Arbitrum DAO is proposing to launch $ARB staking.

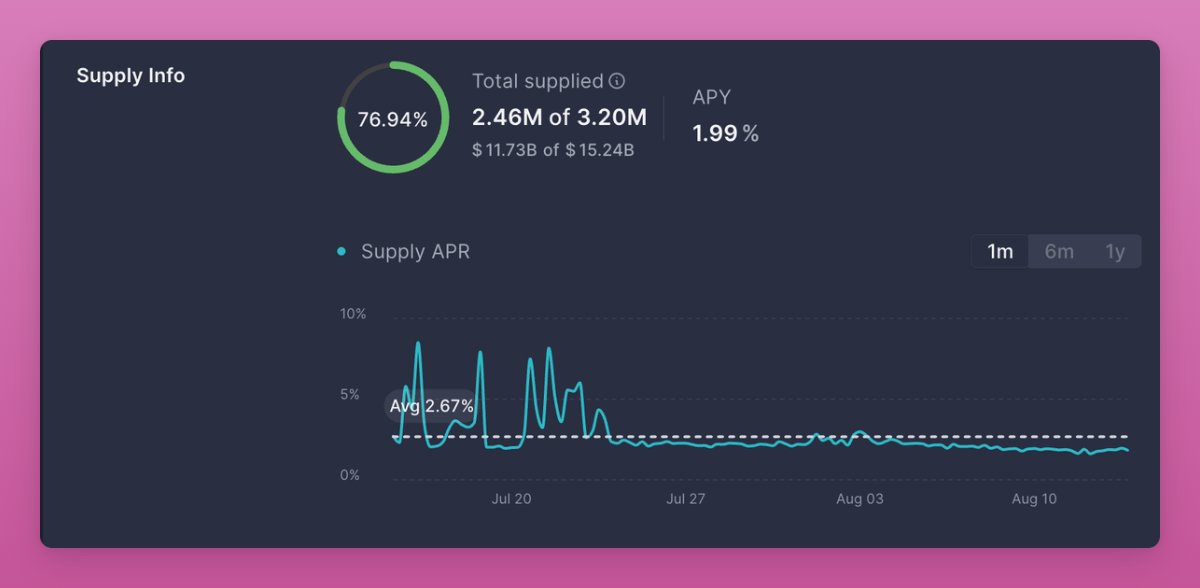

This time, 50% of surplus sequencer fees will be used to reward ARB stakers.

With 12,000 ETH in annual fees and an ARB price of $1, this translates to a 7% APY.

The catch: tokens must be staked and delegated to a delegate with a Karma Score, which calculates participation in DAO forums, off-chain, and on-chain votes.

Delegates would receive 1% of the surplus fees.

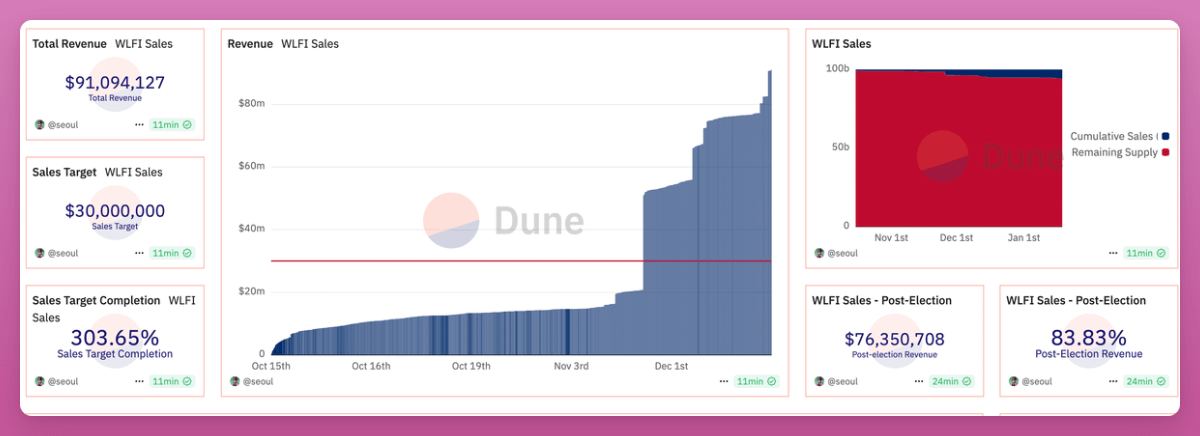

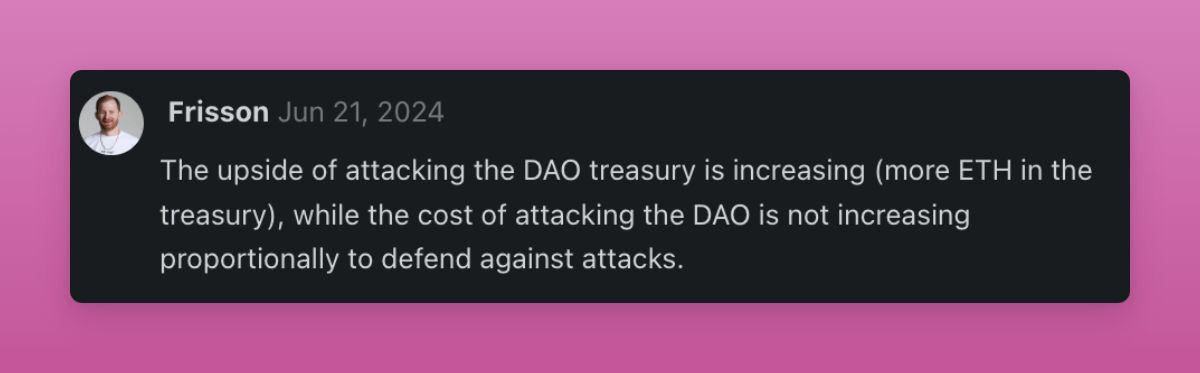

The goal is to strengthen the DAO because with over $50M in surplus fees in Treasury and only 10% of ARB actively used in governance, the DAO is vulnerable to attacks.

Remember Real Value Raiders who vote to shut down DAOs and redistribute Treasury assets?

Obviously, since degens care just about APY, the proposal includes Liquid Staked ARB in partnership with @tallyxyz

Though still a proposal, public feedback has been positive.

Even if all goes well, staking won't be live until September at the earliest.

I believe it's a sensible proposal. And not only because ARB is down only since launch.

It's also high time DAOs with substantial treasuries started sharing part of their revenue with token holders.

Hopefully, an improving regulatory environment and successful proposals like this will encourage other DAOs to implement similar revenue-sharing mechanisms.

This time, 50% of surplus sequencer fees will be used to reward ARB stakers.

With 12,000 ETH in annual fees and an ARB price of $1, this translates to a 7% APY.

The catch: tokens must be staked and delegated to a delegate with a Karma Score, which calculates participation in DAO forums, off-chain, and on-chain votes.

Delegates would receive 1% of the surplus fees.

The goal is to strengthen the DAO because with over $50M in surplus fees in Treasury and only 10% of ARB actively used in governance, the DAO is vulnerable to attacks.

Remember Real Value Raiders who vote to shut down DAOs and redistribute Treasury assets?

Obviously, since degens care just about APY, the proposal includes Liquid Staked ARB in partnership with @tallyxyz

Though still a proposal, public feedback has been positive.

Even if all goes well, staking won't be live until September at the earliest.

I believe it's a sensible proposal. And not only because ARB is down only since launch.

It's also high time DAOs with substantial treasuries started sharing part of their revenue with token holders.

Hopefully, an improving regulatory environment and successful proposals like this will encourage other DAOs to implement similar revenue-sharing mechanisms.

• • •

Missing some Tweet in this thread? You can try to

force a refresh