Subscribe to my DeFi blog to get ahead of the curve 👉 https://t.co/7O0WAdXUnT

Co-founder of @PinkBrains_io DeFi Creator Studio

31 subscribers

How to get URL link on X (Twitter) App

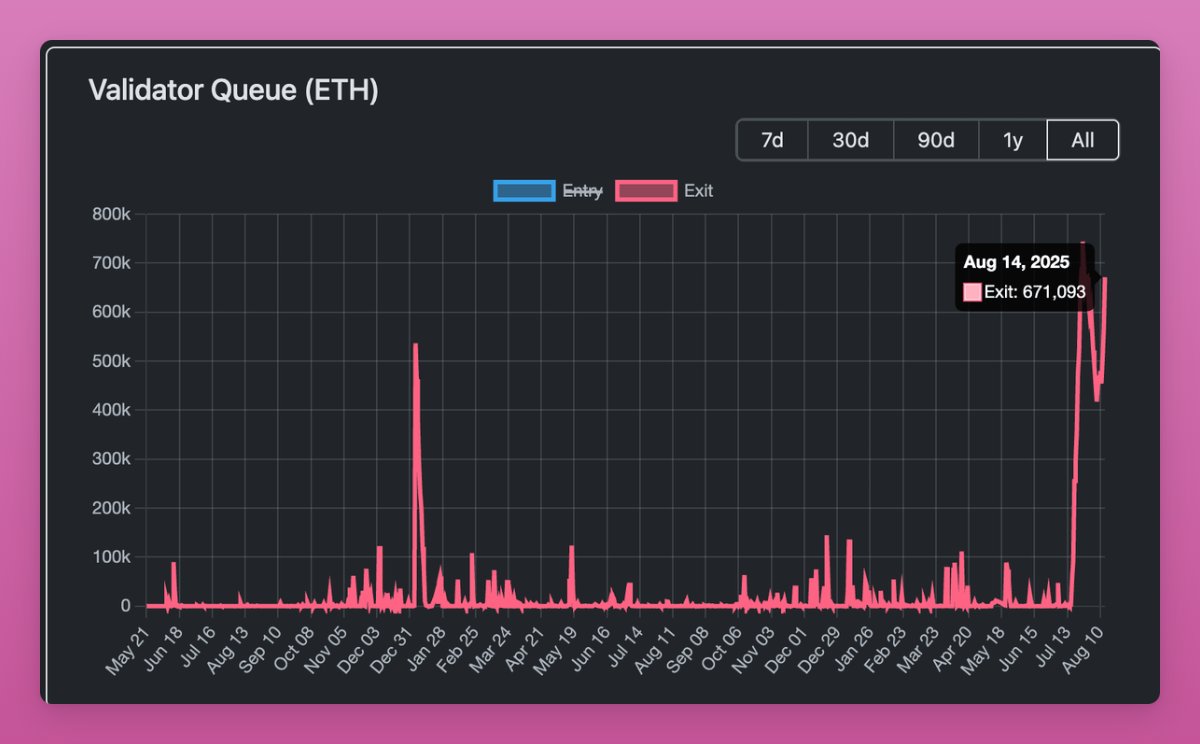

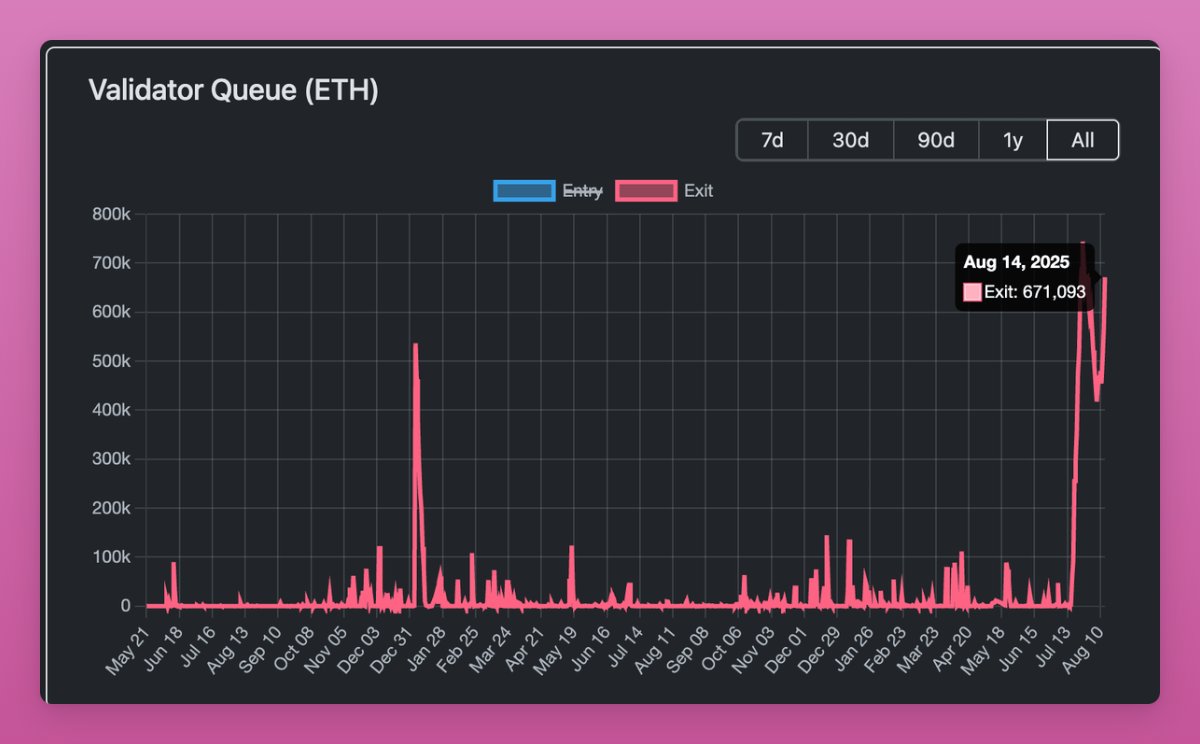

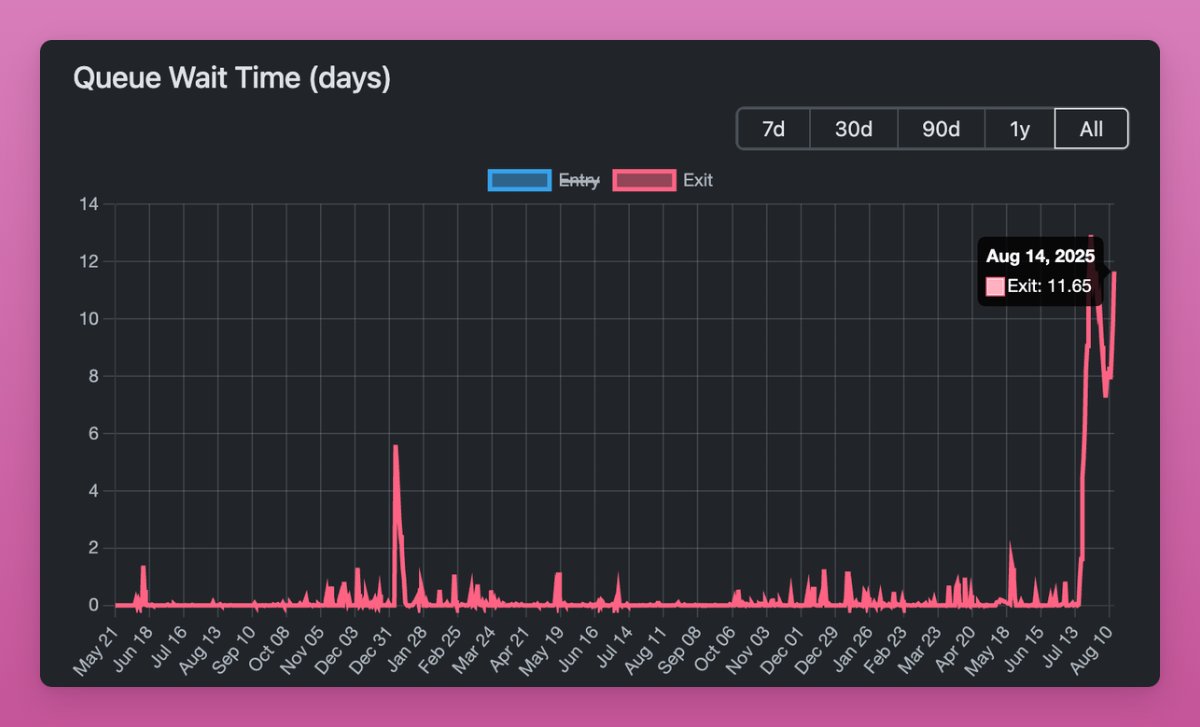

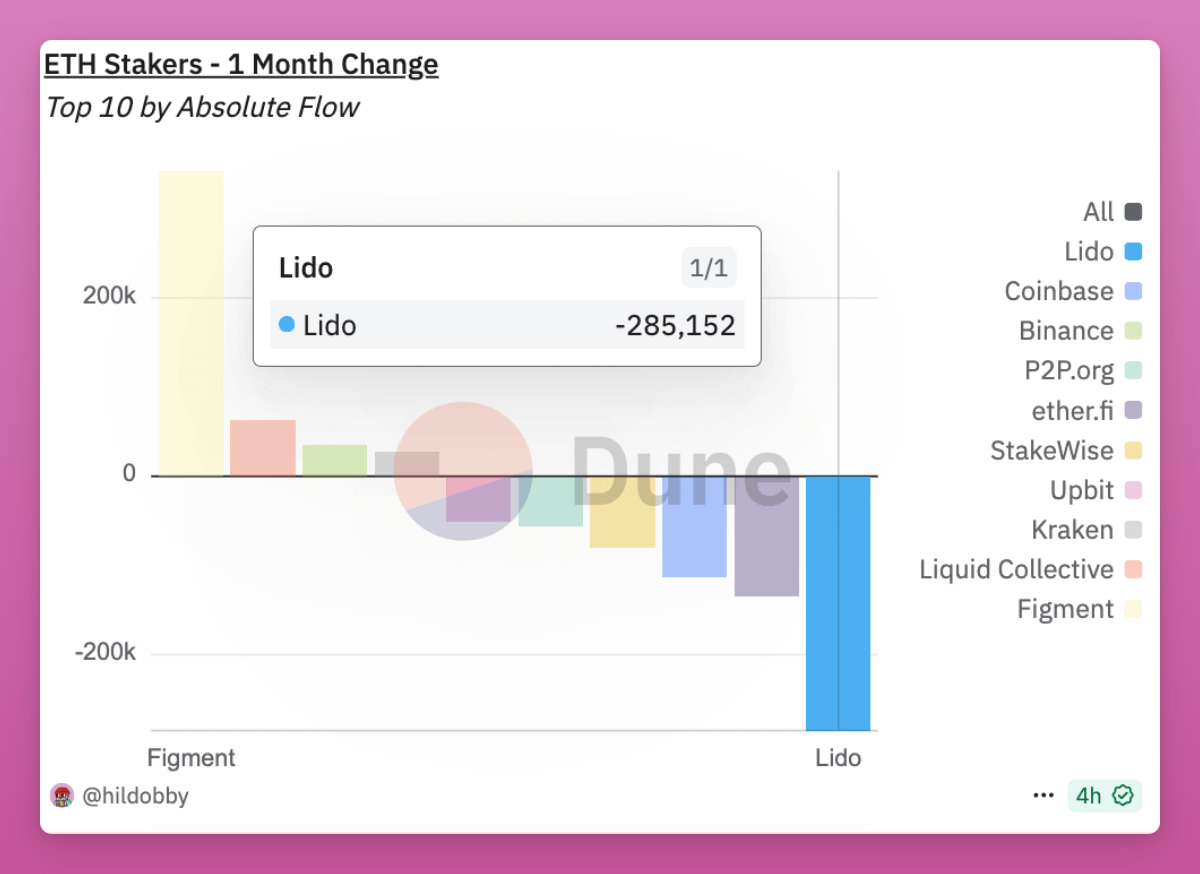

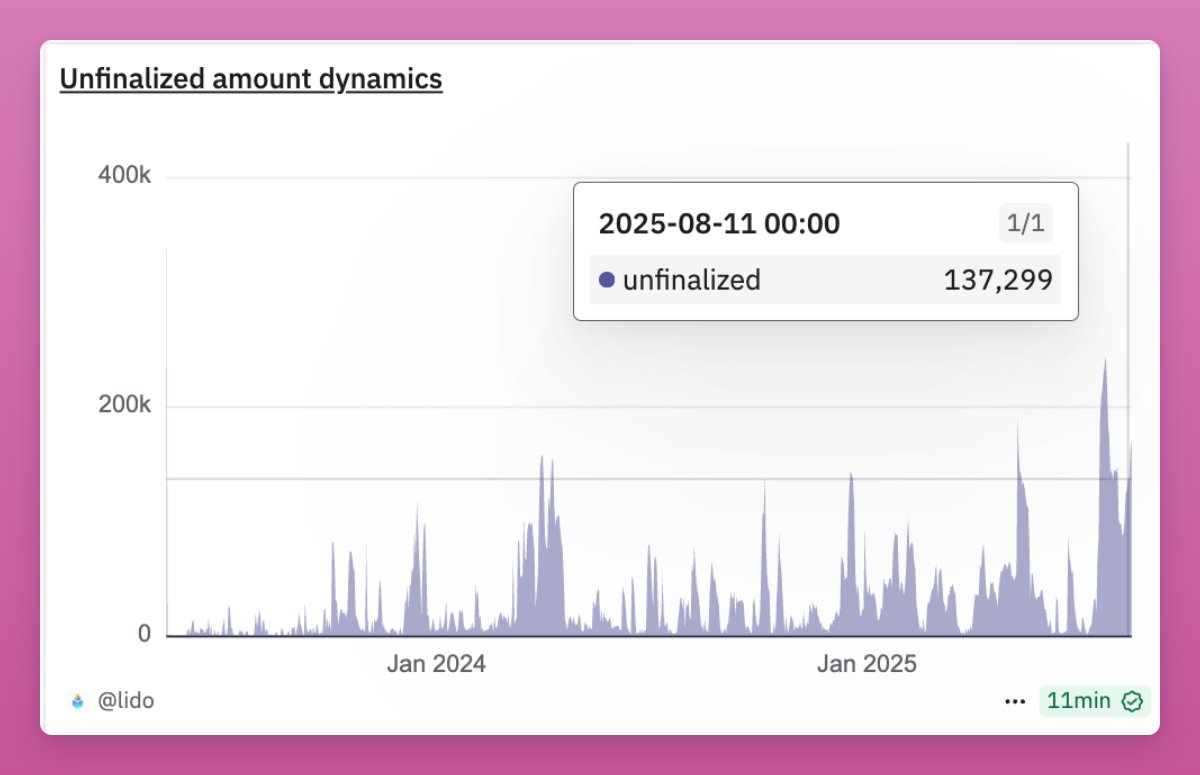

2/ The the past month, the top 3 LSTs accounted for the most unstaked $ETH

2/ The the past month, the top 3 LSTs accounted for the most unstaked $ETH

https://twitter.com/295218901/status/1905732841713078708

https://twitter.com/leptokurtic_/status/1901673138481672339@Etherealize_io Ethena is not the only and last one.

https://x.com/yzilabs/status/1901619591987769440

2/ Arbitrum votes to deploy Treasury $ETH to generate yield:

2/ Arbitrum votes to deploy Treasury $ETH to generate yield:

https://twitter.com/1637885519374721035/status/1869367144695378302

https://twitter.com/redhairshanks86/status/1848653068554166339The mismatch between expectations and reality is stark.

Wouldn't be surprised if Uni v4 first launched on Unichain. Perhaps only on Unichain before moving to other chains.

Wouldn't be surprised if Uni v4 first launched on Unichain. Perhaps only on Unichain before moving to other chains.

2/ It's even more surprising as Eigenlayer has become the third-largest protocol by TVL at $10B, nearly matching AAVE's $11B.

2/ It's even more surprising as Eigenlayer has become the third-largest protocol by TVL at $10B, nearly matching AAVE's $11B.

2/ BTC is undeniably risky, having been the worst-performing major asset in 7 out of the last 10 years.

2/ BTC is undeniably risky, having been the worst-performing major asset in 7 out of the last 10 years.

2/2 Possible explanation was offered by @nic__carter a year ago:

2/2 Possible explanation was offered by @nic__carter a year ago:https://twitter.com/420308365/status/1668245037384073217

2/ Low Inflation:

2/ Low Inflation:

2/ The Pectra Upgrade is Ethereum’s next major upgrade, expected to roll out in Q1 2025.

2/ The Pectra Upgrade is Ethereum’s next major upgrade, expected to roll out in Q1 2025.

2/ The usual crypto playbook involves an official blog post, a tweet with a hope it clicks.

2/ The usual crypto playbook involves an official blog post, a tweet with a hope it clicks.

In total, Polkadot spent $86m USD in the past 6 months:

In total, Polkadot spent $86m USD in the past 6 months:https://twitter.com/1405113174911766529/status/1806832651422122492