Activist short selling focused on frauds and promotes. Presume all tweets reflect short positions and biased opinion. Verify independently. Not inv advice.

How to get URL link on X (Twitter) App

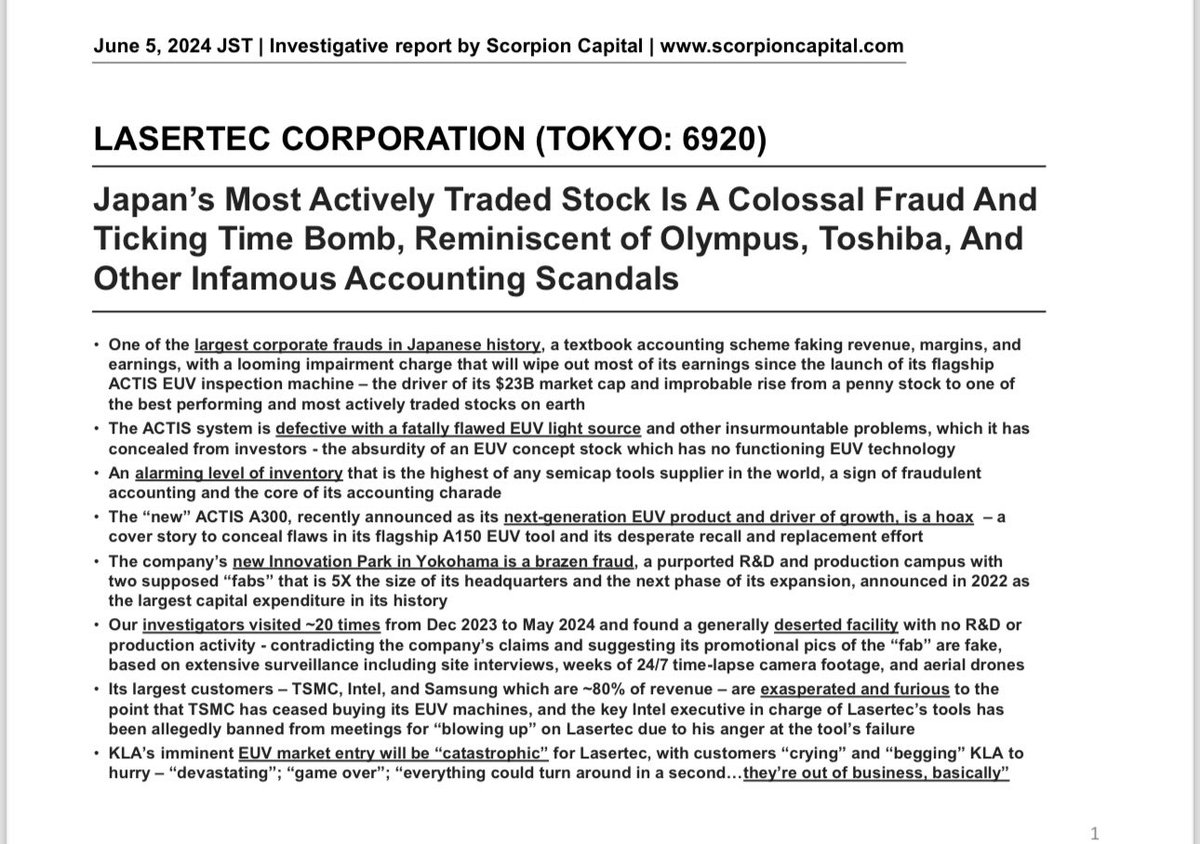

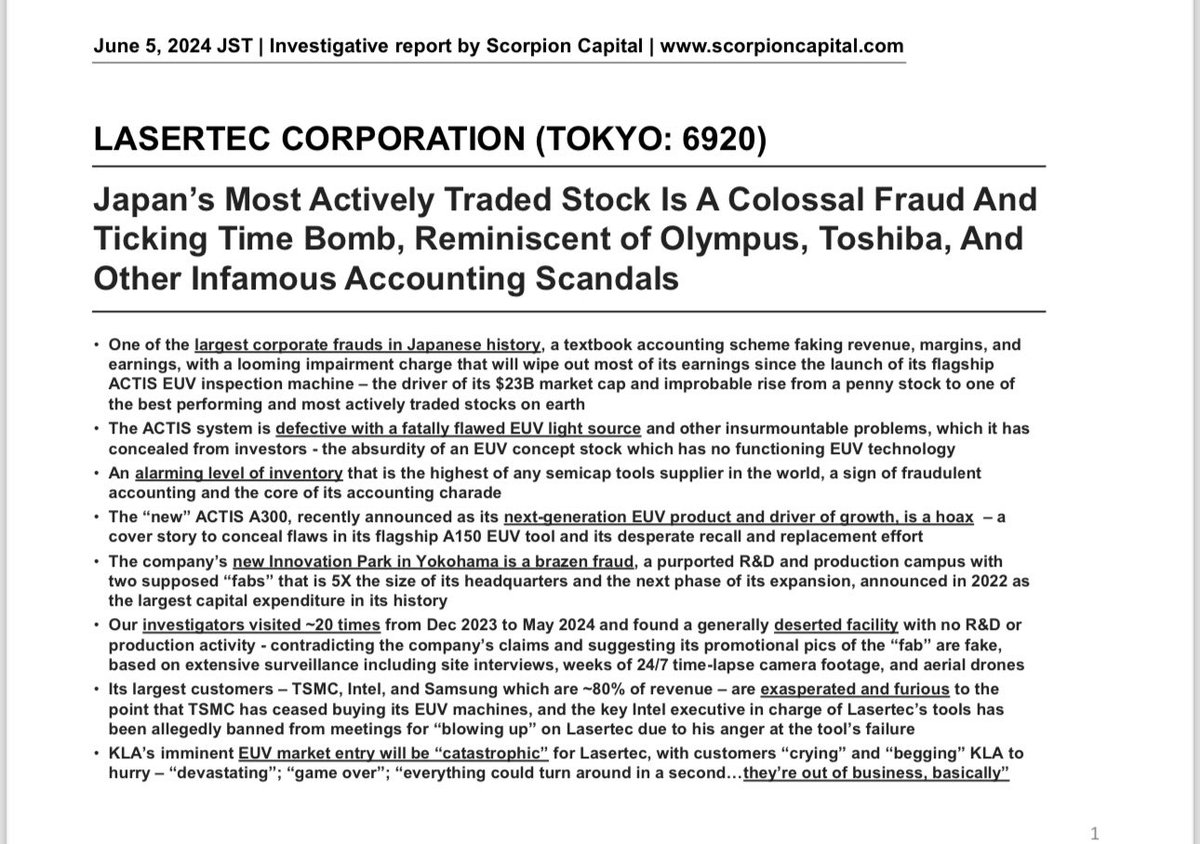

2/Depending on the week, Lasertec’s trading volume is in the top ten globally at $3-4B/day, on the leaderboard with Nvdia, Tesla, Microsoft, Google, Amazon, and Meta, making it one of the biggest bubble stocks on earth. Volumes have recently abated but remain ~$2B (3 month avg) and $1.2B in the last week.

2/Depending on the week, Lasertec’s trading volume is in the top ten globally at $3-4B/day, on the leaderboard with Nvdia, Tesla, Microsoft, Google, Amazon, and Meta, making it one of the biggest bubble stocks on earth. Volumes have recently abated but remain ~$2B (3 month avg) and $1.2B in the last week.

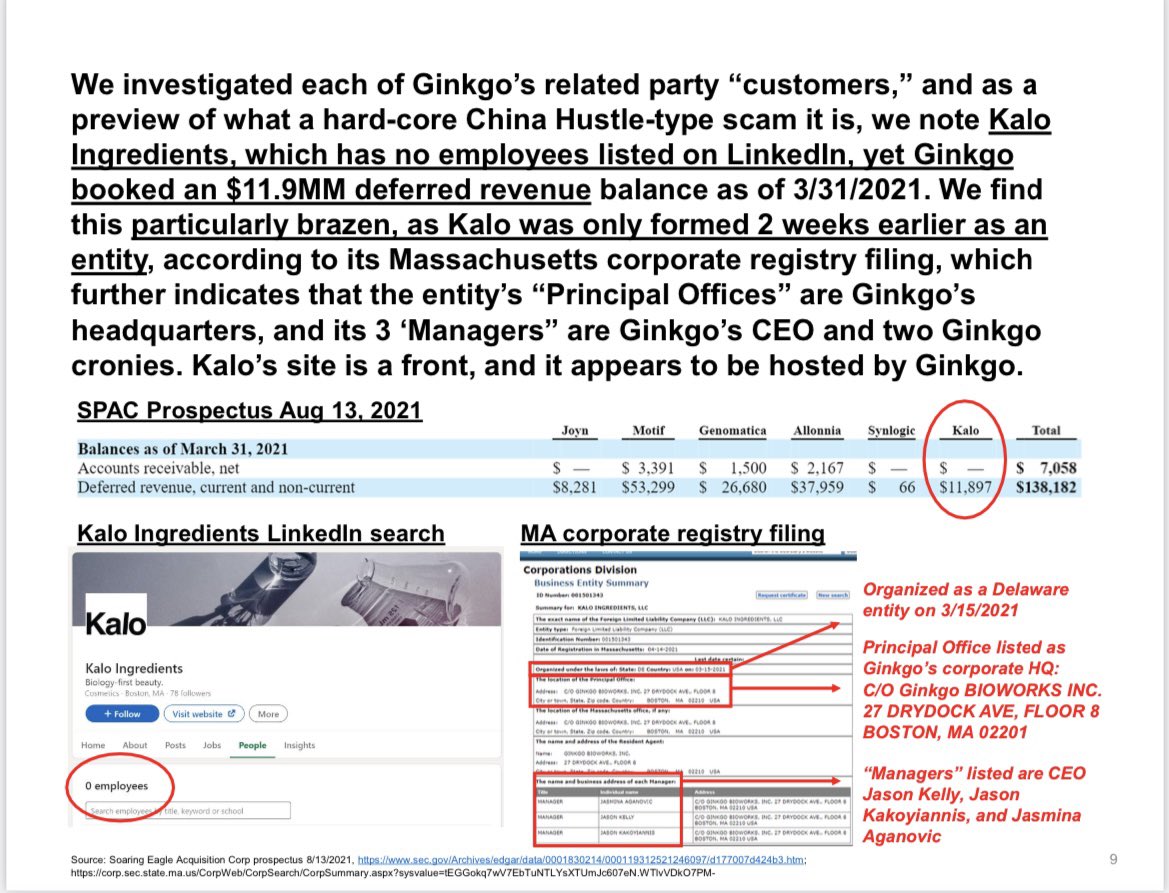

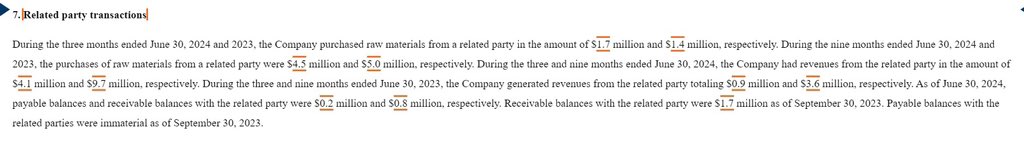

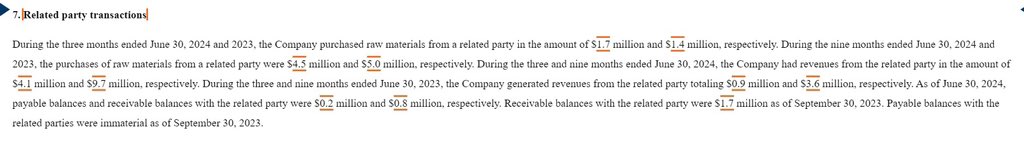

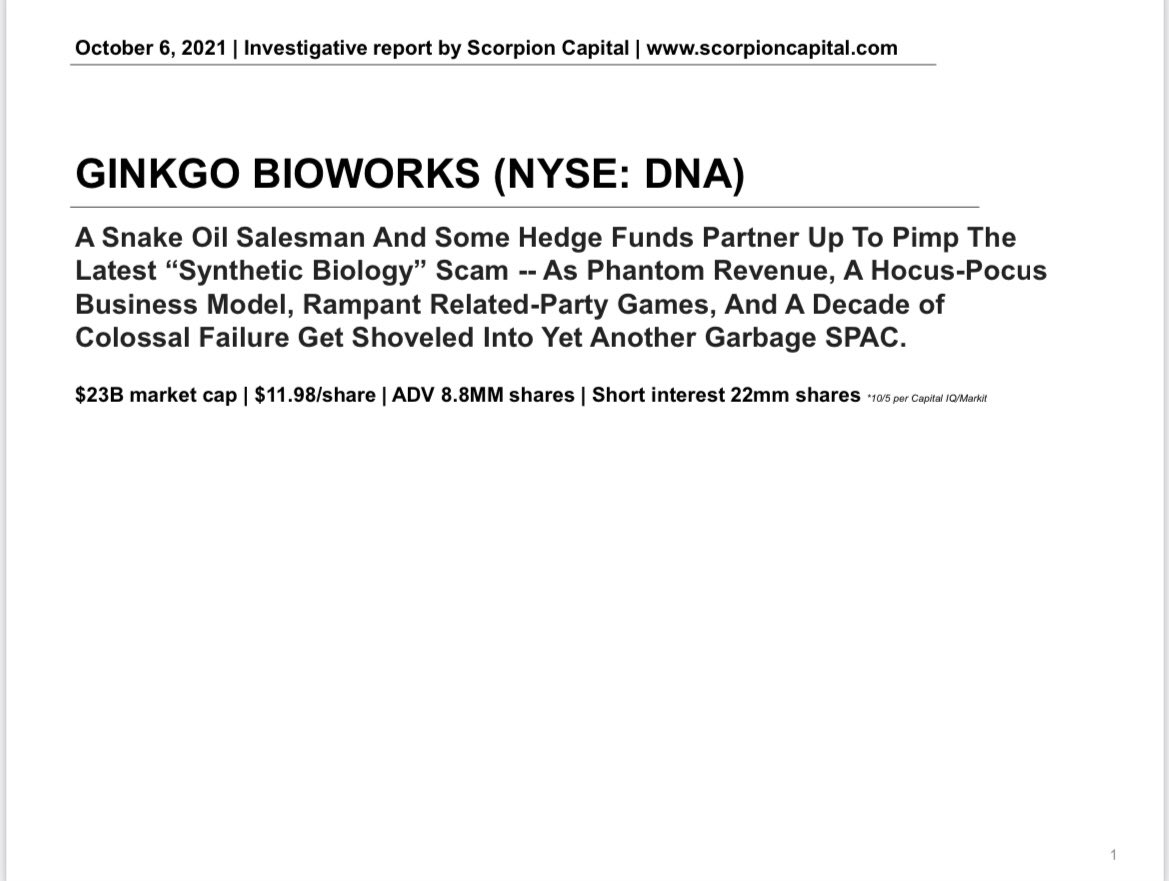

2 Ginkgo’s business model is based on a dubious shell game. Most of its foundry revenue, an absurd 72% in 2020, and ~100% of its deferred revenue are derived from related-party “customers.” Investments into these entities by Ginkgo and its investors are round-tripped back.

2 Ginkgo’s business model is based on a dubious shell game. Most of its foundry revenue, an absurd 72% in 2020, and ~100% of its deferred revenue are derived from related-party “customers.” Investments into these entities by Ginkgo and its investors are round-tripped back.