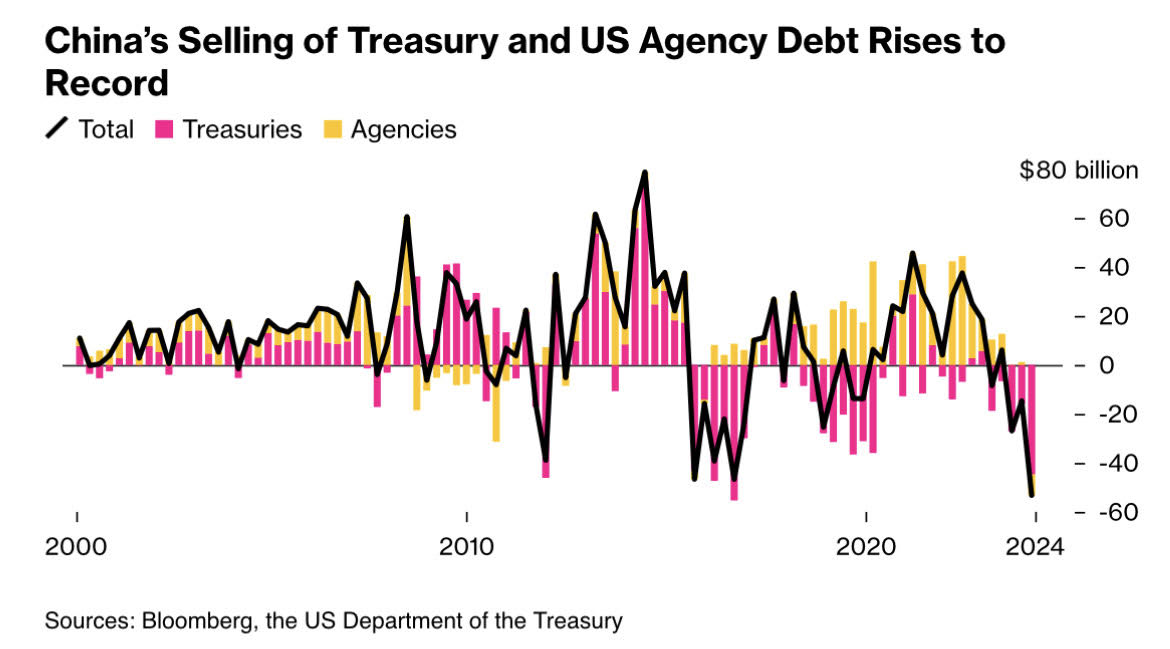

1/ Here is a thread on why recent record sales by the Chinese of US Treasuries might be one of the first signs of a major fiscal crisis in the US. There is a lot of confusion about how this would work so let's go through it step by step.

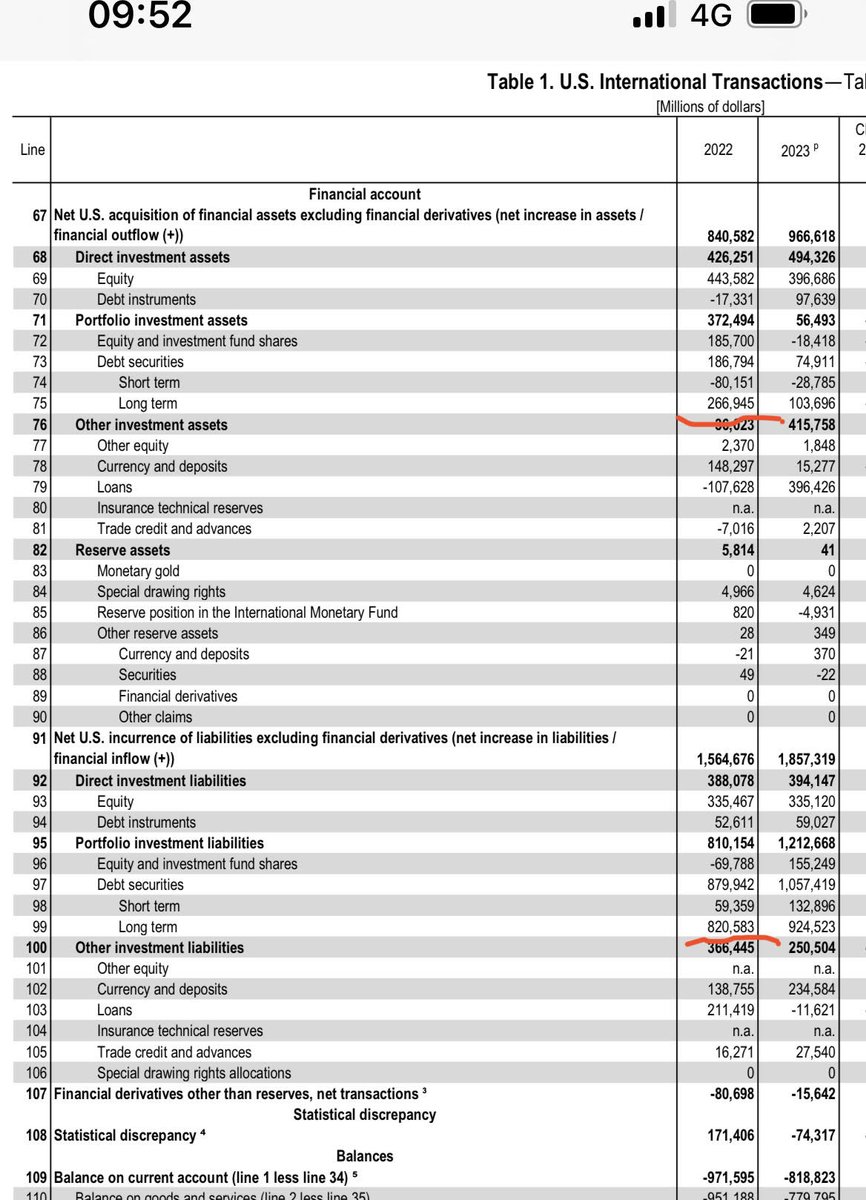

2/ What matters here is not overall US government debt but rather the balance of payments. If a country runs a trade deficit this must be offset by financial inflows on the financial account to maintain equilibrium.

3/ The United States runs a consistent, large trade deficit. As predicted - because it is a necessity - this trade deficit must be matched with financial inflows. Let's look at what those inflows are.

4/ Here we see that the most important component by a very large amount as 'Debt Securities' that are 'Long Term'. In 2023 $924bn were issued and $103bn bought, meaning net issuance of around $821bn.

5/ These are the key balancing item that allows the US to run its trade deficit. What are they? A lot of them are Treasury bonds.

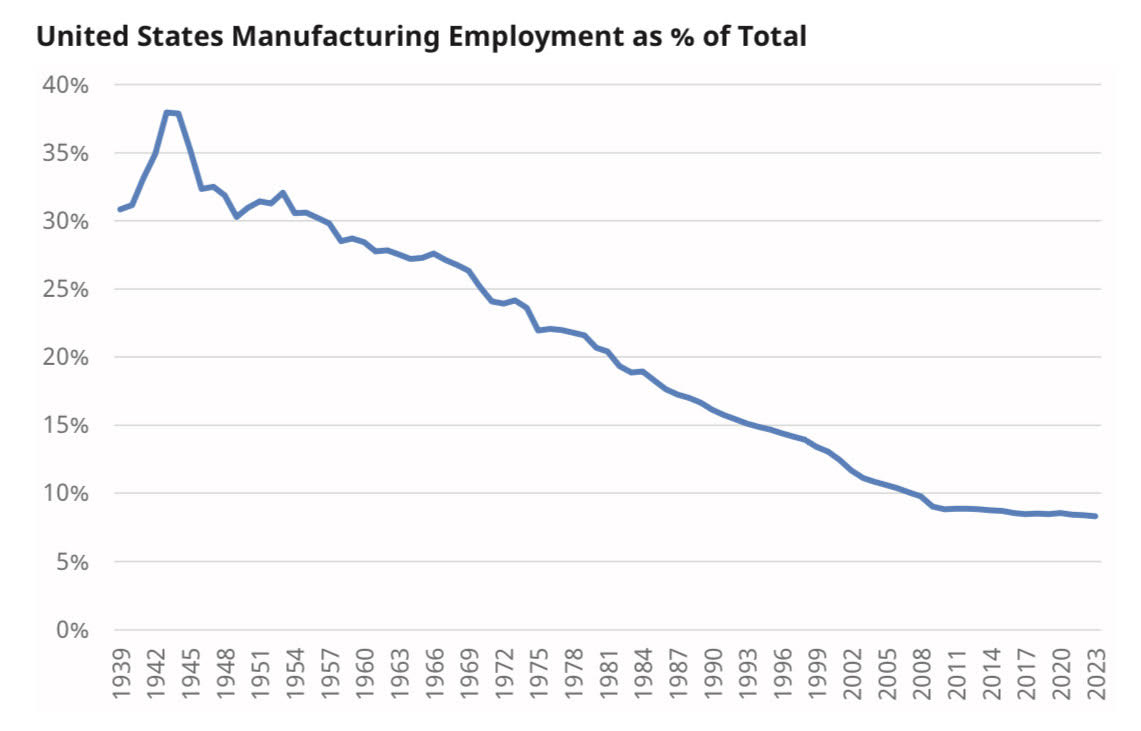

6/ It used to be that these bonds were bought by China and other governments/central banks. These were stable buyers because it was part of their trade strategy - prop up the US trade deficit to sell more exports. Now increasingly they are bought by private foreign investors.

7/ These investors are buying Treasuries because interest rates are high. Right now they look like an attractive investment. But these investors are 'yield sensitive' and so if interest rates come down they will likely dump the bonds.

8/ This will likely happen in a recession when the Fed lowers rates to counteract the downturn, maybe even more QE. And in a recession tax receipts will fall and unemployment claims will rise - so the US will need to issue even more debt. This will only exarcerbate the problem.

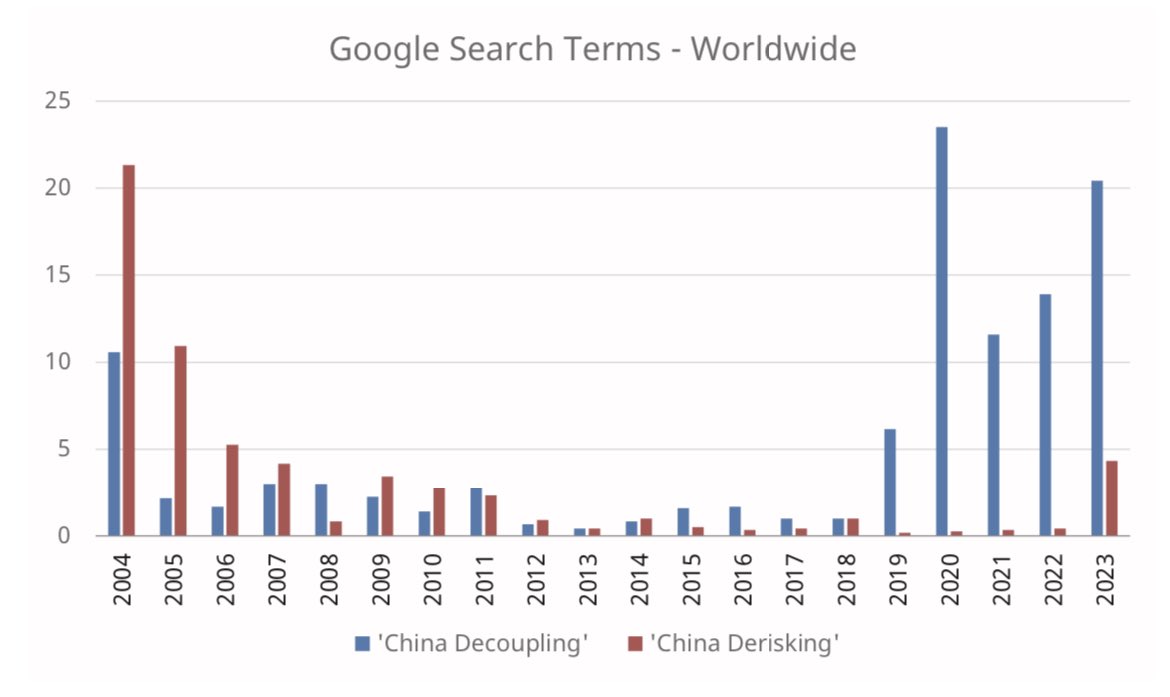

9/ All this is coming on the back of a major Russian-Chinese economic and military alliance that explicitly pushes for a multipolar world order.

10/ Smart strategists on Wall Street understand what is happening, but if you look in the mainstream financial press you will not see any of these stories anywhere.

11/ It appears that those who publish these papers still think 'narrative control' is meaningful. But it no longer is. Only hard economic realities matter now and so the Western press has become like Pravda - a Potemkin Village built for Western leaders to deny reality.

12/ Being blissfully unaware of what is actually happening Western leaders continue to think they control the situation and go around making demands on the Chinese. The Chinese are baffled by this, knowing that they are the United States' creditor.

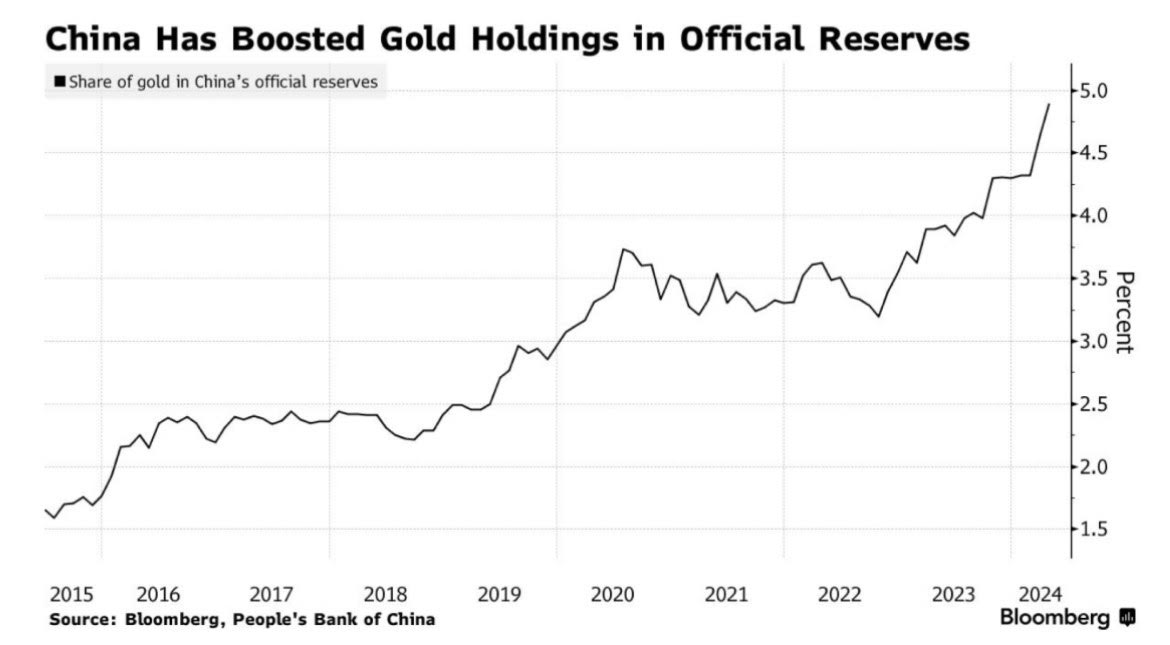

13/ And so the Chinese just keep offloading US Treasuries, handing them off to yield sensitive investors while recycling the money into gold.

14/ How much could living standards fall? It is hard to tell. Simple modelling suggests that US living standards are around 27% too high relative to their trade deficit.

15/ The people who understand the dynamics at play wait for a recession to kick off to see if lower rates and higher debt issuance will lead to foreign investors dumping Treasuries and forcing the US trade deficit to close - and living standards to fall accordingly.

END/

END/

• • •

Missing some Tweet in this thread? You can try to

force a refresh