Sum Insured=25L

Claim amount=5L

The insurer only paid 2 lakhs

One of the most toxic and hidden conditions of health insurance,

Room rent limit and associated deductions

A thread🧵 on what is room rent limit and how it limits the claim paid?👇

Claim amount=5L

The insurer only paid 2 lakhs

One of the most toxic and hidden conditions of health insurance,

Room rent limit and associated deductions

A thread🧵 on what is room rent limit and how it limits the claim paid?👇

What is a room rent limit in a health insurance policy?

Every health insurance plan comes with a set of components that can drastically change the claim amount during the time of billing.

Every health insurance plan comes with a set of components that can drastically change the claim amount during the time of billing.

The hospital room rent limit is nothing but the specific amount of rent u pay for staying in a hospital.

You will occupy a bed or opt for a room in the hospital.

For this service, room charges will be levied on a daily basis.

You will occupy a bed or opt for a room in the hospital.

For this service, room charges will be levied on a daily basis.

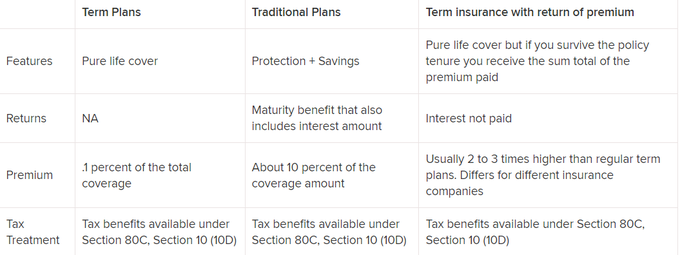

There are different types of room rent limits that insurers impose based on the policy you’ve bought -

1. Financial Limit

Insurers generally put room rent limit at 1% of the Sum Insured

So for a 5 lakh sum insured the limit is at Rs 5,000/day

1. Financial Limit

Insurers generally put room rent limit at 1% of the Sum Insured

So for a 5 lakh sum insured the limit is at Rs 5,000/day

2. Room Category Limit:-

Some insurance plans cover specific types of rooms - such as private room or shared accommodation.

This kind of a limit ensures that you have the type of room, regardless of the cost of it.

Some insurance plans cover specific types of rooms - such as private room or shared accommodation.

This kind of a limit ensures that you have the type of room, regardless of the cost of it.

So how does room rent limit work?

If you choose a room that costs Rs 6000/day but the policy states the limit to be at Rs 4000/day.

The balance is Rs2000/day u will shell out of ur own pocket!

At this point u will say what is the big deal?

If you choose a room that costs Rs 6000/day but the policy states the limit to be at Rs 4000/day.

The balance is Rs2000/day u will shell out of ur own pocket!

At this point u will say what is the big deal?

Now comes the hidden part which no one will tell u

Proportionate deductions:-

As per this clause you will not just pay the difference on the room rent limit.

But You’ll actually pay a proportionate amount of the entire bill.🤯🤯

Proportionate deductions:-

As per this clause you will not just pay the difference on the room rent limit.

But You’ll actually pay a proportionate amount of the entire bill.🤯🤯

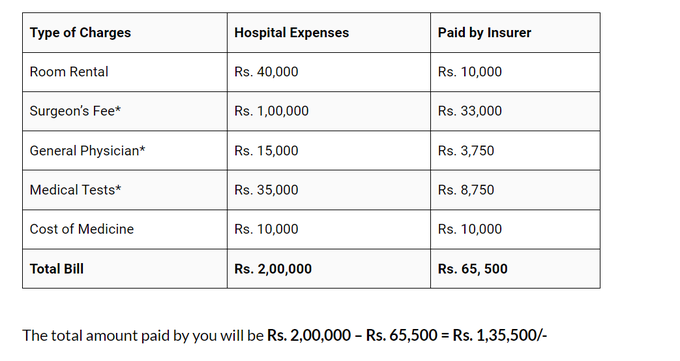

Lets take an example:-

Mr X is hospitalized with a bill of 2 lakh.

The insurance policy had a room rent limit of Rs 2000/day

Mr X had to choose a room for Rs 8000/day.

Now Mr X will not only have to pay Rs 6000/day from his own pocket.

Mr X is hospitalized with a bill of 2 lakh.

The insurance policy had a room rent limit of Rs 2000/day

Mr X had to choose a room for Rs 8000/day.

Now Mr X will not only have to pay Rs 6000/day from his own pocket.

The insurer will apply a proportionate deduction to the entire bill amount in the proportion to the room rent limit.

In case of Mr X will be eligible to only 25% claim under the policy.

Sum Approved = (Room-rent approved / Room-rent Claimed) X Amount Claimed

In case of Mr X will be eligible to only 25% claim under the policy.

Sum Approved = (Room-rent approved / Room-rent Claimed) X Amount Claimed

This will mean even if Mr X has a Sum insured of 10 lakhs.

A hospitalization bill of 2 lakhs will mean he will have to pay 1.35 lakh from his own pocket because of the room rent limit

That is the power of room rent limit.

It can put a limit to what the insurer will pay

A hospitalization bill of 2 lakhs will mean he will have to pay 1.35 lakh from his own pocket because of the room rent limit

That is the power of room rent limit.

It can put a limit to what the insurer will pay

This standard deduction does not apply to-

Cost of pharmacy (all medicines

Cost of diagnostics (lab tests, imaging etc.)

However these will be a very small part of the bill

Cost of pharmacy (all medicines

Cost of diagnostics (lab tests, imaging etc.)

However these will be a very small part of the bill

Why do insurers put these deductions on the entire bill?

Every hospital room has a different rate card for the same service.

A surgery that can cost X in a general room

can cost 2x in a Private room.

This is within the same hospital.

Every hospital room has a different rate card for the same service.

A surgery that can cost X in a general room

can cost 2x in a Private room.

This is within the same hospital.

In order to protect themselves against these unreasonable charges from the hospitals.

Insurers apply proportionate limits on top of the room rent limit.

This feature can really limit what the insurers will pay during a claim!

Insurers apply proportionate limits on top of the room rent limit.

This feature can really limit what the insurers will pay during a claim!

So how to take care of the Room rent limit?

Buy a policy that has no room rent limit!

Most comprehensive policies do not have a room rent limit!

Check ur room rent limit.

You can port ur plan into a better plan with no limits!

Buy a policy that has no room rent limit!

Most comprehensive policies do not have a room rent limit!

Check ur room rent limit.

You can port ur plan into a better plan with no limits!

Conclusion:-

A room rent limit is just not limited to the type of room u can get.

It also limits the amount of claims u can get.

Therefore be very careful with the terms and conditions of the policy.

A room rent limit is just not limited to the type of room u can get.

It also limits the amount of claims u can get.

Therefore be very careful with the terms and conditions of the policy.

Follow me @NIKHILLJHA as I write deep insights into health insurance

Go to my profile and hit the bell icon🔔to always stay updated

Go to my profile and hit the bell icon🔔to always stay updated

• • •

Missing some Tweet in this thread? You can try to

force a refresh