Hercules Advisors,Health+Life Insurance Expert

DM to set up an appointment

Email us on nikhiljha159@gmail.com

https://t.co/WsraacOEJN

8 subscribers

How to get URL link on X (Twitter) App

What is life insurance?

What is life insurance?

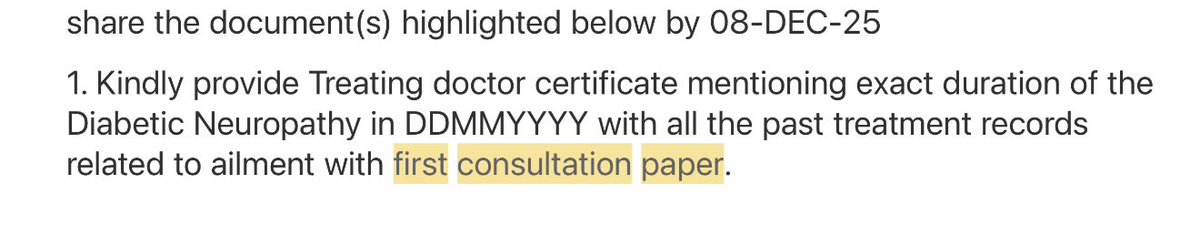

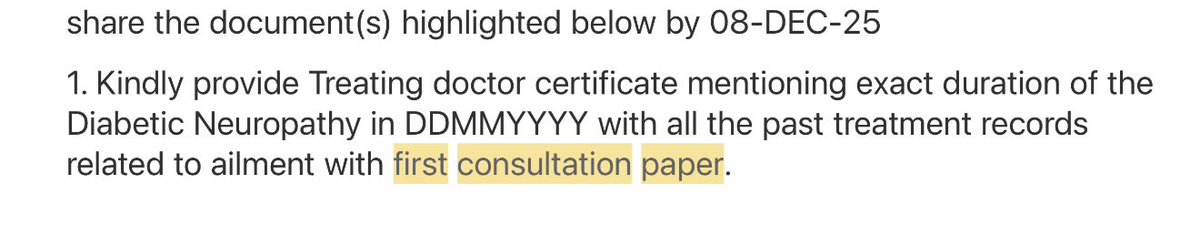

What is first consultation paper ?

What is first consultation paper ?

What are critical illnesses?

What are critical illnesses?

What are deductibles in health insurance?

What are deductibles in health insurance?

What is life insurance?

What is life insurance?

Sum Insured:-

Sum Insured:-

What are critical illnesses?

What are critical illnesses?

Do premiums rise with age?

Do premiums rise with age?

What is a cataract?

What is a cataract?

Room Rent limit:-

Room Rent limit:-

What is health insurance portability?

What is health insurance portability?

What is cancer?

What is cancer?

What is a corporate cover?

What is a corporate cover?

This types of disease, hospitalisation or claims are called as permanent exclusion

This types of disease, hospitalisation or claims are called as permanent exclusion

What is Co-pay in health insurance?

What is Co-pay in health insurance?

Background to the case:-

Background to the case:-

What is a room rent limit in a health insurance policy?

What is a room rent limit in a health insurance policy?

Background

Background

Why do health insurance premiums rise?

Why do health insurance premiums rise?

Background:-

Background:-