Our team at @BloombergNEF published our 10th annual Electric Vehicle Outlook today!

A quick thread on some key findings:

A quick thread on some key findings:

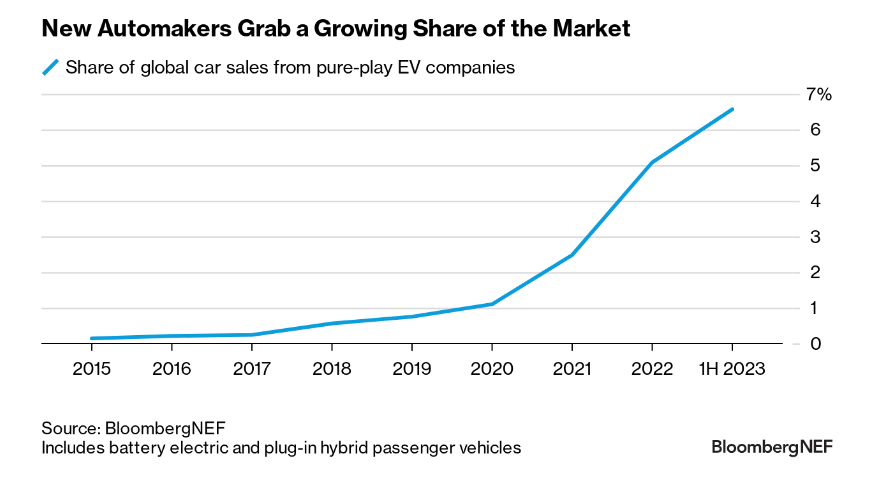

@BloombergNEF 1. EV sales are headed for another record year. Despite the headlines to the contrary, global EV sales continue to grow and are set to rise about 20% this year. combustion vehicle sales peaked in 2017 and have no real route back to that peak.

@BloombergNEF Still, sales growth is much slower than past years and some markets have stalled. That’s been expected by BNEF for some time, but is also a significant threat to climate targets governments have put in place. There’s no room for complacency.

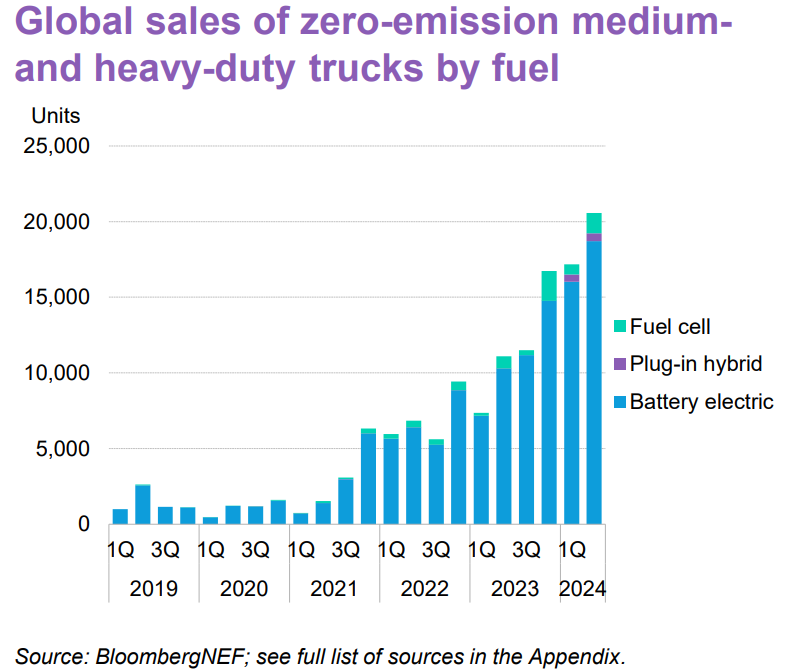

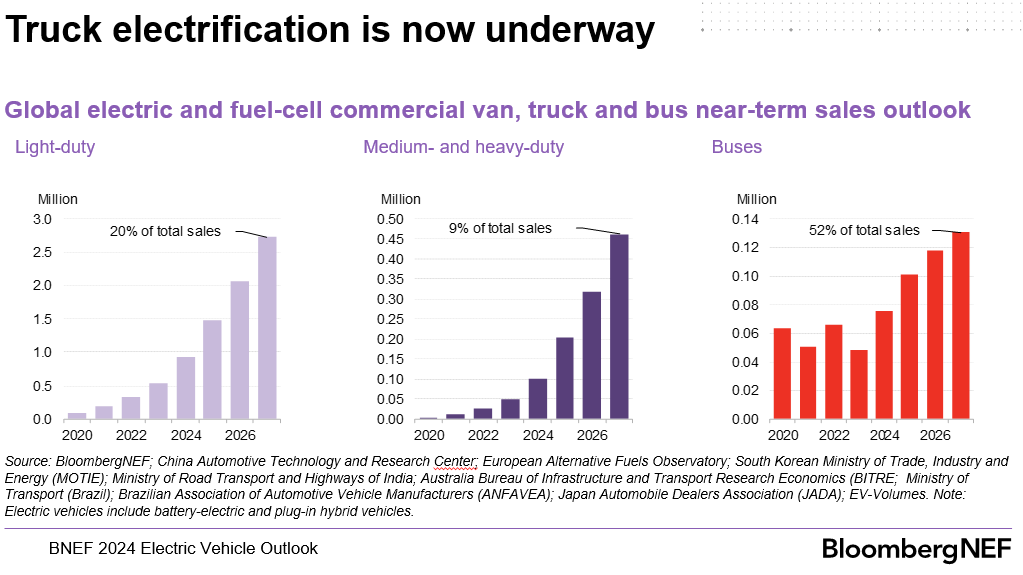

3. Electrification of commercial vehicles is a bright spot, with just under a million sales expected this year. Other areas like two/three wheelers and buses have already achieved high levels of EV adoption.

4. Battery prices in China are plummeting. year-to-date cell prices for LFP cells in China are $53/kWh. Overcapacity and low raw material prices are a factor, but processes and technology are also still improving.

We’re nowhere near the end of how good this technology can get.

We’re nowhere near the end of how good this technology can get.

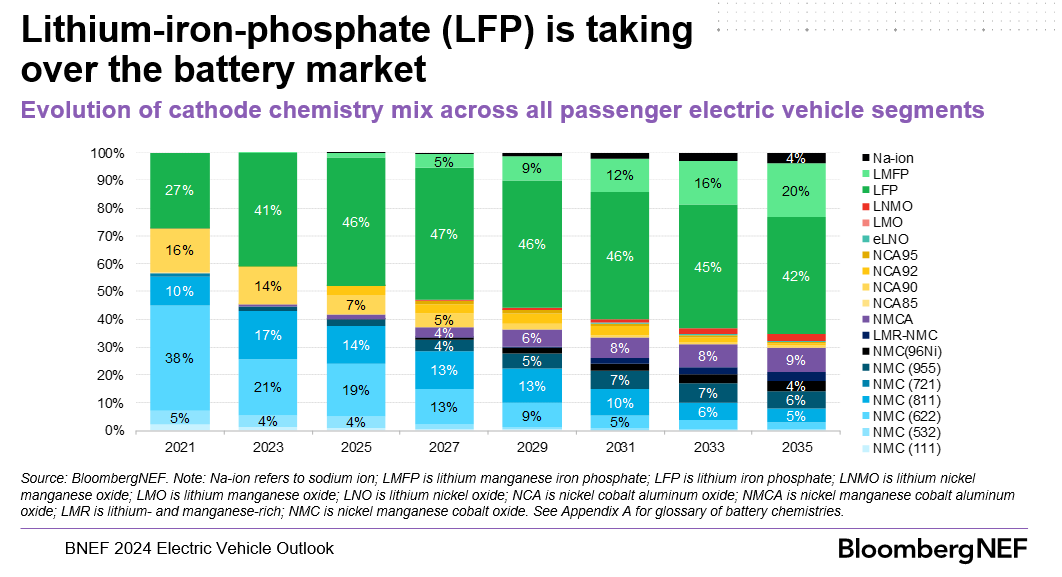

5. Lithium-iron-phosphate is taking over the battery market. It is set to cross 50% of the passenger EV market in the next 2 years, dramatically reducing the need for nickel, manganese and cobalt in the years ahead.

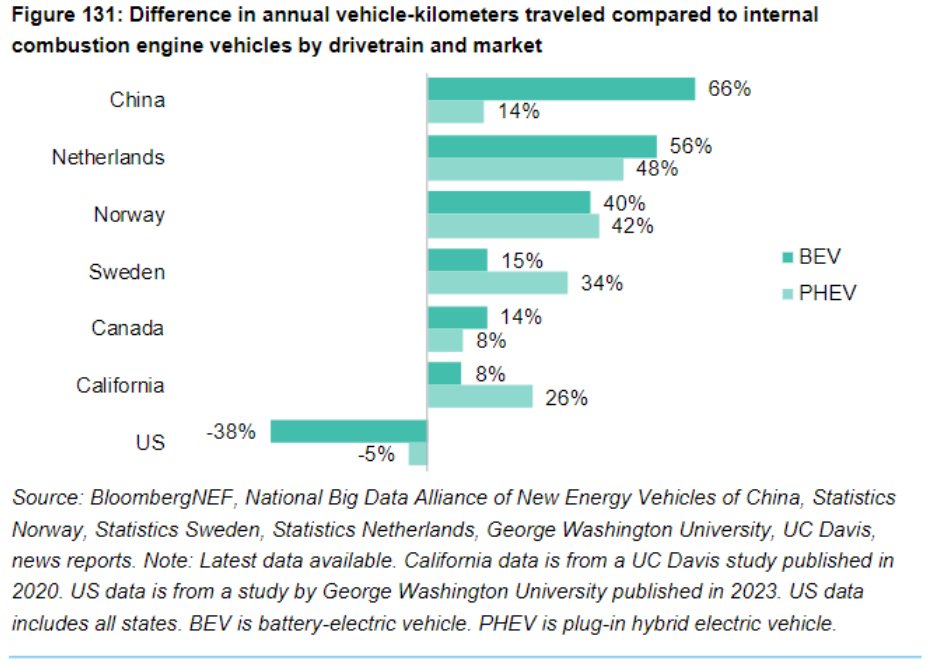

6. EVs are being driven more than combustion cars. This varies by market, with the US a major outlier. High mileage drivers are switching to electric because of lower costs. It’s kilometers not individual cars that matter for oil demand and emissions.

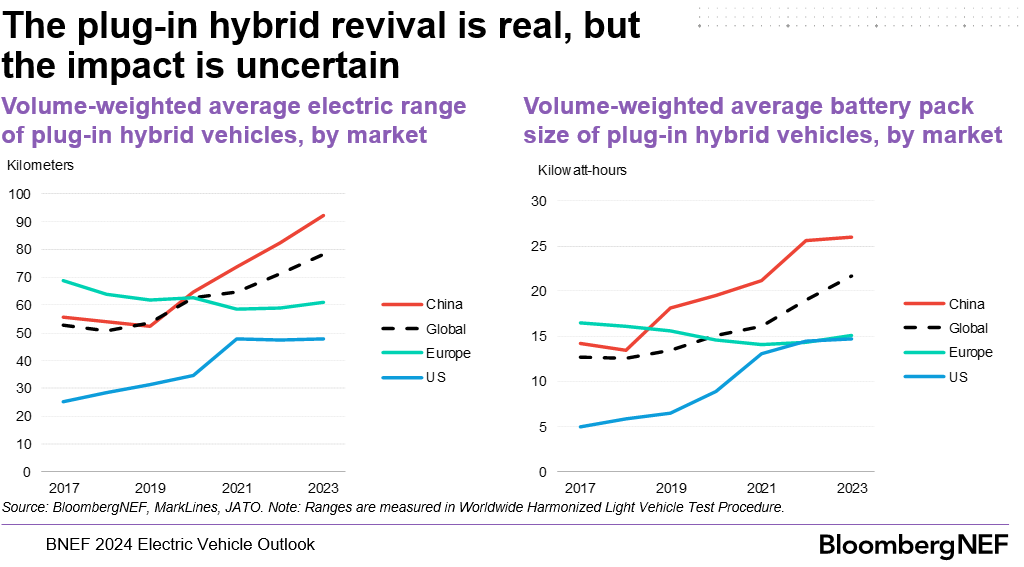

7. The plug-in hybrid revival is real, but the impacts are uncertain. Ranges are rising, and the current wave of PHEVs are aimed at real consumers, not just regulatory compliance. Still, lots of variation on how much they’re used in electric mode.

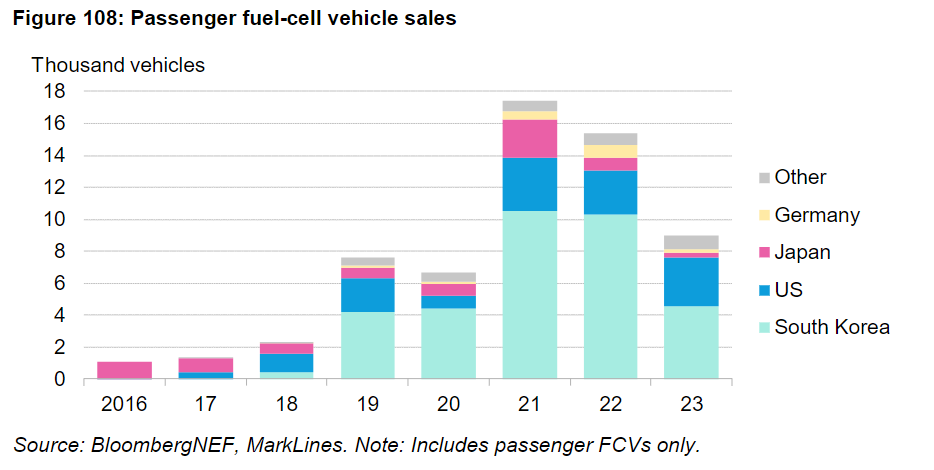

8. Hydrogen fuel cell car sales: down and out. Sales are falling for two years now. The market is now concentrated in South Korea due to very generous incentives.

More Ferraris were sold than fuel cell cars last year.

Let’s stop talking about this.

More Ferraris were sold than fuel cell cars last year.

Let’s stop talking about this.

If you want to talk about a gas in cars, CNG vehicles are taking off in India. Half a million of them were sold there last year, compared to 9,000 global fuel cell vehicle sales.

9. Oil demand peak for road transport is just three years away. Watch China, it’s hitting there soon.

That’s it for now!

BNEF clients can find the full report here:

Exec summary available publicly here: ~

Various webinars and presentations planned for the months ahead, stay tuned.bnef.com/flagships/ev-o…

about.bnef.com/electric-vehic…

BNEF clients can find the full report here:

Exec summary available publicly here: ~

Various webinars and presentations planned for the months ahead, stay tuned.bnef.com/flagships/ev-o…

about.bnef.com/electric-vehic…

A huge thank you to the many BNEF analysts who worked on the outlook this year. Thanks in particular to @agrant49 and Aleksandra O'Donovan, @siyi_mi, @RyanAFisher @CoreyBCantor @maynieyang @kdampofo @YayoiSekine @AndyLeachBatt @EvelinaStoikou and many more!

Finally, I know there are many groups that think this will all go faster and that 100% of car sales will be electric by 2030.

That’s great, go out and create the change you want to see. There’s still room to move the needle on all of this.

That’s great, go out and create the change you want to see. There’s still room to move the needle on all of this.

• • •

Missing some Tweet in this thread? You can try to

force a refresh