One crypto sector is massively underrated:

DePIN.

DePIN is estimated to reach $3.5T by 2028 and is closely related to AI.

Here's your guide to DePIN (+ top projects I'm watching)👇

DePIN.

DePIN is estimated to reach $3.5T by 2028 and is closely related to AI.

Here's your guide to DePIN (+ top projects I'm watching)👇

In this thread, I'll cover:

• What is DePIN

• Why I'm bullish on DePIN

• Top DePIN projects on my watchlist

• What is DePIN

• Why I'm bullish on DePIN

• Top DePIN projects on my watchlist

What is DePIN all about?

DePIN stands for Decentralised Physical Infrastructure Networks.

Protocols from this category essentially operate physical hardware infrastructure in a decentralized way.

To incentivize community participation, they use token reward mechanisms.

DePIN stands for Decentralised Physical Infrastructure Networks.

Protocols from this category essentially operate physical hardware infrastructure in a decentralized way.

To incentivize community participation, they use token reward mechanisms.

Simply put, DePIN empowers people to improve the public infrastructure.

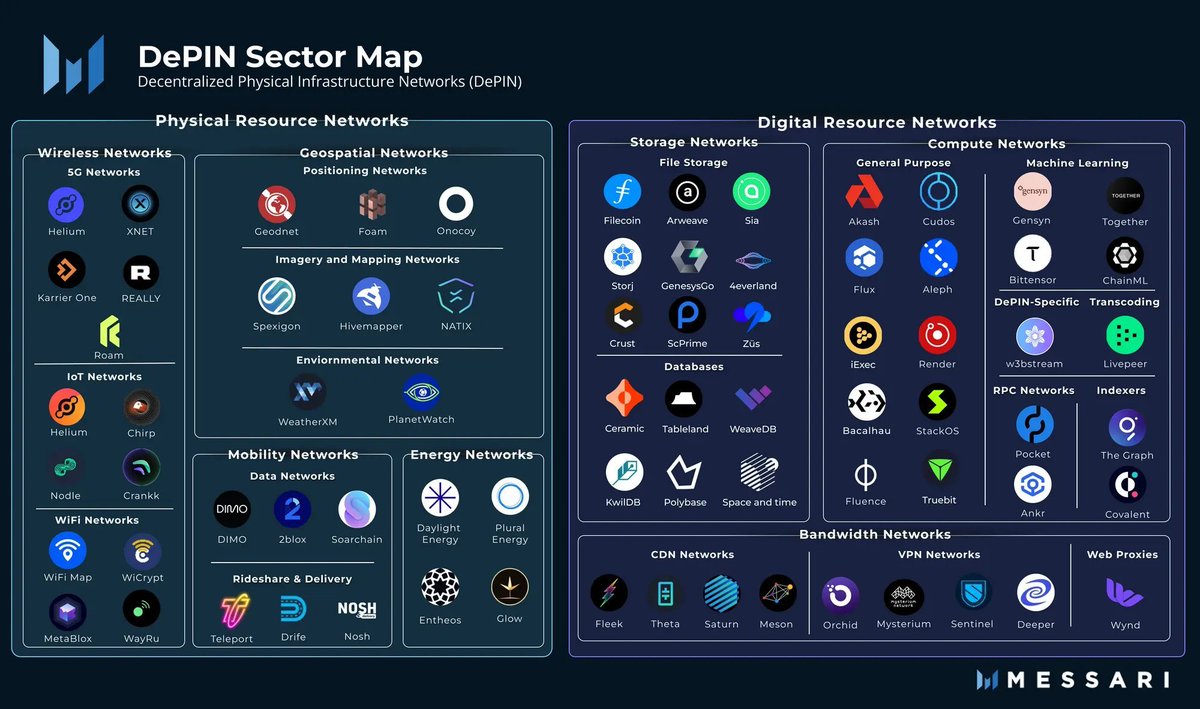

DePIN projects can be grouped into several categories:

Wireless Networks

Compute Networks

Storage Networks

Geospatial Networks

...and the list goes on

DePIN projects can be grouped into several categories:

Wireless Networks

Compute Networks

Storage Networks

Geospatial Networks

...and the list goes on

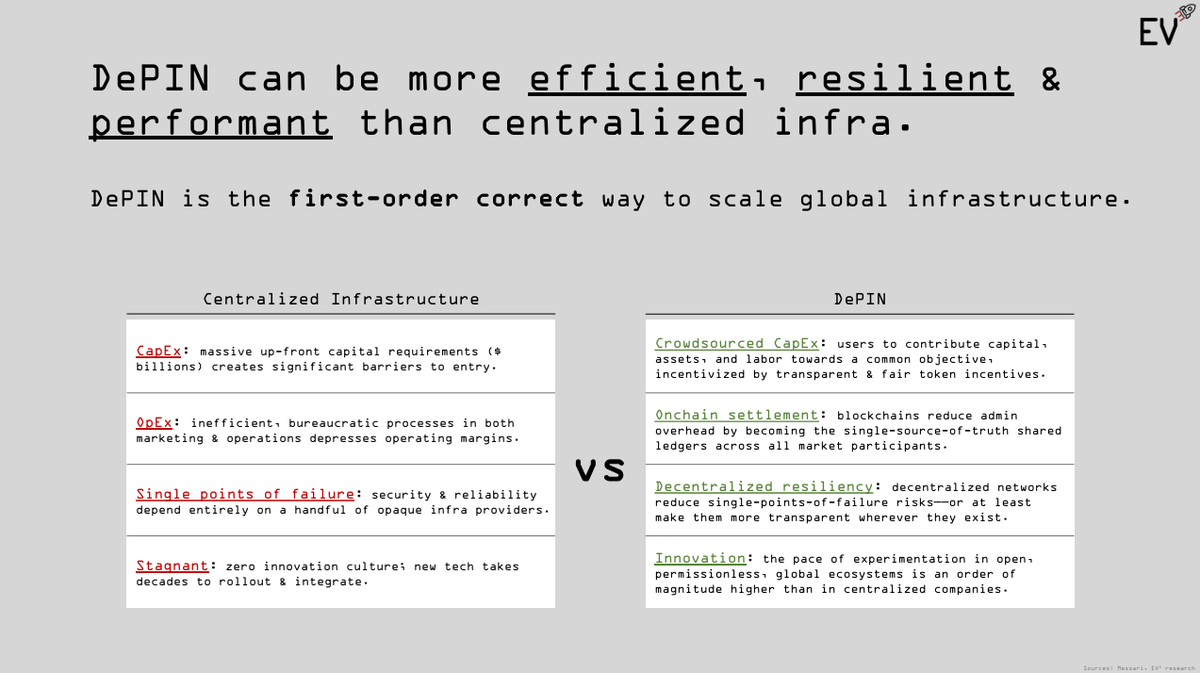

Why I'm bullish on DePIN

DePIN is not just another short-term narrative.

It's a sector that offers better and decentralized alternatives to many highly popular centralized solutions.

For instance, Amazon & Microsoft have over 50% market share in the cloud services industry.

DePIN is not just another short-term narrative.

It's a sector that offers better and decentralized alternatives to many highly popular centralized solutions.

For instance, Amazon & Microsoft have over 50% market share in the cloud services industry.

Their huge market share enables them to set high unfair prices for their services.

Due to the high maintenance costs, small businesses hardly compete with them.

DePIN projects aim to challenge this monopoly by offering more accessible solutions.

Due to the high maintenance costs, small businesses hardly compete with them.

DePIN projects aim to challenge this monopoly by offering more accessible solutions.

Many of those offer massive advantages over the current centralized solutions:

• significantly lower costs

• censorship resistance

• higher security

By using token incentives, the cold start problem that traditional businesses face can be overcome by DePIN projects.

• significantly lower costs

• censorship resistance

• higher security

By using token incentives, the cold start problem that traditional businesses face can be overcome by DePIN projects.

The size of the cloud computing market alone is over $600b.

DePIN has the potential to capture a lot of market share in this market.

With that being said, let's talk about a few of the most interesting DePIN projects:

DePIN has the potential to capture a lot of market share in this market.

With that being said, let's talk about a few of the most interesting DePIN projects:

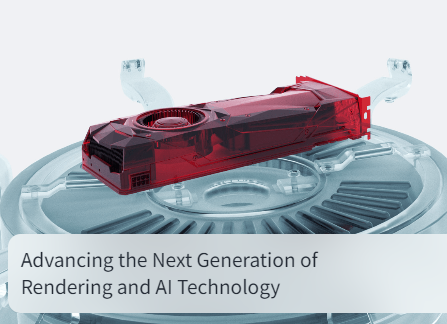

@rendernetwork

Render is a high-performance distributed GPU rendering network.

In short, Render Network allows GPU owners to loan out their GPU power to creators in need of GPU power.

The protocol can also be seen as a solution to render high-quality graphics and train generative AI models.

In comparison with centralized cloud rendering services, Render offers more computing power resources with way lower costs.

Render is a high-performance distributed GPU rendering network.

In short, Render Network allows GPU owners to loan out their GPU power to creators in need of GPU power.

The protocol can also be seen as a solution to render high-quality graphics and train generative AI models.

In comparison with centralized cloud rendering services, Render offers more computing power resources with way lower costs.

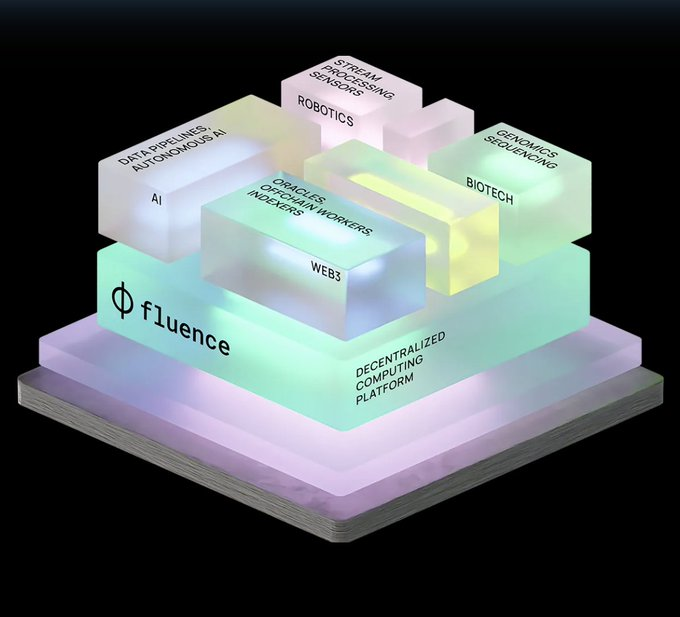

@fluence_project *

Fluence is the first decentralized cloudless computing platform.

It aggregates CPU capacity from data centers worldwide in a resilient platform where these providers compete on price & performance.

By creating a competition of compute providers, the platform enables 60-80% lower prices vs centralized clouds.

Combining this with censorship resistance, Fluence offers a way better alternative than cloud providers like AWS.

Every compute resource and compute job is secured with a $FLT stake to ensure the correctness of job execution.

Interestingly, Fluence is the first protocol that was launched on InterPlanetary Consensus, a scaling technology built by the creators of Protocol Labs, Filecoin & IPFS.

Fluence is the first decentralized cloudless computing platform.

It aggregates CPU capacity from data centers worldwide in a resilient platform where these providers compete on price & performance.

By creating a competition of compute providers, the platform enables 60-80% lower prices vs centralized clouds.

Combining this with censorship resistance, Fluence offers a way better alternative than cloud providers like AWS.

Every compute resource and compute job is secured with a $FLT stake to ensure the correctness of job execution.

Interestingly, Fluence is the first protocol that was launched on InterPlanetary Consensus, a scaling technology built by the creators of Protocol Labs, Filecoin & IPFS.

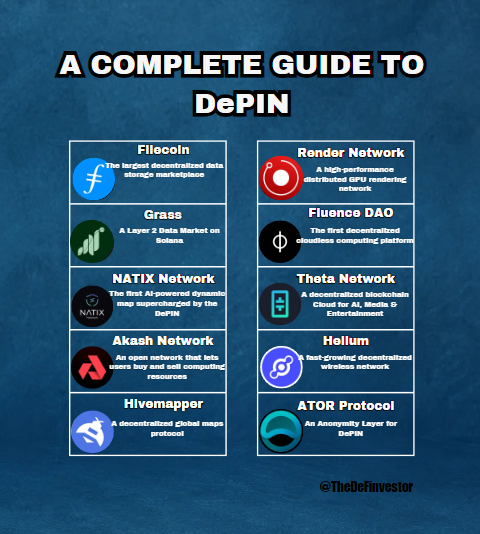

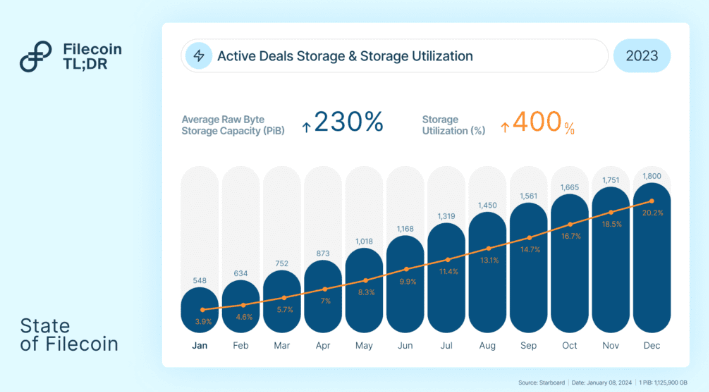

@Filecoin

Filecoin is the largest decentralized data storage marketplace.

It enables users with excess data storage to trade available space to users needing storage space for a fee.

In 2023, its storage utilization grew dramatically to 20% from 3%.

What's more, earlier in 2024, Solana announced an integration with Filecoin to make its block history more accessible and usable.

Filecoin is the largest decentralized data storage marketplace.

It enables users with excess data storage to trade available space to users needing storage space for a fee.

In 2023, its storage utilization grew dramatically to 20% from 3%.

What's more, earlier in 2024, Solana announced an integration with Filecoin to make its block history more accessible and usable.

@NATIXNetwork *

Natix is an AI-powered DePIN project focused on mapping data.

It incentivizes users with points rewards for

downloading their app and mapping your surroundings.

The app lets users record mapping data using smartphone cameras when driving.

The data collected is useful for smart-city and mobility applications and is sold to businesses in need through a marketplace.

Recently, the Natix team announced that the $NATIX token launch will happen on @CoinList, a tier 1 launchpad.

Natix is an AI-powered DePIN project focused on mapping data.

It incentivizes users with points rewards for

downloading their app and mapping your surroundings.

The app lets users record mapping data using smartphone cameras when driving.

The data collected is useful for smart-city and mobility applications and is sold to businesses in need through a marketplace.

Recently, the Natix team announced that the $NATIX token launch will happen on @CoinList, a tier 1 launchpad.

@helium

Helium is a fast-growing decentralized wireless network.

By deploying a Helium Hotspot anywhere in the world, you can provide others with wireless network coverage.

In exchange for doing this, you're rewarded with Helium tokens.

According to Helium Explorer, there are over 400k active hotspots around the world.

Helium Mobile Network has seen incredible growth over the past months, growing at a 15.4% monthly growth rate.

Helium is a fast-growing decentralized wireless network.

By deploying a Helium Hotspot anywhere in the world, you can provide others with wireless network coverage.

In exchange for doing this, you're rewarded with Helium tokens.

According to Helium Explorer, there are over 400k active hotspots around the world.

Helium Mobile Network has seen incredible growth over the past months, growing at a 15.4% monthly growth rate.

@getgrass_io

Grass is the first-ever Layer 2 Data Market on Solana.

Using it you can get paid for your unused internet by contributing it towards the development of AI models.

Grass raised $3.5M in funding last year.

By installing the Grass browser extension that works in the background, you can turn your unused internet bandwidth into a revenue stream.

If you have an internet plan that exceeds your daily usage, then if you want you can farm its airdrop. (as Grass token isn't live yet)

If you want to give it a try, here's an invite link:

app.getgrass.io/register/?refe…

Grass is the first-ever Layer 2 Data Market on Solana.

Using it you can get paid for your unused internet by contributing it towards the development of AI models.

Grass raised $3.5M in funding last year.

By installing the Grass browser extension that works in the background, you can turn your unused internet bandwidth into a revenue stream.

If you have an internet plan that exceeds your daily usage, then if you want you can farm its airdrop. (as Grass token isn't live yet)

If you want to give it a try, here's an invite link:

app.getgrass.io/register/?refe…

Other projects worth mentioning:

@atorprotocol -A decentralized network for internet privacy

@Theta_Network -A blockchain Cloud for AI, Media & Entertainment

@akashnet_ -A network that lets users buy & sell computing resources

@Hivemapper -A decentralized global maps protocol

@atorprotocol -A decentralized network for internet privacy

@Theta_Network -A blockchain Cloud for AI, Media & Entertainment

@akashnet_ -A network that lets users buy & sell computing resources

@Hivemapper -A decentralized global maps protocol

There are so many innovative DePIN projects that I can't cover all of them.

But I'm always looking for new gems, so let me know in the comments if there are any other interesting projects I'm missing.

But I'm always looking for new gems, so let me know in the comments if there are any other interesting projects I'm missing.

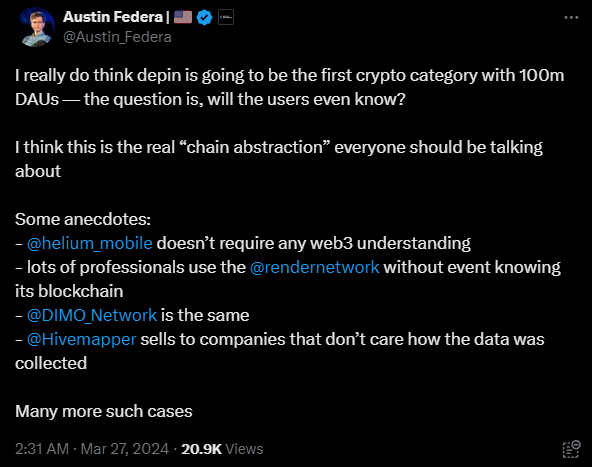

DePIN has the potential to be the first crypto sector to reach 100M daily active users.

It's more than just a short-term narrative given that it involves building better alternatives to popular centralized solutions.

It's only a matter of time until it gains a lot of traction.

It's more than just a short-term narrative given that it involves building better alternatives to popular centralized solutions.

It's only a matter of time until it gains a lot of traction.

I hope you've found this thread helpful.

Full disclosure: I'm an early investor in the projects marked with a *.

Follow me @TheDeFinvestor for more content like this.

Like/Repost the tweet below if you can.🫡

Full disclosure: I'm an early investor in the projects marked with a *.

Follow me @TheDeFinvestor for more content like this.

Like/Repost the tweet below if you can.🫡

https://twitter.com/TheDeFinvestor/status/1790415668279480825

• • •

Missing some Tweet in this thread? You can try to

force a refresh