financial nihilist. mev-thirsty. data @ Flashbots. co-host @indexed_pod. council @thelatestindefi. previously data @0xProject @ConsenSys.

How to get URL link on X (Twitter) App

You should prob not trade on solver auctions, but go to DEX aggregators, if your size is big enough.

You should prob not trade on solver auctions, but go to DEX aggregators, if your size is big enough.

https://twitter.com/1462812538731745286/status/1815520545774944466We observe that the Orderflow Market follows the Pareto rule:

All the other Telegram Bots on Base show a similarly 20x higher gas price level.

All the other Telegram Bots on Base show a similarly 20x higher gas price level.

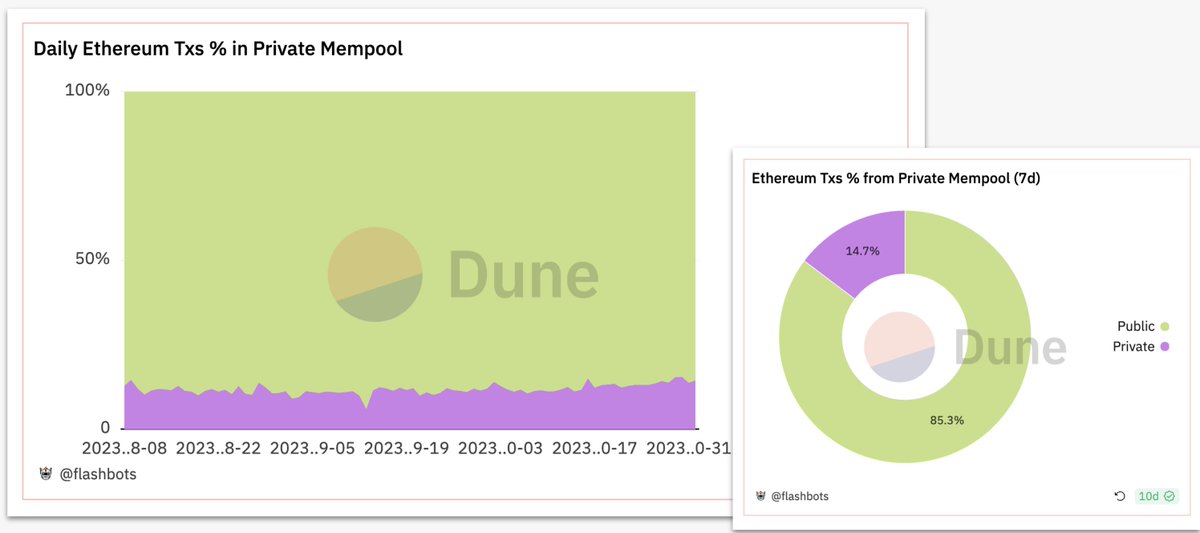

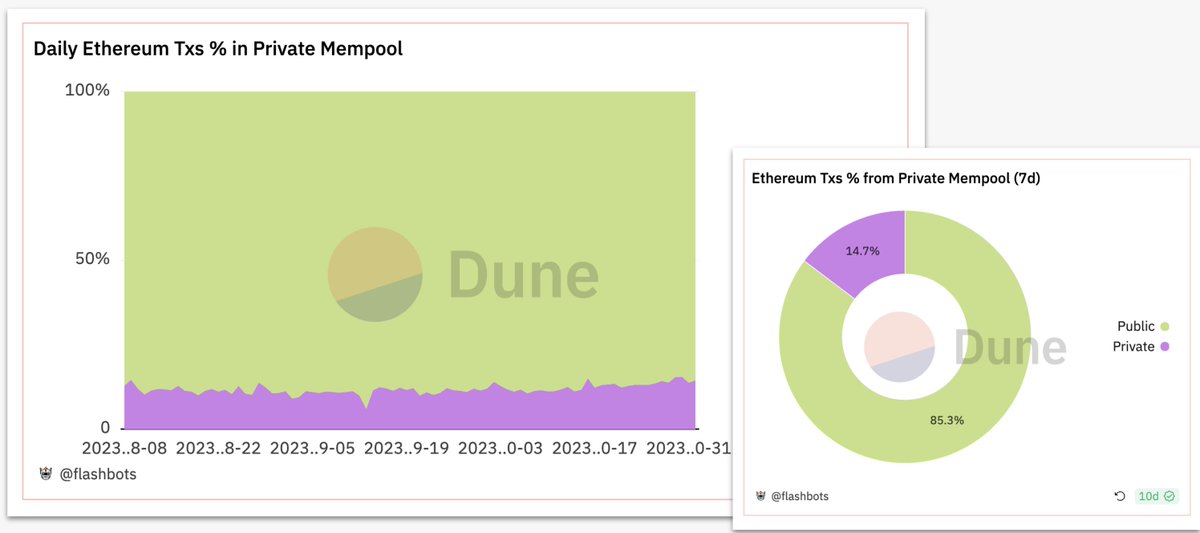

Over 50% of Non-toxic (uninformed) volume are settled thru private mempool.

Over 50% of Non-toxic (uninformed) volume are settled thru private mempool.