Debt Mutual Funds

So many categories of Debt Mutual funds like

1. Liquid fund

2. Short term fund

3. Gilt funds

and many more

Which one should u choose?🤔🤔

A thread🧵 on various types of debt funds and which one to choose?

Lets go👇

So many categories of Debt Mutual funds like

1. Liquid fund

2. Short term fund

3. Gilt funds

and many more

Which one should u choose?🤔🤔

A thread🧵 on various types of debt funds and which one to choose?

Lets go👇

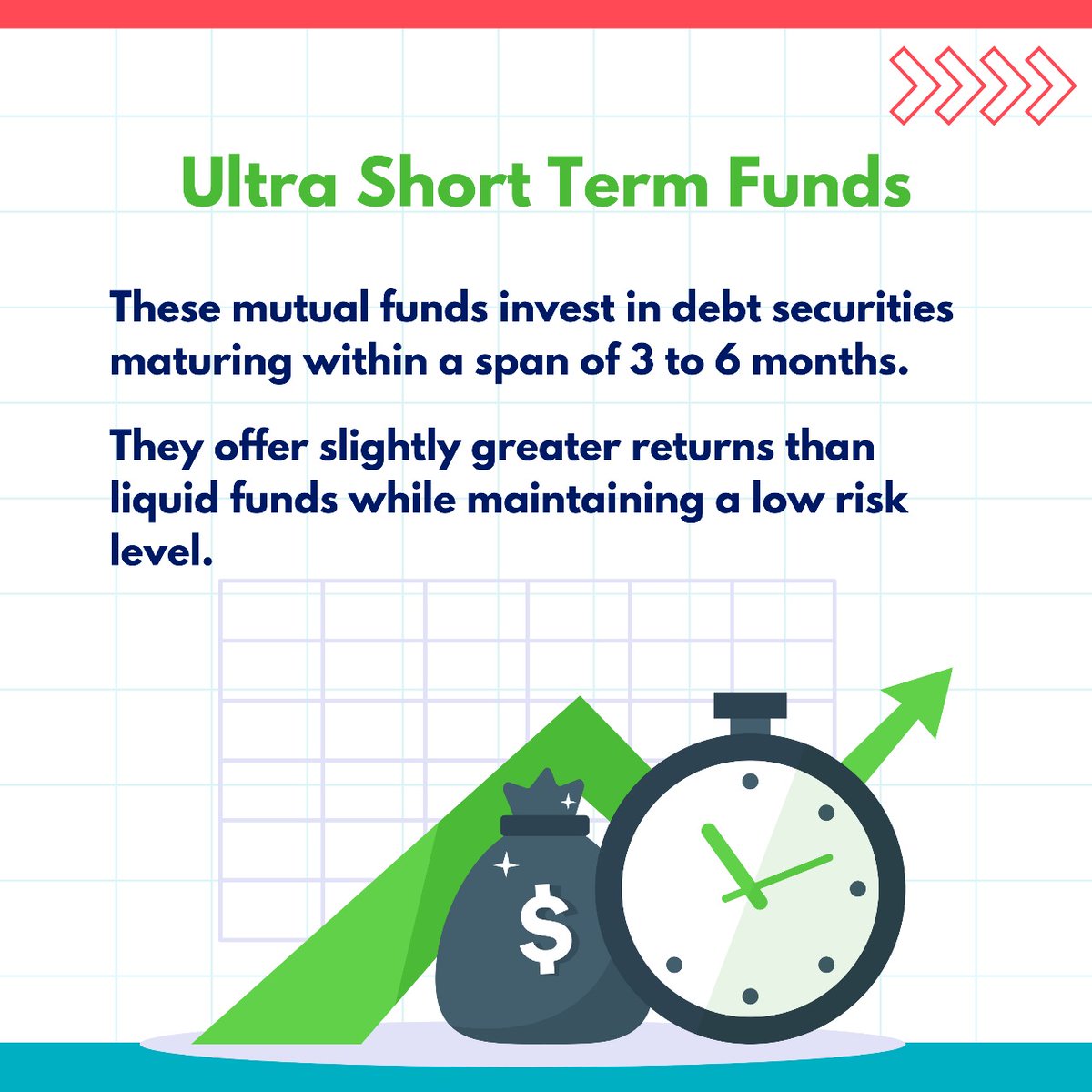

Types of Debt Funds

Based on the fixed-income securities they invest in

1. Liquid

2. Overnight

3. Short term

4. Gilt fund

5. Banking and PSU debt fund

6.Dynamic Funds

7. Medium Duration Funds

Based on the fixed-income securities they invest in

1. Liquid

2. Overnight

3. Short term

4. Gilt fund

5. Banking and PSU debt fund

6.Dynamic Funds

7. Medium Duration Funds

Keep following me -@AdityaD_Shah as I write daily to make you aware around:

📈Personal Finance

📈Investing

📈Stock Analysis

Go to my profile and hit the bell icon🔔to always stay updated

📈Personal Finance

📈Investing

📈Stock Analysis

Go to my profile and hit the bell icon🔔to always stay updated

• • •

Missing some Tweet in this thread? You can try to

force a refresh