One factor index has beaten almost all indices.

It has trumped top-performing indices like the Midcap 150 and Nifty 200 Momentum 30.

We are talking about the Nifty200 Alpha 30 Index.

.@MiraeAsset_IN MF has a new fund in this space.

Let’s look at its details. Retweet🧵to educate more investors.

It has trumped top-performing indices like the Midcap 150 and Nifty 200 Momentum 30.

We are talking about the Nifty200 Alpha 30 Index.

.@MiraeAsset_IN MF has a new fund in this space.

Let’s look at its details. Retweet🧵to educate more investors.

Background

Mirae Asset MF launched a Nifty 200 Alpha 30 ETF eight months back.

After its success, the AMC is now offering a ‘fund of fund (FoF)’ that will invest in the ETF.

So, you won’t need a trading account to invest in the Nifty 200 Alpha 30 fund.

Let’s now analyse the scheme 👇

Mirae Asset MF launched a Nifty 200 Alpha 30 ETF eight months back.

After its success, the AMC is now offering a ‘fund of fund (FoF)’ that will invest in the ETF.

So, you won’t need a trading account to invest in the Nifty 200 Alpha 30 fund.

Let’s now analyse the scheme 👇

As this is a passive fund, we will focus on the Nifty 200 Alpha 30 index.

In this analysis, we will cover two key aspects of the index:

1. Construct

2. Performance

Let’s start.

In this analysis, we will cover two key aspects of the index:

1. Construct

2. Performance

Let’s start.

1. CONSTRUCT

The Nifty 200 Alpha 30 index consists of 30 stocks picked from the top 200 companies.

The allocation of each stock depends on its alpha score.

Nonetheless, the maximum allocation a stock can have is 5%.

The index is re-balanced every quarter.

The Nifty 200 Alpha 30 index consists of 30 stocks picked from the top 200 companies.

The allocation of each stock depends on its alpha score.

Nonetheless, the maximum allocation a stock can have is 5%.

The index is re-balanced every quarter.

The Alpha index is a variation of momentum.

Momentum investing involves selecting stocks based on their 3-, 6-, or 12-month price movements.

The Alpha index looks at stocks based on a 1-year price history.

That’s why we said it’s a variation of the Momentum strategy.

Momentum investing involves selecting stocks based on their 3-, 6-, or 12-month price movements.

The Alpha index looks at stocks based on a 1-year price history.

That’s why we said it’s a variation of the Momentum strategy.

There’s one difference in the stock selection process of the Alpha and Momentum indices.

Momentum-based indices select stocks based on the free-float market cap.

There’s no such criterion when constructing Alpha indices.

This difference can impact returns.

Momentum-based indices select stocks based on the free-float market cap.

There’s no such criterion when constructing Alpha indices.

This difference can impact returns.

The momentum index will always have bigger companies as the free-float market cap is one of the selection criteria.

That’s because bigger companies have a higher free float.

But that’s not the case for most alpha-based indices.

Here’s how this difference impacts returns. 👇

That’s because bigger companies have a higher free float.

But that’s not the case for most alpha-based indices.

Here’s how this difference impacts returns. 👇

Momentum indices would fall less when markets correct due to their large caps bias.

Indices based on Alpha will have a higher allocation to large-caps or mid-caps, depending on which is performing better in the prevailing market.

So they can deliver higher returns.

Indices based on Alpha will have a higher allocation to large-caps or mid-caps, depending on which is performing better in the prevailing market.

So they can deliver higher returns.

2. PERFORMANCE

The Nifty 200 Alpha 30 index’s universe includes allocations to large-cap and mid-cap stocks, so we compared it with active Large & Mid Cap equity funds.

Back-tested data shows the Alpha index would have outperformed all active funds.

The Nifty 200 Alpha 30 index’s universe includes allocations to large-cap and mid-cap stocks, so we compared it with active Large & Mid Cap equity funds.

Back-tested data shows the Alpha index would have outperformed all active funds.

We also checked the SIP returns of Nifty 200 Alpha 30 vs other indices.

Here, too, the Alpha index has impressive returns.

Here, too, the Alpha index has impressive returns.

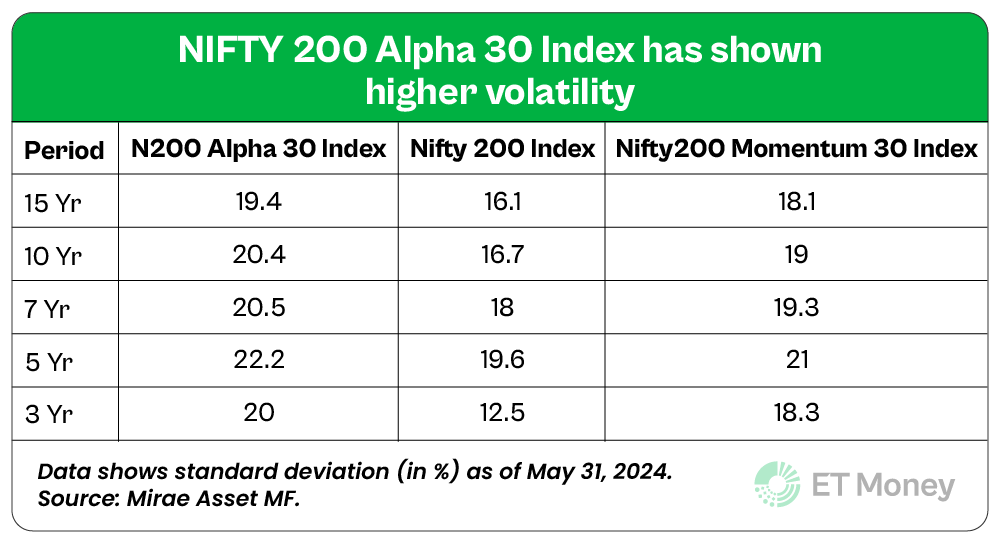

Higher Volatility

The impressive performance comes with higher volatility. (See image)

One reason is the dynamic nature of the index, as discussed above.

This is something worth noting.

Another reason for the volatility is the stock selection criteria.

The impressive performance comes with higher volatility. (See image)

One reason is the dynamic nature of the index, as discussed above.

This is something worth noting.

Another reason for the volatility is the stock selection criteria.

In Momentum indices, one parameter for stock selection is volatility.

Stocks with higher volatility are not included.

However, the filter is not used in Alpha indices.

This difference usually makes single-factor Alpha indices more volatile.

Stocks with higher volatility are not included.

However, the filter is not used in Alpha indices.

This difference usually makes single-factor Alpha indices more volatile.

Wrap Up

Overall, the performance does look promising.

But remember, it does come with higher volatility.

The NFO is open till Jul 22, 2024.

Like any other NFO, you can invest in this on ET Money.

Overall, the performance does look promising.

But remember, it does come with higher volatility.

The NFO is open till Jul 22, 2024.

Like any other NFO, you can invest in this on ET Money.

If you found this useful, show some love❤️

Please like, share, and retweet the first tweet.

Please like, share, and retweet the first tweet.

https://x.com/ETMONEY/status/1813930119783936340

• • •

Missing some Tweet in this thread? You can try to

force a refresh