1/ Today's crypto users are statistically more impatient and impulsive than the average population.

Understanding these tendencies is key to crafting effective airdrop schemes🧵

Understanding these tendencies is key to crafting effective airdrop schemes🧵

2/ Airdrops have evolved from their early days to serve as a multifaceted tool to:

+ reward early users

+ decentralize governance

+ boost product marketing

+ reward early users

+ decentralize governance

+ boost product marketing

3/ While the airdrop meta has been a highlight of this cycle, the underlying concept of rewarding user adoption is far from novel

It's actually a common strategy in Web2 bootstrapping

It's actually a common strategy in Web2 bootstrapping

4/ Take Paypal:

In its early days, PayPal paid new users $10 to use its product and cover switching costs.

The idea was that paying enough people to join would eventually raise the network value, leading new users to join for free and creating a self-sustaining network

In its early days, PayPal paid new users $10 to use its product and cover switching costs.

The idea was that paying enough people to join would eventually raise the network value, leading new users to join for free and creating a self-sustaining network

5/ Designing an effective airdrop mechanism is challenging and almost an art form. Key considerations include:

• Who to reward

• The value attributed to their efforts

• When and how to distribute rewards

• Who to reward

• The value attributed to their efforts

• When and how to distribute rewards

6/ Most frameworks rely on guesswork, sentiment, or precedents, but using a quantitative framework ensures fairness and strategic alignment with long-term objectives.

7/ Enter the quasi-hyperbolic discounting model:

U(x)= U(t)*β*δ^t

A framework exploring how individuals make choices involving trade-offs between immediate and future rewards, especially where impulsivity and inconsistency affect decision-making.

U(x)= U(t)*β*δ^t

A framework exploring how individuals make choices involving trade-offs between immediate and future rewards, especially where impulsivity and inconsistency affect decision-making.

8/ It uses two population-specific terms:

9/ Present Bias (𝛽): Measures preference for immediate rewards over future ones

1: balanced

0: favors immediate rewards

Discount Factor (𝛿): Reflects how future rewards’ value diminishes over time

1: future rewards valued more

0: steeply discounted

1: balanced

0: favors immediate rewards

Discount Factor (𝛿): Reflects how future rewards’ value diminishes over time

1: future rewards valued more

0: steeply discounted

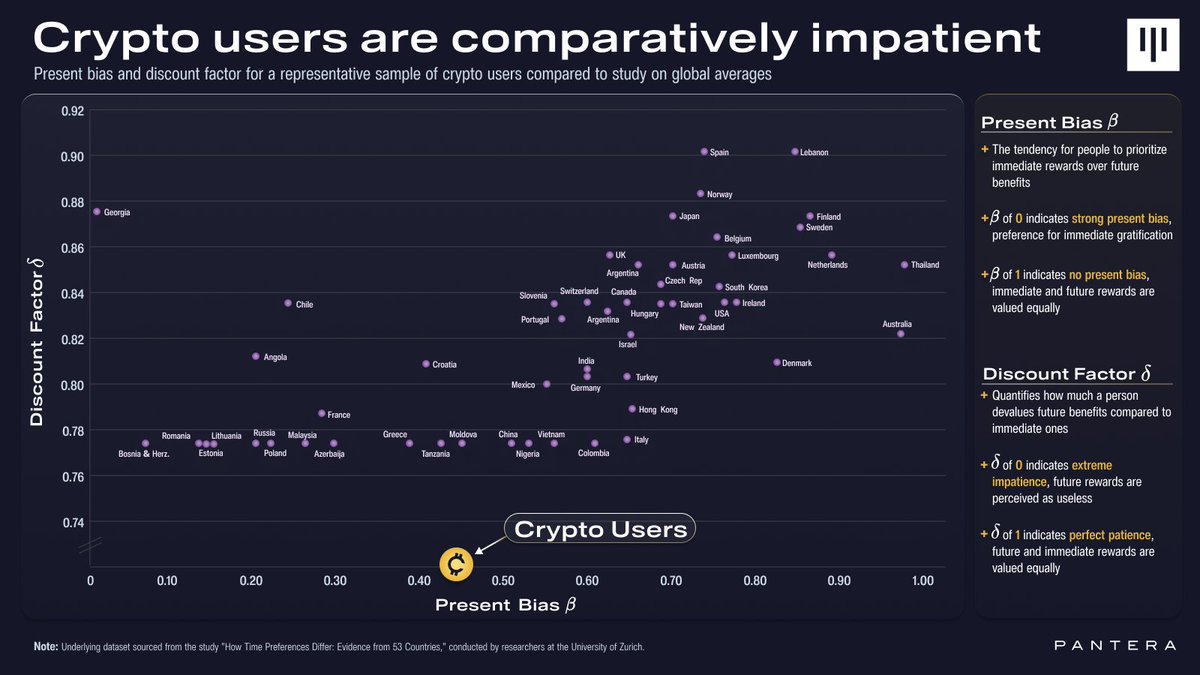

10/ Last year, Pantera Research Lab studied a sample of crypto users to see how they compared on these parameters to benchmark studies on normal people...

11/ Crypto users show high present bias (~0.4) and notably low discount factor indicating a tendency toward impatience and immediate gratification

Not surprising, given the natural periodicity of crypto markets and the generally speculative nature of crypto apps at the moment.

Not surprising, given the natural periodicity of crypto markets and the generally speculative nature of crypto apps at the moment.

12/ This doesn't mean crypto users won’t wait

It means there’s a shorter timeframe in which they will wait for a higher reward.

In the context of airdrops, vesting schedules or gradual releases can be timed based on recipient tendencies.

It means there’s a shorter timeframe in which they will wait for a higher reward.

In the context of airdrops, vesting schedules or gradual releases can be timed based on recipient tendencies.

13/ Just a few weeks ago, @DriftProtocol implemented a gradual release mechanism where users' rewards doubled if they waited 6 hours to claim

~85% of recipients waited to claim to receive their full allocation

~85% of recipients waited to claim to receive their full allocation

https://x.com/fknmarqu/status/1791171012609855961

14/ Based on our research, for a doubled reward, Drift could have extended the period a few months and still would have appeased most users

15/ For more on the study, the model, and the implications, check out the full piece from @stephensonmatt and me:

pantera-research-lab.vercel.app

pantera-research-lab.vercel.app

• • •

Missing some Tweet in this thread? You can try to

force a refresh