I smell trouble brewing with Kamino Multiply…

A few days ago, the team at @KaminoFinance announced the launch of JupSOL on their platform by promoting its use in their Multiply product. It was a great educational series of threads.

I'm a fan of Kamino (daily user), but felt the risks were being underplayed.

In the days that followed, I've noticed a lot of people piling into Multiply, enticed by...

"~40%APY, NO DEPEG RISK!"

I'm now quite concerned for users of Multiply. I'd planned a whiteboard but that won't be ready in time...

New format, here we go 🫡

🧵

A few days ago, the team at @KaminoFinance announced the launch of JupSOL on their platform by promoting its use in their Multiply product. It was a great educational series of threads.

I'm a fan of Kamino (daily user), but felt the risks were being underplayed.

In the days that followed, I've noticed a lot of people piling into Multiply, enticed by...

"~40%APY, NO DEPEG RISK!"

I'm now quite concerned for users of Multiply. I'd planned a whiteboard but that won't be ready in time...

New format, here we go 🫡

🧵

1/ Key point

It is my view that Kamino Multiply users are currently exposed to heightened risk.

Multiply only works if the interest rate to borrow SOL is less than the APY rate on the LST (JupSOL or hSOL).

The interest rate to borrow SOL is determined by the 'utilisation' (ratio of supplied SOL vs. borrowed SOL). This number goes up when more people borrow SOL or remove their SOL supply from Kamino.

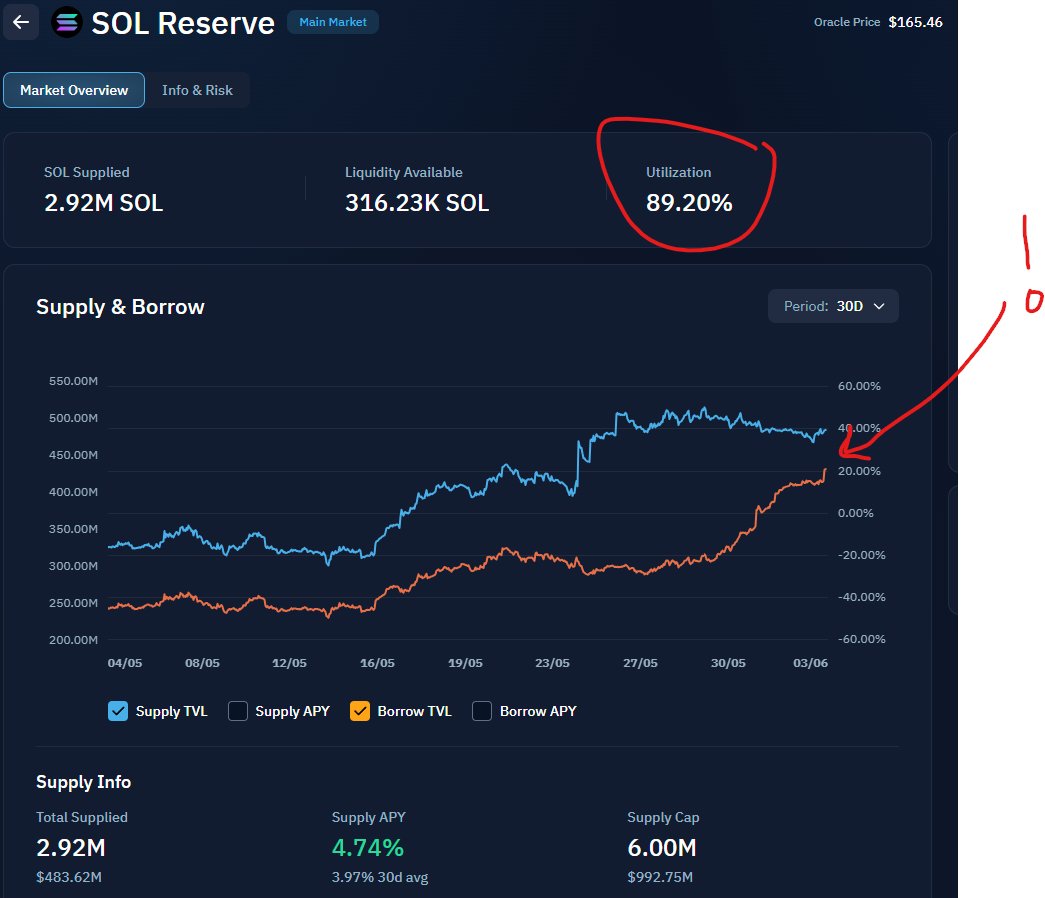

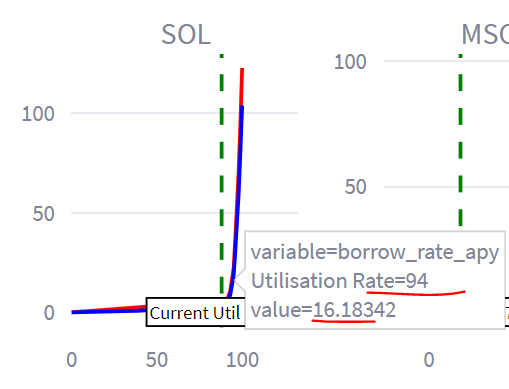

Right now, SOL utilisation is sitting at 91% on Kamino's own risk dashboard (this is extremely high)...

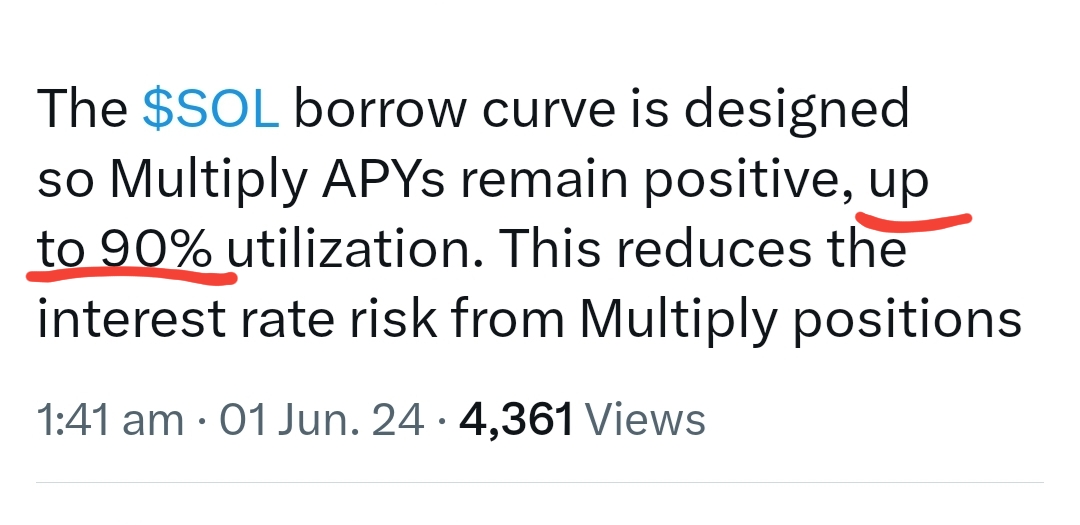

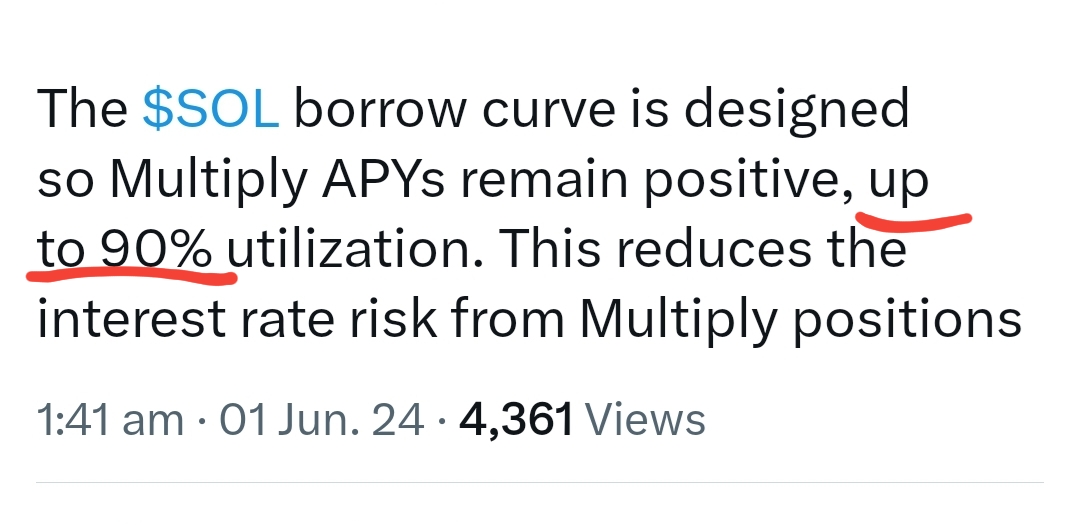

In fact, it's currently higher than the quoted upper-bound of curve-control quoted by @KaminoFinance in their own hSOL multiply post. Screenshot below, or

full post here: .

It is my view that Kamino Multiply users are currently exposed to heightened risk.

Multiply only works if the interest rate to borrow SOL is less than the APY rate on the LST (JupSOL or hSOL).

The interest rate to borrow SOL is determined by the 'utilisation' (ratio of supplied SOL vs. borrowed SOL). This number goes up when more people borrow SOL or remove their SOL supply from Kamino.

Right now, SOL utilisation is sitting at 91% on Kamino's own risk dashboard (this is extremely high)...

In fact, it's currently higher than the quoted upper-bound of curve-control quoted by @KaminoFinance in their own hSOL multiply post. Screenshot below, or

full post here: .

https://x.com/KaminoFinance/status/1796567562118918276

2/ Context

Two days ago, I flagged this initial concern with @durdenwannabe and again the following day with @toothfairy_hk requesting clarification (no response). At the time, the SOL utilisation rate was around 70%.

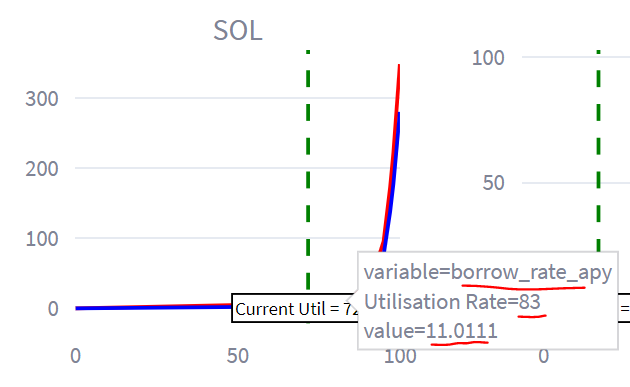

At the time, Kamino's own Interest rate curve on the live risk dashboard suggested that at a utilisation rate of 83%, all Multiply positions would be under water (SOL borrow rate above 11%). I took the screenshot (below) in preparation for my planned weekend whiteboard.

Receipts:

a)

b)

Two days ago, I flagged this initial concern with @durdenwannabe and again the following day with @toothfairy_hk requesting clarification (no response). At the time, the SOL utilisation rate was around 70%.

At the time, Kamino's own Interest rate curve on the live risk dashboard suggested that at a utilisation rate of 83%, all Multiply positions would be under water (SOL borrow rate above 11%). I took the screenshot (below) in preparation for my planned weekend whiteboard.

Receipts:

a)

b)

https://x.com/JamesleyHanley/status/1796659799062610190

https://x.com/JamesleyHanley/status/1796363851480608951?t=Ez7xyVs4XkL_xhGCaBMCbQ&s=19

3/ The current situation

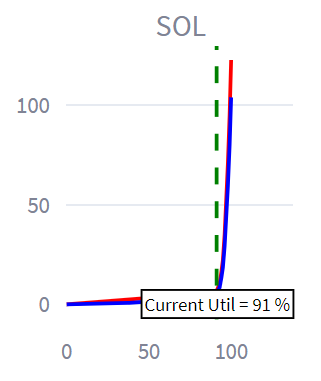

The SOL pool is currently at 91% utilisation (used for Multiply), up from 83% this morning... Yet the borrow APY is still quoted at 6%...

How are we not under water? You might be wondering.

The team have been kicking the can down the road by flattening the interest rate curve (everything to the left of the green dotted line).

This makes everything to the right of the dotted line, much, much steeper. The thinner this margin, the steeper the curve, the more violent the rate moves at higher utilisation rates.

So steep, in fact, that if the pool increases in util by only 3% to 94%, all Multiply positions would be under water (JupSOL, hSOL, mSOL) as the SOL borrow rate far exceeds the LST's APY.

The SOL pool is currently at 91% utilisation (used for Multiply), up from 83% this morning... Yet the borrow APY is still quoted at 6%...

How are we not under water? You might be wondering.

The team have been kicking the can down the road by flattening the interest rate curve (everything to the left of the green dotted line).

This makes everything to the right of the dotted line, much, much steeper. The thinner this margin, the steeper the curve, the more violent the rate moves at higher utilisation rates.

So steep, in fact, that if the pool increases in util by only 3% to 94%, all Multiply positions would be under water (JupSOL, hSOL, mSOL) as the SOL borrow rate far exceeds the LST's APY.

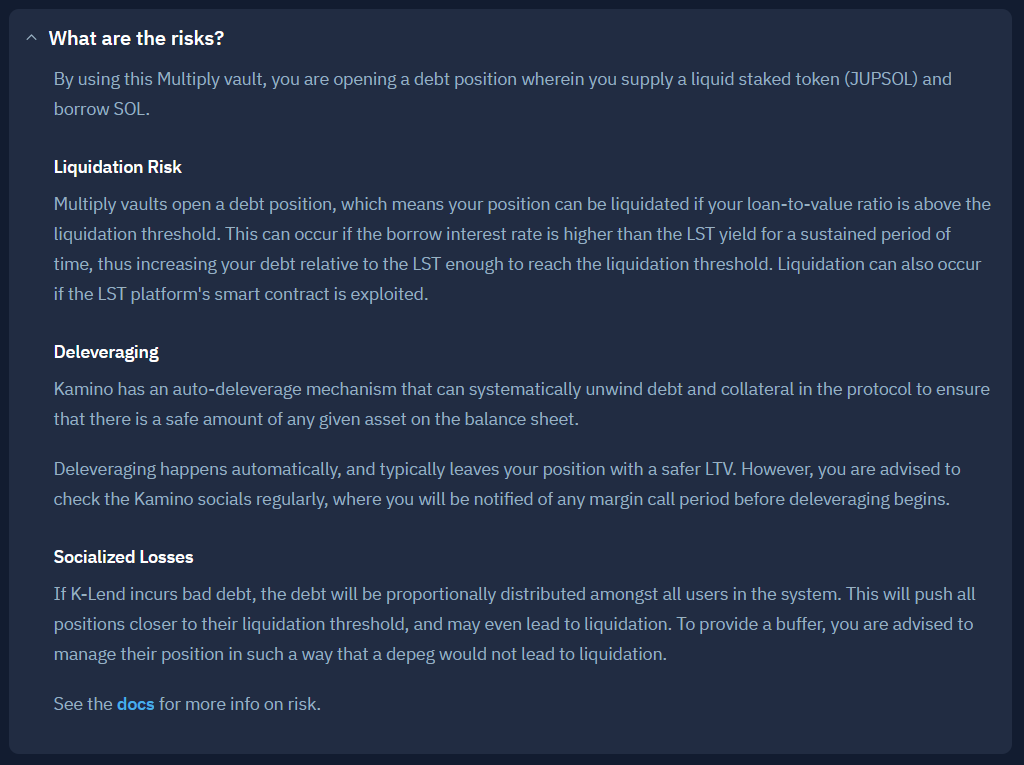

4/ What could happen?

If the following occurs:

A) people continue to pile into Multiply; and/or

B) any significant amount of SOL is withdrawn from the pool.

This could put all the positions in negative APY (underwater) and at risk of liquidation as Borrow rate far exceeds the LST APY.

The team noted the upper-threshold of the curve control is 90% util, but now we're now at 91%.

Here's what the website says for unwinds (see img):

If the following occurs:

A) people continue to pile into Multiply; and/or

B) any significant amount of SOL is withdrawn from the pool.

This could put all the positions in negative APY (underwater) and at risk of liquidation as Borrow rate far exceeds the LST APY.

The team noted the upper-threshold of the curve control is 90% util, but now we're now at 91%.

Here's what the website says for unwinds (see img):

https://x.com/toothfairy_hk/status/1796113197197316409

5/ Conclusion and next steps

Use Kamino Multiply right now at your own risk.

I'm keen to see how @KaminoFinance team deal with this situation.

Here are their options in my view:

➜ Incentivise more SOL deposits (short-term solution) noting SOL is already heavily subsidised with 5x KMNO points.

➜ Disable new multiply positions from being opened, impose a cap at 90% Util (or less).

➜ Re-emphasize to users that any additional open Multiply positions from here will be at much higher risk of unwind than previously.

➜ Do nothing, let rates spike out of hand, start unwinding people from multiply and say "too bad, you signed the risk waiver".

Use Kamino Multiply right now at your own risk.

I'm keen to see how @KaminoFinance team deal with this situation.

Here are their options in my view:

➜ Incentivise more SOL deposits (short-term solution) noting SOL is already heavily subsidised with 5x KMNO points.

➜ Disable new multiply positions from being opened, impose a cap at 90% Util (or less).

➜ Re-emphasize to users that any additional open Multiply positions from here will be at much higher risk of unwind than previously.

➜ Do nothing, let rates spike out of hand, start unwinding people from multiply and say "too bad, you signed the risk waiver".

6/ Fin

There are no free lunches. Multiply is no exception.

Note: I actually really like Multiply, I use it myself, but felt it important to call out after chatting with @surajr_ about it today (thx for reaching out).

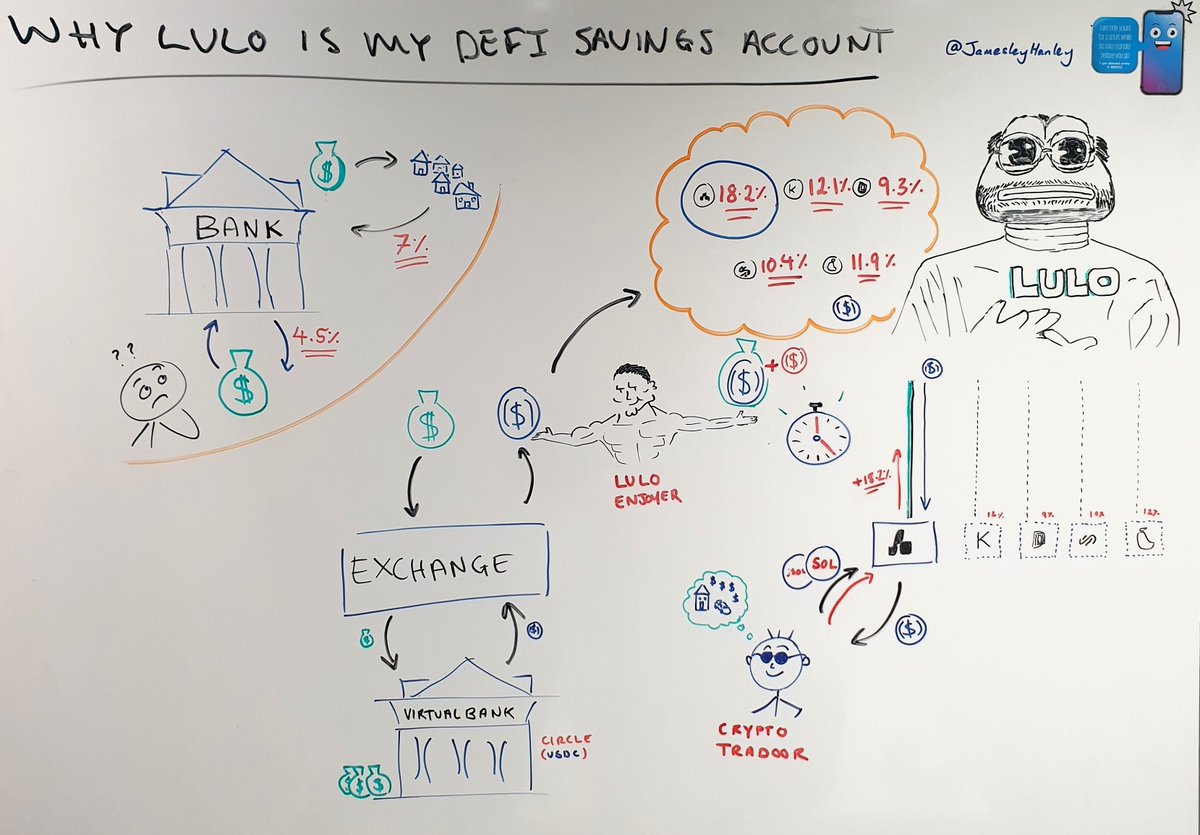

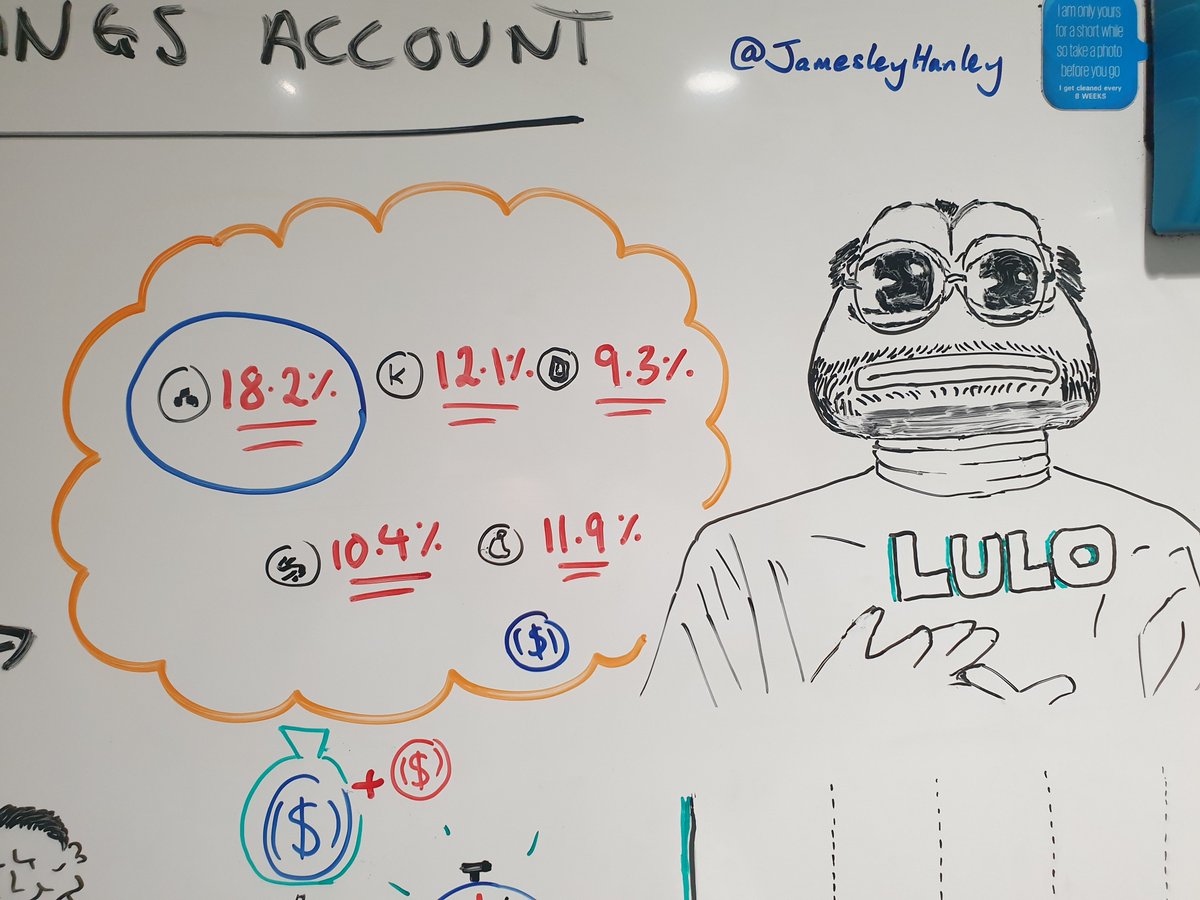

Whiteboard still on the way. Caution advised.

James 🫡

There are no free lunches. Multiply is no exception.

Note: I actually really like Multiply, I use it myself, but felt it important to call out after chatting with @surajr_ about it today (thx for reaching out).

Whiteboard still on the way. Caution advised.

James 🫡

7/ Update

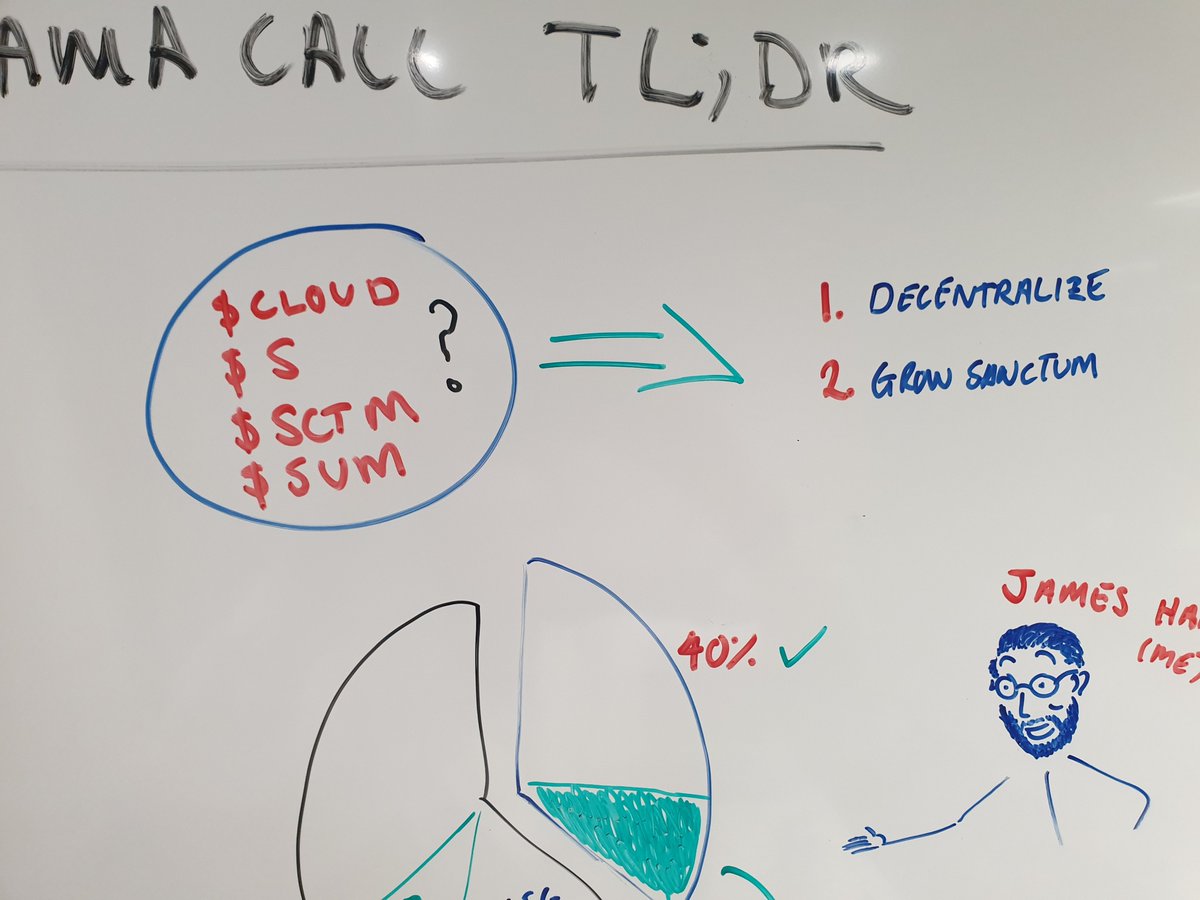

@KaminoFinance team have confirmed the utilisation for SOL borrows is capped at 90% to mitigate the risks outlined in this thread.

Info from the team in response to my thread can be found here:

Note: the live Risk Engine is currently showing 91% (screenshot from 1min ago), @y2kappa and @toothfairy_hk have clarified this is a bug which will be fixed in coming days.

Grateful to all those who've taken the time to thoughtfully respond to this post 🤝

@KaminoFinance team have confirmed the utilisation for SOL borrows is capped at 90% to mitigate the risks outlined in this thread.

Info from the team in response to my thread can be found here:

Note: the live Risk Engine is currently showing 91% (screenshot from 1min ago), @y2kappa and @toothfairy_hk have clarified this is a bug which will be fixed in coming days.

Grateful to all those who've taken the time to thoughtfully respond to this post 🤝

https://x.com/y2kappa/status/1797603876922617960

• • •

Missing some Tweet in this thread? You can try to

force a refresh