1/ Runes protocol launch ended up as a "sell-the-news" event.

But the Runes community is still strong and BTCFi protocol teams continue to build.

I believe a small spark is needed to ignite the Runes hype fire again. A few possible catalysts ahead: ↓

But the Runes community is still strong and BTCFi protocol teams continue to build.

I believe a small spark is needed to ignite the Runes hype fire again. A few possible catalysts ahead: ↓

2/ First short-term catalyst is Runes token listing on major CEXes.

Both Kraken and Binance recently released research reports on Runes.

Kraken even teased Runes listing on their exchange.

Both Kraken and Binance recently released research reports on Runes.

Kraken even teased Runes listing on their exchange.

3/ Currently, Runes trading experience isn't much different from trading BRC20s.

(Although Magic Eden did some UI improvements).

But Bitcoin soft forks (or speculation of it) like OP_CAT could bring significant improvements for Bitcoin L2s, smart contracts & all BTCFi space.

(Although Magic Eden did some UI improvements).

But Bitcoin soft forks (or speculation of it) like OP_CAT could bring significant improvements for Bitcoin L2s, smart contracts & all BTCFi space.

https://twitter.com/14527699/status/1781710214439297162

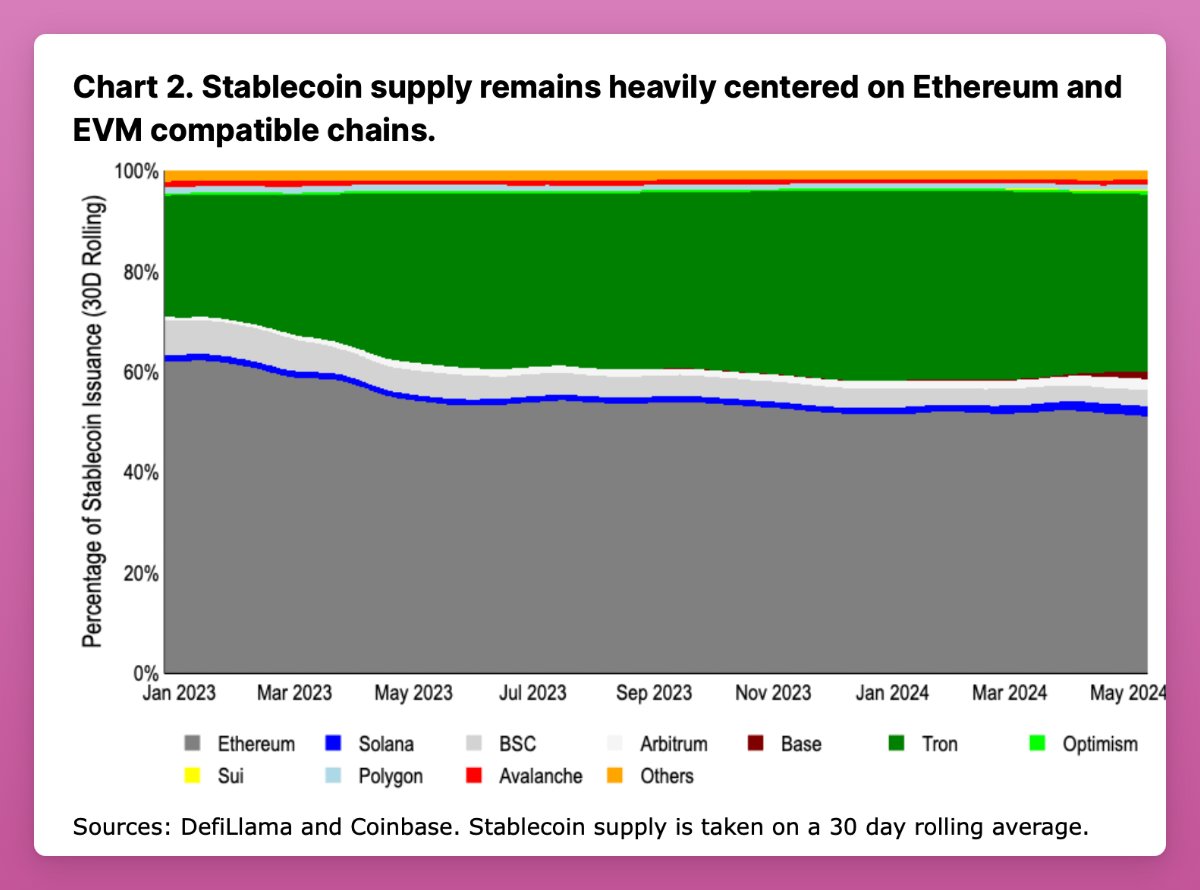

4/ Another catalyst for BTCFi growth can be the launch of USDC or USDT on Bitcoin as Runes.

Circle/Tether can pre-mine trillions of Rune tokens and issue/redeem them on demand.

Demand for stablecoins is low, but would increase as Bitcoin AMM/Lending dApps improve UX.

Circle/Tether can pre-mine trillions of Rune tokens and issue/redeem them on demand.

Demand for stablecoins is low, but would increase as Bitcoin AMM/Lending dApps improve UX.

5/ What other catalysts do you see?

Quite likely, a new catalyst for FOMO will end up being something unexpected.

But as I was bearish leading to the Runes protocol launch, I'm now turning more bullish on Runes with each passing day.

Quite likely, a new catalyst for FOMO will end up being something unexpected.

But as I was bearish leading to the Runes protocol launch, I'm now turning more bullish on Runes with each passing day.

https://twitter.com/831767219071754240/status/1780547832287789556

6/ In any case, as speculation on narratives comes in waves, I'm waiting for the 5th BTCFi wave.

I believe it will come soon as narratives based on technical innovation often have multiple waves and BTCFi is one of the top 0-to-1 innovations this cycle.

I believe it will come soon as narratives based on technical innovation often have multiple waves and BTCFi is one of the top 0-to-1 innovations this cycle.

• • •

Missing some Tweet in this thread? You can try to

force a refresh