Every quarter I spend a few days combing through onchain data to compile Ethereum's financial performance so that you don't have to.

A 🧵on the L2 sector performance in Q2:

Active users: L2s now have 6x that of the L1 (up from 3x last qtr)

Data: @tokenterminal

A 🧵on the L2 sector performance in Q2:

Active users: L2s now have 6x that of the L1 (up from 3x last qtr)

Data: @tokenterminal

Active addresses/users on L2 only:

@arbitrum averaging more than Ethereum now.

@base in the number 2 spot.

Data: @tokenterminal

@arbitrum averaging more than Ethereum now.

@base in the number 2 spot.

Data: @tokenterminal

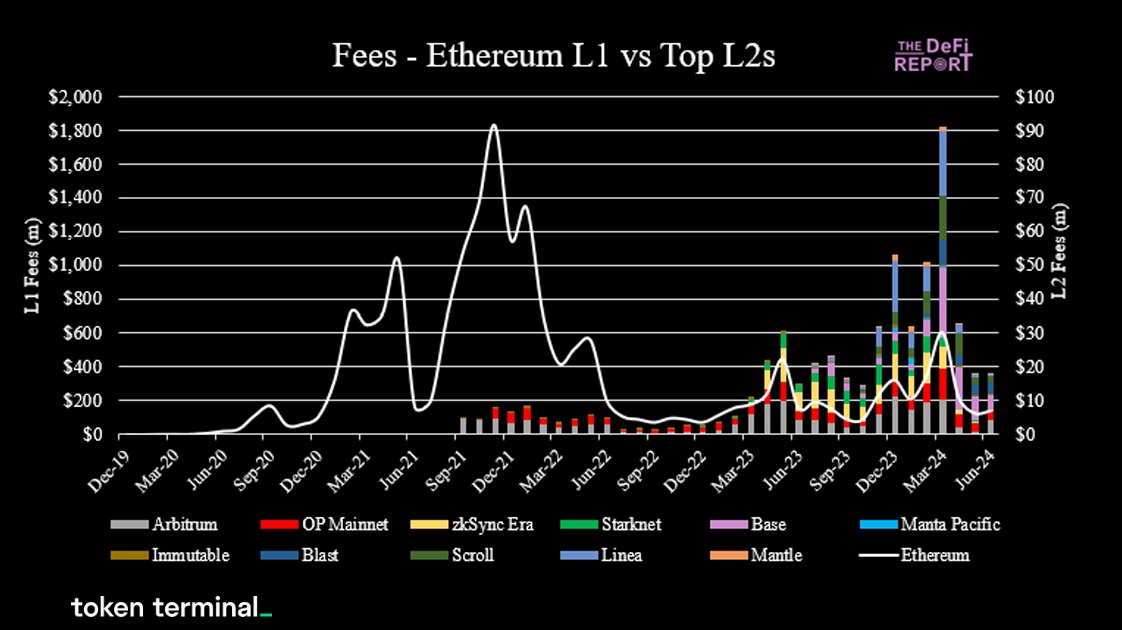

Fees: ETH vs L2s

ETH Fees dropped $679m in Q2 due to EIP4844 👀

Activity on L2s increased, but with fees dropping due to tech upgrades, sequencer revenues were flat for the qtr.

Data: @tokenterminal

ETH Fees dropped $679m in Q2 due to EIP4844 👀

Activity on L2s increased, but with fees dropping due to tech upgrades, sequencer revenues were flat for the qtr.

Data: @tokenterminal

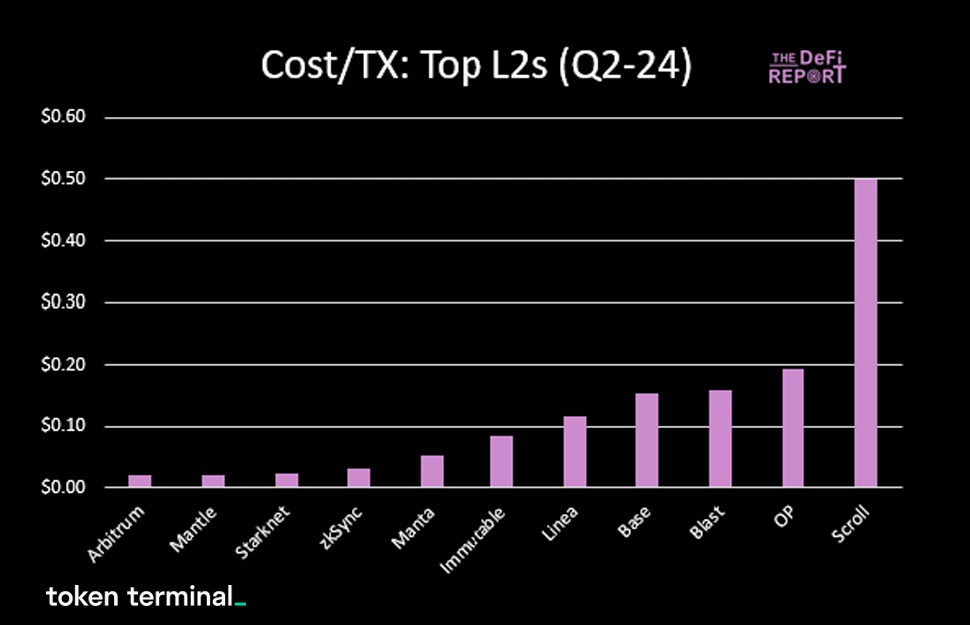

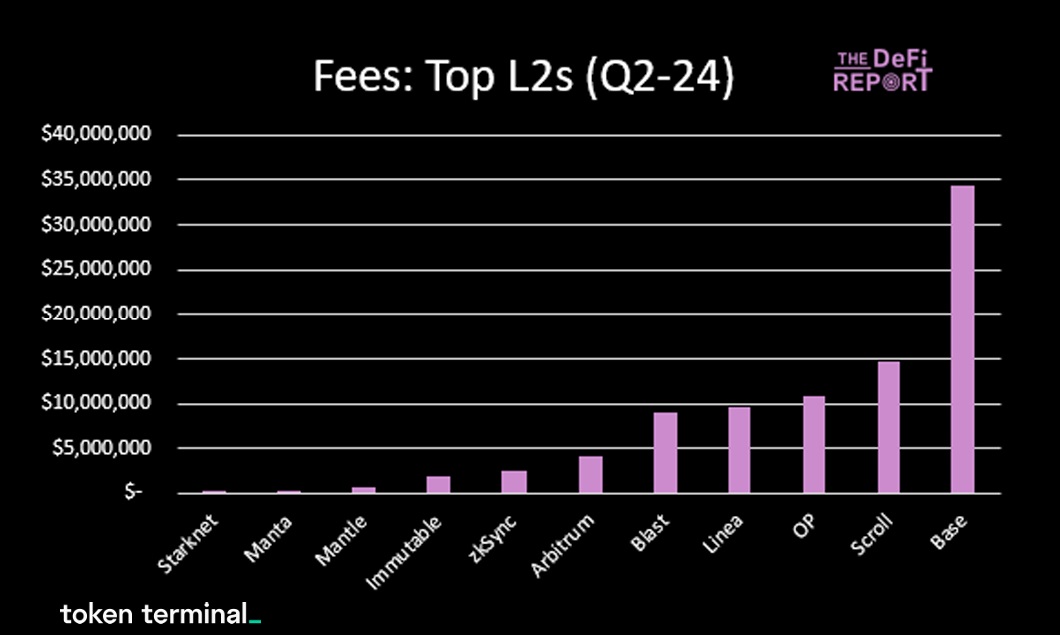

Fees - L2s only.

@base dominating the field here. Note that @arbitrum was #1 in tx, but #6 in fees -- due to cost/tx significantly lower than Base during the qtr.

Data: @tokenterminal

@base dominating the field here. Note that @arbitrum was #1 in tx, but #6 in fees -- due to cost/tx significantly lower than Base during the qtr.

Data: @tokenterminal

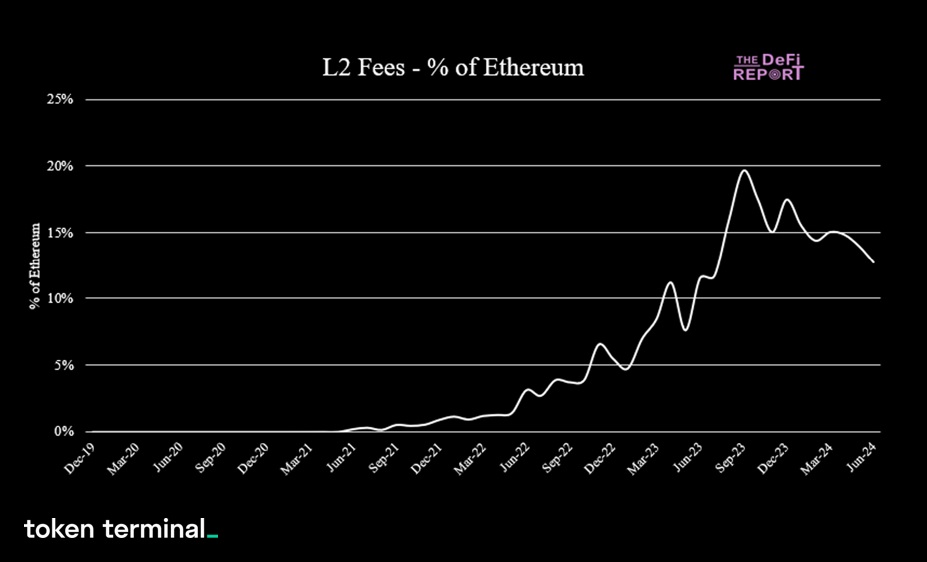

Fees - L2s as a % of Ethereum: 13% in Q2

This is down from a peak of nearly 20% in Q4 of last year. Largely due to EIP4844.

Data: @tokenterminal

This is down from a peak of nearly 20% in Q4 of last year. Largely due to EIP4844.

Data: @tokenterminal

The combined daily cost of revenue for the top L2s:

Fell off a cliff.

Once again, EIP4844 telling the story in Q2.

Data: @tokenterminal

Fell off a cliff.

Once again, EIP4844 telling the story in Q2.

Data: @tokenterminal

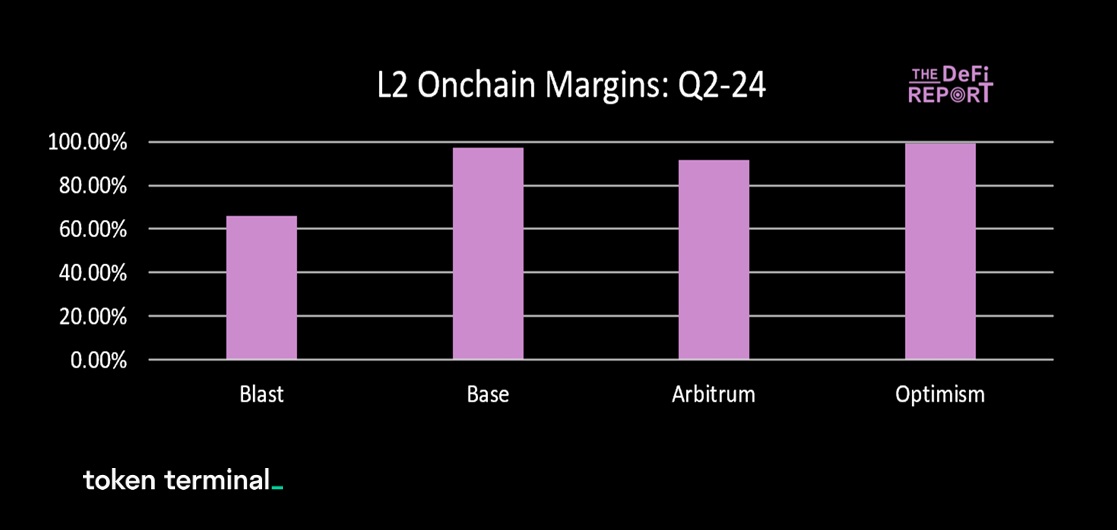

Onchain margins:

Improved dramatically in Q2.

@Optimism was 99%.

@base = 97% (does not include payments to OP)

@arbitrum 92%

@blast 66% (improved to 96% upon implementation of blobs in late May)

The catalyst? EIP4844

Data: @tokenterminal

Improved dramatically in Q2.

@Optimism was 99%.

@base = 97% (does not include payments to OP)

@arbitrum 92%

@blast 66% (improved to 96% upon implementation of blobs in late May)

The catalyst? EIP4844

Data: @tokenterminal

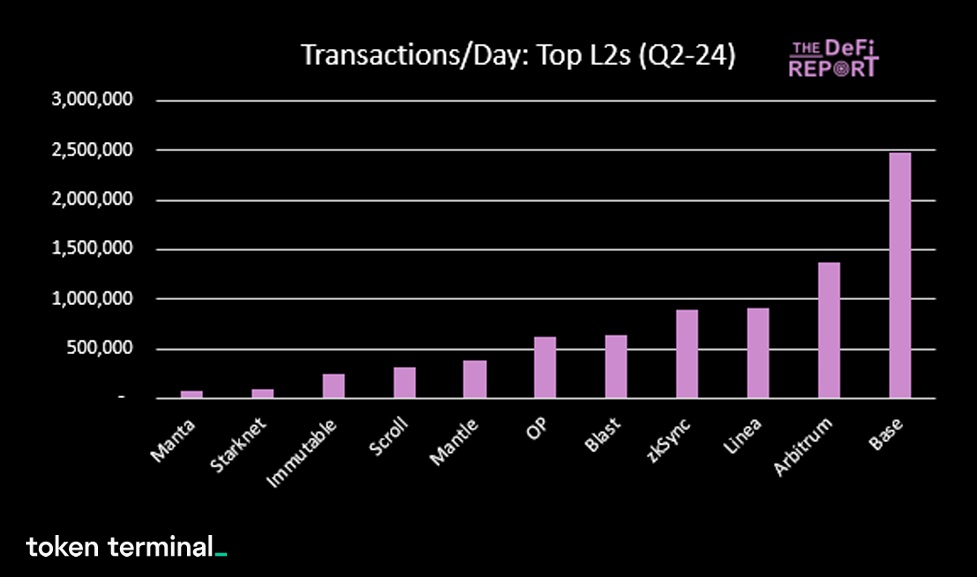

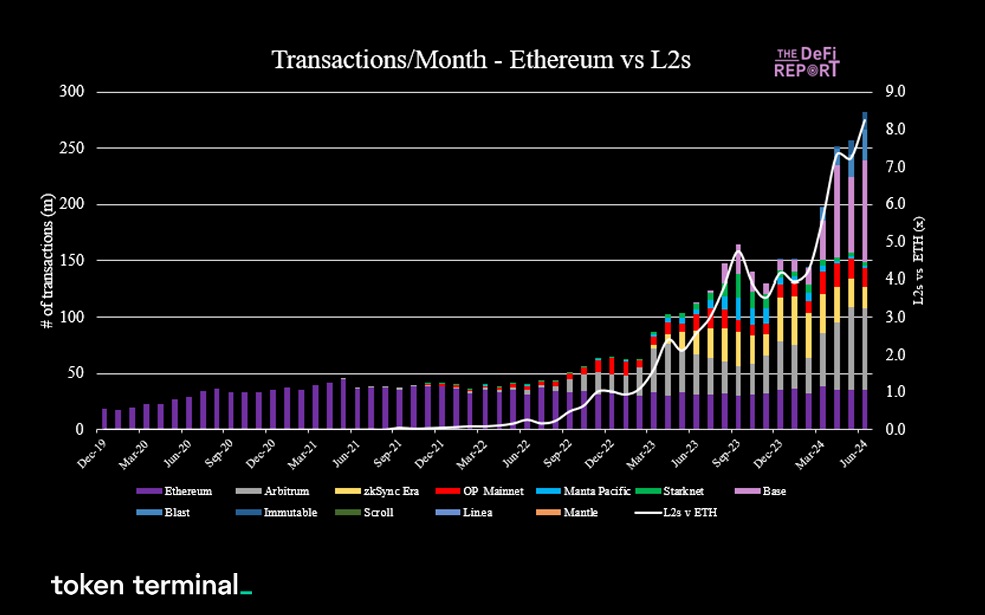

Transactions: ETH vs L2s

L2s are now nearly 9x that of ETH L1 (up from 4x last qtr).

Data: @tokenterminal

L2s are now nearly 9x that of ETH L1 (up from 4x last qtr).

Data: @tokenterminal

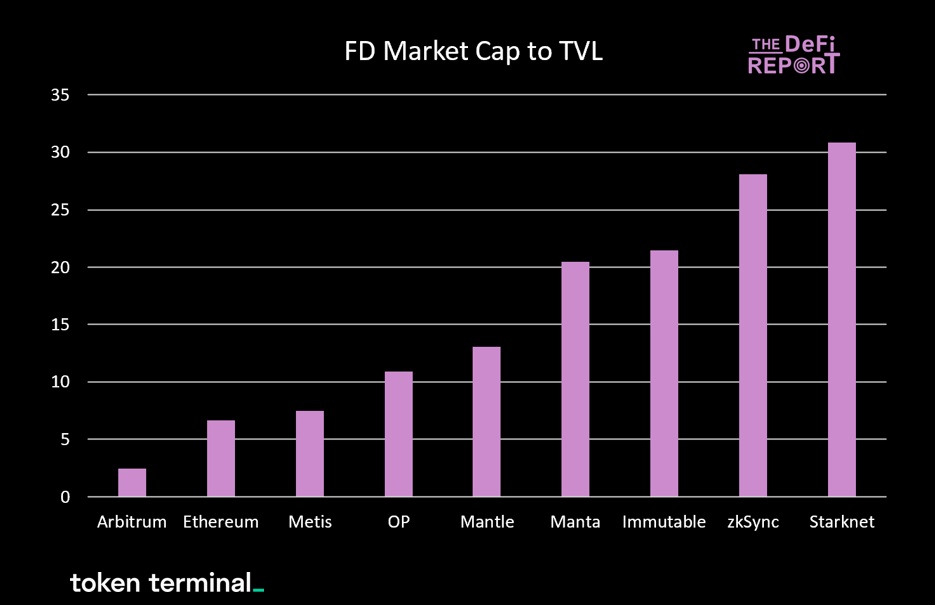

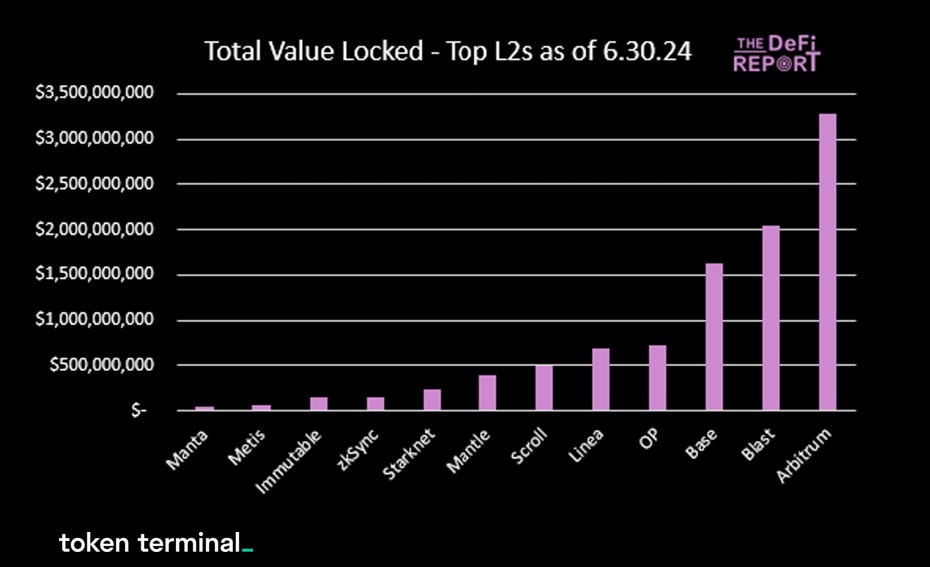

Total Value Locked:

@arbitrum leading the pack once again with over $3.3b as of 6/30. Notable to see @blast in the #2 spot ahead of @base

Data: @tokenterminal

@arbitrum leading the pack once again with over $3.3b as of 6/30. Notable to see @blast in the #2 spot ahead of @base

Data: @tokenterminal

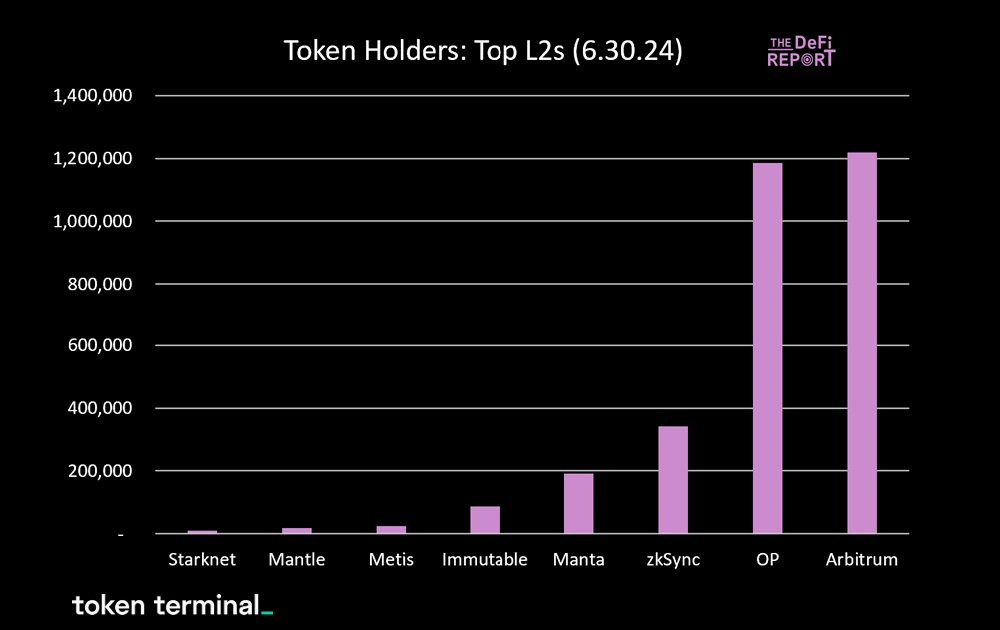

Token holders:

@arbitrum and @Optimism leading the pack with approximately 1.2m holders.

For reference, ETH L1 had over 123m as of 6/30.

Data: @tokenterminal

@arbitrum and @Optimism leading the pack with approximately 1.2m holders.

For reference, ETH L1 had over 123m as of 6/30.

Data: @tokenterminal

Want more?

If you'd like to access all 77 charts covering ETH's Q2 performance, including:

- Operating performance

- Token economics

- Stablecoins

- RWAs

- DeFi

- Onchain P&L

- Valuation

- Correlations

- ETH vs SOL

access here:

thedefireport.io/ethereum-inves…

If you'd like to access all 77 charts covering ETH's Q2 performance, including:

- Operating performance

- Token economics

- Stablecoins

- RWAs

- DeFi

- Onchain P&L

- Valuation

- Correlations

- ETH vs SOL

access here:

thedefireport.io/ethereum-inves…

https://x.com/JustDeauIt/status/1813634431804211426

• • •

Missing some Tweet in this thread? You can try to

force a refresh