How to get URL link on X (Twitter) App

2) Why does anyone care about TVL at all?

2) Why does anyone care about TVL at all?

1/ One of Solana's key design choices is allowing direct access to the leader and processing transactions as a stream, leading to the fast block times we see.

1/ One of Solana's key design choices is allowing direct access to the leader and processing transactions as a stream, leading to the fast block times we see.

2. For background, the exploit involved an oracle price manipulation attack on the $MNGO market.

2. For background, the exploit involved an oracle price manipulation attack on the $MNGO market.https://twitter.com/joshua_j_lim/status/1579987648546246658

Most of the USDC coming in seems to flow out of the wallet in due time as well, although the net balance does grow slowly over time.

Most of the USDC coming in seems to flow out of the wallet in due time as well, although the net balance does grow slowly over time.

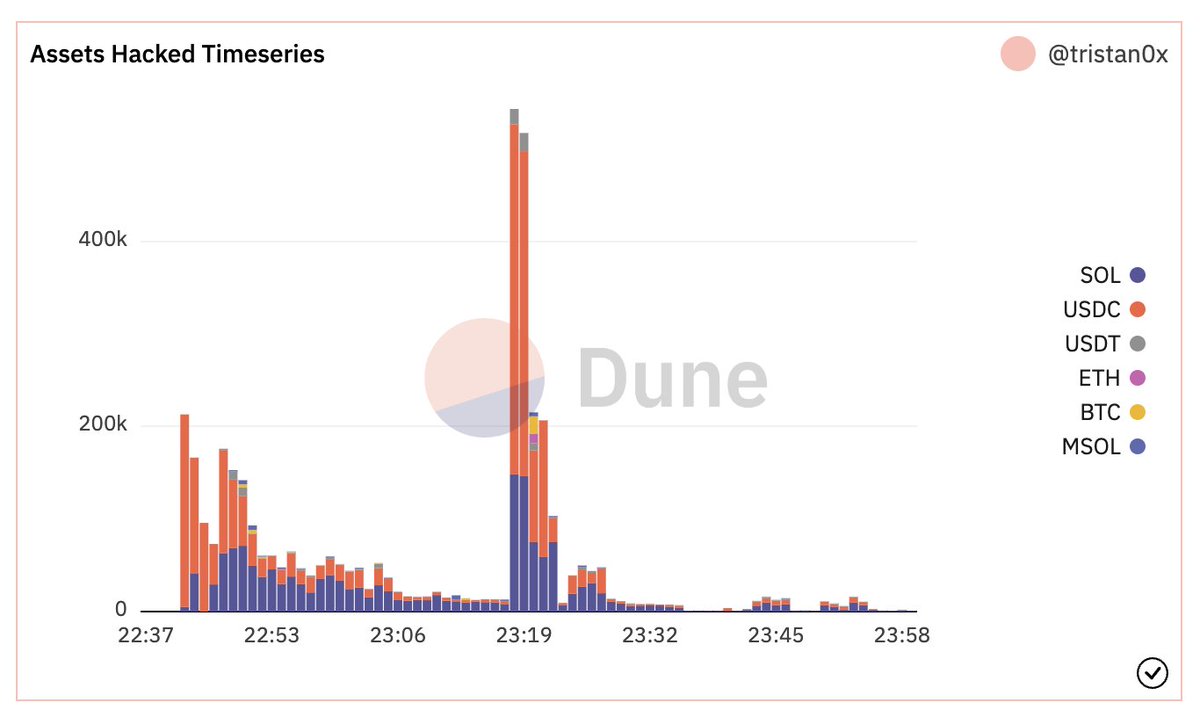

2/ During the initial phase, funds were extracted at an aggressive pace with hundreds of thousands of dollars being lost minute to minute (all sizes here are converted to USD).

2/ During the initial phase, funds were extracted at an aggressive pace with hundreds of thousands of dollars being lost minute to minute (all sizes here are converted to USD).

1. Programming fundamentals

1. Programming fundamentals