Thrilled to share our latest work with @AdrienBilal! Check out our new working paper:

𝗧𝗵𝗲 𝗠𝗮𝗰𝗿𝗼𝗲𝗰𝗼𝗻𝗼𝗺𝗶𝗰 𝗜𝗺𝗽𝗮𝗰𝘁 𝗼𝗳 𝗖𝗹𝗶𝗺𝗮𝘁𝗲 𝗖𝗵𝗮𝗻𝗴𝗲: 𝗚𝗹𝗼𝗯𝗮𝗹 𝘃𝘀. 𝗟𝗼𝗰𝗮𝗹 𝗧𝗲𝗺𝗽𝗲𝗿𝗮𝘁𝘂𝗿𝗲

Read here:

Thread below👇 bit.ly/4bsxvU0

𝗧𝗵𝗲 𝗠𝗮𝗰𝗿𝗼𝗲𝗰𝗼𝗻𝗼𝗺𝗶𝗰 𝗜𝗺𝗽𝗮𝗰𝘁 𝗼𝗳 𝗖𝗹𝗶𝗺𝗮𝘁𝗲 𝗖𝗵𝗮𝗻𝗴𝗲: 𝗚𝗹𝗼𝗯𝗮𝗹 𝘃𝘀. 𝗟𝗼𝗰𝗮𝗹 𝗧𝗲𝗺𝗽𝗲𝗿𝗮𝘁𝘂𝗿𝗲

Read here:

Thread below👇 bit.ly/4bsxvU0

𝗠𝗼𝘁𝗶𝘃𝗮𝘁𝗶𝗼𝗻: Climate change is often portrayed as an existential threat, posing significant risks to our lives, livelihoods and the global economy.

Yet, empirical estimates using historical temperature variation imply small damages, ~1-3% GDP loss per 1°C.

Yet, empirical estimates using historical temperature variation imply small damages, ~1-3% GDP loss per 1°C.

The existing literature focuses on 𝘸𝘪𝘵𝘩𝘪𝘯-𝘤𝘰𝘶𝘯𝘵𝘳𝘺, 𝘭𝘰𝘤𝘢𝘭 temperature variation in panel.

Are the economic consequences of climate change truly so small? Or is local temperature an incomplete representation of climate change?

Are the economic consequences of climate change truly so small? Or is local temperature an incomplete representation of climate change?

We build on the shoulders of giants that have pioneered credible identification of the effects of temperature changes @MelissaLDell @bfjo @Ben_Olken @MarshallBBurke @tedmiguel Solomon Hsiang

But propose a new focus: 𝘁𝗶𝗺𝗲-𝘀𝗲𝗿𝗶𝗲𝘀 variation in 𝗴𝗹𝗼𝗯𝗮𝗹 temperature

But propose a new focus: 𝘁𝗶𝗺𝗲-𝘀𝗲𝗿𝗶𝗲𝘀 variation in 𝗴𝗹𝗼𝗯𝗮𝗹 temperature

Idea: Climate change originates with a rise in global temperature, which affects the Earth’s climate system as a whole, influencing the frequency, intensity and distribution of extreme climatic events.

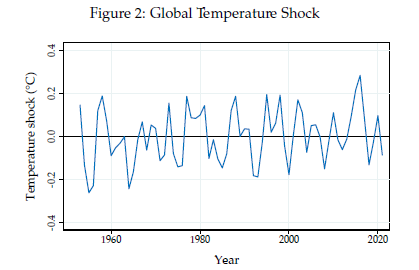

𝗜𝗱𝗲𝗻𝘁𝗶𝗳𝗶𝗰𝗮𝘁𝗶𝗼𝗻: Construct global temperature shocks as transient component in global temperature using Hamilton filter.

Captures external&internal climate variability such as Solar cycles or El Niño events

Captures external&internal climate variability such as Solar cycles or El Niño events

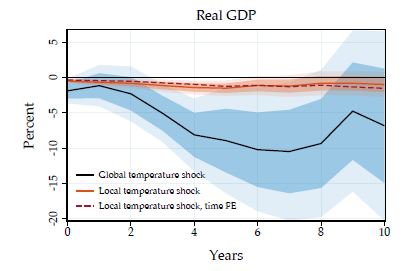

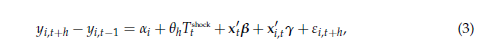

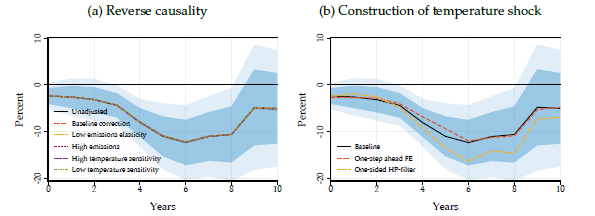

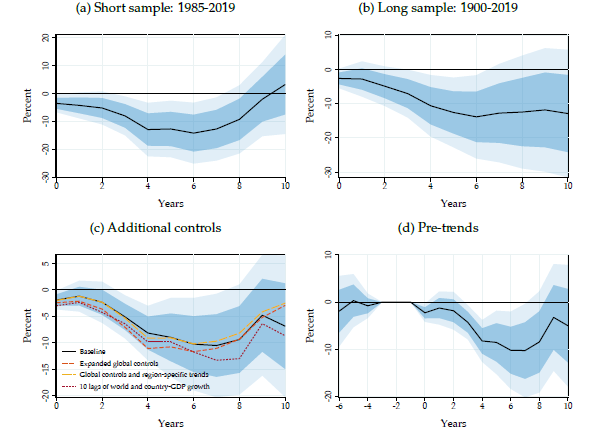

Estimate dynamic causal effects of global temperature shocks on real GDP using local projections.

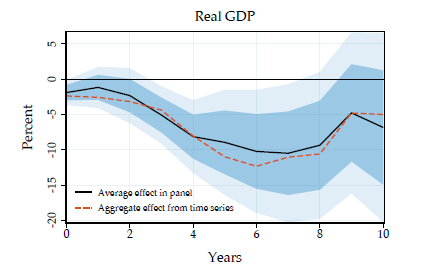

We include rich set of country-specific and global controls to account for confounding factors. As robustness, we also formally account for reverse causality threats.

We include rich set of country-specific and global controls to account for confounding factors. As robustness, we also formally account for reverse causality threats.

𝗠𝗮𝗶𝗻 𝗿𝗲𝘀𝘂𝗹𝘁: A 1°C increase in global temperature leads to a 12% decline in world GDP. The response is highly statistically significant and persistent.

The impact turns out to be robust:

-Time-series and panel estimates very similar

-Robust to construction of shock

-Robust to sample period

-Robust to controls included/accounting for reverse causality

-Time-series and panel estimates very similar

-Robust to construction of shock

-Robust to sample period

-Robust to controls included/accounting for reverse causality

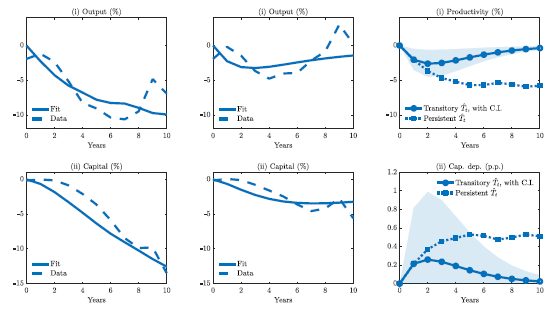

𝗠𝗲𝗰𝗵𝗮𝗻𝗶𝘀𝗺: Global temperature shocks predict strong rise in damaging extreme events. From Deschênes-Greenstone 2011; Hsiang-Jina 2014 we know that such events are associated with substantial economic damages.

The impact of local shocks on extreme events is much weaker

The impact of local shocks on extreme events is much weaker

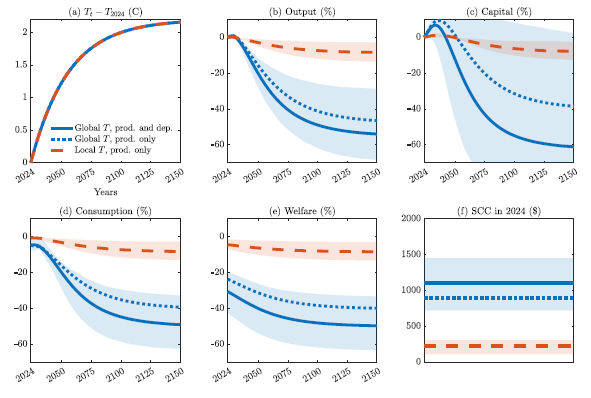

𝗦𝗖𝗖 𝗮𝗻𝗱 𝘄𝗲𝗹𝗳𝗮𝗿𝗲: We use our reduced-form impacts to estimate structural damage functions in IAM and quantify the social cost of carbon and welfare cost of climate change.

Consistent with the potential damages of storms, we allow for productivity and capital damages

Consistent with the potential damages of storms, we allow for productivity and capital damages

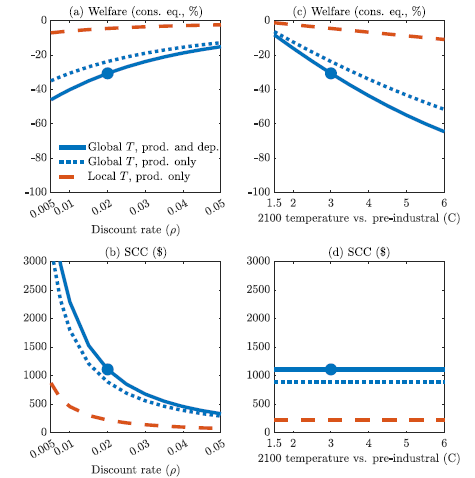

Our results imply a SCC of $1,056 per ton of carbon dioxide vs. $151/tCO2 when we estimate the model on local temperature shocks.

A business-as-usual warming scenario leads to a present value welfare loss of 31%. Both are multiple orders of magnitude above previous estimates.

A business-as-usual warming scenario leads to a present value welfare loss of 31%. Both are multiple orders of magnitude above previous estimates.

Magnitudes are robust wrt warming scenario and discount rates. Even under moderate warming of 2°C or large discount rate of 4% we find substantial economic impacts.

𝗣𝗼𝗹𝗶𝗰𝘆 𝗶𝗺𝗽𝗹𝗶𝗰𝗮𝘁𝗶𝗼𝗻𝘀: Our results have important policy implications. Unilateral decarbonization policy is not cost-effective under existing estimates of domestic cost of carbon.

Our estimates reverse this trade-off: Unilateral decarbonization policies become optimal for large countries such as the United States.

Thanks for reading. Comments and feedback very much welcome!

NBER WP :

Ungated: bit.ly/4bsxvU0

dkaenzig.github.io/diegokaenzig.c…

NBER WP :

Ungated: bit.ly/4bsxvU0

dkaenzig.github.io/diegokaenzig.c…

#ClimateChange #Macroeconomics #Damages #EconTwitter

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh