Managing Partner and CIO @legaciscapital | Chartered Accountant | Investor | Free Multibagger Playbook https://t.co/5EQS5xFQWQ

24 subscribers

How to get URL link on X (Twitter) App

1⃣PPFAS Mutual Fund has announced the launch of its new equity scheme, the Parag Parikh Large Cap Fund. The New Fund Offer (NFO) will open on January 19 and close on January 30, during which investors can subscribe at the launch price.

1⃣PPFAS Mutual Fund has announced the launch of its new equity scheme, the Parag Parikh Large Cap Fund. The New Fund Offer (NFO) will open on January 19 and close on January 30, during which investors can subscribe at the launch price.

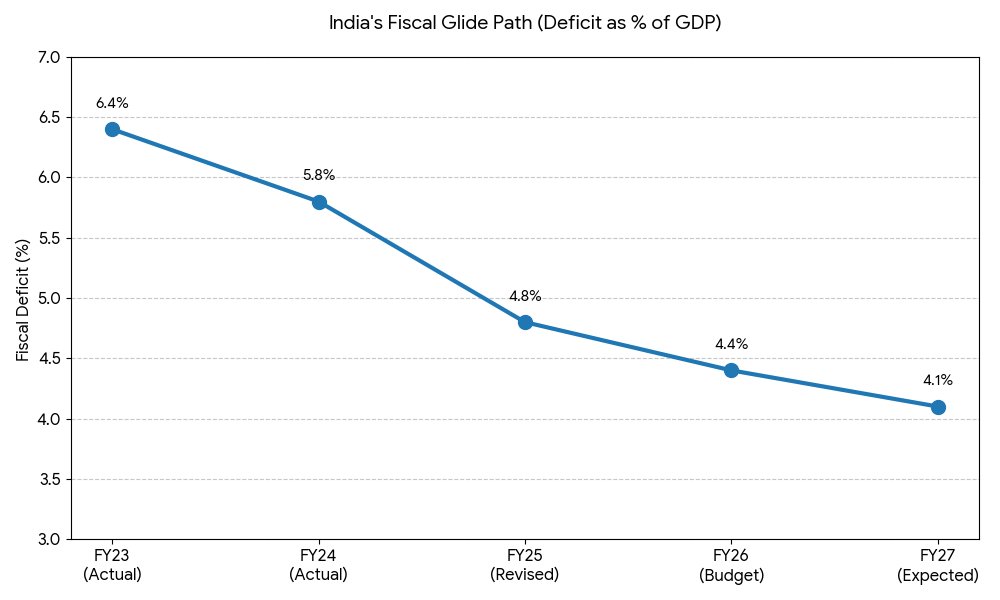

1⃣The Macro-Economic Blueprint

1⃣The Macro-Economic Blueprint

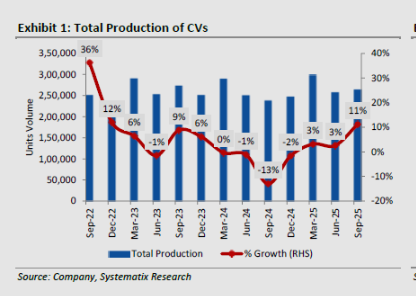

1⃣India’s commercial vehicle (CV) sector is slowly coming out of a weak phase and is now moving towards a fresh growth cycle. Especially in Medium & Heavy Commercial Vehicles (MHCVs), the signs of a new uptrend are clearly visible. Industry growth, which remained muted in the past few years, is now expected to accelerate to 8% in FY26 and 10% in FY27, compared with earlier expectations of 4–5%.

1⃣India’s commercial vehicle (CV) sector is slowly coming out of a weak phase and is now moving towards a fresh growth cycle. Especially in Medium & Heavy Commercial Vehicles (MHCVs), the signs of a new uptrend are clearly visible. Industry growth, which remained muted in the past few years, is now expected to accelerate to 8% in FY26 and 10% in FY27, compared with earlier expectations of 4–5%.

✍️About the company:

✍️About the company:

✍️Sarda Energy & Minerals Ltd:

✍️Sarda Energy & Minerals Ltd:

1⃣India’s mining and metals sector has entered a decisive structural upcycle, driven by infrastructure-led demand, policy reforms, critical mineral security, and sustained capital investment. As the backbone of steel, power, cement, aluminium, and clean-energy supply chains, the mining industry is no longer a cyclical tailwind; it is emerging as a long-duration strategic asset for India’s economic ambitions.

1⃣India’s mining and metals sector has entered a decisive structural upcycle, driven by infrastructure-led demand, policy reforms, critical mineral security, and sustained capital investment. As the backbone of steel, power, cement, aluminium, and clean-energy supply chains, the mining industry is no longer a cyclical tailwind; it is emerging as a long-duration strategic asset for India’s economic ambitions.

🌟Mr. Mukul Agrawal:

🌟Mr. Mukul Agrawal:

✍️ Vasa Denticity Ltd:

✍️ Vasa Denticity Ltd:

1⃣About the Funds

1⃣About the Funds

✍️The Filter Used:

✍️The Filter Used:

✍️About the Company:

✍️About the Company:

✨Key Investing Principles of Warren Buffett

✨Key Investing Principles of Warren Buffett

1⃣Artificial Intelligence (AI) has become an indispensable companion for today’s investors. From summarising management concalls to identifying breakout charts or tracking real-time market sentiment, macroeconomic indicators, SEBI filings, AI tools now perform tasks that once took hours in just minutes.

1⃣Artificial Intelligence (AI) has become an indispensable companion for today’s investors. From summarising management concalls to identifying breakout charts or tracking real-time market sentiment, macroeconomic indicators, SEBI filings, AI tools now perform tasks that once took hours in just minutes.

1⃣Launched on 25 February 2020 as IDFC Small Cap Fund, the scheme became part of Bandhan Mutual Fund after the Bandhan-led consortium acquired IDFC Asset Management Company. The rebrand took effect in March 2023.

1⃣Launched on 25 February 2020 as IDFC Small Cap Fund, the scheme became part of Bandhan Mutual Fund after the Bandhan-led consortium acquired IDFC Asset Management Company. The rebrand took effect in March 2023.

🔶Hindustan Aeronautics Ltd.:

🔶Hindustan Aeronautics Ltd.:

🔹The United States and India are close to finalizing a major trade agreement that may cut tariffs on key Indian exports from around 50% to 15–16%, marking a significant boost for Indian industry and export competitiveness.

🔹The United States and India are close to finalizing a major trade agreement that may cut tariffs on key Indian exports from around 50% to 15–16%, marking a significant boost for Indian industry and export competitiveness.

🪔JM Financial

🪔JM Financial