Starmer, if he becomes PM, will inherit the highest British taxes since the war. Only an idiot would say this is his fault. Thing is, it's not Sunak's fault either.

A thread where I will annoy everyone.

A thread where I will annoy everyone.

Arguing about which small tax rises politicians may or may not make is an unforgivable failure to deal with the real questions: How come taxes are so high, when public services are often so poor? And what can be done about it?

Why are taxes so high? It's a mixture of:

- demographic change - more retirees to support, fewer workers. But - unlike elsewhere in Europe - there are indications this could reverse in a few years: ft.com/content/700206…

- demographic change - more retirees to support, fewer workers. But - unlike elsewhere in Europe - there are indications this could reverse in a few years: ft.com/content/700206…

- the cost of Covid measures - a staggering £310-410bn (and yes, there was fraud, but the figures are a rounding error on these huge numbers) .commonslibrary.parliament.uk/research-brief…

- a long-term productivity gap with the US, France, Germany, going back decades economicsobservatory.com/the-uks-produc…

- poor growth since 2010. I'll let others more qualified than I am debate how much of this is post-GFC fallout, Brexit, austerity, other factors reuters.com/world/uk/slow-…

Clearly the spectacular rise post-2020 is a pandemic effect. But the chart gives the impression of stability in the 2010s, when what was actually happening was real term cuts in public services with taxes remaining broadly level.

And - whisper it, because it's politically inconvenient for both parties - but it's been companies and high-earners paying higher tax, not average households. ifs.org.uk/articles/how-t…

Raising tax hasn't been a simple political choice - it's been a necessity caused by short term economic factors that nobody could control, and complex long term economic factors that nobody quite agrees on.

There is only one way to get ourselves out of this hole: growth.

I'm not an economist. I can only talk about tax. But there are changes we could make to the tax system that would nudge it in a pro-growth direction:

VAT is inefficient; the VAT threshold is too high, and that stops small businesses from growing. The exemptions and zero rates cause uncertainty for business and disproportionately benefit the wealthy. The flat rate scheme is being widely abused. taxpolicy.org.uk/2023/01/30/vat…

Corporation tax has become impossibly complicated. The move to "full expensing" was incomplete. The constant changes to the rate (three in one year) make it difficult to plan. The OECD global minimum tax means that the largest companies pay two taxes taxpolicy.org.uk/2023/10/23/com…

Income tax has been damaged by a series of gimmicks, bodges and compromises employed to avoid increasing the rate. There's an "accidental" top marginal rate of 62% for people earning between £100k and £125k. And it can get worse. taxpolicy.org.uk/2024/03/11/mar…

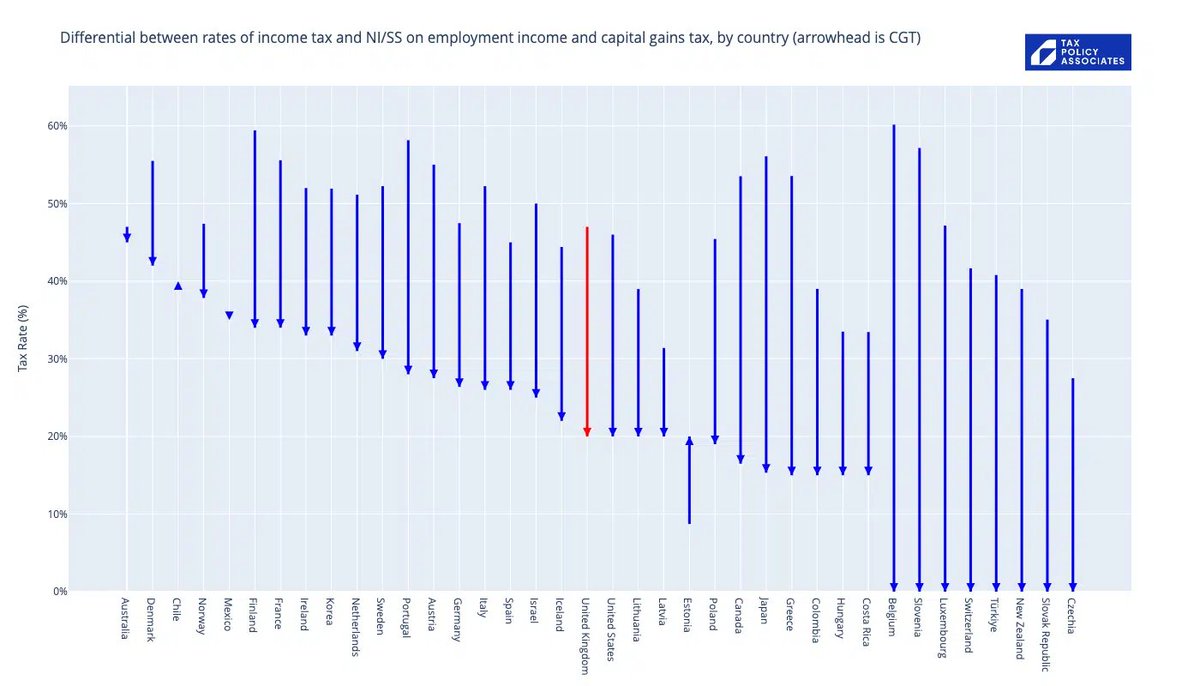

Employer national insurance creates a massive difference between the cost of employing someone and the cost of engaging an independent contractor. The result: complexity, uncertainty, disputes, avoidance, evasion.

Stamp duty land tax reduces labour mobility, results in inefficient use of land, and plausibly holds back economic growth. The frequent holidays/freebies just make things worse: taxpolicy.org.uk/2024/06/09/sta…

Council tax is hilariously broken, based on 1991 valuations, and with bands which mean that the Buckingham Palace residence pays less council tax than a semi in Blackpool. taxpolicy.org.uk/2024/06/09/sta…

Inheritance tax is deservedly unpopular. The rate is too high. The burden falls on the upper middle class. The very wealthy easily escape it. taxpolicy.org.uk/2022/07/27/iht…

Tax reform alone isn't going to transform the UK. But a pro-growth agenda that doesn't include ambitious tax reform is a dud.

And if we, the electorate, get distracted by shiny baubles of tax cuts/rises that are irrelevant to a £2.4 trillion economy, the failures that follow are on us.

• • •

Missing some Tweet in this thread? You can try to

force a refresh