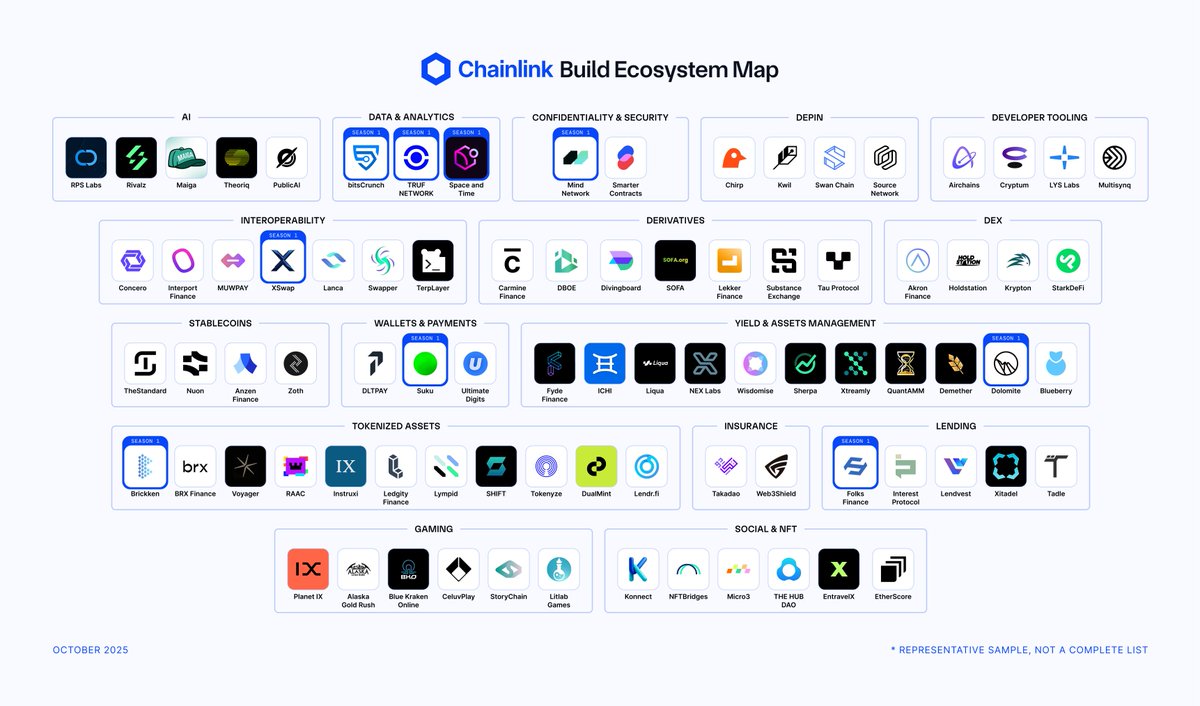

Chainlink is essential infrastructure for the tokenized asset economy, providing data, interoperability, and security to RWAs at scale.

12 examples of how Chainlink is powering the tokenization megatrend 🧵

1. Verifying ARKB BTC ETF reserves with @21shares_us:

2. Helping to calculate collateral value on @AngleProtocol when users borrow agEUR using RWAs:

3. Increasing the transparency of @BackedFi’s tokenized treasuries, ETFs, and other RWAs:

4. Supporting the adoption of @Brickken’s tokenization solution via #ChainlinkBUILD:

5. Supporting the digitization of gold reserves with @iondigitalusa:

6. Helping to secure the minting and cross-chain movement of tokenized short-term U.S. Treasury Bills by @realMatrixport:

7. Supporting @Paxos’ PAX Gold (PAXG) tokens with high-quality price data:

8. Enabling PYUSD to be adopted across DeFi through tamper-proof market data:

9. Helping to secure the minting function of @Poundtoken:

10. Helping to power staking rewards distribution for @PropyKeys:

11. Increasing reserves transparency for @StablREuro:

12. Helping to secure the minting of @tusdio:

In addition to the growing adoption of Chainlink’s essential infrastructure for tokenized assets, Chainlink has been highlighted as the most active RWA-related protocol based on the number of GitHub commits in the last 30 days:

Tokenization is the first step toward reformatting the financial system. If you’d like to take a deep dive into the RWA megatrend, read this report with contributions from BCG, 21Shares, Paxos, Backed, and Chainlink: prnewswire.com/news-releases/…

angle.money/blog/integrati…

backed.fi/news-updates/b…

brickken.com/en/post/brickk…

data.chain.link/feeds/avalanch…

matrixdock.com/blog/announcem…

data.chain.link/feeds/ethereum…

data.chain.link/feeds/ethereum…

chain.link/case-studies/p…

propykeys.medium.com/propykeys-inte…

stablr.com/insights/stabl…

data.chain.link/feeds/ethereum…

pages.chain.link/hubfs/e/defini…

12 examples of how Chainlink is powering the tokenization megatrend 🧵

1. Verifying ARKB BTC ETF reserves with @21shares_us:

2. Helping to calculate collateral value on @AngleProtocol when users borrow agEUR using RWAs:

3. Increasing the transparency of @BackedFi’s tokenized treasuries, ETFs, and other RWAs:

4. Supporting the adoption of @Brickken’s tokenization solution via #ChainlinkBUILD:

5. Supporting the digitization of gold reserves with @iondigitalusa:

6. Helping to secure the minting and cross-chain movement of tokenized short-term U.S. Treasury Bills by @realMatrixport:

7. Supporting @Paxos’ PAX Gold (PAXG) tokens with high-quality price data:

8. Enabling PYUSD to be adopted across DeFi through tamper-proof market data:

9. Helping to secure the minting function of @Poundtoken:

10. Helping to power staking rewards distribution for @PropyKeys:

11. Increasing reserves transparency for @StablREuro:

12. Helping to secure the minting of @tusdio:

In addition to the growing adoption of Chainlink’s essential infrastructure for tokenized assets, Chainlink has been highlighted as the most active RWA-related protocol based on the number of GitHub commits in the last 30 days:

Tokenization is the first step toward reformatting the financial system. If you’d like to take a deep dive into the RWA megatrend, read this report with contributions from BCG, 21Shares, Paxos, Backed, and Chainlink: prnewswire.com/news-releases/…

angle.money/blog/integrati…

backed.fi/news-updates/b…

brickken.com/en/post/brickk…

data.chain.link/feeds/avalanch…

matrixdock.com/blog/announcem…

data.chain.link/feeds/ethereum…

data.chain.link/feeds/ethereum…

chain.link/case-studies/p…

propykeys.medium.com/propykeys-inte…

stablr.com/insights/stabl…

data.chain.link/feeds/ethereum…

https://twitter.com/johnmorganfl/status/1787794551454712071

pages.chain.link/hubfs/e/defini…

• • •

Missing some Tweet in this thread? You can try to

force a refresh