Scotland is about to create an amazing new legal vehicle for money launderers, tax evaders and sanctions-busters. By accident.

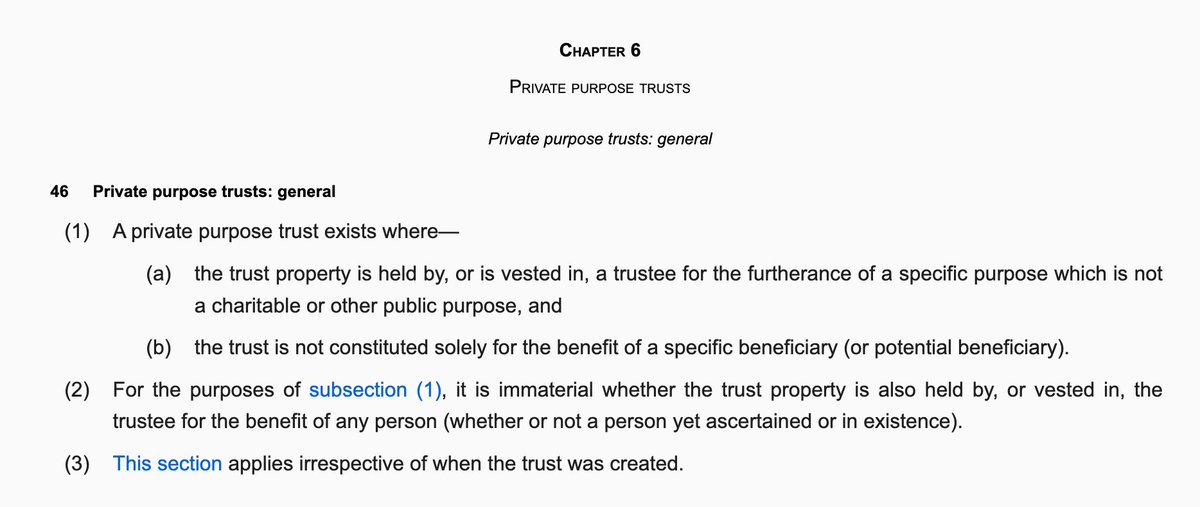

"Private purpose trusts" have been widely used abroad for tax evasion, money laundering and sanctions-busting. They've never been permitted in the UK.

But Scotland is about to introduce them. This seems a serious mistake.

But Scotland is about to introduce them. This seems a serious mistake.

Scottish limited partnerships have been widely abused.

But the potential for abuse of private purpose trusts is far greater - not least because there will be no public disclosure that the trust even exists.transparency.org.uk/tackling-abuse…

But the potential for abuse of private purpose trusts is far greater - not least because there will be no public disclosure that the trust even exists.transparency.org.uk/tackling-abuse…

We have a very complex series of tax rules dealing with trusts, which (mostly) make trusts useless for tax avoidance (with the exception of non-doms, and that's about to go).

None of the existing rules expect UK private purpose trusts to exist.

None of the existing rules expect UK private purpose trusts to exist.

If we *really really* want to introduce private purpose trusts, we first need consequential changes in other laws (particularly transparency and tax).

Without that we'll see a wave of tax avoidance, tax evasion and criminality. We'll be picking up the pieces for years.

Without that we'll see a wave of tax avoidance, tax evasion and criminality. We'll be picking up the pieces for years.

It's particularly disappointing that these issues aren't raised anywhere in the Scottish Law Commission report that inspired this change. Not even mentioned. scotlawcom.gov.uk/files/4014/090…

This needs careful thought. The Scottish government should hold-off implementation until appropriate safeguards are in place.

Many thanks to Alan Eccles (@WillsCharityLaw) for alerting me to this - his article is here: …tishcharityandwealthlaw.wordpress.com/2024/06/20/wha…

Alan's LinkedIn thread here: linkedin.com/posts/alan-ecc…

One final controversial point: the impact Scottish private purpose trusts will have upon the whole of the UK means that the UK Government should IMO have considered using its powers to block the Trusts and Succession (Scotland) Act 2024. It's now too late.

Oh, and how did this get through the Scottish Parliament without scrutiny?

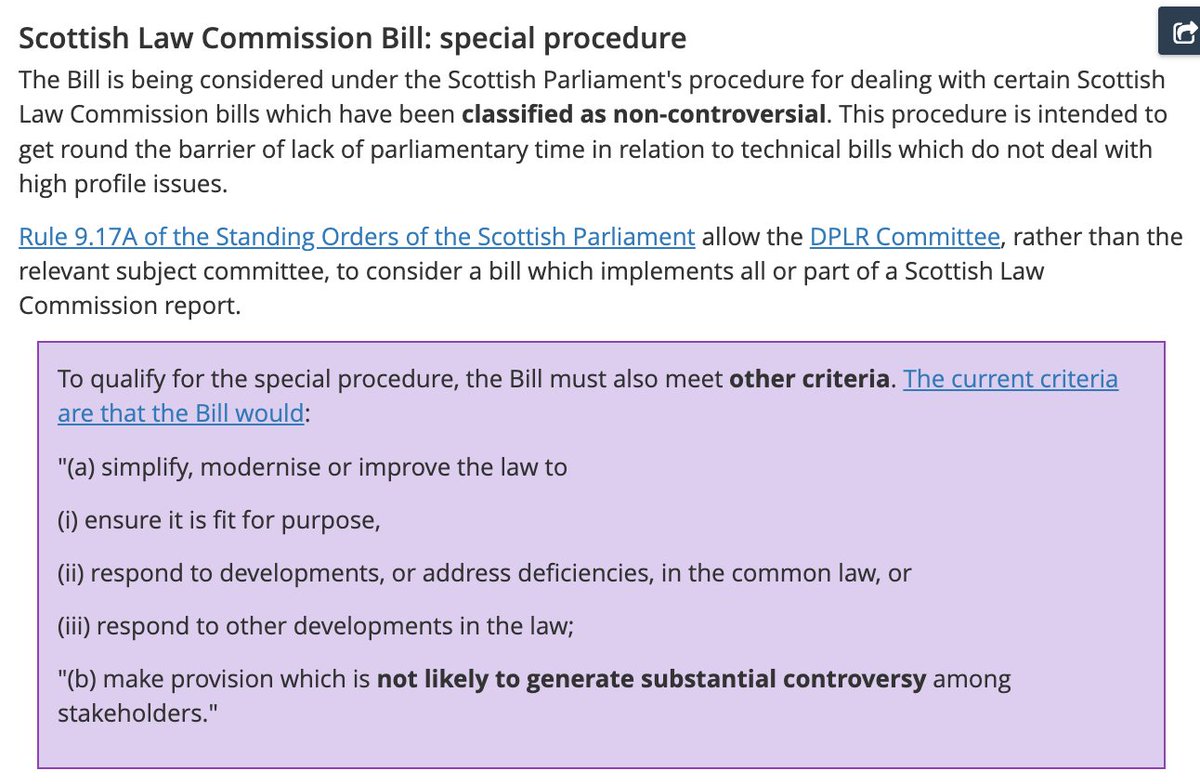

Because they used the special procedure for measures "not likely to generate substantial controversy"

(thank to @ncsmiff)

Because they used the special procedure for measures "not likely to generate substantial controversy"

(thank to @ncsmiff)

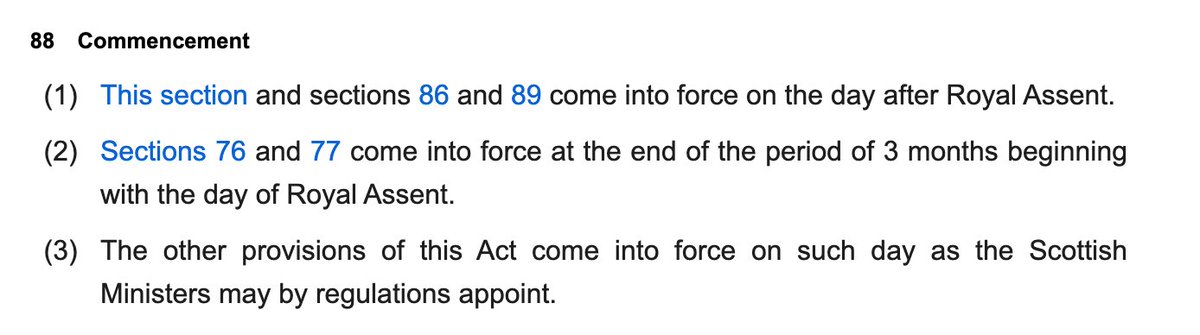

There is still time. The Act is, I believe, not yet in force - that requires Scottish Ministers to make regulations.

They should hold-off.

They should hold-off.

• • •

Missing some Tweet in this thread? You can try to

force a refresh