We could be seeing the death of the white-collar job.

10 trends that prove the Blue-Collar Wave is happening right now:

10 trends that prove the Blue-Collar Wave is happening right now:

1. 56% of Gen Z would rather turn a wrench than type in a spreadsheet.

They see:

• Insane college costs

• Rising pay of blue-collar jobs

• Less stigma on working with your hands

The Wall Street Journal calls them the 'Toolbelt Generation.' It's easy to see why:

They see:

• Insane college costs

• Rising pay of blue-collar jobs

• Less stigma on working with your hands

The Wall Street Journal calls them the 'Toolbelt Generation.' It's easy to see why:

2. College ROI is being questioned like never before

Studies show 40-50% of recent grads end up in jobs that don't use their degree.

With skyrocketing tuition and student loan debt, many are rethinking the value of higher ed altogether.

Studies show 40-50% of recent grads end up in jobs that don't use their degree.

With skyrocketing tuition and student loan debt, many are rethinking the value of higher ed altogether.

More and more are opting for career paths wihtout expensive schooling.

Is the college premium still worth it? Gen Z isn't so sure.

Is the college premium still worth it? Gen Z isn't so sure.

3. AI anxiety has workers rethinking what fields are "safe"

ChatGPT's showing how many white-collar jobs could be automated.

But plumbers? Electricians? Mechanics? Not so much.

Gen Z now believes the trades = security

ChatGPT's showing how many white-collar jobs could be automated.

But plumbers? Electricians? Mechanics? Not so much.

Gen Z now believes the trades = security

4. Dirty fingernails are starting to out-earn clean ones

Recent construction hires saw pay jump 5.1% to a median of $48,089.

Recent construction hires saw pay jump 5.1% to a median of $48,089.

That's almost twice as fast as professional service roles, which rose just 2.7% to $39,520.

The median construction worker now earns $69,200—not far behind business roles at $78,500.

The median construction worker now earns $69,200—not far behind business roles at $78,500.

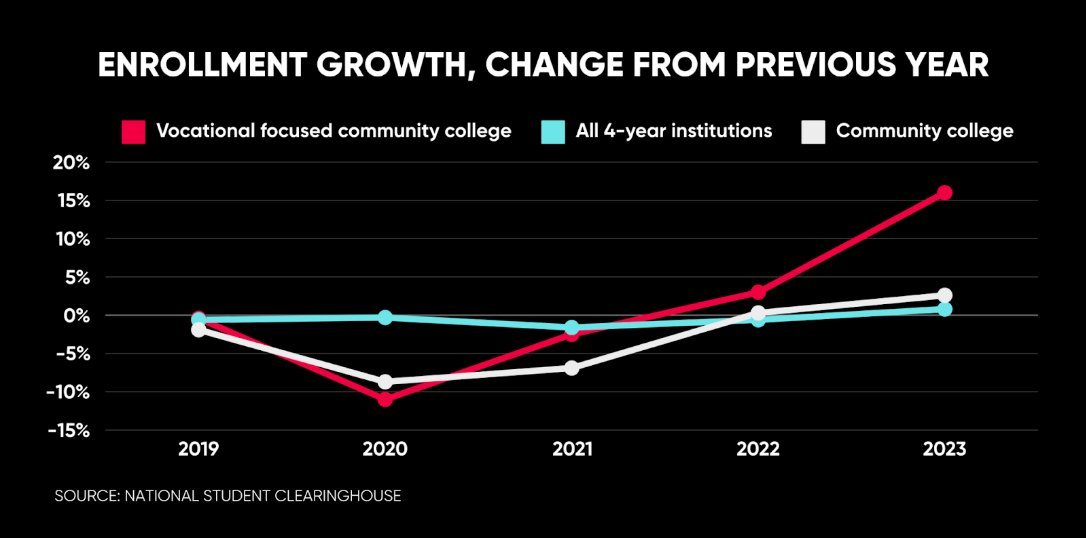

5. Vocational schools have soaring growth

Trade school enrollment surged 16% last year alone.

74% of people still see a stigma around vocational education—but that's expected to fade fast.

Trade school enrollment surged 16% last year alone.

74% of people still see a stigma around vocational education—but that's expected to fade fast.

6. Innovative new school models are blending the classroom and the jobsite

Campuses like Opportunity Central in Texas mix academics with real-world work experience.

The future of education may look more like this than a lecture hall:

Campuses like Opportunity Central in Texas mix academics with real-world work experience.

The future of education may look more like this than a lecture hall:

7. Retiring boomers are creating a surge in blue-collar demand

Mass retirements are leaving huge gaps in critical fields.

It's creating a desperate need for young talent in the trades.

Mass retirements are leaving huge gaps in critical fields.

It's creating a desperate need for young talent in the trades.

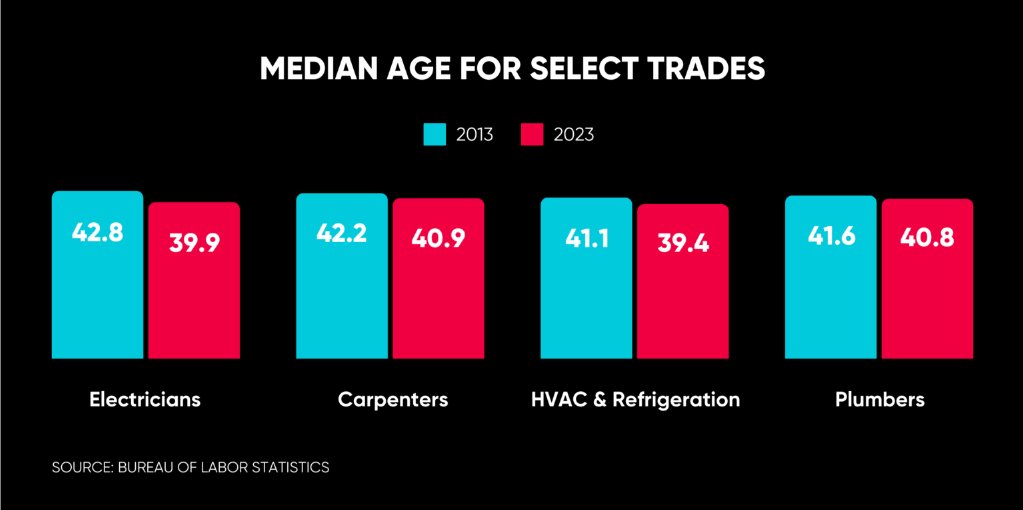

8. Trades workers ARE younger than ever

The average age of electricians, plumbers, & mechanics is trending down.

This is a stark contrast to the overall aging of the population.

As boomers retire, Gen Z is stepping up.

The average age of electricians, plumbers, & mechanics is trending down.

This is a stark contrast to the overall aging of the population.

As boomers retire, Gen Z is stepping up.

9. Tech & falling stigmas are making dirty jobs more attractive than ever

Advancing tools & safety tech are modernizing blue-collar fields.

Attitudes are shifting.

The jobs that keep our world running are finally getting their due.

Advancing tools & safety tech are modernizing blue-collar fields.

Attitudes are shifting.

The jobs that keep our world running are finally getting their due.

10. Young people are realizing the potential of local business

They see the upside in owning a welding shop over being a cubicle dweller.

Our community alone has seen dozens & dozens of ex-teachers and laid-off techies opt for cashflowing biz's over re-entering the rat race.

They see the upside in owning a welding shop over being a cubicle dweller.

Our community alone has seen dozens & dozens of ex-teachers and laid-off techies opt for cashflowing biz's over re-entering the rat race.

The tides are turning.

Those who build and fix may soon out-earn those who type and talk.

It's not just a trend. It's a movement.

And it's just getting started...

Those who build and fix may soon out-earn those who type and talk.

It's not just a trend. It's a movement.

And it's just getting started...

Shoutout to our builders @_CTCommunity riding the Blue Collar Wave.

Share here if you want others to see this, and follow me @Codie_Sanchez for more:

Share here if you want others to see this, and follow me @Codie_Sanchez for more:

https://twitter.com/Codie_Sanchez/status/1791824568597774810

@_CTCommunity A lot of you are interested by this idea.

Yes, it's Gen Z. But it's also you and me.

If you feel serious about business-buying, you can book a consult with our team:

contrarianthinking.biz/community-tw

Yes, it's Gen Z. But it's also you and me.

If you feel serious about business-buying, you can book a consult with our team:

contrarianthinking.biz/community-tw

• • •

Missing some Tweet in this thread? You can try to

force a refresh