How to get URL link on X (Twitter) App

https://twitter.com/hansolar21/status/1659388643725967360#1: Pick an expiry date

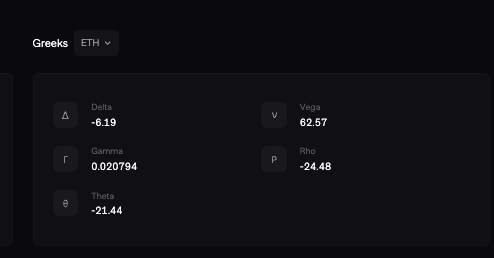

Aevo’s Portfolio Margin system is the first DEX to allow options and perps from the same account!

Aevo’s Portfolio Margin system is the first DEX to allow options and perps from the same account!

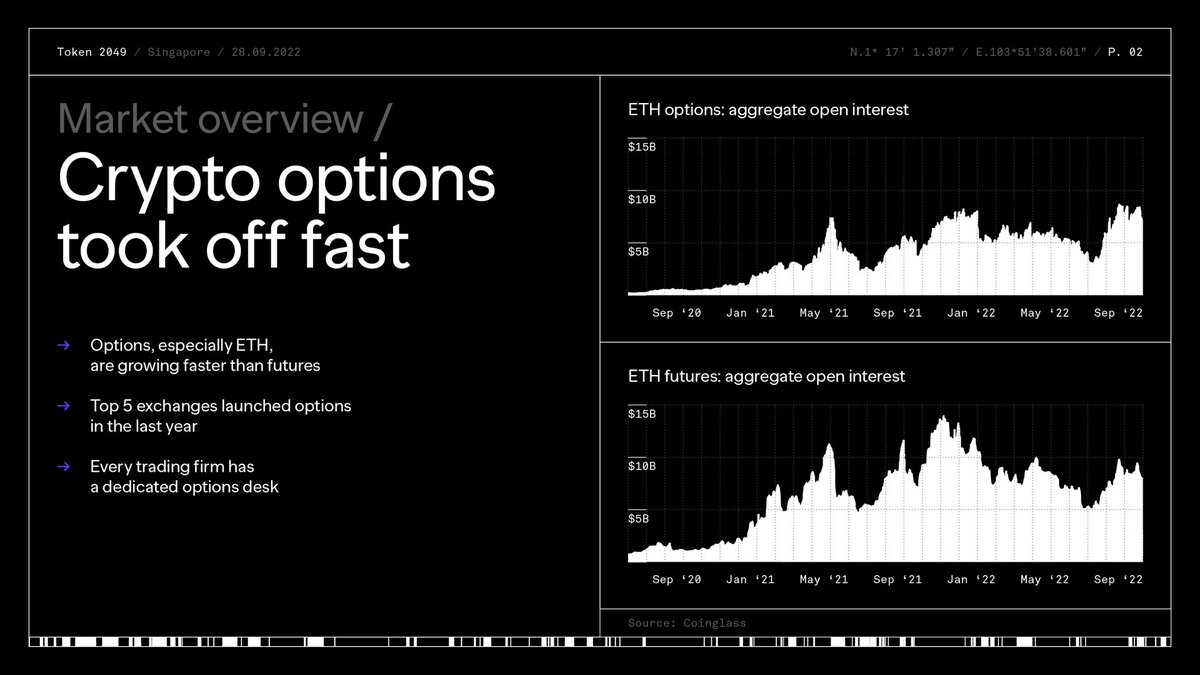

Crypto options has seen significant growth.

Crypto options has seen significant growth.