Introducing: Aevo Strategies

Aevo Strategies are automated trading vaults that execute sophisticated strategies on the users behalf.

Aevo Strategies are automated trading vaults that execute sophisticated strategies on the users behalf.

You can now access exclusive vaults with trading strategies that are usually used by large institutions and market makers, all in just one click.

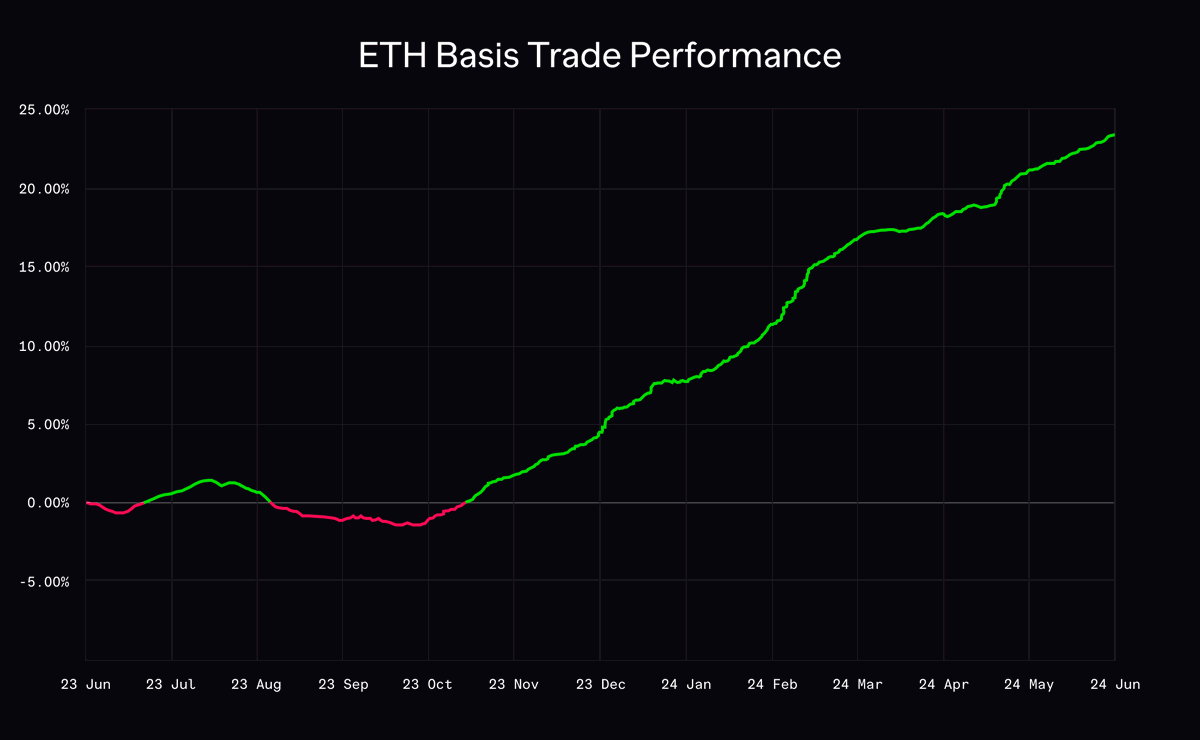

Our first vault is the basis trade vault. This is one of the most common delta-neutral trading strategies, and the main yield source behind protocols such as @ethena_labs.

The basis trade vault earns yield by collecting funding payments, which vary depending on market conditions.

It works by simultaneously buying spot and selling a perpetual future contract for the same asset.

It works by simultaneously buying spot and selling a perpetual future contract for the same asset.

The vault does not take any directional exposure (delta-neutral), as every long spot position is balanced by a short perpetual future position.

The vault is expected to perform positively as long as the funding rate is positive.

The vault is expected to perform positively as long as the funding rate is positive.

Over the last year (June 23 to June 24), the ETH basis trade returned 23.4%.

This is just the first strategy that we are launching under Aevo Strategies.

More to come very soon!

This is just the first strategy that we are launching under Aevo Strategies.

More to come very soon!

• • •

Missing some Tweet in this thread? You can try to

force a refresh