Chief Whiteboard Explainer.

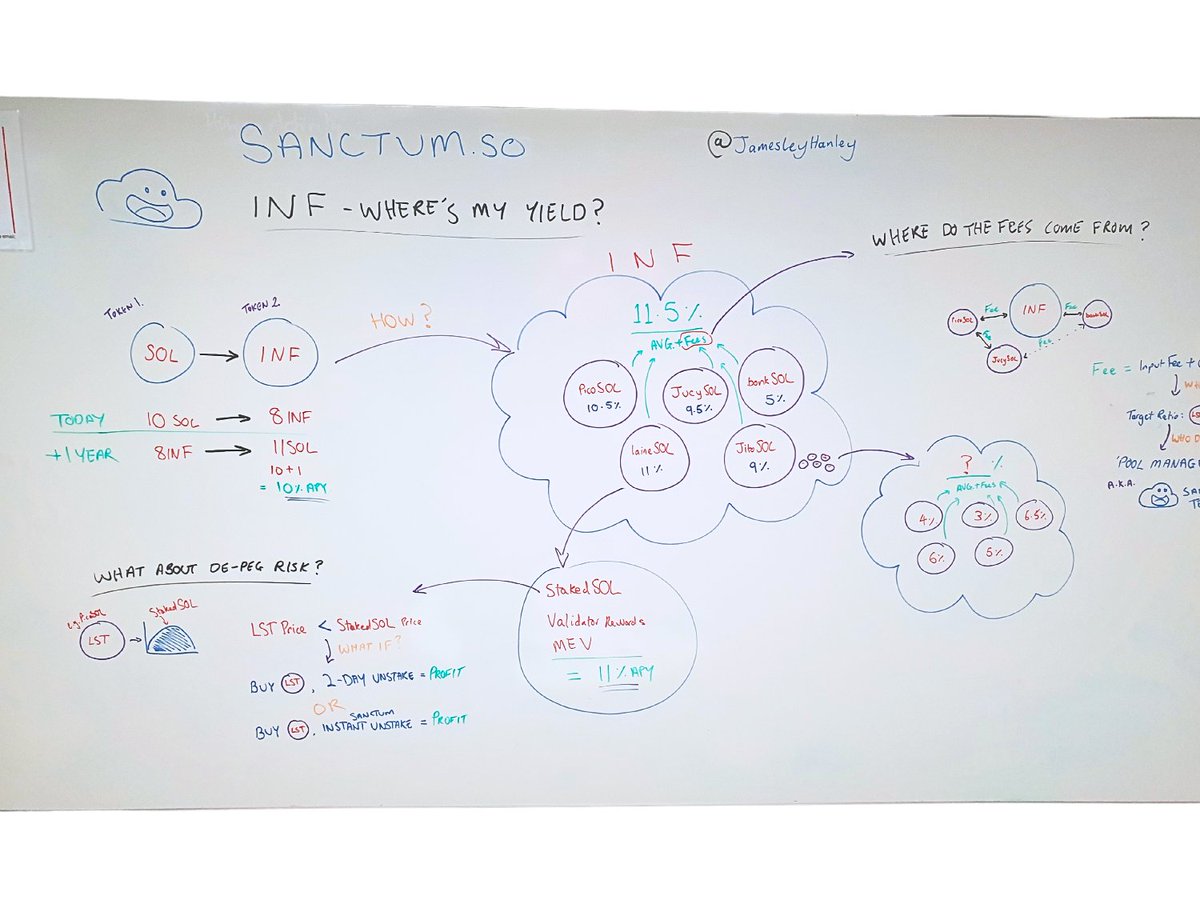

Sanctum ref code: JAMES

https://t.co/cUdOfmAmLm

OBOS. Only Bullish On Solana 😎 🏊♂️

How to get URL link on X (Twitter) App

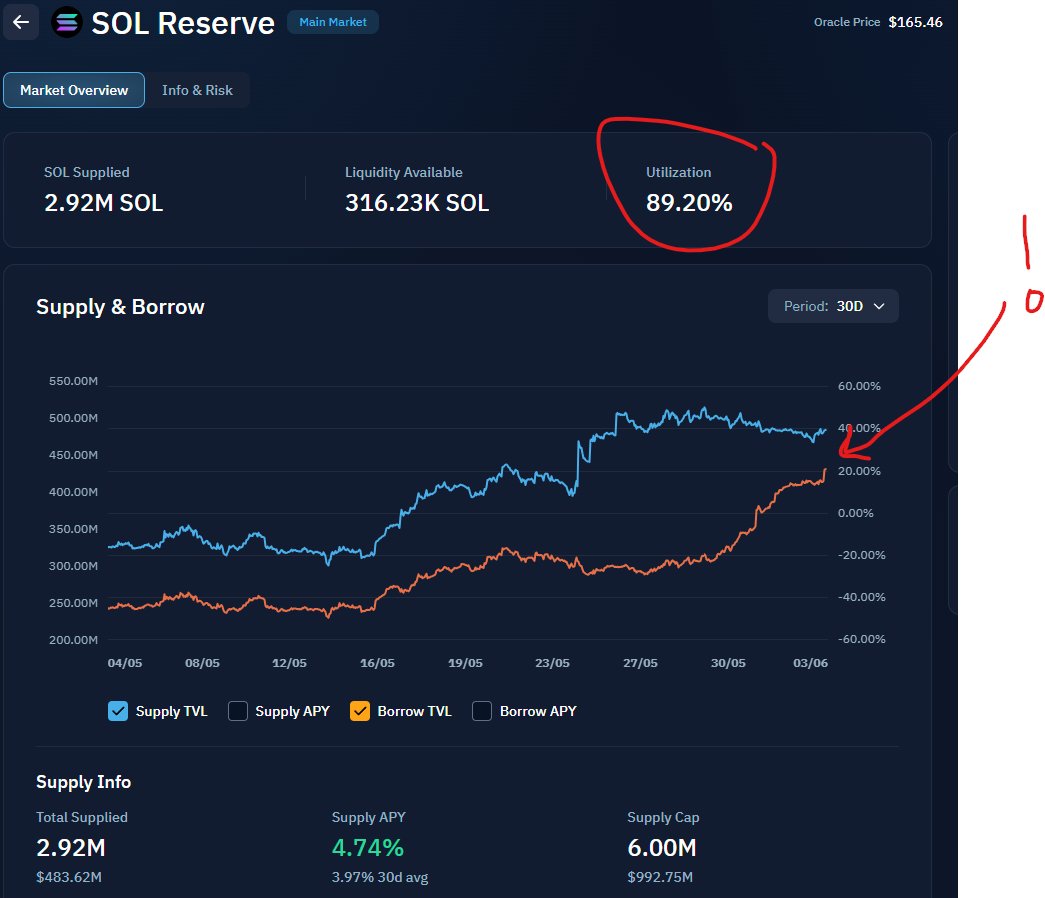

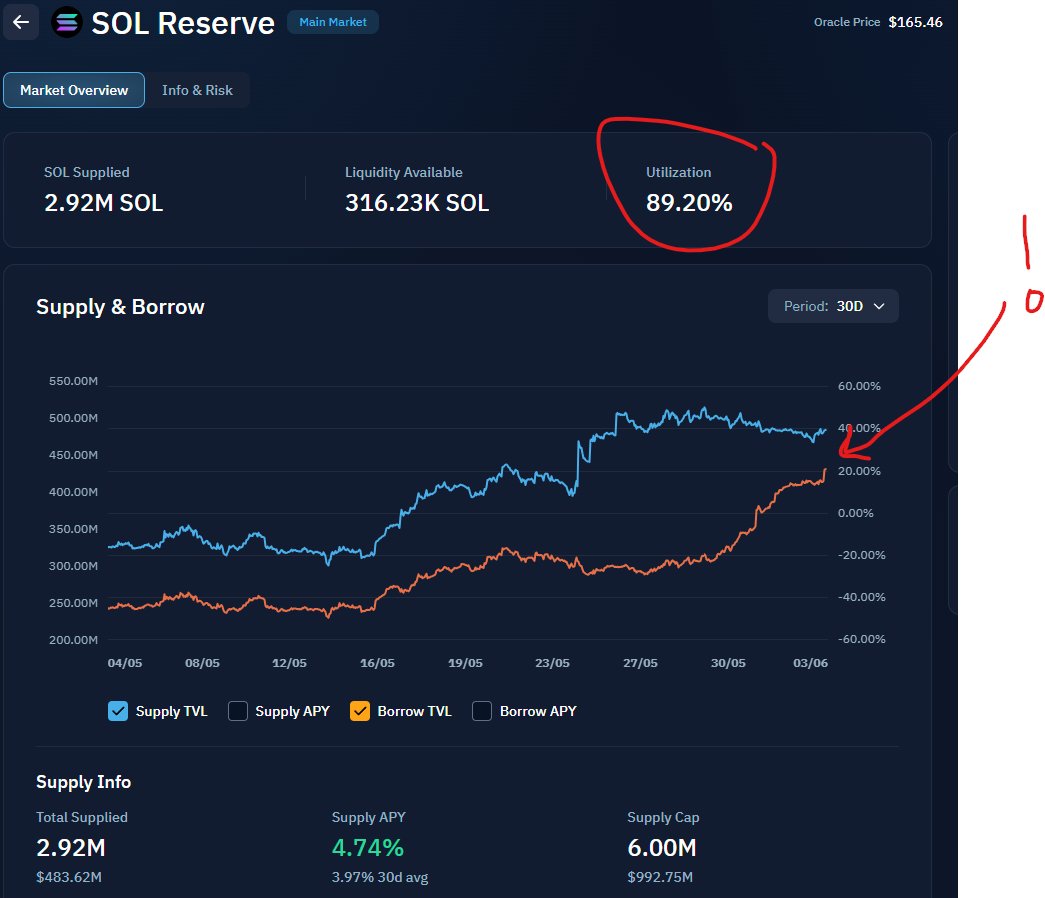

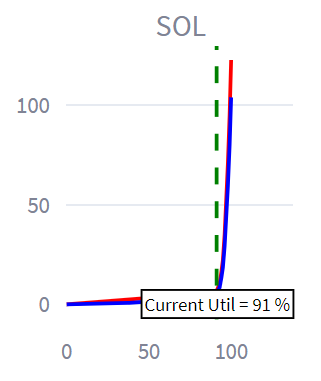

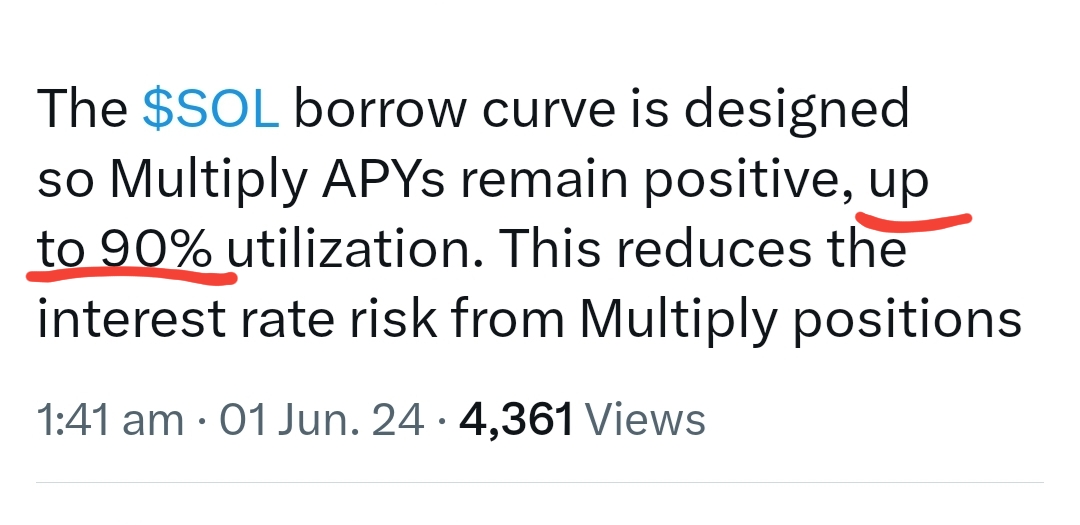

1/ Key point

1/ Key pointhttps://x.com/KaminoFinance/status/1796567562118918276

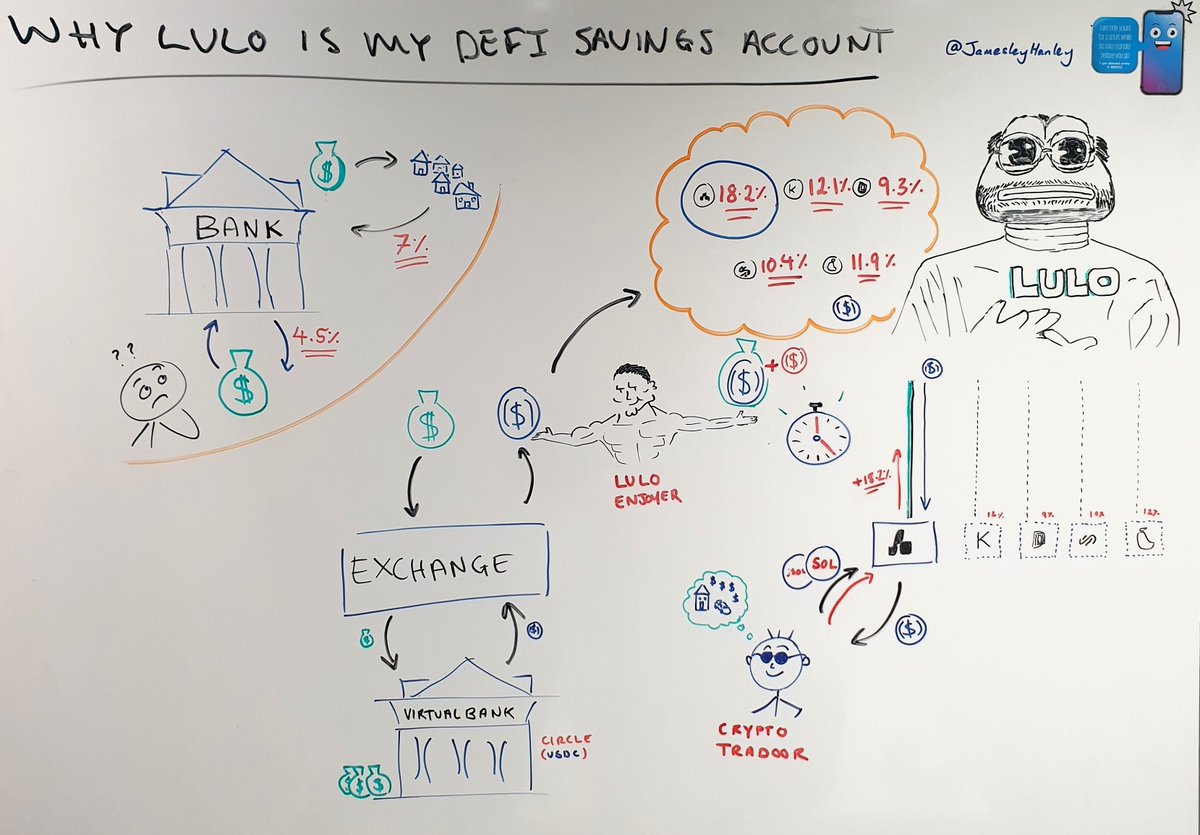

1/ Let me set the scene

1/ Let me set the scene

1/ Highlights

1/ Highlights

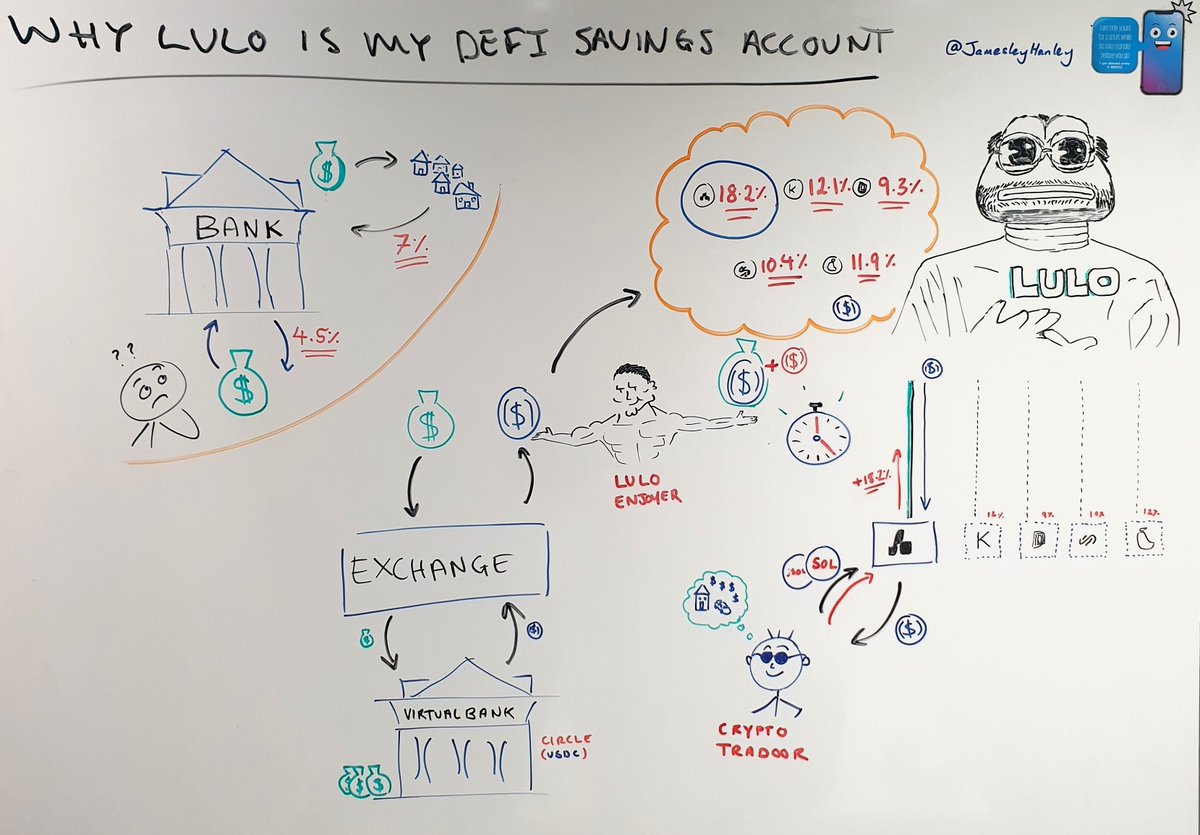

1/ Okay, I'll bite. How does staking actually work on Solana?

1/ Okay, I'll bite. How does staking actually work on Solana?

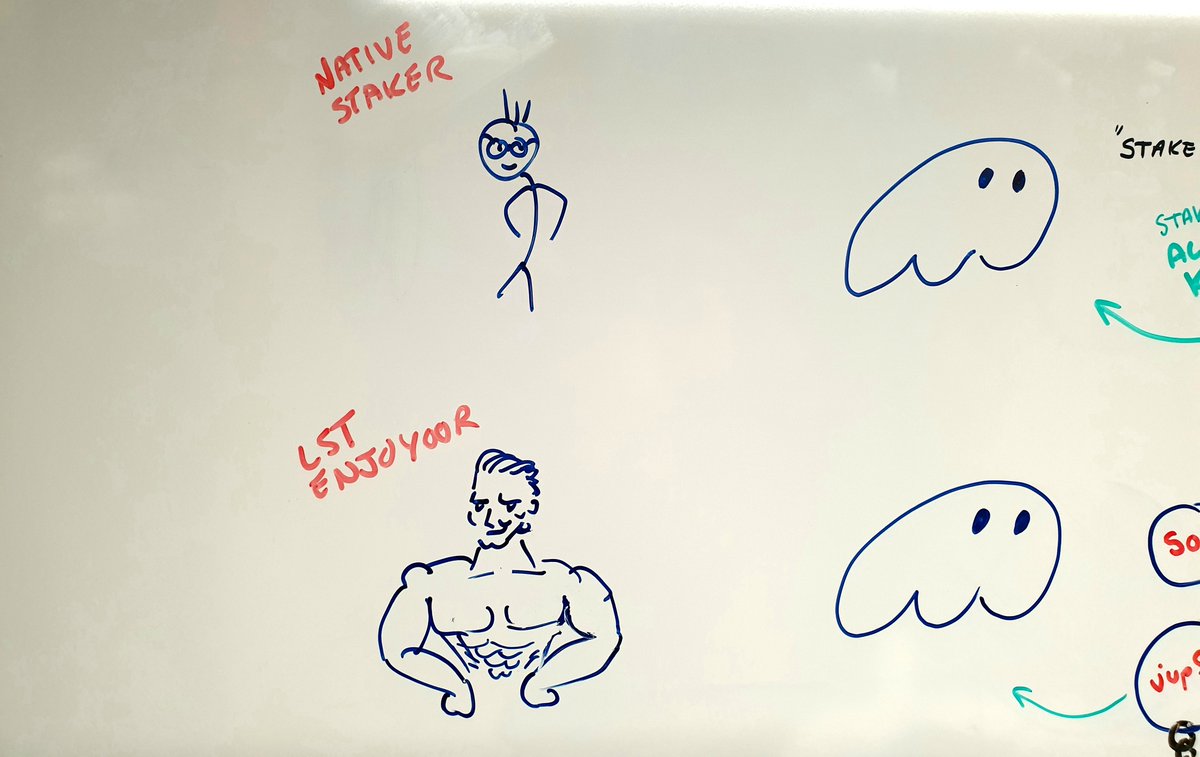

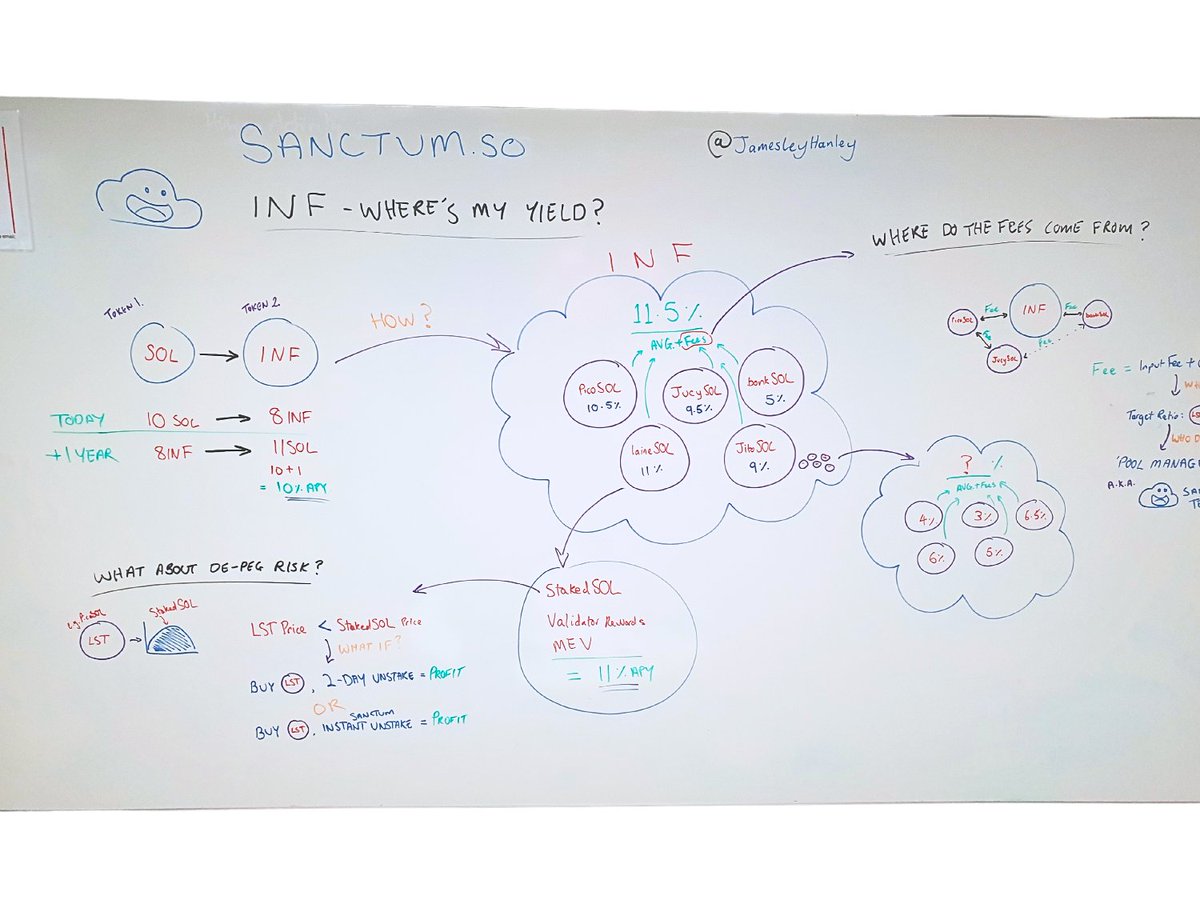

1/ The opportunity is enormous.

1/ The opportunity is enormous.

1/ Okay so I've grabbed some INF, how do I stake it?

1/ Okay so I've grabbed some INF, how do I stake it?