It's time to talk about L2 MEV!

L2s activities surged after Dencun. As the cost goes down, more bot activities and spamming tactics appear. They cause 2 problems: gas congestions & high reverts.

On Base, BananaGun Telegram Bot users pay 43x‼️ higher gas price than other users!

L2s activities surged after Dencun. As the cost goes down, more bot activities and spamming tactics appear. They cause 2 problems: gas congestions & high reverts.

On Base, BananaGun Telegram Bot users pay 43x‼️ higher gas price than other users!

All the other Telegram Bots on Base show a similarly 20x higher gas price level.

Right after Dencun, Base avg gas fees quickly spiked over than its highest before the upgrade. The team has been scaling up throughout (gas target/s) a few times ever since: growthepie.xyz/fundamentals/t…

Right after Dencun, Base avg gas fees quickly spiked over than its highest before the upgrade. The team has been scaling up throughout (gas target/s) a few times ever since: growthepie.xyz/fundamentals/t…

Revert rates across L2s also notably increased after Dencun:

Prior to upgrade, Base's was ~2%; but it has since spiked to around 15%, with a peak of 30% on April 4th.

Arbitrum & OP Mainnet have seen periodic spikes ranging from 10% to 20%.

(Ethereum: ~2%, BNB & Polygon: 5-6%)

Prior to upgrade, Base's was ~2%; but it has since spiked to around 15%, with a peak of 30% on April 4th.

Arbitrum & OP Mainnet have seen periodic spikes ranging from 10% to 20%.

(Ethereum: ~2%, BNB & Polygon: 5-6%)

However, when squint hard: One would note that it doesn't represent☝️average users' experience on L2s, as the 60% avg revert rate contracts are MEV bots rather than retail routers.

It doesn't mean we don't need to solve the issue, as it's still wasted gas cost and blockspace.

It doesn't mean we don't need to solve the issue, as it's still wasted gas cost and blockspace.

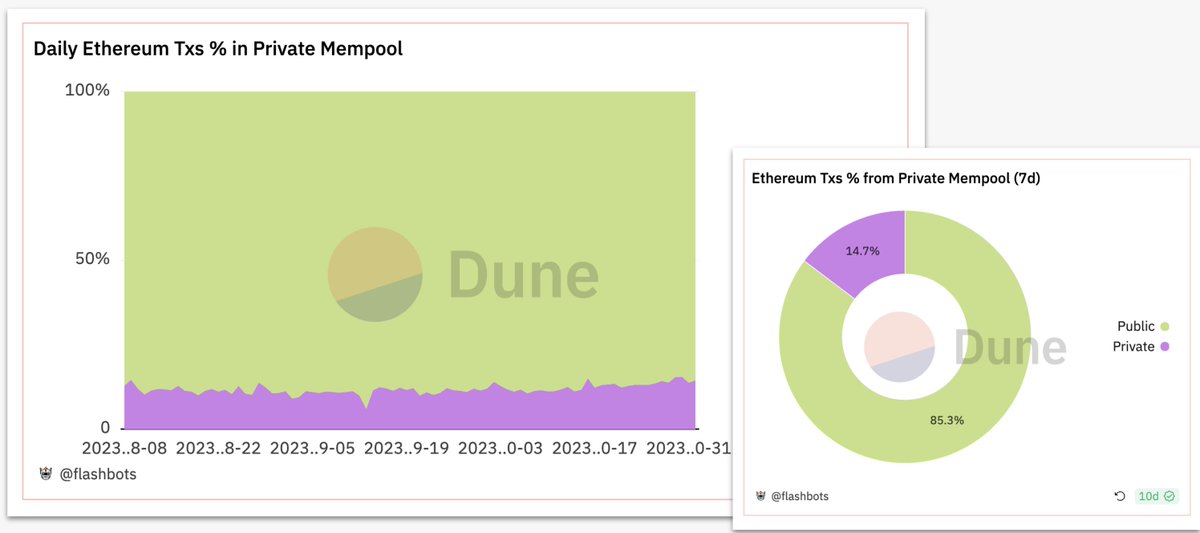

How much MEV are on L2s? There isn't an agreed upon number as of today, but there is a major distinction from MEV on L1s:

With single sequencer on L2s, there isn't much sandwiches happening due to lack of mempool, and most feasible strategy is to spam arbitrages, sniping, liq.

With single sequencer on L2s, there isn't much sandwiches happening due to lack of mempool, and most feasible strategy is to spam arbitrages, sniping, liq.

How big the MEV market can be on L2s? No clear answer before quantification and indexing are in place, but imo the potential revenue size is huge:

For the week of March 25th, BananaGun TG Bot's volume on Base ($150m) was almost the total of Ethereum ($62m) and Solana ($99m)

For the week of March 25th, BananaGun TG Bot's volume on Base ($150m) was almost the total of Ethereum ($62m) and Solana ($99m)

Also in March, BananaGun paid $23m+ to Ethereum builders & validators.

Certainly one trading bot's volume doesn't paint the full picture, but Base's memecoin trading momentum and TVL trend indicate significant MEV revenue potential, if can be captured w/ mature infrastructure.

Certainly one trading bot's volume doesn't paint the full picture, but Base's memecoin trading momentum and TVL trend indicate significant MEV revenue potential, if can be captured w/ mature infrastructure.

To reference MEV rewards on other L1s' execution layer:

Ethereum's MEV-boost block’s median value is 4x than vanilla blocks; and validators' revenue from MEV-Boost totals to $968m (if ETH at $3500)

Solana validators’ extra MEV revenue via Jito stands at ~$338m (if SOL at $130).

Ethereum's MEV-boost block’s median value is 4x than vanilla blocks; and validators' revenue from MEV-Boost totals to $968m (if ETH at $3500)

Solana validators’ extra MEV revenue via Jito stands at ~$338m (if SOL at $130).

L2s should consider MEV solutions to avoid negative externalities and capture value more efficiently.

Introducing bundle services offloads a lot of pressure from MEV competition:

Users can be exempt from high gas raced by bots; Searchers can reduce cost from revert protection.

Introducing bundle services offloads a lot of pressure from MEV competition:

Users can be exempt from high gas raced by bots; Searchers can reduce cost from revert protection.

When shared sequencers are introduced, mempools will be introduced and hence sandwiches are inevitable.

More mature tooling and services for retail users - like Flashbots Protect and MEV Share- can help them avoid being sandwiched w/ huge slippages, with potential extra refunds.

More mature tooling and services for retail users - like Flashbots Protect and MEV Share- can help them avoid being sandwiched w/ huge slippages, with potential extra refunds.

More challenges and nuances are ahead with L2s' faster block time and cheaper blockspace, and we'd love to encourage more research, data, and solutions to appear!

Please reach out to @defin00b to learn more about the L2 MEV Data grant!

Full post link: collective.flashbots.net/t/it-s-time-to…

Please reach out to @defin00b to learn more about the L2 MEV Data grant!

Full post link: collective.flashbots.net/t/it-s-time-to…

Lastly, shoutout to @MSilb7 for reviews and contributions from @bertcmiller @Freddmannen @DistributedMarz @hasufl @elenahoolu @defin00b for this post! 🙇♀️🙇♀️🙇♀️

Also @MSilb7 @hildobby_ @whale_hunter_ for curating open datasets used in the post 🔮🧙.

Also @MSilb7 @hildobby_ @whale_hunter_ for curating open datasets used in the post 🔮🧙.

• • •

Missing some Tweet in this thread? You can try to

force a refresh