NEW: We are short Iris Energy $IREN. Our full report is now available on our website, culperresearch.com

2) $IREN was founded in 2018 but now in 2024 promotes itself as an HPC data center play, claiming that "from Day 1, we've built out our facilities" as "multi-decade high-performance data centers." This is a contrived, nonsense pivot reminiscent of COVID-19 era biotech scams.

3) $IREN Co-CEO Daniel Roberts constantly touts $IREN's supposed HPC prowess on paid stock promotion outlets like Proactive and McNallie Money, but behind the scenes has started dumping his own shares alongside his brother and Co-CEO, Will Roberts.

4) Meanwhile, since 2020, $IREN has burned $716 million in cash, and funded this charade by diluting investors to seemingly no end – share count has exploded 12x in the past 4 years.

5) $IREN now claims that it has developed "HPC-ready" data centers, but what $IREN is actually building lacks numerous HPC-critical features. The proof is in $IREN's financials: $IREN is spending less than $1M per MW, while true HPC data centers cost $10 to $20M per MW.

6) Our analysis of Childress exposes numerous deficiencies. To analogize, $IREN claims that it's set to win the Monaco Grand Prix, but just arrived to the track in a Toyota Prius.

6) $IREN implies "Tier 3" standards or better, implying at least one if not two power redundancies (i.e., batteries & diesel generators). Childress, however, has none, and is now stuck - lead times are 1+ years, and we estimate batteries & generators would cost >$1 billion.

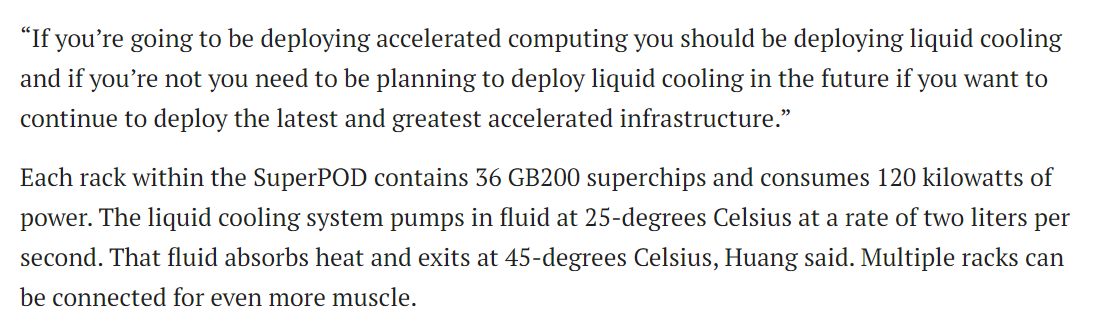

8) $IREN also claims to have a "proven" air cooling solution for GPUs in Childress, based on the small cluster of GPUs it has run in BC, where temperatures are 20 to 40 degrees cooler. One expert we spoke with said "they're crazy" to claim that air cooling will work at Childress.

9) $IREN stands alone in its insistence on air cooling: nearly all HPC data centers we reviewed all opted for liquid cooling, especially at higher densities, while NVIDIA's next-generation architecture will require liquid cooling, leaving $IREN in the dust.

10) $IREN claims Childress is an attractive asset due to low power costs, but these costs are low because Childress curtails power and sells power back to the grid. In HPC environments requiring 99.9% uptime, $IREN would need to sign a PPA, likely at a substantially higher cost.

11) $IREN claims its always foreseen the need for HPC, but then decided to build in Childress, Texas, which resembles both a literal and figurative desert. FCC records show Childress County has just a single fiber provider, vs. 20+ by those such as $CORZ in Denton, Texas.

12) $IREN then promotes its undeveloped land and power as being worth "$5 to $12 million per MW" based on a Morgan Stanley research note. But $IREN blatantly misrepresents the note, which referred to fully built infrastructure - not land and power - as being valuable.

13) Led on by these claims, $IREN now trades at $7.6 million per MW. Investors cheer on recent M&A offers (CoreWeave for CORZ; RIOT for BITF; CLSK for GRDI) but these came at multiples of $2.3M per MW, $2.6M per MW, and $2.8M per MW, implying 55% downside for $IREN.

14/14) Similarly, $IREN shares now trade at 2x public peer levels on multiples of present and fwd. MWs, again implying ~50% downside. $IREN unravels as investors realize the Company's HPC claims are nonsense. We're following the lead set by the Roberts Brothers and selling $IREN.

• • •

Missing some Tweet in this thread? You can try to

force a refresh