How to get URL link on X (Twitter) App

https://twitter.com/1622243071806128131/status/1902762309950292010

Beyond this initial core pairing in the AMM, USDe can offer a unique revenue stream for locked LP tokens on new memecoin launches

Beyond this initial core pairing in the AMM, USDe can offer a unique revenue stream for locked LP tokens on new memecoin launches

We see two core use cases for blockchains:

We see two core use cases for blockchains:

Onboarding Ethena into the Spark Liquidity Layer will allow Spark to access Ethena rewards directly rather than via lending

Onboarding Ethena into the Spark Liquidity Layer will allow Spark to access Ethena rewards directly rather than via lending

USDtb will soon become a primary collateral asset for Usual’s USD0, currently with over $850 million in TVL

USDtb will soon become a primary collateral asset for Usual’s USD0, currently with over $850 million in TVLhttps://twitter.com/1637885519374721035/status/1868657723799470361

USDtb functions like a traditional stablecoin such as USDC or USDT, utilizing cash and cash-equivalent reserve assets to back each token

USDtb functions like a traditional stablecoin such as USDC or USDT, utilizing cash and cash-equivalent reserve assets to back each token

The Ethena swap facility for Sky enables maximum flexibility to react to changes in the current interest rate environment

The Ethena swap facility for Sky enables maximum flexibility to react to changes in the current interest rate environment

Issuers are invited to pitch Ethena for an allocation of their RWA, or reward bearing asset

Issuers are invited to pitch Ethena for an allocation of their RWA, or reward bearing asset

Summary:

Summary:

How does this work?

How does this work?

https://twitter.com/1589990734601625601/status/1788857362557596066

Summary sections:

Summary sections:

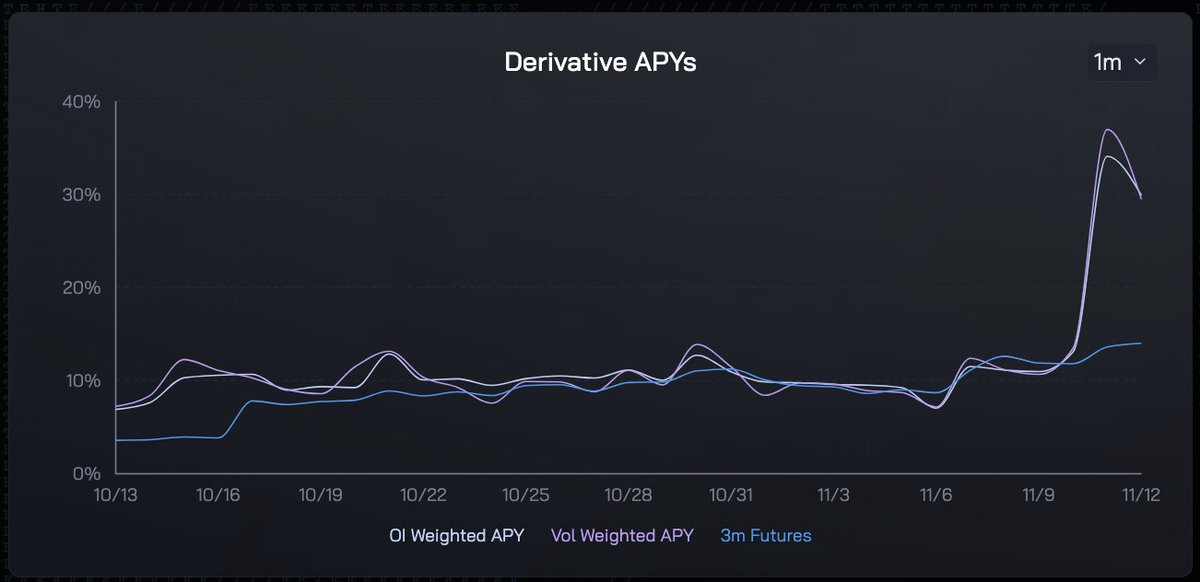

2/ The spread between CeFi futures basis and CME's stayed positive since the end of October, highlighting a strong demand from institutional investors in the midst of spot ETF rumours

2/ The spread between CeFi futures basis and CME's stayed positive since the end of October, highlighting a strong demand from institutional investors in the midst of spot ETF rumours