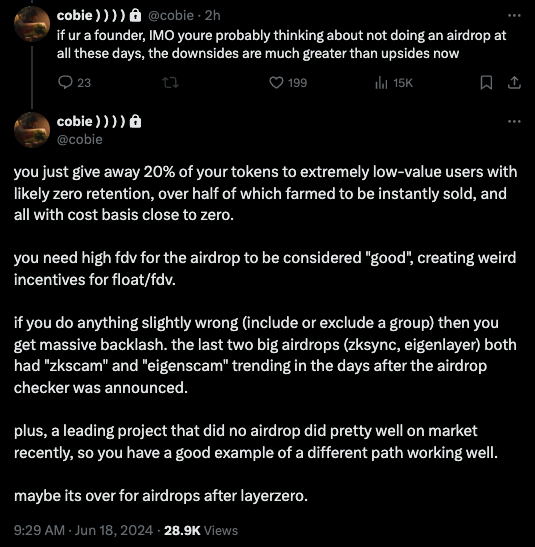

Largely agree with @cobie on this, airdrops can cause more harm than good IF lazily designed.

That's why I put literal fucking weeks into finessing our airdrop models, trawling activity patterns and analysing distribution statistics. Like I'm learning first hand you can NEVER make everyone happy, but you can at least be smart and avoid a few major stumbling blocks:

The Hidden Cost of Low Value Users

Most wallets are bottom of the barrel, low effort farmers. Over 25% of all wallets on our airdrop did <$500 in volume (paying less than a meagre ~50c in trading fees). As a normal B2C business would you waste any time on such low LTV customers? Most certainly not. Hence we safely excluded all these users knowing confidently they were 1. either blatant sybils or 2. had no intention of trading long term - so like @cobie said their retention post airdrop is probably ~zero. Forget 'em, just a waste of resources.

The Problem with a Zero Cost Basis

Say you received a free memecoin in your wallet. You don't really know what it is and you did nothing to obtain it, but hey it's worth $100 - fuck it, why wouldn't you sell it, free money right? And that's the mentality of most people who play these "TVL games". You yeet some spare change into a vault or cycle it through a bunch of protocols depositing and withdrawing at no risk, you collect your free tokens and you dump them. Zero skin in the game.

With more active protocols like Zeta, users had to trade and not only invest their time and capital via trading fees and at-risk positions. This forms a sort of "proof of work" that is much harder to game, and weeds out the lazy participants. With that in mind, I spent a bunch of time analzying our distribution numbers to make sure that 99.99% of all users recouped their initial trading fees on the airdrop (that's the bare minimum to not leave people feeling cheated), and in fact on average users of Zeta made ~10x back on their fees! That's some damn good ROI if you ask me. As you'd imagine, most traders in our Discord were super pleased with their final allocations!

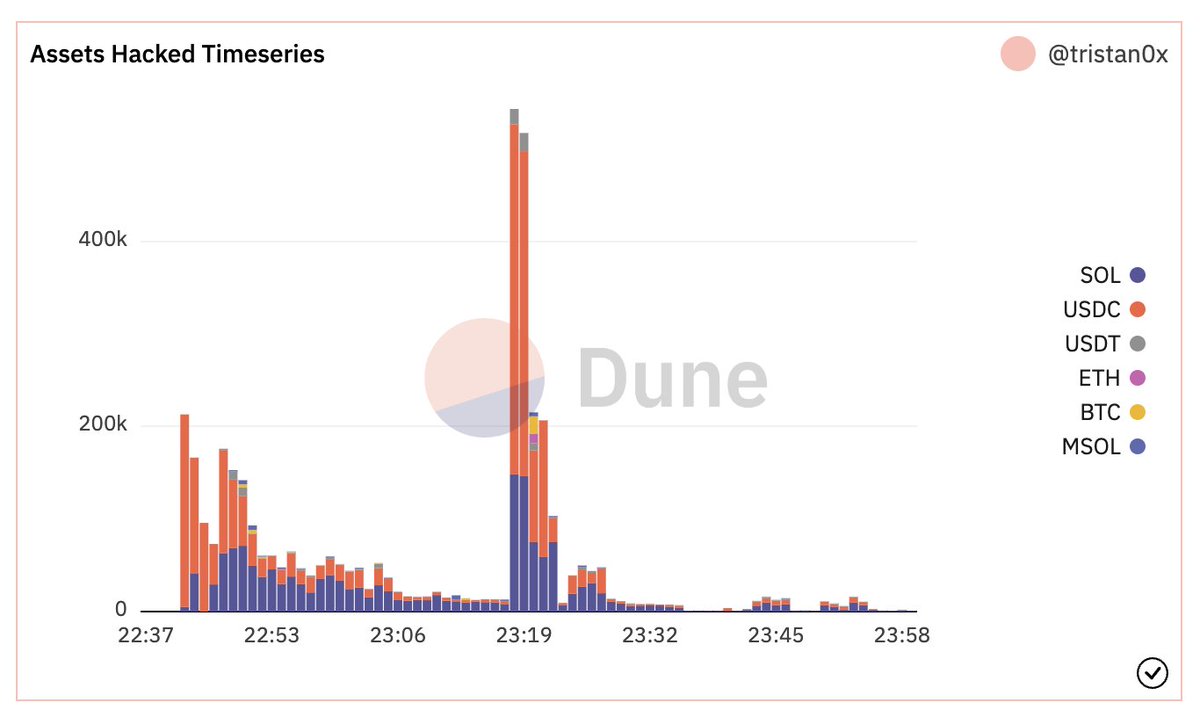

The Danger of Instant Sell Pressure

First and foremost, we were very intentional that team and investors WILL NOT unlock at TGE. This is a predatory pattern that's become all too common of high FDV projects where seed VCs up 100x get day 0 liquidity. All investors/team for Zeta have 3-4yr vesting and 1yr cliffs for this reason.

Furthermore, since airdrops create an instantaneous supply shock, for price to stabilise it requires a ton of buy demand on listing, and during weaker macro market conditions this is harder to maintain. So we reasoned it would be sensible to have a similar (short-term) vesting period for the first 7 days. The freedom to claim instantly, but if you truly cared about the long-term vision of the project and weren't in a rush to dump your tokens, you'd be rewarded with 2x your allocation. We'll see how it plays out, but I think it's a no brainer for most, 7d is nothing for a project that has been building for 3yrs+.

You Can Never Make Everyone Happy

I recall chatting to @weremeow shortly after the Jup launch and he really drilled this reality into my head. Everyone wants their own allocation to be bigger. "He got too much, she got too little, blah, blah, blah". I've just accepted that fuck it, people will complain no matter what happens, that's just present day crypto for you.

That being said we tried hard to be inclusive of REAL USERS. This meant 1. getting rid of people who didn't meet a (very achievable) minimum threshold 2. capping the upside on the biggest wallets to make it more equitable for the rest 3. meticulously weeding out bad actors who created hundreds of programmatic sybil wallets and/or wash traded 4. boosting scores on traders who were both active and had traded since the early days (OGs).

Yeah, we still copped a bunch of unhappy messages from whales who felt entitled to $100k+ airdrops, but we hope they will stick by us with what I would still consider quite substantial airdrops regardless.

Overall I would still say our sentiment was overall very positive (I only got called a scammer twice!! 🤯). I was dreading this day for a while, but I'm glad all the effort I spent crunching SQL and pandas dataframes, eyeballing statistics, talking to our users, studying other airdrops - seems like it paid off.

So is the airdrop meta over for good? Perhaps. They're a pretty exhausted route. But I think there's a lot you do to innovate the right way. Maybe they'll relive their glory days once more... 🪂

That's why I put literal fucking weeks into finessing our airdrop models, trawling activity patterns and analysing distribution statistics. Like I'm learning first hand you can NEVER make everyone happy, but you can at least be smart and avoid a few major stumbling blocks:

The Hidden Cost of Low Value Users

Most wallets are bottom of the barrel, low effort farmers. Over 25% of all wallets on our airdrop did <$500 in volume (paying less than a meagre ~50c in trading fees). As a normal B2C business would you waste any time on such low LTV customers? Most certainly not. Hence we safely excluded all these users knowing confidently they were 1. either blatant sybils or 2. had no intention of trading long term - so like @cobie said their retention post airdrop is probably ~zero. Forget 'em, just a waste of resources.

The Problem with a Zero Cost Basis

Say you received a free memecoin in your wallet. You don't really know what it is and you did nothing to obtain it, but hey it's worth $100 - fuck it, why wouldn't you sell it, free money right? And that's the mentality of most people who play these "TVL games". You yeet some spare change into a vault or cycle it through a bunch of protocols depositing and withdrawing at no risk, you collect your free tokens and you dump them. Zero skin in the game.

With more active protocols like Zeta, users had to trade and not only invest their time and capital via trading fees and at-risk positions. This forms a sort of "proof of work" that is much harder to game, and weeds out the lazy participants. With that in mind, I spent a bunch of time analzying our distribution numbers to make sure that 99.99% of all users recouped their initial trading fees on the airdrop (that's the bare minimum to not leave people feeling cheated), and in fact on average users of Zeta made ~10x back on their fees! That's some damn good ROI if you ask me. As you'd imagine, most traders in our Discord were super pleased with their final allocations!

The Danger of Instant Sell Pressure

First and foremost, we were very intentional that team and investors WILL NOT unlock at TGE. This is a predatory pattern that's become all too common of high FDV projects where seed VCs up 100x get day 0 liquidity. All investors/team for Zeta have 3-4yr vesting and 1yr cliffs for this reason.

Furthermore, since airdrops create an instantaneous supply shock, for price to stabilise it requires a ton of buy demand on listing, and during weaker macro market conditions this is harder to maintain. So we reasoned it would be sensible to have a similar (short-term) vesting period for the first 7 days. The freedom to claim instantly, but if you truly cared about the long-term vision of the project and weren't in a rush to dump your tokens, you'd be rewarded with 2x your allocation. We'll see how it plays out, but I think it's a no brainer for most, 7d is nothing for a project that has been building for 3yrs+.

You Can Never Make Everyone Happy

I recall chatting to @weremeow shortly after the Jup launch and he really drilled this reality into my head. Everyone wants their own allocation to be bigger. "He got too much, she got too little, blah, blah, blah". I've just accepted that fuck it, people will complain no matter what happens, that's just present day crypto for you.

That being said we tried hard to be inclusive of REAL USERS. This meant 1. getting rid of people who didn't meet a (very achievable) minimum threshold 2. capping the upside on the biggest wallets to make it more equitable for the rest 3. meticulously weeding out bad actors who created hundreds of programmatic sybil wallets and/or wash traded 4. boosting scores on traders who were both active and had traded since the early days (OGs).

Yeah, we still copped a bunch of unhappy messages from whales who felt entitled to $100k+ airdrops, but we hope they will stick by us with what I would still consider quite substantial airdrops regardless.

Overall I would still say our sentiment was overall very positive (I only got called a scammer twice!! 🤯). I was dreading this day for a while, but I'm glad all the effort I spent crunching SQL and pandas dataframes, eyeballing statistics, talking to our users, studying other airdrops - seems like it paid off.

So is the airdrop meta over for good? Perhaps. They're a pretty exhausted route. But I think there's a lot you do to innovate the right way. Maybe they'll relive their glory days once more... 🪂

• • •

Missing some Tweet in this thread? You can try to

force a refresh