1/[Full thread] We are short Lasertec Corp (TSE:6920) $6920, one of the largest corporate frauds in Japanese history ($23B market cap) and easily the largest outright fraud in the world by average daily volume. 330 page presentation now live in English and Japanese at :

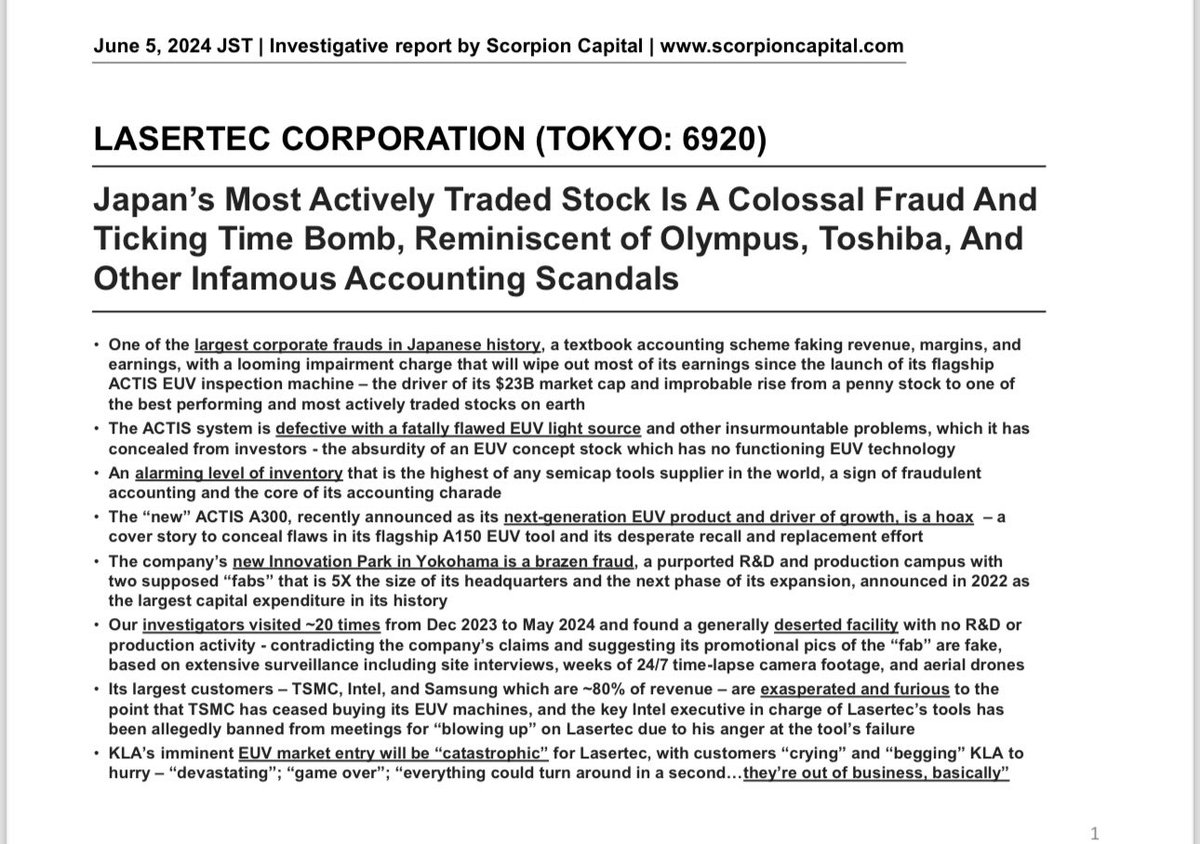

Japan’s Most Actively Traded Stock Is A Colossal Fraud And Ticking Time Bomb, Reminiscent Of Olympus, Toshiba, And Other Infamous Accounting Scandalsscorpioncapital.com

Japan’s Most Actively Traded Stock Is A Colossal Fraud And Ticking Time Bomb, Reminiscent Of Olympus, Toshiba, And Other Infamous Accounting Scandalsscorpioncapital.com

2/Depending on the week, Lasertec’s trading volume is in the top ten globally at $3-4B/day, on the leaderboard with Nvdia, Tesla, Microsoft, Google, Amazon, and Meta, making it one of the biggest bubble stocks on earth. Volumes have recently abated but remain ~$2B (3 month avg) and $1.2B in the last week.

3/The longtime CEO Osamu Okabayashi abruptly announced his resignation a few weeks ago, having run the company for the last 15 years, on the same day as earnings with the stock near all-time highs – typically an ominous sign and one of our most reliable indica that the end is near. In one major corporate fraud after another, we see the CEO and/or CFO depart when the scheme becomes too big to sustain. Okabayashi provided no explanation for the unexpected timing.

4/Founded in the 1960’s, Lasertec was a small, obscure supplier of basic measurement and inspection equipment, with revenue stuck between $30-100MM for most of the 2000’s – and is now hailed as “Japan’s ASML,” the largest semicap in the world with $377B market cap. It struggled the entire decade prior to its EUV product launch in 2017, with mediocre margins and no growth, trading at 1-2X revenue as a penny stock around $0.50 to $2 (¥75 to ¥300), unable to exceed $50-200MM market cap.

5/Out of nowhere, the stock has spiked 100-200X since it became an EUV story, depending on the baseline date, making it the best performing stock in Japan in the last 5 years (1,700%) and 10 years (16,000%); and the 6th best in the world >$5B market cap over the last decade.

6/It is the most actively traded semicap equipment stock in the world, despite having a fraction of the market cap of ASML ($377B), Applied Materials ($177B), Lam ($122B), Tokyo Electron ($101B), and KLA ($102B). On some days it trades 10X the dollar volume of ASML, the world’s largest semicap player. Its multiple is equally preposterous at 17X sales, eclipsing all of the leading semicap suppliers.

7/ Lasertec for most of its history was a microcap, marginal supplier with no money for R&D, yet now claims to have a monopoly with its actinic EUV mask inspection tool – its claim to fame - magically replicating a technology that took ASML 20 years, $10B in investment, and 1,000 engineers to develop. Too good to be true?

8/ We undertook an intensive 5-month investigation encompassing over 20 in-depth research interviews, typically 60-90 minutes each; ~20 investigator field visits to Lasertec’s new Innovation Park; and an extensive review of the scientific literature on EUV light sources and actinic mask inspection. Our sources included 6 contacts at TSMC, and key executives at Intel, Samsung, Global Foundries, and Marvell. Additional sources included 4 Lasertec and other field engineers working full-time on its ACTIS EUV systems; two of the leading experts in EUV source development; multiple industry executives in Japan, including two in touch with Lasertec’s CEO; and many others.

9/Lasertec is an extreme, textbook accounting fraud that checks off every box: claiming to have the highest margins in the industry; but alarmingly little cash flow and the lowest cash conversion among its peers; accompanied by the highest inventory level of any semicap equipment supplier in the world.

10/The warning signs are classic: firing their longtime auditor right when the anomalies first appeared; secrecy as evidenced by vague disclosures in the financial statements; and terse, evasive replies by the CEO and CFO during quarterly Q&A.

11/Lasertec’s new Innovation Park in Yokohama is a brazen fraud, a purported R&D and production campus with two supposed “fabs” that is 5X the size of its headquarters and the next phase of its expansion, announced in 2022 as the largest capital expenditure in its history.

12/Our investigators visited ~20 times from Dec 2023 to May 2024 and found a generally deserted facility with no R&D or production activity - contradicting the company’s claims and suggesting its promotional pics of the “fab” are fake, based on extensive surveillance including site interviews, weeks of 24/7 time-lapse and motion-detector camera footage, and aerial drones.

13/ Overstated revenue and earnings are at the core of the fraud, offset by improperly valued inventory, with a looming, inevitable 65-70% write-down and impairment charge – a loss that will wipe out ~70% of its cumulative earnings since the launch of its flagship ACTIS EUV system and 85% of its retained earnings. In other words, its parabolic stock rise has been based on an illusion. The hit will far exceed what Olympus incurred and is considerable versus Toshiba, when their frauds were exposed.

14/Lasertec purported margins are so high that they significantly exceed every one of the five largest semiconductor equipment companies in the world by revenue – even eclipsing ASML, which invented EUV lithography systems and has a monopoly. Lasertec’s margins are so astonishing that they even exceed Apple’s (30%), Google’s (29%), Meta/Facebook’s (37%), and are on par with Microsoft’s (42%), having spiked from 28% in 2019 when it launched its ACTIS EUV machine to 41% in 2023.

15/With margins far higher than the five largest semicap companies, one would expect Lasertec’s net income – the earnings reported on an accrual basis on its income statement – to convert to copious amounts of operating cash flow – and at a higher rate given its higher margins. But therein lies to the key to the fraud – while Lasertec claims to have the highest profitability, its cash conversion is the lowest – a striking anomaly at the center of the largest corporate frauds in history.

16/Cash conversion has plummeted since the launch of its ACTIS EUV line in 2019/2020 – over the last 5 years, one dollar of earnings has produced only 65 cents of cash, in contrast to its peers which have extraordinary cash conversion, such as ASML with 130-180% conversion despite margins far lower than the ones Lasertec claims; and KLA at >100% in all but one of the last 5 years

17/Lasertec’s cash conversion has dropped sharply over time, particularly over the last two years – collapsing even further in the last two quarters (30% Dec’23 and 28% Mar’24), in addition to exhibiting troubling volatility. This is a typical progression in frauds with a high-flying stock and pressure to show rising earnings, which requires the accounting fraud to get larger every period until it becomes unsustainable and collapses.

18/Aside from the unusually high margins and missing cash flow, the anomaly that drew our focus was the alarming level of inventory - $1.1B, a figure that has barely fluctuated in 6 quarters, itself a sign of a fabricated number. The absolute level of inventory has gone parabolic; is highly abnormal as a percent of revenue versus its historical trend; began to spike right when it entered the EUV market; hit a preposterous 120-135% of revenue in some recent quarters; hit its highest level in the last 2 quarters as a percent of assets; is the most inflated inventory level of any semicap supplier in the world; and has no explanation versus the 5 largest players - triple or quadruple ASML, Applied Materials, Lam, Tokyo Electron, KLA - even though they all make complex, long lead-time tools.

19/The origin of the accounting fraud: Lasertec’s flagship ACTIS actinic EUV mask inspection machine is defective with a fatally flawed EUV light source – the core of any EUV system – in addition to insurmountable problems with other key components like the optics and mask stage. Shockingly, it has a $23B market cap as an EUV story without an EUV technology that works.

20/The “new” ACTIS A300, announced with fanfare in Nov 2023 as Lasertec’s next-generation EUV product and driver of growth, is a hoax – a cover story to conceal fatal flaws with the EUV light source in its flagship tool, the A150, and the resulting, costly replacement and recall crisis. The company’s EUV story - and its stock - would have collapsed had it revealed that the source – the foundation of an EUV system - was defective and had to be hastily, secretly swapped with one from a small, 12-person Russian R&D project called Isteq, which it misrepresents as in-house Japanese technology under the name “Urashima.”

21/Lasertec’s largest customers – notably TSMC, Intel, and Samsung, which are 77% of its revenue – are struggling, exasperated, and/or furious with its EUV mask inspection system, to the point that TSMC has ceased buying its EUV machines, and the key Intel executive in charge of Lasertec’s tools has been allegedly banned from meetings for “blowing up” on Lasertec due to his anger at the tool’s failure.

22/Key customers are “really struggling about what to do”; “it’s painful, extremely painful” to use Lasertec’s tool; “it would be stupid” to buy more machines. One of Intel’s most senior and tenured executives, with a leadership role in EUV, confirmed that Lasertec’s EUV source “is not a well-controlled process…it was painful…if you choose a bad technology you just can’t get there”; Intel’s VP mask operations VP confirmed the struggles.

23/Struggles at TSMC. The world’s largest chipmaker’s experience with Lasertec has been a disaster, not only with its ACTIS EUV systems but also with its outdated, previous-generation DUV tools. Multiple sources including TSMC’s ex-head of R&D, a procurement executive who first brought Lasertec into TSMC, and the head of TSMC’s mask shop – one of whom laughed at Lasertec’s tool - indicated that TSMC stopped buying its ACTIS machines years ago; that they are so unreliable that masks require parallel, redundant inspection with older tools; that at best it is a niche, laboratory R&D tool unsuitable for fabs.

• • •

Missing some Tweet in this thread? You can try to

force a refresh