VCs hate memecoins but I will explain why there’s no difference between memecoins and governance tokens.

Governance tokens are just memecoins dressed in a suit. Mega thread 🧵

Governance tokens are just memecoins dressed in a suit. Mega thread 🧵

1/ [Chapter 1]: Governance Tokens are Memecoins w/ extra steps.

All governance tokens are essentially memecoins, valued by the memetic provenance of the protocol. Why?

- No revenue sharing (due to security laws)

- Governance tokens don't work well in a community-oriented decision-making framework.

All governance tokens are essentially memecoins, valued by the memetic provenance of the protocol. Why?

- No revenue sharing (due to security laws)

- Governance tokens don't work well in a community-oriented decision-making framework.

2/ Holding tends to be concentrated, and there’s apathy in participation or DAOs are generally dysfunctional — rendering them as useful as memecoins.

Whether it’s ARB (Arbitrum’s governance token) or WLD (Worldcoin’s token) — they are essentially memecoins attached to those projects.

Whether it’s ARB (Arbitrum’s governance token) or WLD (Worldcoin’s token) — they are essentially memecoins attached to those projects.

3/ Governance tokens can in many cases cause as much harm as memecoins for:

1️⃣ Community: Most governance tokens are VC-backed coins launched at high valuations and gradually offloaded onto retail investors.

1️⃣ Community: Most governance tokens are VC-backed coins launched at high valuations and gradually offloaded onto retail investors.

4/

2️⃣ Builders: Many big-name VC-backed governance tokens launch (eg. Zeus launching at $1 billion FDV) before the product creating significant disillusionment. Whereas many founders struggle to attain such a valuation even after achieving significant traction.

Not to say Zeus won’t succeed but simply to point out that it is routine for tokens to launch before a product.

2️⃣ Builders: Many big-name VC-backed governance tokens launch (eg. Zeus launching at $1 billion FDV) before the product creating significant disillusionment. Whereas many founders struggle to attain such a valuation even after achieving significant traction.

Not to say Zeus won’t succeed but simply to point out that it is routine for tokens to launch before a product.

5/ Even the 2017 ICOs were preferable to the current VC-backed low float tokens, as they were much fairer, with most of the supply unlocked at launch.

6/ Taking the case of EigenLayer –– typical low float, high FDV play backed by VCs who own 29.5%

The insiders (VCs and team) hold a sizeable chunk of 55%. Last cycle, we blamed FTX/Alameda, but this cycle we’re no better.

The insiders (VCs and team) hold a sizeable chunk of 55%. Last cycle, we blamed FTX/Alameda, but this cycle we’re no better.

7/ If a group of insiders is taking > 50%, we are seriously hindering the redistributive effects of crypto and making insiders insanely rich with high FDV launches.

If the insiders truly believe, they are better off taking far less allocation, given high FDV token launches.

If the insiders truly believe, they are better off taking far less allocation, given high FDV token launches.

8/ [Chapter 2]: Will the real Cabal please stand up?

Given the absurdity of the capital formation process — we end up with:

- VCs blaming meme coins

- Memers blaming VCs

for leading the space through a muck of regulatory confusion & reputational hazard among serious builders.

Given the absurdity of the capital formation process — we end up with:

- VCs blaming meme coins

- Memers blaming VCs

for leading the space through a muck of regulatory confusion & reputational hazard among serious builders.

9/ But why are VCs so detrimental to the token?

There is a structural reason for VCs to inflate FDV.

Let’s say a big VC fund invests $4 million for 20% at $20 million; logically, they would have to pump the FDV to at least $400 million at TGE to make it lucrative for LPs.

There is a structural reason for VCs to inflate FDV.

Let’s say a big VC fund invests $4 million for 20% at $20 million; logically, they would have to pump the FDV to at least $400 million at TGE to make it lucrative for LPs.

10/ The bigger the fund, the more likely they are to give projects:

An absurdly high private valuation → build a strong narrative → raise rounds at higher valuations (marks up pre-seed/seed investors’ bags) → launch at much higher public valuations → dump on retail.

An absurdly high private valuation → build a strong narrative → raise rounds at higher valuations (marks up pre-seed/seed investors’ bags) → launch at much higher public valuations → dump on retail.

11/

1️⃣ Launching at a high FDV just results in a downward spiral and zero mindshare. Study Starkware.

2️⃣ Launching at a lower FDV allows retail to profit from the repricing and helps form community and mindshare. Study Celestia.

1️⃣ Launching at a high FDV just results in a downward spiral and zero mindshare. Study Starkware.

2️⃣ Launching at a lower FDV allows retail to profit from the repricing and helps form community and mindshare. Study Celestia.

12/ Retail is more unlock-sensitive than ever.

In May alone, $1.25 billion of Pyth will get unlocked along with hundreds of millions from Avalanche, Aptos, Arbitrum, and more. [Check @Token_Unlocks]

In May alone, $1.25 billion of Pyth will get unlocked along with hundreds of millions from Avalanche, Aptos, Arbitrum, and more. [Check @Token_Unlocks]

13/ [Chapter 3]: Memecoins are the result of a broken financial system. (eg. Bitcoin after the financial crisis)

The negative/zeo real rates forced every saver to speculate on new shiny asset classes (e.g., memecoins). The zero-rate environment created markets stuffed with zombie firms.

The negative/zeo real rates forced every saver to speculate on new shiny asset classes (e.g., memecoins). The zero-rate environment created markets stuffed with zombie firms.

14/ Even the top indexes like the S&P 500 have ~5% zombie firms, and with rising interest rates now, they are about to get worse, making them no better than memecoins.

What’s worse? They have been pitched by fund managers, and retail keeps buying them every month.

Study GME.

What’s worse? They have been pitched by fund managers, and retail keeps buying them every month.

Study GME.

15/ There’s a reason why speculation never dies. For this cycle, they are memecoins.

Study Financial Nihilism.

Study Financial Nihilism.

16/ [Chapter 4]: Memecoins are battle-testing Infra:

I respectfully disagree with @eddylazzarin's stance. Memecoins have a net positive impact on the network.

Without memecoins, chains like @solana wouldn’t have faced network congestion, and all networking/economic bugs wouldn’t have surfaced.

I respectfully disagree with @eddylazzarin's stance. Memecoins have a net positive impact on the network.

Without memecoins, chains like @solana wouldn’t have faced network congestion, and all networking/economic bugs wouldn’t have surfaced.

17/ Memecoins on Solana have been net positive:

1️⃣ All DEXs have not only processed all-time high volumes but have also surpassed their Ethereum counterparts.

2️⃣ Money markets integrate memecoins to increase TVL.

3️⃣ Validators earn huge fees, thanks to priority fees and MEV.

1️⃣ All DEXs have not only processed all-time high volumes but have also surpassed their Ethereum counterparts.

2️⃣ Money markets integrate memecoins to increase TVL.

3️⃣ Validators earn huge fees, thanks to priority fees and MEV.

18/

4️⃣ Consumer apps integrate memecoins to gain attention or for marketing purposes.

5️⃣ Broader network effects in DeFi due to increased liquidity and activity.

4️⃣ Consumer apps integrate memecoins to gain attention or for marketing purposes.

5️⃣ Broader network effects in DeFi due to increased liquidity and activity.

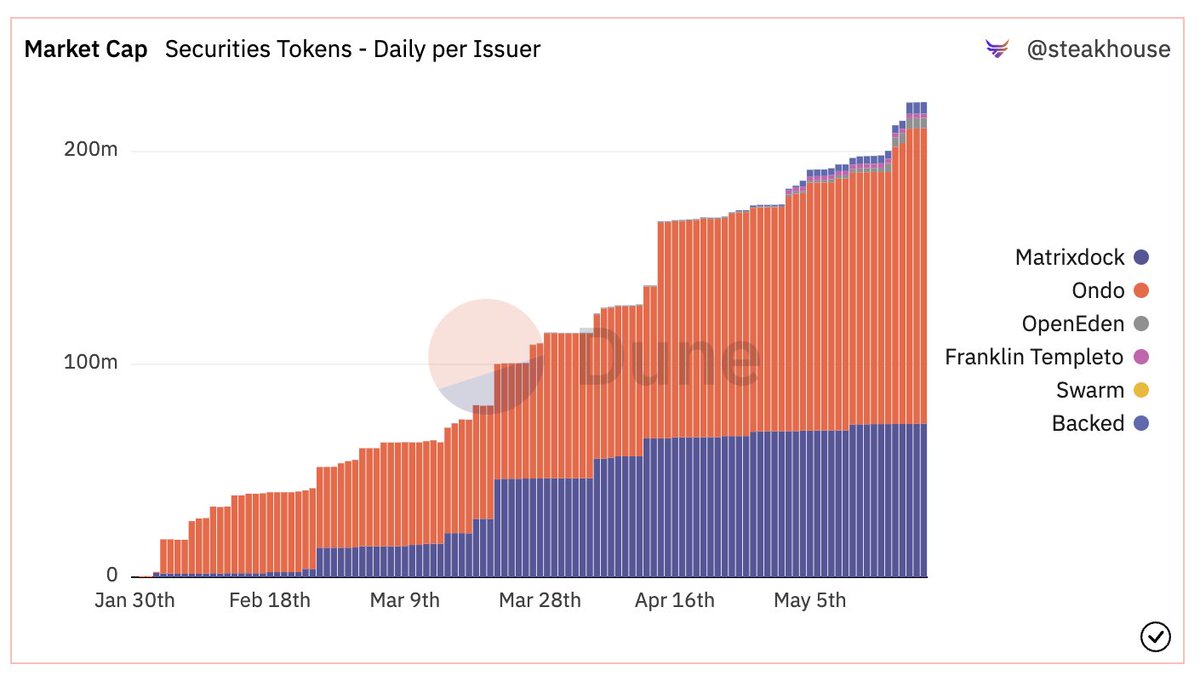

19/ For serious RWAs to trade on-chain, we need stress-tested infra (DEXs/broader DeFi) with liquidity (look at top memecoins; they have the deepest liquidity aside from L1 tokens/stables).

Memecoins aren’t a distraction; they are just another asset class on a shared ledger.

Memecoins aren’t a distraction; they are just another asset class on a shared ledger.

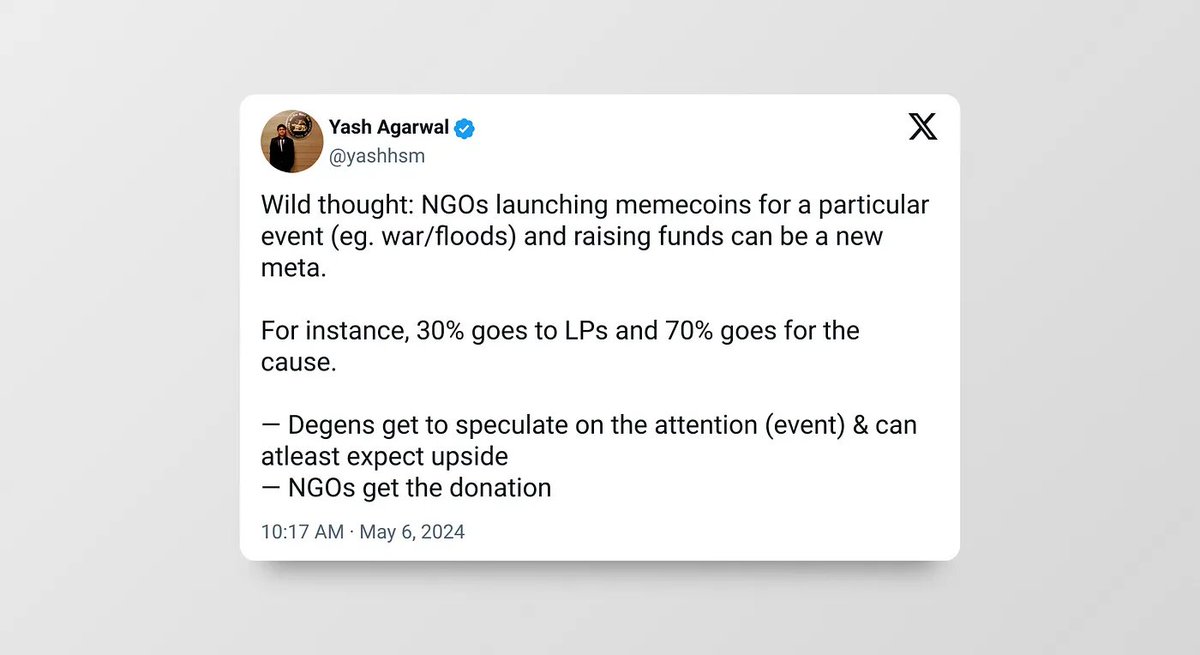

20/ [Chapter 6]: Memecoins as Fundraising Mechanisms

Study @pumpdotfun on Solana. 1000s of memecoins being launched and millions in fees generated daily.

For the first time in human history, anyone can create and participate in a financial asset in <$2 and <2 mins!

Study @pumpdotfun on Solana. 1000s of memecoins being launched and millions in fees generated daily.

For the first time in human history, anyone can create and participate in a financial asset in <$2 and <2 mins!

21/ Mememcoins can serve as an excellent fundraising and GTM strategy.

Traditionally: Projects raised $$ by allocating 15–20% to VCs → developing product → launching the token → building a community through memes/ marketing.

However, the community is eventually abandoned by the VCs.

Traditionally: Projects raised $$ by allocating 15–20% to VCs → developing product → launching the token → building a community through memes/ marketing.

However, the community is eventually abandoned by the VCs.

22/ In the memecoin era:

Lanch memecoin (no roadmap, just for fun) → Raise Capital → Forming a tribalistic community early on → build apps/infrastructure → continually adding utility to the memecoin without making false promises or providing roadmaps.

Lanch memecoin (no roadmap, just for fun) → Raise Capital → Forming a tribalistic community early on → build apps/infrastructure → continually adding utility to the memecoin without making false promises or providing roadmaps.

23/ This approach leverages the tribalism of memecoin communities (bagholder bias), ensuring high engagement from community members who become your BD/marketers.

Ensuring much fairer token distributions, countering the low float high FDV pump and dump tactics employed by VCs.

Ensuring much fairer token distributions, countering the low float high FDV pump and dump tactics employed by VCs.

24/ This trend will eventually lead to the convergence of memecoins and governance tokens:

→ @bonkbot_io, a Telegram bot (peak daily volume of $250M) spawned from the BONK memecoin, burns 10% of the trading fees.

→ @degentokenbase, Farcaster memecoin (now building L3)

→ @bonkbot_io, a Telegram bot (peak daily volume of $250M) spawned from the BONK memecoin, burns 10% of the trading fees.

→ @degentokenbase, Farcaster memecoin (now building L3)

@bonkbot_io @degentokenbase 25/ [Chapter 6] –– Final: What's Ahead?

Everyone wants to be early; memecoins give retail that leverage as compared to slow institutions as access to VC private deals is restricted.

While Memecoins are giving the community power, yes it does make crypto look like a Casino.

Everyone wants to be early; memecoins give retail that leverage as compared to slow institutions as access to VC private deals is restricted.

While Memecoins are giving the community power, yes it does make crypto look like a Casino.

@bonkbot_io @degentokenbase 26/ So, what’s the solution?

To VCs — Put your deals on platforms like @echodotxyz, let the community participate in syndicate deals, and witness the memecoin-like magic of community rallying for projects from their early days.

To VCs — Put your deals on platforms like @echodotxyz, let the community participate in syndicate deals, and witness the memecoin-like magic of community rallying for projects from their early days.

@bonkbot_io @degentokenbase @echodotxyz 27/ To clarify, I am not against VC/private funding; VCs should be rewarded for their early risk-taking.

I am just advocating for fairer distribution; creating a level playing field where everyone has a chance at financial sovereignty.

I am just advocating for fairer distribution; creating a level playing field where everyone has a chance at financial sovereignty.

@bonkbot_io @degentokenbase @echodotxyz 28/ Crypto isn’t just about open and permissionless technology; it’s also about making early-stage financing open, which is currently as opaque as traditional startups.

@bonkbot_io @degentokenbase @echodotxyz 29/ To conclude this massive thread:

1️⃣ Everything is a memecoin.

2️⃣ Study Memecoins as fundraising and community building mechanisms.

3️⃣ Projects should tend towards a more Fair Launch.

It’s time to make early-stage financing more open.

1️⃣ Everything is a memecoin.

2️⃣ Study Memecoins as fundraising and community building mechanisms.

3️⃣ Projects should tend towards a more Fair Launch.

It’s time to make early-stage financing more open.

@bonkbot_io @degentokenbase @echodotxyz 30/ Check the pinned tweet on my profile for my OG article.

RT/QT if you found it insightful 🙏🏻

RT/QT if you found it insightful 🙏🏻

https://x.com/yashhsm/status/1790055210942976420

• • •

Missing some Tweet in this thread? You can try to

force a refresh