⚡️10 companies based out of Andhra Pradesh in focus as Chandrababu Naidu becomes the kingmaker in the NDA Govt

[A thread..]🧵👇

[A thread..]🧵👇

✍️Amara Raja Energy & Mobility Ltd:

A leading manufacturer of lead-acid batteries for industrial and automotive applications, with seven manufacturing facilities in Andhra Pradesh, India.

🔹M Cap: ₹ 24,153 Cr

🔹P/E: 26.6

🔹CMP: ₹ 1,320

🔹3 Years Sales Growth: 16.4%

A leading manufacturer of lead-acid batteries for industrial and automotive applications, with seven manufacturing facilities in Andhra Pradesh, India.

🔹M Cap: ₹ 24,153 Cr

🔹P/E: 26.6

🔹CMP: ₹ 1,320

🔹3 Years Sales Growth: 16.4%

✍️Epack Durable Ltd:

Company operates as an Original Design Manufacturer (ODM) specializing in room air conditioners (RAC). It boasts three manufacturing facilities, one situated in Sricity, Andhra Pradesh.

🔹M Cap: ₹1,700 Cr

🔹P/E: 48.1

🔹CMP: ₹178

🔹3 Years Sales Growth: 24.5%

Company operates as an Original Design Manufacturer (ODM) specializing in room air conditioners (RAC). It boasts three manufacturing facilities, one situated in Sricity, Andhra Pradesh.

🔹M Cap: ₹1,700 Cr

🔹P/E: 48.1

🔹CMP: ₹178

🔹3 Years Sales Growth: 24.5%

✍️Pondy Oxides & Chemicals Ltd:

POCL converts lead scraps into pure lead and alloys, operating three facilities in India, including one in Chittoor, Andhra Pradesh which is close to the Amara Raja plant.

🔹M Cap: ₹768 Cr

🔹P/E: 19.4

🔹CMP: ₹661

🔹3 Years Sales Growth: 14.9%

POCL converts lead scraps into pure lead and alloys, operating three facilities in India, including one in Chittoor, Andhra Pradesh which is close to the Amara Raja plant.

🔹M Cap: ₹768 Cr

🔹P/E: 19.4

🔹CMP: ₹661

🔹3 Years Sales Growth: 14.9%

✍️CCL Products (India) Ltd:

Company produces and distributes coffee, with freeze-dried instant coffee plants in Duggirala and Kuvvakoli, Andhra Pradesh.

🔹M Cap: ₹7,618 Cr

🔹P/E: 30.4

🔹CMP: ₹570

🔹3 Years Sales Growth: 28.8%

Company produces and distributes coffee, with freeze-dried instant coffee plants in Duggirala and Kuvvakoli, Andhra Pradesh.

🔹M Cap: ₹7,618 Cr

🔹P/E: 30.4

🔹CMP: ₹570

🔹3 Years Sales Growth: 28.8%

✍️Heritage Foods Ltd:

Engaged in procuring and processing milk and dairy products, it is one of South India's largest private dairies with a significant market share in Andhra Pradesh, Telangana, Karnataka, and Tamil Nadu.

🔹M Cap: ₹5,471 Cr

🔹P/E: 51.3

🔹CMP: ₹590

🔹3 Years Sales Growth: 15.3%

Engaged in procuring and processing milk and dairy products, it is one of South India's largest private dairies with a significant market share in Andhra Pradesh, Telangana, Karnataka, and Tamil Nadu.

🔹M Cap: ₹5,471 Cr

🔹P/E: 51.3

🔹CMP: ₹590

🔹3 Years Sales Growth: 15.3%

✍️Dodla Dairy Ltd:

A leading South Indian dairy company, operates 15 plants (22+ LLPD capacity) and 110+ chilling centers, with an additional cattle feed facility in Andhra Pradesh.

🔹M Cap: ₹5,509 Cr

🔹P/E: 33.0

🔹CMP: ₹926

🔹3 Years Sales Growth: 17.2%

A leading South Indian dairy company, operates 15 plants (22+ LLPD capacity) and 110+ chilling centers, with an additional cattle feed facility in Andhra Pradesh.

🔹M Cap: ₹5,509 Cr

🔹P/E: 33.0

🔹CMP: ₹926

🔹3 Years Sales Growth: 17.2%

✍️Nelcast Ltd:

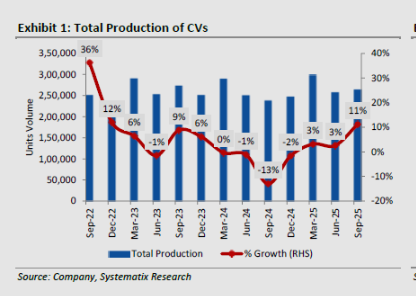

The company manufactures iron castings at plants in Andhra Pradesh and Tamil Nadu, serving M&HCV, tractor industries, and rail projects.

🔹M Cap: ₹1,195 Cr

🔹P/E: 29.6

🔹CMP: ₹137

🔹3 Years Sales Growth: 27.2%

The company manufactures iron castings at plants in Andhra Pradesh and Tamil Nadu, serving M&HCV, tractor industries, and rail projects.

🔹M Cap: ₹1,195 Cr

🔹P/E: 29.6

🔹CMP: ₹137

🔹3 Years Sales Growth: 27.2%

✍️Apex Frozen Foods Ltd:

Company exports shelf-stable aquaculture products, with processing facilities in Kakinada, G. Ragampeta, and Bapatla, supported by cold storage and freezing-capable vehicles.

🔹M Cap: ₹686 Cr

🔹P/E: 47.0

🔹CMP: ₹220

🔹3 Years Sales Growth: -0.59%

Company exports shelf-stable aquaculture products, with processing facilities in Kakinada, G. Ragampeta, and Bapatla, supported by cold storage and freezing-capable vehicles.

🔹M Cap: ₹686 Cr

🔹P/E: 47.0

🔹CMP: ₹220

🔹3 Years Sales Growth: -0.59%

✍️Avanti Feeds Ltd:

Company produces shrimp feed, exports processed shrimp, and operates 7 manufacturing plants, with 6 in Andhra Pradesh and 1 in Gujarat.

🔹M Cap: ₹7,698 Cr

🔹P/E: 21.6

🔹CMP: ₹565

🔹3 Years Sales Growth: 9.40%

Company produces shrimp feed, exports processed shrimp, and operates 7 manufacturing plants, with 6 in Andhra Pradesh and 1 in Gujarat.

🔹M Cap: ₹7,698 Cr

🔹P/E: 21.6

🔹CMP: ₹565

🔹3 Years Sales Growth: 9.40%

✍️Divi's Laboratories Ltd:

Company manufactures and exports APIs, intermediates, and nutraceutical ingredients, with 3 R&D centers and 6 multi-purpose manufacturing facilities, including 2 in Telangana and 4 in Visakhapatnam, Andhra Pradesh.

🔹M Cap: ₹1,17,868 Cr

🔹P/E: 73.6

🔹CMP: ₹4,440

🔹3 Years Sales Growth: 4.02%

Company manufactures and exports APIs, intermediates, and nutraceutical ingredients, with 3 R&D centers and 6 multi-purpose manufacturing facilities, including 2 in Telangana and 4 in Visakhapatnam, Andhra Pradesh.

🔹M Cap: ₹1,17,868 Cr

🔹P/E: 73.6

🔹CMP: ₹4,440

🔹3 Years Sales Growth: 4.02%

⚡️Disclaimer: The above data should not be considered as a Buy or Sell recommendation.The analysis has been done for educational and learning purpose only.

✅Follow <@raghavwadhwa> for more insights on Micro cap companies and various sectors.

✅Join our Free telegram Channel

✅Subscribe to our YouTube Channel

✅Like & Retweet♻️

✅Visit our website t.me/samarwealth

youtube.com/@raghav.wadhwa

samarwealth.com

✅Join our Free telegram Channel

✅Subscribe to our YouTube Channel

✅Like & Retweet♻️

✅Visit our website t.me/samarwealth

youtube.com/@raghav.wadhwa

samarwealth.com

• • •

Missing some Tweet in this thread? You can try to

force a refresh