1/?

🚨SECURE Act FINAL Regs are here!🚨

I honestly can't remember a time when advisors, tax pros and "mom and pop" investors more eagerly awaited news from the IRS.

But more than 4 1/2 years after SECURE was passed, we now have some definitive answers to key Qs.

A thread...

🚨SECURE Act FINAL Regs are here!🚨

I honestly can't remember a time when advisors, tax pros and "mom and pop" investors more eagerly awaited news from the IRS.

But more than 4 1/2 years after SECURE was passed, we now have some definitive answers to key Qs.

A thread...

2/x

As usual, I'll be live tweeting my thoughts/commentary in this thread as I go through the Regs.

So tweets will ebb and flow.

You'll know when I'm "done," I promise! Until then, if there's a break in the tweeting, I'm reading, taking care of my day job, or parenting😜

As usual, I'll be live tweeting my thoughts/commentary in this thread as I go through the Regs.

So tweets will ebb and flow.

You'll know when I'm "done," I promise! Until then, if there's a break in the tweeting, I'm reading, taking care of my day job, or parenting😜

3/

Some basics.

Final Regs come in at 260 pages. As far as Regs go, pretty beefy.

That said, at only 260 pages, there are almost certainly going to be a lot of things NOT covered by the Regs that IRS will need to address in the future.

Link to Regs: public-inspection.federalregister.gov/2024-14542.pdf

Some basics.

Final Regs come in at 260 pages. As far as Regs go, pretty beefy.

That said, at only 260 pages, there are almost certainly going to be a lot of things NOT covered by the Regs that IRS will need to address in the future.

Link to Regs: public-inspection.federalregister.gov/2024-14542.pdf

4/

And right as I say that, I see that in addition to the 260 pgs of FINAL Regs, there are an additional 36 pgs of new, PROPOSED Regs, which will help us to answer some of those "other" things I noted in the previous tweet.

Link to Proposed Regs: public-inspection.federalregister.gov/2024-14543.pdf

And right as I say that, I see that in addition to the 260 pgs of FINAL Regs, there are an additional 36 pgs of new, PROPOSED Regs, which will help us to answer some of those "other" things I noted in the previous tweet.

Link to Proposed Regs: public-inspection.federalregister.gov/2024-14543.pdf

5/

OK, let's address the #1 question advisors have asked for 2+ years now...

"Are ANNUAL distributions required DURING the 10-Year Rule?"

⭐⭐⭐Answer: YES, IF death occurred on or after the RBD ⭐⭐⭐

[Sorry, I don't make the rules, I just report them!!!]

OK, let's address the #1 question advisors have asked for 2+ years now...

"Are ANNUAL distributions required DURING the 10-Year Rule?"

⭐⭐⭐Answer: YES, IF death occurred on or after the RBD ⭐⭐⭐

[Sorry, I don't make the rules, I just report them!!!]

6/

Reminder: Thanks to Notices 2022-53, 2023-54, and 2024-35, this rule won't actually begin to apply until next year (2025).

So, to be clear, no RMDs during the 10-Year Rule from 2021 - 2024.

Reminder: Thanks to Notices 2022-53, 2023-54, and 2024-35, this rule won't actually begin to apply until next year (2025).

So, to be clear, no RMDs during the 10-Year Rule from 2021 - 2024.

7/

Of course, just b/c someone doesn't have to take an RMD this year doesn't mean they shouldn't.

Shame on those who prioritize a lower tax bill this year at the expense of a much higher lifetime tax bill (if, say, future distributions are so big they drive up the rate).

Of course, just b/c someone doesn't have to take an RMD this year doesn't mean they shouldn't.

Shame on those who prioritize a lower tax bill this year at the expense of a much higher lifetime tax bill (if, say, future distributions are so big they drive up the rate).

8/

Some more on the technical aspects of the implementation of the 10-Year Rule:

1️⃣ Owner death before RBD = "JUST" empty within 10 years

2️⃣ Owner death on/after RBD - "Stretch" style RMDs years 1-9 after death AND empty everything left in the acct in year 10

Some more on the technical aspects of the implementation of the 10-Year Rule:

1️⃣ Owner death before RBD = "JUST" empty within 10 years

2️⃣ Owner death on/after RBD - "Stretch" style RMDs years 1-9 after death AND empty everything left in the acct in year 10

9/

While Final Regs won't apply until 2025 (no RMDs during 10-Year Rule 2021-2024), prior years WILL still count as part of the 10-Year period.

Ex: 10-Year Rule Bene inherited in 2021 from 78-year-old ➡

🔸No RMDs 2022-2024

🔸Annual RMDs 2025-2030

🔸Must empty acct in 2031

While Final Regs won't apply until 2025 (no RMDs during 10-Year Rule 2021-2024), prior years WILL still count as part of the 10-Year period.

Ex: 10-Year Rule Bene inherited in 2021 from 78-year-old ➡

🔸No RMDs 2022-2024

🔸Annual RMDs 2025-2030

🔸Must empty acct in 2031

10/

Why this madness?

The SECURE Act ADDED the 10-Year Rule to the Tax Code, but it didn't remove the "at least as rapidly" rule found in 401(a)(9)(B)(i) which applies to deaths after distributions have (RMDs) begun.

Congress almost certainly didn't intend this... but they also didn't "fix" it when they passed SECURE 2.0.

They easily could have done so. But they didn't. Which in effect was a tacit endorsement of this new whacky regime we have.

Why this madness?

The SECURE Act ADDED the 10-Year Rule to the Tax Code, but it didn't remove the "at least as rapidly" rule found in 401(a)(9)(B)(i) which applies to deaths after distributions have (RMDs) begun.

Congress almost certainly didn't intend this... but they also didn't "fix" it when they passed SECURE 2.0.

They easily could have done so. But they didn't. Which in effect was a tacit endorsement of this new whacky regime we have.

13/

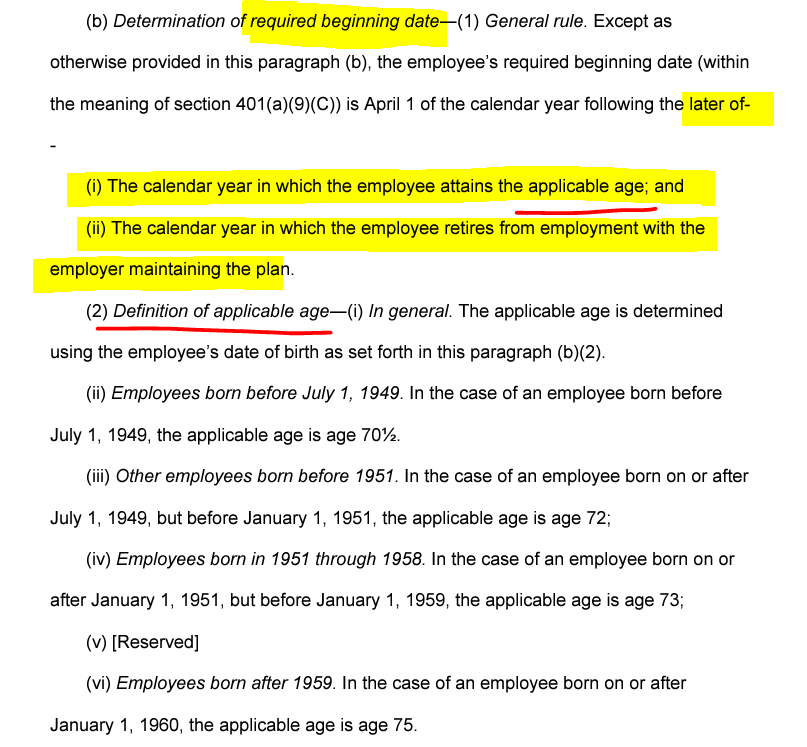

OK, onto other things... Remember how RMDs used to start at 70 1/2?

And then 72?

And now at 73 for some but 75 for others?

That makes writing regs complicated. So, now, regs refer to the starting time as the "Applicable Age" and we get this mess to define that term⬇

OK, onto other things... Remember how RMDs used to start at 70 1/2?

And then 72?

And now at 73 for some but 75 for others?

That makes writing regs complicated. So, now, regs refer to the starting time as the "Applicable Age" and we get this mess to define that term⬇

14/

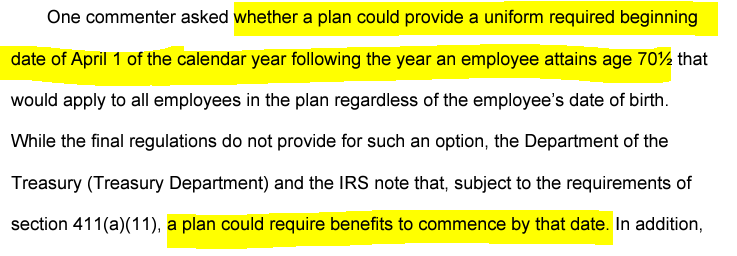

🤔

Question to IRS: "Can a plan just treat 70 1/2 as the RMD start for all participants?"

IRS response essentially: "Regs don't address it directly, but sure. Why not?!"

Curious to see if its widely adopted. Would be a BIG nudge toward an IRA for those who don't want RMD.

🤔

Question to IRS: "Can a plan just treat 70 1/2 as the RMD start for all participants?"

IRS response essentially: "Regs don't address it directly, but sure. Why not?!"

Curious to see if its widely adopted. Would be a BIG nudge toward an IRA for those who don't want RMD.

15/

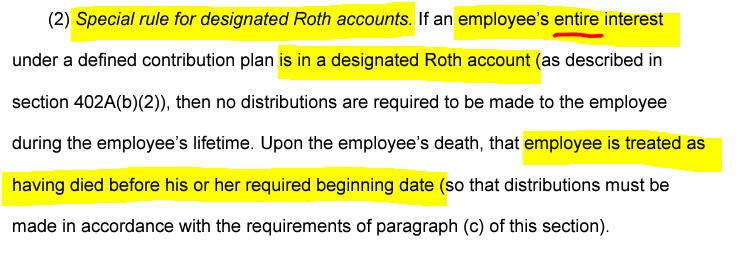

Interesting...

If a person's ENTIRE PLAN balance is Roth, they are treated as always dying before RBD (makes sense).

But...

If $1 is in traditional side, it "taints" entire plan?

Meaning death is after RBD and annual RMDs are needed during 10-Year Rule? Even for Roth🤢

Interesting...

If a person's ENTIRE PLAN balance is Roth, they are treated as always dying before RBD (makes sense).

But...

If $1 is in traditional side, it "taints" entire plan?

Meaning death is after RBD and annual RMDs are needed during 10-Year Rule? Even for Roth🤢

16/

Well, someone somewhere has a pretty twisted sense of humor.

Power has been out for hours now😵💫

I’ve read legislation, regs, etc on vacation, on planes, and on zero hours sleep.

But this is the first time I’ve done so by candlelight🕯️😲

More from me still to come…

Well, someone somewhere has a pretty twisted sense of humor.

Power has been out for hours now😵💫

I’ve read legislation, regs, etc on vacation, on planes, and on zero hours sleep.

But this is the first time I’ve done so by candlelight🕯️😲

More from me still to come…

17/

Also interesting…

With respect to Eligible Designated Benes, the Proposed Regs said plans could:

1) Require them to use the Stretch method

2) Require them to use the 10-Year Rule

3) Allow them to pick between the two methods

The Final Regs take this a step further…

Also interesting…

With respect to Eligible Designated Benes, the Proposed Regs said plans could:

1) Require them to use the Stretch method

2) Require them to use the 10-Year Rule

3) Allow them to pick between the two methods

The Final Regs take this a step further…

18/

Final Regs say plans can have diff rules for diff SUB-CATEGORIES of Eligible Designated Benes.

For instance, one rule for surviving spouses, and another for persons not more than 10 years younger than the decedent.

Makes knowing YOUR plan’s rules even more important.

Final Regs say plans can have diff rules for diff SUB-CATEGORIES of Eligible Designated Benes.

For instance, one rule for surviving spouses, and another for persons not more than 10 years younger than the decedent.

Makes knowing YOUR plan’s rules even more important.

19/

Important item here…

If your client inherited a retirement account in 2020, 2021, 2022, or 2023, and they’re an Eligible Designated Bene b/c they are disabled or chronically ill, then…

They MUST provide relevant documentation to plan/IRA custodian by October 31, 2025.

Important item here…

If your client inherited a retirement account in 2020, 2021, 2022, or 2023, and they’re an Eligible Designated Bene b/c they are disabled or chronically ill, then…

They MUST provide relevant documentation to plan/IRA custodian by October 31, 2025.

20/

Strike that…

Interestingly, that’s apparently ONLY going to apply to plans.

No similar documentation required for IRA benes.

So, your IRA custodian doesn’t need to be apprised of this info, but your former employer needs to be all up in your beneficiary’s business for them to be treated as an eligible designated beneficiary by virtue of disability or chronic illness🥴

Weird choice, IRS🤷♂️

Strike that…

Interestingly, that’s apparently ONLY going to apply to plans.

No similar documentation required for IRA benes.

So, your IRA custodian doesn’t need to be apprised of this info, but your former employer needs to be all up in your beneficiary’s business for them to be treated as an eligible designated beneficiary by virtue of disability or chronic illness🥴

Weird choice, IRS🤷♂️

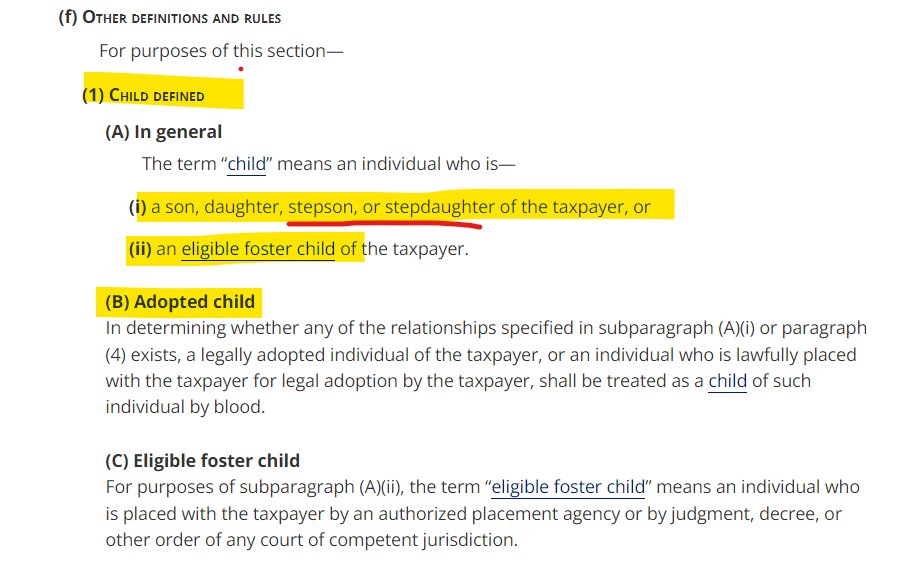

21/

Okay, this is a nice.

In terms of "Which children are minor children OF THE DECEDENT?" for purposes of being an Eligible Designated Bene, they're going with the IRC 152(f)(1) definition.

Notably, that includes step-children, even if they're not adopted.

Okay, this is a nice.

In terms of "Which children are minor children OF THE DECEDENT?" for purposes of being an Eligible Designated Bene, they're going with the IRC 152(f)(1) definition.

Notably, that includes step-children, even if they're not adopted.

22/

Not surprisingly, lots of people asked for a lot of changes to the trust regs.

IRS chose not to adopt most of them. Also not a surprise ;-)

Not surprisingly, lots of people asked for a lot of changes to the trust regs.

IRS chose not to adopt most of them. Also not a surprise ;-)

23/

Now THIS is fascinating.

Historically, to be considered a "See-through trust", documentation needed to be provided to either the plan administrator or the IRA custodian.

If I'm reading this correctly, this documentation requirement no longer applies to IRAs!👀

Now THIS is fascinating.

Historically, to be considered a "See-through trust", documentation needed to be provided to either the plan administrator or the IRA custodian.

If I'm reading this correctly, this documentation requirement no longer applies to IRAs!👀

24/

If that's the case - and I'm pretty sure it is - that would be another MAJOR reason to roll from a plan to an IRA.

One less requirement after death. One less way to mess up better tax treatment.

If that's the case - and I'm pretty sure it is - that would be another MAJOR reason to roll from a plan to an IRA.

One less requirement after death. One less way to mess up better tax treatment.

25/

In a way, this is odd. B/c recently, Congress has been working hard to put plans and IRAs on a more level playing field (e.g., Roth 401(k)s no longer have RMDs, just like Roth IRAs).

But these Regs have, so far, in several places, created more lines of separation🤷♂️

In a way, this is odd. B/c recently, Congress has been working hard to put plans and IRAs on a more level playing field (e.g., Roth 401(k)s no longer have RMDs, just like Roth IRAs).

But these Regs have, so far, in several places, created more lines of separation🤷♂️

26/

IRS held onto this position:

If Eligible Designated Bene dies after beginning to Stretch, the successor bene is subject to annual RMDs AND the 10-Year Rule... even if the original owner died before their RBD.

My take: RMDs are like Pringles. Once you pop you can't stop.

IRS held onto this position:

If Eligible Designated Bene dies after beginning to Stretch, the successor bene is subject to annual RMDs AND the 10-Year Rule... even if the original owner died before their RBD.

My take: RMDs are like Pringles. Once you pop you can't stop.

27/

Finally found one of the items I was looking for.

Final Regs say a decedent's year of death RMD can be taken by any beneficiary/ies in any amount(s) they desire (as long as they get the total out between them).

No longer needs to be taken proportionally.

Taxpayer win.

Finally found one of the items I was looking for.

Final Regs say a decedent's year of death RMD can be taken by any beneficiary/ies in any amount(s) they desire (as long as they get the total out between them).

No longer needs to be taken proportionally.

Taxpayer win.

28/

Oooo. This is a HUGE change by the IRS. A departure from previous positions and another MAJOR win for taxpayers.

The separate account rule can now apply to trusts. There are some conditions, but they seem easy to satisfy.

Really can't overstate how significant this is...

Oooo. This is a HUGE change by the IRS. A departure from previous positions and another MAJOR win for taxpayers.

The separate account rule can now apply to trusts. There are some conditions, but they seem easy to satisfy.

Really can't overstate how significant this is...

29/

Ex: Trust beneficiary. 50% of trust to spouse, 25% to healthy adult child, 25% to charity.

SINGLE trust can be named on the bene form and as long as it splits into sub-trusts right away, each bene uses own post-death rules (e.g., spouse stretchs, child gets 10 years).

Ex: Trust beneficiary. 50% of trust to spouse, 25% to healthy adult child, 25% to charity.

SINGLE trust can be named on the bene form and as long as it splits into sub-trusts right away, each bene uses own post-death rules (e.g., spouse stretchs, child gets 10 years).

30/

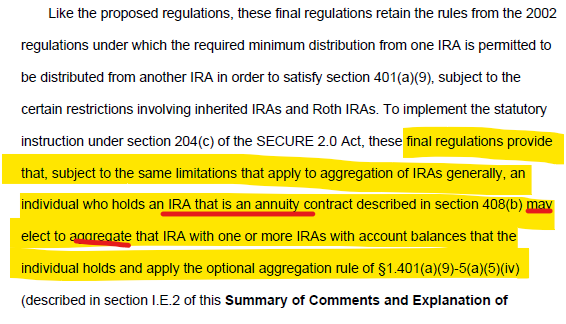

Sweet!

SECURE 2.0 expanded RMD aggregation rules to allow annuity distributions from a partially annuitized plan to offset RMDs for rest of plan.

I was confident IRS would apply this to IRAs, but got a LOT of pushback. Now it's clear it does, which means a certain someone who shall remain nameless owes me a dinner😜

Sweet!

SECURE 2.0 expanded RMD aggregation rules to allow annuity distributions from a partially annuitized plan to offset RMDs for rest of plan.

I was confident IRS would apply this to IRAs, but got a LOT of pushback. Now it's clear it does, which means a certain someone who shall remain nameless owes me a dinner😜

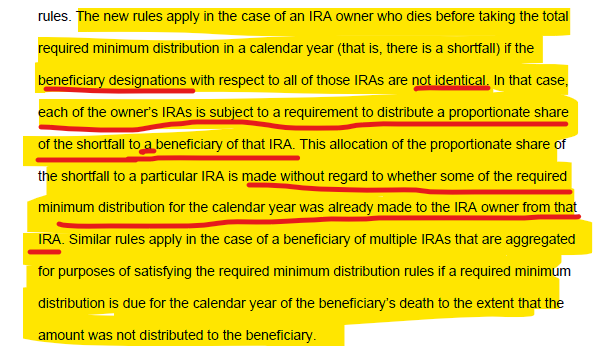

31/

This one makes my brain hurt. Frankly, I'm not even sure it's legal under some state privacy laws.

So, the amount that might HAVE to come out of one inherited IRA could be differ depending upon whether the owner had other IRAs and who the benes of those IRAs are?

This one makes my brain hurt. Frankly, I'm not even sure it's legal under some state privacy laws.

So, the amount that might HAVE to come out of one inherited IRA could be differ depending upon whether the owner had other IRAs and who the benes of those IRAs are?

32/

Whether the person who left a bene IRA money had other IRAs, and whether the benes of those IRAs are the same sure sounds like info that shouldn't be available to the bene!

Yeah, the more I think about it, the more I think IRS will need to set this one ablaze.

Daenerys?

Whether the person who left a bene IRA money had other IRAs, and whether the benes of those IRAs are the same sure sounds like info that shouldn't be available to the bene!

Yeah, the more I think about it, the more I think IRS will need to set this one ablaze.

Daenerys?

33/

Final Regs say that all minor children reach age of majority when they reach age 21.

This is good policy.

We no longer have to consider what state the child lives in, whether the child is still in school, etc.

Final Regs say that all minor children reach age of majority when they reach age 21.

This is good policy.

We no longer have to consider what state the child lives in, whether the child is still in school, etc.

34/

OK, I think those are the biggest things most advisors will want to know about the Final Regs.

Now onto a shorter set of new PROPOSED Regs that were released at the same time.

Link to Proposed Regs: public-inspection.federalregister.gov/2024-14543.pdf

OK, I think those are the biggest things most advisors will want to know about the Final Regs.

Now onto a shorter set of new PROPOSED Regs that were released at the same time.

Link to Proposed Regs: public-inspection.federalregister.gov/2024-14543.pdf

35/

SECURE 2.0 eliminated RMDs for plan Roth accts, so there's a bunch of stuff related to that.

For instance, distributions from plan Roth acct would not count toward plan RMD...

Makes sense, since the balances in those accts aren't included for RMDs in the first place👍

SECURE 2.0 eliminated RMDs for plan Roth accts, so there's a bunch of stuff related to that.

For instance, distributions from plan Roth acct would not count toward plan RMD...

Makes sense, since the balances in those accts aren't included for RMDs in the first place👍

36/

SECURE 2.0 created a new option for surviving spouse benes, beginning in 2024.

Big Q was whether any spouse bene could make the election, or "only" if they inherit in 2024 or later.

Prop Regs say it can be made by ANY spouse whose bene RMDs begin this year or later. NICE!

SECURE 2.0 created a new option for surviving spouse benes, beginning in 2024.

Big Q was whether any spouse bene could make the election, or "only" if they inherit in 2024 or later.

Prop Regs say it can be made by ANY spouse whose bene RMDs begin this year or later. NICE!

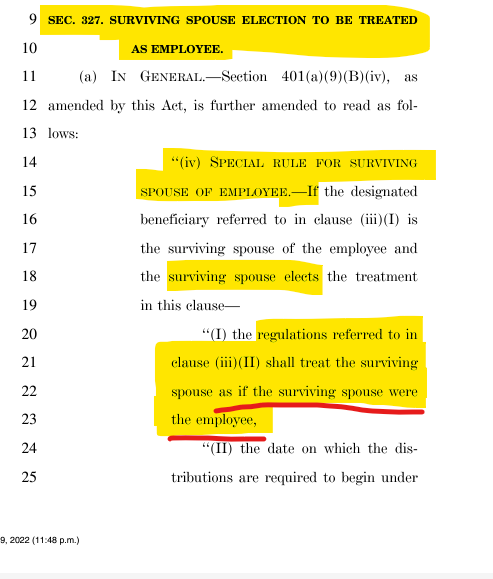

37/

Hrm... Seems that IRS and I have different interpretations of the statute regarding this election.

Relevant section of SECURE 2.0 below.

I read "as if the surviving spouse were the employee" very literally. Like "use the employee's (owner's) age to calculate the RMD"...

Hrm... Seems that IRS and I have different interpretations of the statute regarding this election.

Relevant section of SECURE 2.0 below.

I read "as if the surviving spouse were the employee" very literally. Like "use the employee's (owner's) age to calculate the RMD"...

38/

IRS seems to read it less literally. Almost like it says "as if the spouse were AN employee" rather than "THE employee".

Bottom line, the Prop Regs say if the election is made and an RMD is required, use the spouse bene's age, but with the UNIFORM table (used for owners).

IRS seems to read it less literally. Almost like it says "as if the spouse were AN employee" rather than "THE employee".

Bottom line, the Prop Regs say if the election is made and an RMD is required, use the spouse bene's age, but with the UNIFORM table (used for owners).

39/

OK, I think that's all the big stuff advisors need to know.

Sorry for the delay and lack of GIFs. That power outage really threw a wrench into things!

Please share this thread w/ others who may find it helpful and...

OK, I think that's all the big stuff advisors need to know.

Sorry for the delay and lack of GIFs. That power outage really threw a wrench into things!

Please share this thread w/ others who may find it helpful and...

https://x.com/CPAPlanner/status/1814002724343841046

• • •

Missing some Tweet in this thread? You can try to

force a refresh