Today marks an important step forward in more closely aligning the growth and use of $USDe with $ENA

The launch of a generalized staking capability for $ENA with @symbioticfi and @LayerZero_Labs is the first step in adding functional utility for $ENA within the Ethena ecosystem

The launch of a generalized staking capability for $ENA with @symbioticfi and @LayerZero_Labs is the first step in adding functional utility for $ENA within the Ethena ecosystem

Summary:

i) Introduction of generalized restaking modules for $ENA and $sUSDe

ii) $ENA restaking pools within @symbioticfi to secure the Ethena Chain

iii) Immediate 50% reduction of go-forward $ENA inflation for Season 1 campaign participants to support long term alignment

i) Introduction of generalized restaking modules for $ENA and $sUSDe

ii) $ENA restaking pools within @symbioticfi to secure the Ethena Chain

iii) Immediate 50% reduction of go-forward $ENA inflation for Season 1 campaign participants to support long term alignment

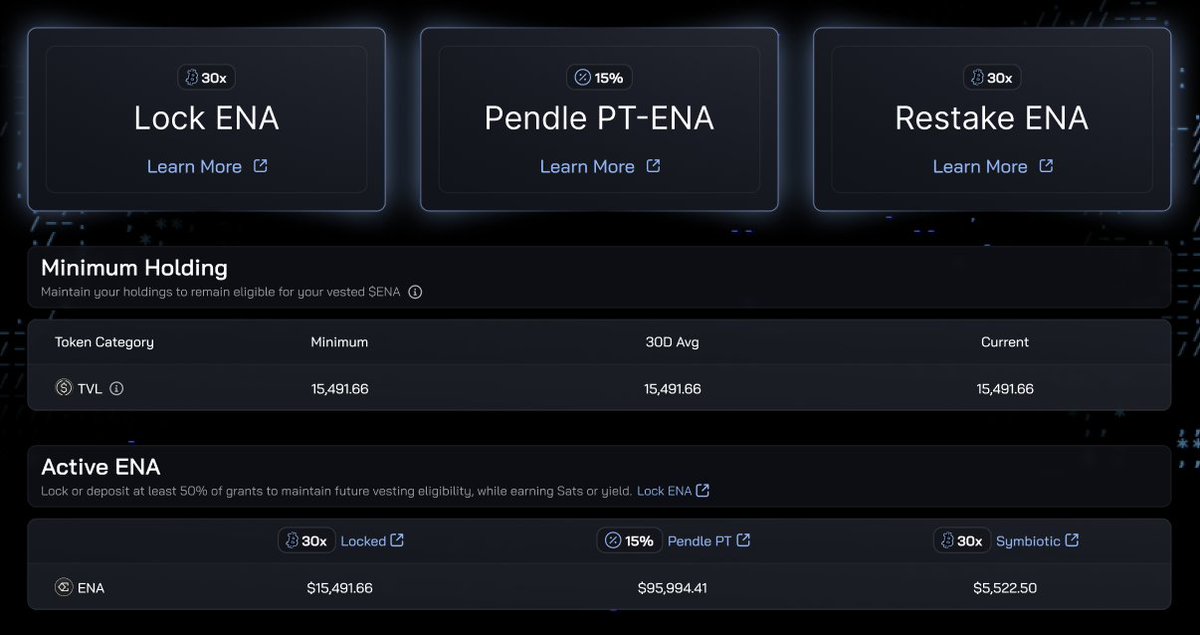

At present $ENA can be:

i) Locked in Ethena for 30x rewards

ii) Added to PT-ENA in Pendle for ~75% fixed APR

i) Locked in Ethena for 30x rewards

ii) Added to PT-ENA in Pendle for ~75% fixed APR

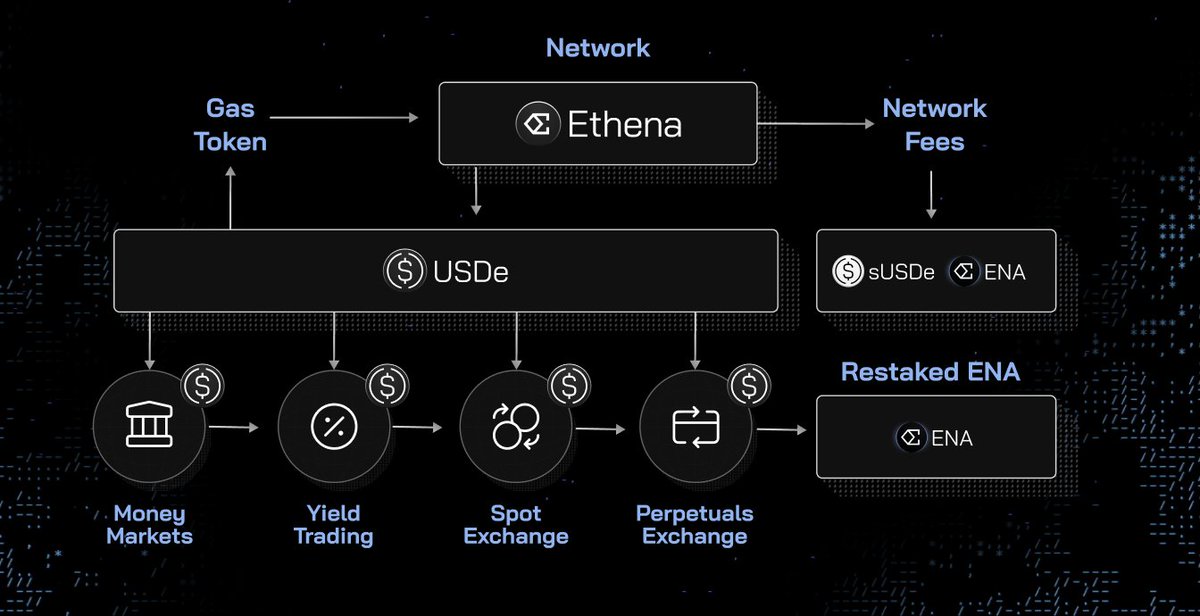

The next phase of incorporating $ENA into the Ethena system and adding utility will leverage generalized restaking pools to provide economic security for the Ethena Chain

The first use case is cross-chain transfers of USDe built on the @LayerZero_Labs DVN based messaging system

The first use case is cross-chain transfers of USDe built on the @LayerZero_Labs DVN based messaging system

This is the first of multiple layers of infrastructure and financial applications built upon the Ethena Chain which will utilize and benefit from restaked $ENA modules

mirror.xyz/0x29a99F7Fe080…

mirror.xyz/0x29a99F7Fe080…

Staked $ENA and $sUSDe will be the only newly available assets to deposit in @symbioticfi in the upcoming epoch with the initial LST caps all already filled within hours

Staked $ENA pools will launch on 26th of June

Staked $ENA pools will launch on 26th of June

Staked $ENA in Symbiotic will receive the following rewards:

-Ethena 30x per ENA per day

-Symbiotic points

-Mellow points

-Future potential LayerZero RFP allocations (if allocated to Ethena)

-Ethena 30x per ENA per day

-Symbiotic points

-Mellow points

-Future potential LayerZero RFP allocations (if allocated to Ethena)

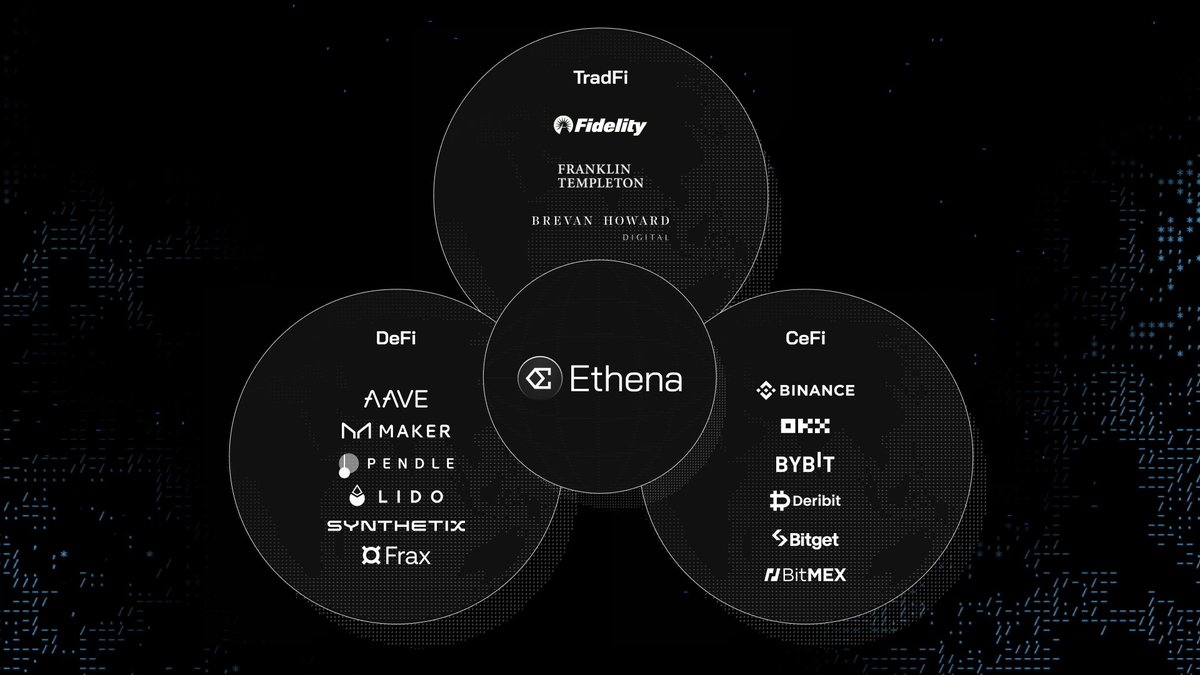

The Ethena Chain will host financial applications and infrastructure built upon $USDe as the gas token and fulcrum asset within the system

Restaked $ENA will provide security across these protocols, and in return may be eligible for potential future airdrops at their discretion

Restaked $ENA will provide security across these protocols, and in return may be eligible for potential future airdrops at their discretion

In addition, as of 17th of June, any user receiving $ENA via airdrop for Season 1 will be required to lock a minimum of 50% of the claimable $ENA in one of the three options outlined in the first section

Failing to do so will result in all of the user’s unvested $ENA attributed to the relevant wallet being redistributed to other users who lock $ENA

To be clear: the intent of the above is to incentivize realignment of $ENA holders from mercenary capital to long term aligned users

None of the $ENA which is forfeited will be retained by the foundation, team or investors - it is solely to benefit ecosystem aligned users

None of the $ENA which is forfeited will be retained by the foundation, team or investors - it is solely to benefit ecosystem aligned users

• • •

Missing some Tweet in this thread? You can try to

force a refresh