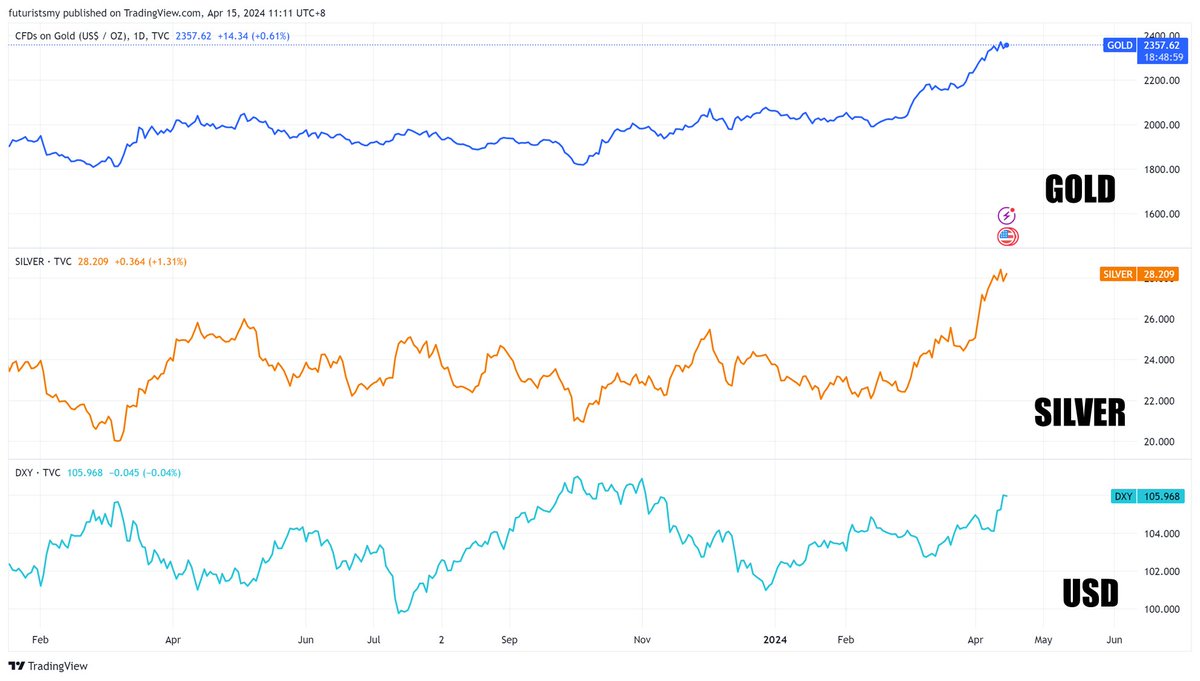

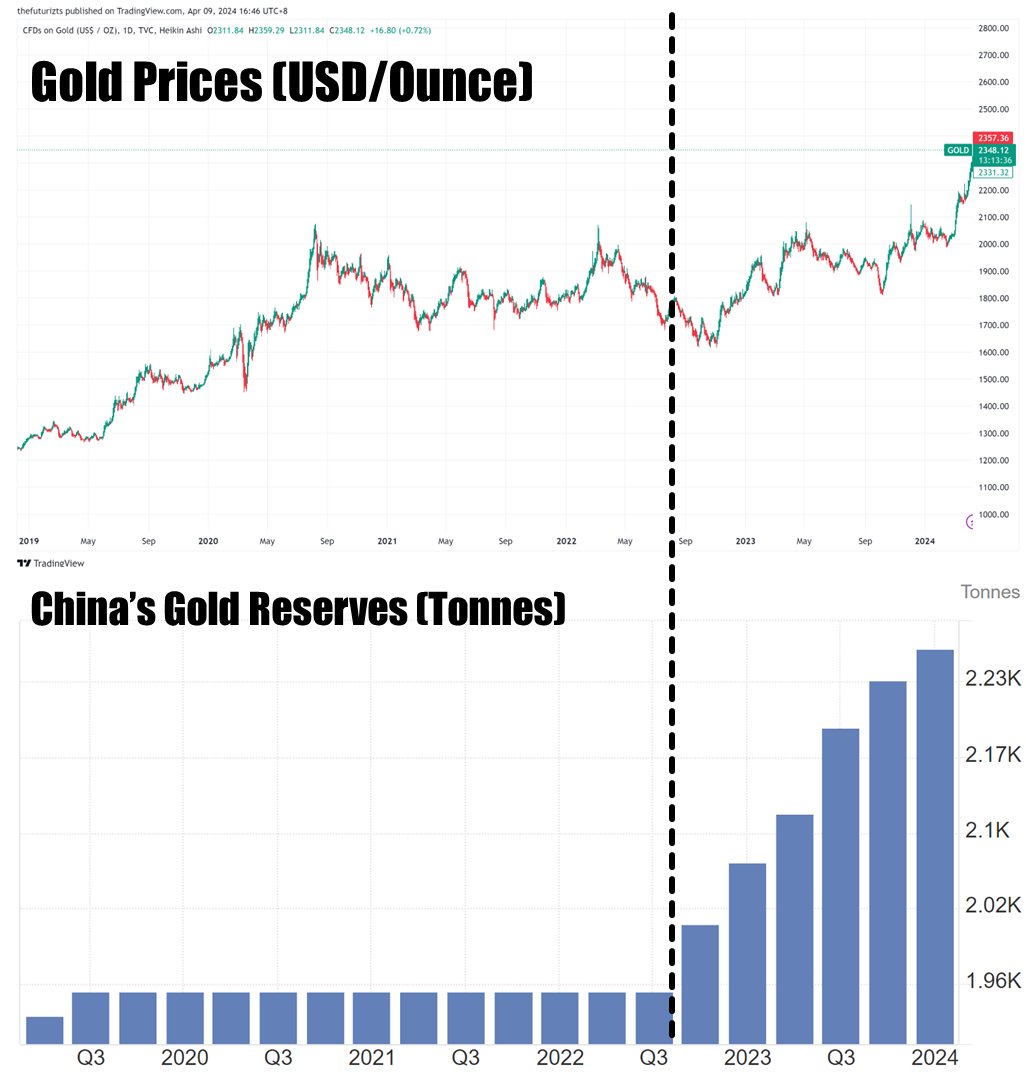

thefuturizts.beehiiv.com/p/ringgit-weak

If you learned something, follow us @TheFuturizts to stay updated on all things finance.

Something else that may interest you:

thefuturizts.beehiiv.com/p/ringgit-weak

• • •

Missing some Tweet in this thread? You can try to

force a refresh