I met a GENIUS investor who has made >30 Crores in the stock market and has a CAGR > 70%

Here are his key learnings so you can replicate his performance as well

A thread 🧵

Please bookmark and retweet :)

Here are his key learnings so you can replicate his performance as well

A thread 🧵

Please bookmark and retweet :)

1. Smallcaps and Microcaps are Kings

Biggest wealth is created by investing in small caps and microcaps.

You have to find small companies with excellent promoters and managements which can become supremely big in the future.

Microcap investing is higher risk if you get it wrong but much higher reward for those who study and do information driven investing

Biggest wealth is created by investing in small caps and microcaps.

You have to find small companies with excellent promoters and managements which can become supremely big in the future.

Microcap investing is higher risk if you get it wrong but much higher reward for those who study and do information driven investing

2. Hockey Stick Growth

Contrary to popular belief, the biggest multibaggers originate from 300-3000 Cr market cap range instead of <300 Cr range

The companies which have achieved a market cap of 300 Cr have demonstrated a strong product market fit for their business and some of them can experience hockey stick growth.

Our job, as investors, is to find this hockey stick growth and invest in the companies which will witness this hockey stick growth

Contrary to popular belief, the biggest multibaggers originate from 300-3000 Cr market cap range instead of <300 Cr range

The companies which have achieved a market cap of 300 Cr have demonstrated a strong product market fit for their business and some of them can experience hockey stick growth.

Our job, as investors, is to find this hockey stick growth and invest in the companies which will witness this hockey stick growth

3. Cash is King

Invest in companies which are cash rich either through IPO or through preferential equity allotment

If you compare between 2 companies which are equal in everything except cash, the one with higher cash wins because they can use the cash to grow the business.

Hence, go gor companies which have cash in their bank accounts through IPO/ preferential

List of companies which have done preferential: sovrenn.com/discovery/Pref…

Invest in companies which are cash rich either through IPO or through preferential equity allotment

If you compare between 2 companies which are equal in everything except cash, the one with higher cash wins because they can use the cash to grow the business.

Hence, go gor companies which have cash in their bank accounts through IPO/ preferential

List of companies which have done preferential: sovrenn.com/discovery/Pref…

4. High PE can be good

A randomly selected high PE stock can be super risky but a high PE stock with a huge order book can be a great buy. In fact, this high PE can be a validation that order book is genuine.

In case of high PE stocks, always try and estimate the forward PE. If this is possible, great and take a decision accordingly

If this is not possible, you can skip as you have no estimate of forward PE

List of companies with large order books/ revenue guidance: sovrenn.com/discovery/Reve…

A randomly selected high PE stock can be super risky but a high PE stock with a huge order book can be a great buy. In fact, this high PE can be a validation that order book is genuine.

In case of high PE stocks, always try and estimate the forward PE. If this is possible, great and take a decision accordingly

If this is not possible, you can skip as you have no estimate of forward PE

List of companies with large order books/ revenue guidance: sovrenn.com/discovery/Reve…

5. Equal Allocation is powerful

No person on earth can say with certainty that this stock will be a multibagger.

The more intelligent thing to do is buy 20 stocks or 20 lottery tickets with EXACT equal allocation after in depth study and hope some of them become multibaggers.

Equal allocation improves your chances of success and helps you sleep better

No person on earth can say with certainty that this stock will be a multibagger.

The more intelligent thing to do is buy 20 stocks or 20 lottery tickets with EXACT equal allocation after in depth study and hope some of them become multibaggers.

Equal allocation improves your chances of success and helps you sleep better

6. Buying 20 preferential equity allotment stocks with exact equal allocation can be a POWERFUL strategy

If you only have preferential equity allotment stocks in your portfolio, then your portfolio companies are super cash rich and poised for growth.

This equal allocation preferential equity allotment is perhaps the best started ever created

List of companies which have done preferential equity allotment: sovrenn.com/discovery/Pref…

If you only have preferential equity allotment stocks in your portfolio, then your portfolio companies are super cash rich and poised for growth.

This equal allocation preferential equity allotment is perhaps the best started ever created

List of companies which have done preferential equity allotment: sovrenn.com/discovery/Pref…

3 L invested in #GensolEngineering turned into 1.5 crores in 3 years. Just imagine the wealth created

This is the power of multibagger investing

A great place to spot potential multibaggers is

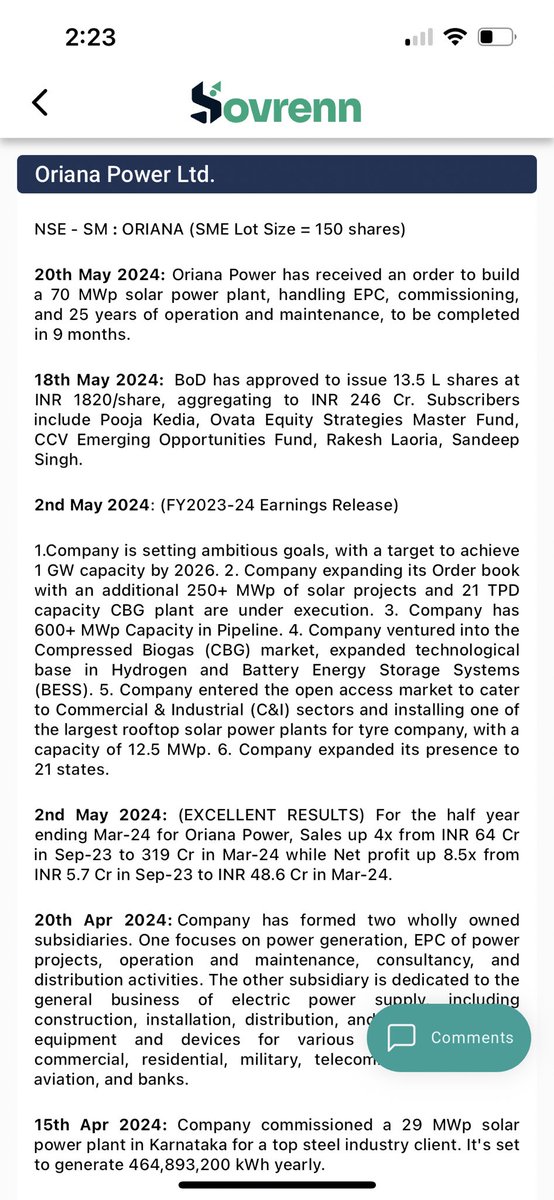

shares high quality information about small caps and microcaps such as:

1. Capacity expansions

2. Large Orders

3. Excellent Results

4. JV/Acquistions

5. HNI Buying

6. Promoter Buying

One can try FREE for 15 daysSovrenn.com

Sovrenn.com

Sovrenn.com

This is the power of multibagger investing

A great place to spot potential multibaggers is

shares high quality information about small caps and microcaps such as:

1. Capacity expansions

2. Large Orders

3. Excellent Results

4. JV/Acquistions

5. HNI Buying

6. Promoter Buying

One can try FREE for 15 daysSovrenn.com

Sovrenn.com

Sovrenn.com

Please follow the following twitter handles to learn more about finding miltibaggers

1. @SwaroopAkriti

2. @nikeshyadva

3 @MedhanshBairar2

4. @Karanbd1

5. @MohitKarode1

6. @Anupam_Mittal26

7. @InvestInMicro

8. @CorporateNaukar

9. @preet2419

1. @SwaroopAkriti

2. @nikeshyadva

3 @MedhanshBairar2

4. @Karanbd1

5. @MohitKarode1

6. @Anupam_Mittal26

7. @InvestInMicro

8. @CorporateNaukar

9. @preet2419

@SwaroopAkriti @nikeshyadva @MedhanshBairar2 @Karanbd1 @MohitKarode1 @Anupam_Mittal26 @InvestInMicro @CorporateNaukar @preet2419 Please do follow me on LinkedIn for detailed information on small caps and microcaps: in.linkedin.com/in/adityajoshi1

@SwaroopAkriti @nikeshyadva @MedhanshBairar2 @Karanbd1 @MohitKarode1 @Anupam_Mittal26 @InvestInMicro @CorporateNaukar @preet2419 Please subscribe to our YouTube channel to get high quality information about Smallcaps and microcaps

youtube.com/@aditya_joshi1…

youtube.com/@aditya_joshi1…

• • •

Missing some Tweet in this thread? You can try to

force a refresh