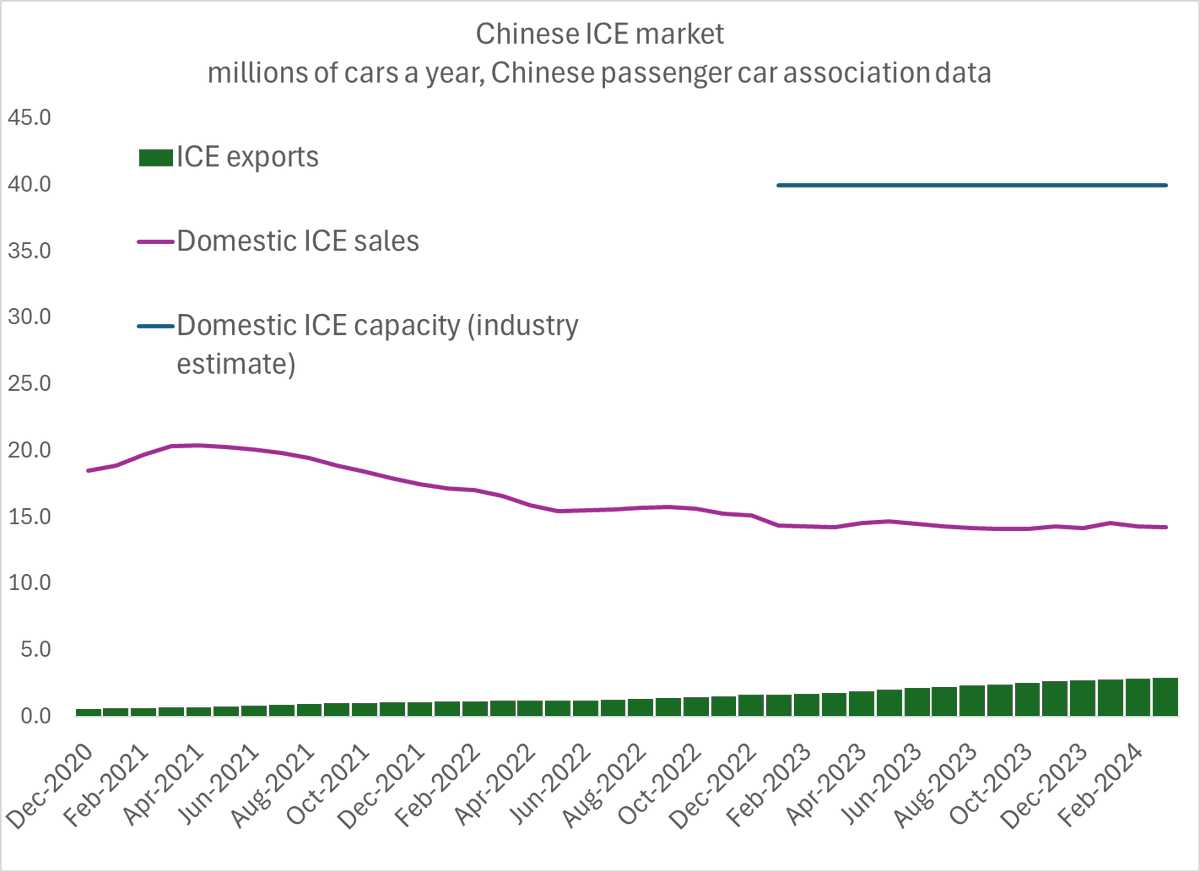

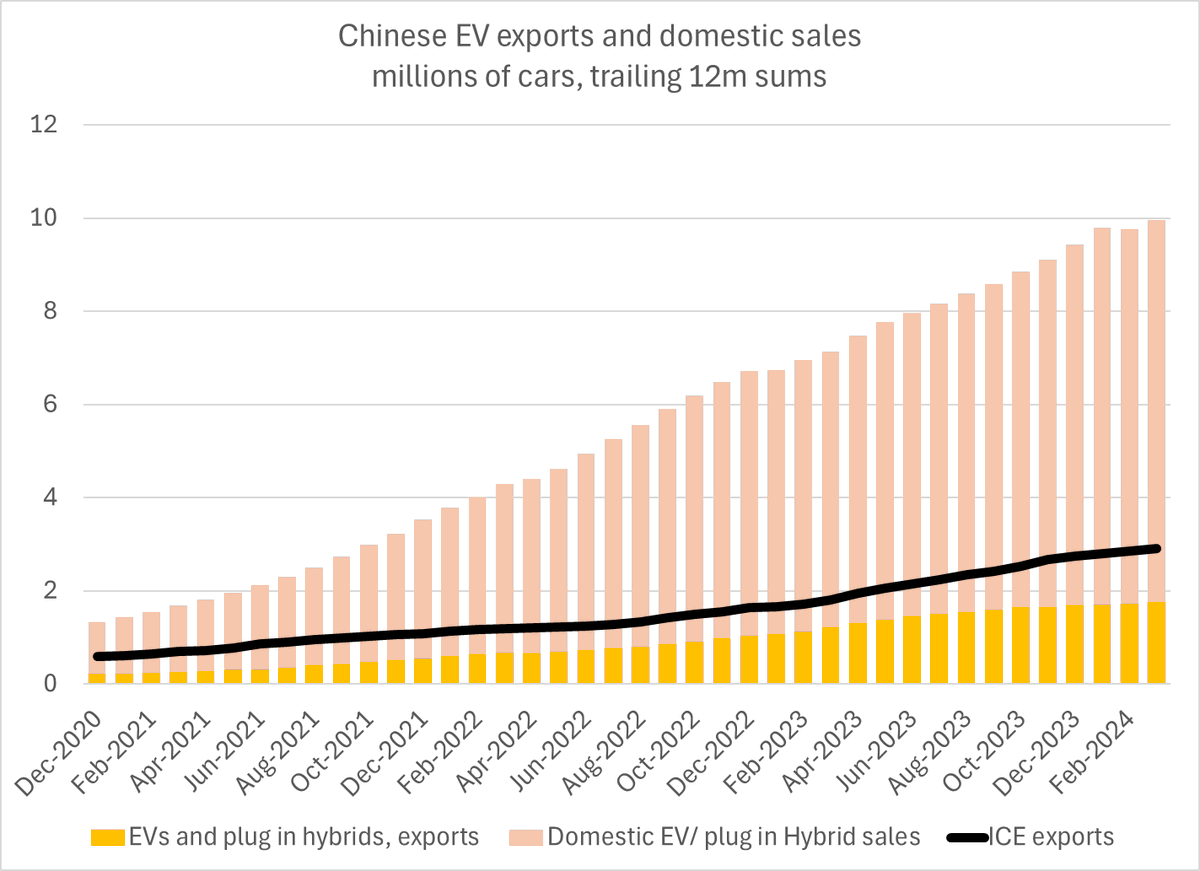

EVs tend to get all the attention. But the bulk of China's vehicle exports are traditional internal combustion engine cars. And that is where the is clear overcapacity (WSJ reports 40 m in capacity v 15m and falling domestic sales)

1/

1/

there were concerns (see Keith Bradsher) about overcapacity in China's ICE sector even before EVs took off. Total car demand is now under 25m and it was never over 30m in a sustained way, but folks built for a much higher number. Now supply is potentially basically elastic

2/

2/

EVs are a bit different -- China made 10m EVs over the last 12ms (over 8 m for the domestic market, just under 2m for export) and most factories are producing close to all out.

But there is also a price and feature going on ...

3/

But there is also a price and feature going on ...

3/

That is part because firms like Zhido are resurrected from the dead with subsidies and are now adding to capacity --

(Zhido got support from the authorities in Gansu, Three Gorges, and Geely)

4/

wsj.com/business/autos…

(Zhido got support from the authorities in Gansu, Three Gorges, and Geely)

4/

wsj.com/business/autos…

China auto exports were constrained by a shortage of auto ships last year, but capacity is being added there & with global EV prices well above domestic EV prices in a crowded market, Chinese quality EV producers have a big incentive to export (making global supply elastic)

5/

5/

There isn't a consensus estimate that I know of Chinese auto production capacity (EVs + ICEs). tis clearly over 40 and under 50m autos a year (a huge number).

Which means China already has the capacity to export more than 4-5m passenger cars a year ...

6/

Which means China already has the capacity to export more than 4-5m passenger cars a year ...

6/

Would be most interested if @KeithBradsher or the WSJ reporters on the ground would be able to get a good estimate of projected EV capacity by the end of 24 and the end of 25 (along side ICE capacity and some estimate of ICE to EV capacity conversions) ...

7/

7/

@KeithBradsher But from a global point of view, the key point is that there is no limit -- other than perhaps the ability to transport autos by ship -- that prevents China from moving from 5m passenger car exports a year to 10 ...

8/8nytimes.com/2023/09/06/bus…

8/8nytimes.com/2023/09/06/bus…

p.s. estimate of China having 40m in ICE capacity comes from Bradsher/ NYT not WSJ.

"China has more than 100 factories with the capacity to build close to 40 million internal combustion engine cars a year."

nytimes.com/2024/04/23/bus…

"China has more than 100 factories with the capacity to build close to 40 million internal combustion engine cars a year."

nytimes.com/2024/04/23/bus…

• • •

Missing some Tweet in this thread? You can try to

force a refresh