A MAJOR fundamental flaw in crypto is starting to emerge.

It's the #1 reason why altcoins are underperforming this cycle.

And currently, there seems to be no fix.

I just dug through all the data (what I found was shocking).

🧵: How altcoin dispersion is killing crypto.👇

It's the #1 reason why altcoins are underperforming this cycle.

And currently, there seems to be no fix.

I just dug through all the data (what I found was shocking).

🧵: How altcoin dispersion is killing crypto.👇

The objective of this thread is to give you more insight into crypto's biggest issue.

It will explain exactly how we got here, why prices are behaving the way they are, and the path forward.

It will explain exactly how we got here, why prices are behaving the way they are, and the path forward.

Let me take you back to 2021.

The market was in a frenzy.

New liquidity was rapidly pouring into the market, mainly being driven by fresh retail.

The bull market seemed unstoppable, and risk appetite was at its highest.

The market was in a frenzy.

New liquidity was rapidly pouring into the market, mainly being driven by fresh retail.

The bull market seemed unstoppable, and risk appetite was at its highest.

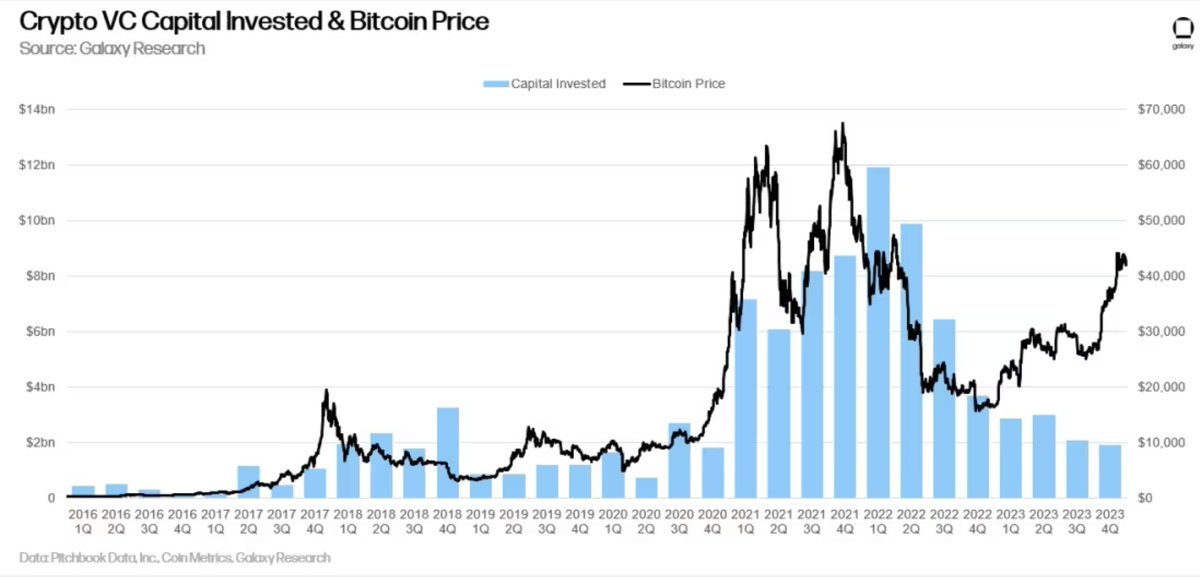

During this time, VCs started pouring unprecedented amounts of capital into the space.

Founders & VCs are just like retail - they're opportunists.

The uptick in investment was a natural capitalistic response to market conditions.

Founders & VCs are just like retail - they're opportunists.

The uptick in investment was a natural capitalistic response to market conditions.

For those who don't understand private markets, put simply, a VC will invest capital into a project at an early stage (typically 6 months - 2 years prior to launch), at a typically lower valuation (with vesting attached).

This investment helps fund the project with capital to develop, with VCs also often providing other services/connections to help get a project off the ground.

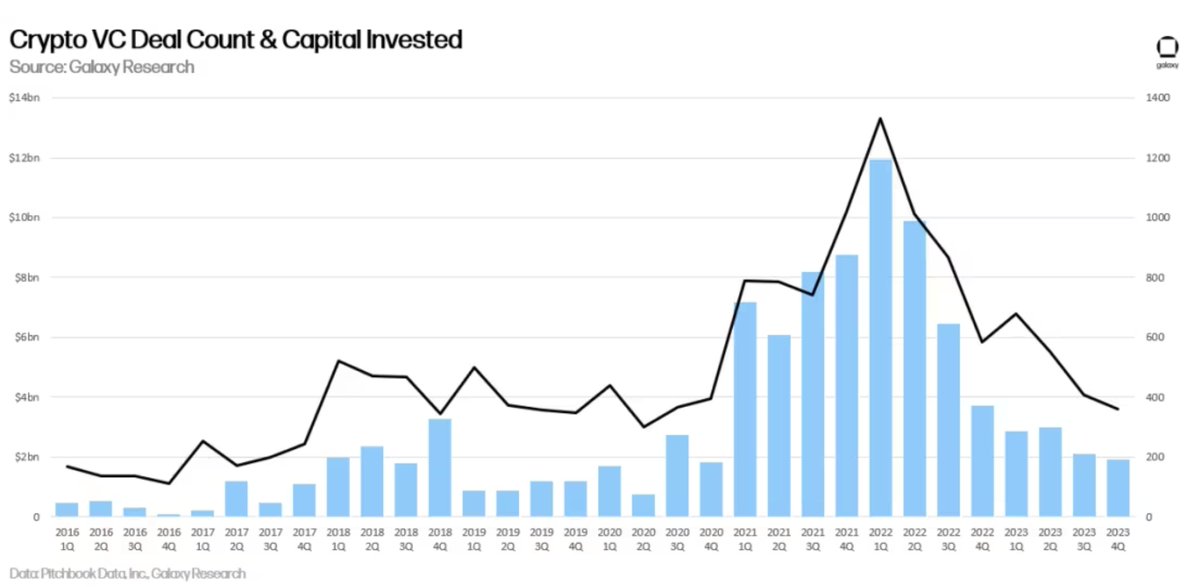

Interestingly, the largest quarter EVER for VC funding ($12b) was Q1 2022.

This marked the beginning of the bear (yes, VCs timed the top).

This marked the beginning of the bear (yes, VCs timed the top).

But remember, VCs are only investors.

Increased deal count volume also comes from an increase in the amount of projects being created.

Increased deal count volume also comes from an increase in the amount of projects being created.

The low barriers to entry, combined with the high upside crypto presented in the bull market, made web3 a breeding ground for new startups.

New tokens were popping up left right and centre, resulting in the total crypto token count tripling between 2021-2022.

New tokens were popping up left right and centre, resulting in the total crypto token count tripling between 2021-2022.

But shortly after, the party stopped.

A cascade of contagion, starting with LUNA, and ending with FTX, completely decimated the market.

A cascade of contagion, starting with LUNA, and ending with FTX, completely decimated the market.

So what did the projects do, that raised all that money earlier in the year?

They delayed.

And delayed.

And delayed.

They delayed.

And delayed.

And delayed.

Launching a project in the midst of a bear is a death sentence.

Low liquidity + bad sentiment + lack of interest means many new bear market launches were dead on arrival.

So founders decided to wait for a reversal.

Low liquidity + bad sentiment + lack of interest means many new bear market launches were dead on arrival.

So founders decided to wait for a reversal.

It took a while, but eventually - in Q4 2023, they got it.

(remember, the biggest spike in VC funding was in Q1 2022, 18 months prior).

(remember, the biggest spike in VC funding was in Q1 2022, 18 months prior).

After months and months of delaying, they could FINALLY launch their tokens in better conditions.

So they did.

It started with one.

And another, and another, and another.

So they did.

It started with one.

And another, and another, and another.

And it wasn't just the OLD projects deciding to launch.

Many new players saw the new bullish conditions as an opportunity to launch a project and make a quick buck.

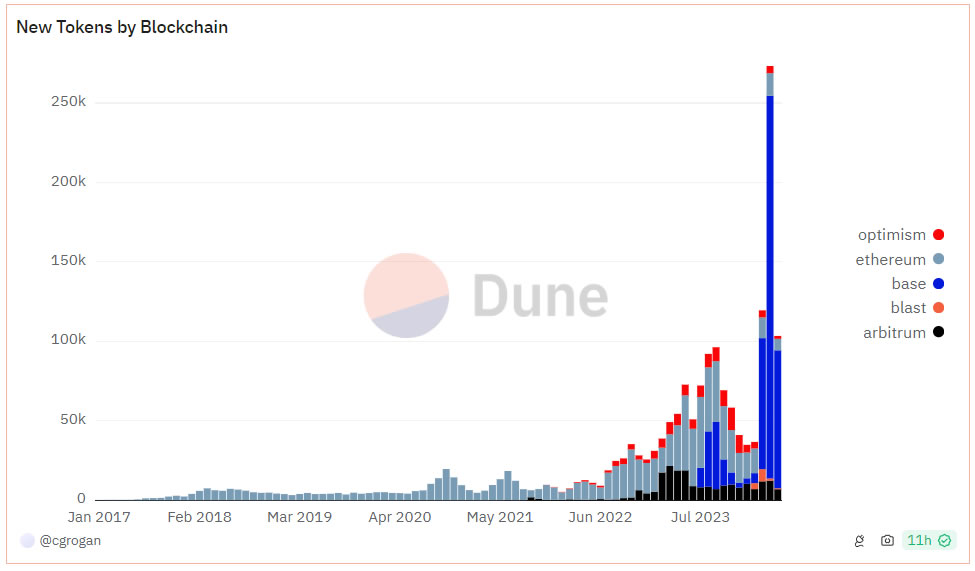

As a result, 2024 has seen a historic number of new launches.

Many new players saw the new bullish conditions as an opportunity to launch a project and make a quick buck.

As a result, 2024 has seen a historic number of new launches.

Here are the stats. They're crazy.

Over 1 million new crypto tokens have been launched since April alone.

(half of which are meme coins created on the Solana network).

Over 1 million new crypto tokens have been launched since April alone.

(half of which are meme coins created on the Solana network).

You could argue that these numbers are inflated by the ease of deploying a meme on-chain.

And that's true, yes.

But it's still an insane figure.

For a more accurate number, see the image below from CoinGecko, which excludes many of the smaller memes.

And that's true, yes.

But it's still an insane figure.

For a more accurate number, see the image below from CoinGecko, which excludes many of the smaller memes.

This is a big problem. And is one of the major reasons why crypto has been struggling this year, despite $BTC hitting new ATHs.

Why?

Why?

The more tokens that launch, the more cumulative supply pressure on the market.

And this supply pressure "stacks".

Many projects from 2021 are still unlocking, with supply "stacking" across every subsequent year (2022, 2023, 2024).

And this supply pressure "stacks".

Many projects from 2021 are still unlocking, with supply "stacking" across every subsequent year (2022, 2023, 2024).

Current estimates suggest there is around $150m-$200m of new supply pressure per day.

This constant sell pressure takes a huge toll on the market.

This constant sell pressure takes a huge toll on the market.

Think of token dilution as inflation.

If the government prints USD, this, in turn, reduces USD's purchasing power relative to the cost of goods and services.

If the government prints USD, this, in turn, reduces USD's purchasing power relative to the cost of goods and services.

It's the exact same in crypto.

If you print more tokens, this, in turn, reduces crypto's purchasing power relative to other currencies (like USD).

Altcoin dispersion is basically crypto's version of inflation.

If you print more tokens, this, in turn, reduces crypto's purchasing power relative to other currencies (like USD).

Altcoin dispersion is basically crypto's version of inflation.

And it's not only the volume of tokens launching that is a problem.

The low FDV/high float mechanics of many of these new launches is a big issue.

It leads to a) a high degree of dispersion, and b) constant supply pressure.

The low FDV/high float mechanics of many of these new launches is a big issue.

It leads to a) a high degree of dispersion, and b) constant supply pressure.

All of these new launches and supply would be fine and dandy if new liquidity was entering the market.

In 2021, there were hundreds of new launches per day - and everything was up only.

In 2021, there were hundreds of new launches per day - and everything was up only.

However, it's not. So we find ourselves in the situation of:

A) Not enough new liquidity entering the market, and

B) An insane amount of dilution/sell pressure from unlocks

A) Not enough new liquidity entering the market, and

B) An insane amount of dilution/sell pressure from unlocks

I wrote a thread last week on the impact of these unlocks (with data).

If you're interested, check it out below.

If you're interested, check it out below.

https://twitter.com/1530033576/status/1800190144374554728

Now you know what the issue is, let's discuss the question at hand.

How could things turn around?

How could things turn around?

Firstly, I must emphasise the need for more liquid funds in crypto.

There are comparatively too many VCs.

The skew towards private market is one of the biggest (and most damaging) issues in crypto, especially compared to other markets like equites and real estate.

There are comparatively too many VCs.

The skew towards private market is one of the biggest (and most damaging) issues in crypto, especially compared to other markets like equites and real estate.

This skew becomes an issue because retail feel like they can't win.

And if they feel like they can't win, they won't play the game.

Why do you think memes have dominated this year?

It's the only meta where retail feels like they have a fighting chance.

And if they feel like they can't win, they won't play the game.

Why do you think memes have dominated this year?

It's the only meta where retail feels like they have a fighting chance.

With price discovery for many of these high FDV coins happening in private markets, retail doesn't have a shot at a 10x, 20x or 50x like the VCs.

In 2021, you could ape a launchpad token and genuinely hit a 100x.

In 2021, you could ape a launchpad token and genuinely hit a 100x.

This cycle, tokens launch at $5b, $10b, $20b+ and leave no room for price discovery in the open market.

And then they bleed, bleed, and bleed as their unlocks start to hit the market.

And then they bleed, bleed, and bleed as their unlocks start to hit the market.

I don't have all the answers to this problem.

It's a complex issue and there are many players who could make a difference.

Here are a few ideas, however.

It's a complex issue and there are many players who could make a difference.

Here are a few ideas, however.

• Exchanges could enforce better token distribution

• Teams could prioritise community allocation & bigger pools for genuine users

• Higher % could be unlocked on launch (potentially implementing measures like laddered sell taxes etc. to disincentive dumping).

• Teams could prioritise community allocation & bigger pools for genuine users

• Higher % could be unlocked on launch (potentially implementing measures like laddered sell taxes etc. to disincentive dumping).

Even if the insiders don't enforce change, the market eventually will.

The market will always self correct and adjust, with the diminishing efficacy of the current meta + public response likely to sway things in the future.

The market will always self correct and adjust, with the diminishing efficacy of the current meta + public response likely to sway things in the future.

At the end of the day, a more retail-friendly market bodes well for everyone.

The projects, the VCs, and the exchanges.

More users is good for everyone.

Most of the current issues are a symptom of short-sightedness (and the nascency of the industry).

The projects, the VCs, and the exchanges.

More users is good for everyone.

Most of the current issues are a symptom of short-sightedness (and the nascency of the industry).

Also, on the exchange side, I'd also like to see exchanges be more pragmatic.

One way to offset the insane amount of new listings/dilution, is to be equally ruthless with delistings.

Let's flush out the 10,000 dead projects that are still soaking up valuable liquidity.

One way to offset the insane amount of new listings/dilution, is to be equally ruthless with delistings.

Let's flush out the 10,000 dead projects that are still soaking up valuable liquidity.

The market needs to give retail a reason to come back. This, at least, fixes one half of the problem.

Whether it be a a $BTC pump, $ETH ETF, macro shift, or killer apps that people actually want to use.

There are lots of potential catalysts out there.

Whether it be a a $BTC pump, $ETH ETF, macro shift, or killer apps that people actually want to use.

There are lots of potential catalysts out there.

Hopefully I was able to make some sense of what's been occurring lately, for those that have been confused about recent price action.

Dispersion isn't the only problem, but it certainly is a major one - and something that needs to be discussed.

Dispersion isn't the only problem, but it certainly is a major one - and something that needs to be discussed.

Over the coming weeks, I'm going to be a sharing guide with the top altcoins with low/no dilution.

Follow me @milesdeutscher so you don't miss it.

Also, Like/Repost the quote below to share this important issue with more people (awareness = change). 💙

Follow me @milesdeutscher so you don't miss it.

Also, Like/Repost the quote below to share this important issue with more people (awareness = change). 💙

https://twitter.com/1530033576/status/1803071315257254211

• • •

Missing some Tweet in this thread? You can try to

force a refresh