This is a deep dive on @GM General Motors' 2Q financials released 2 hours ago.

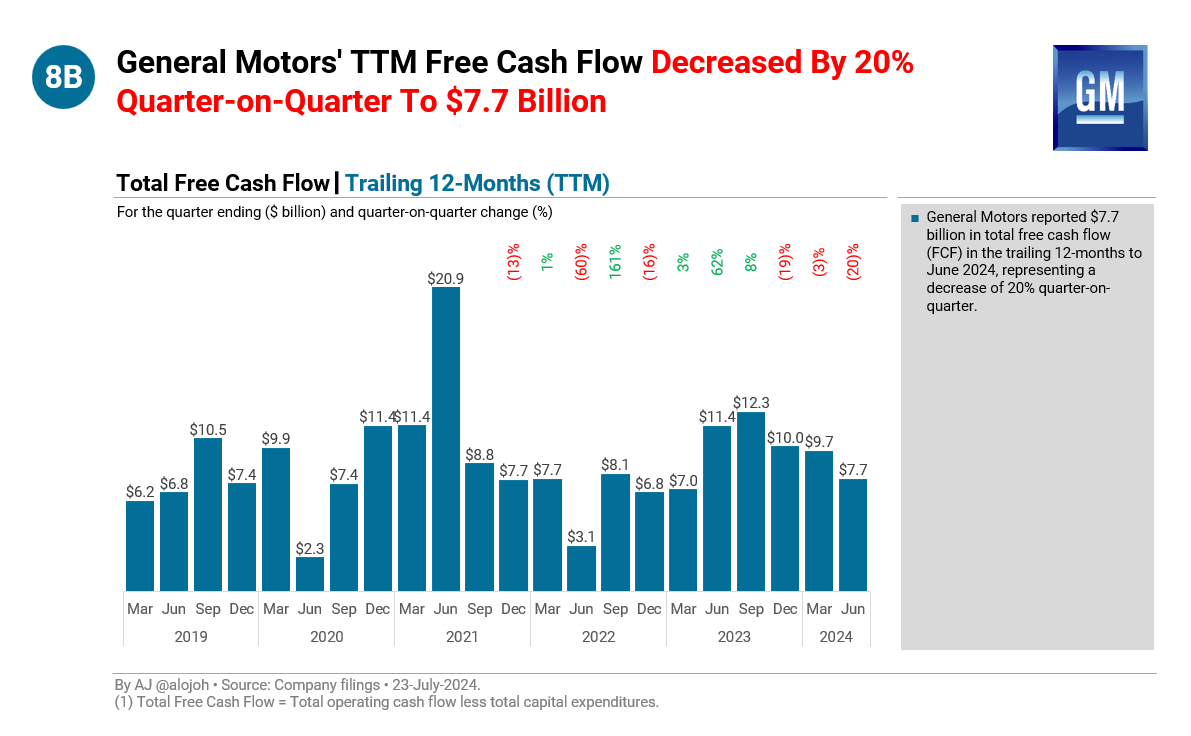

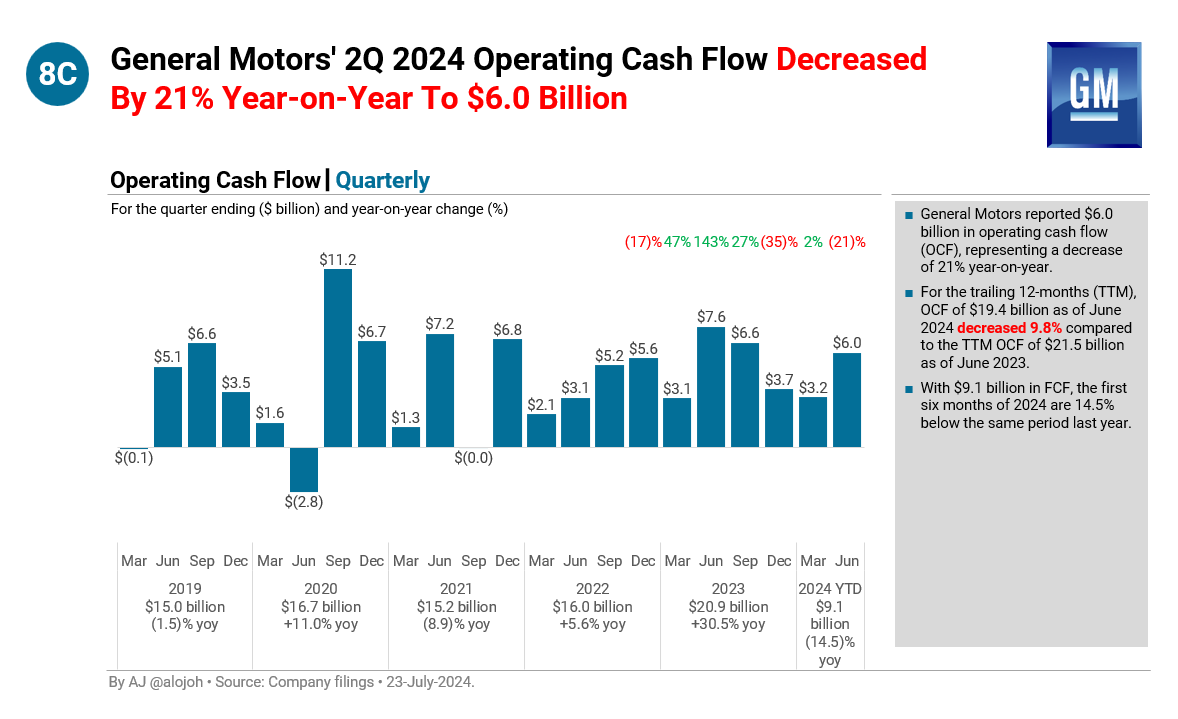

Key takeaway: the numbers and trend looks good until you look at cash flow.

I'll provide a more indepth analysis once the 10-Q filings is out.

GM is up +2.5% pre-market (market is flat).

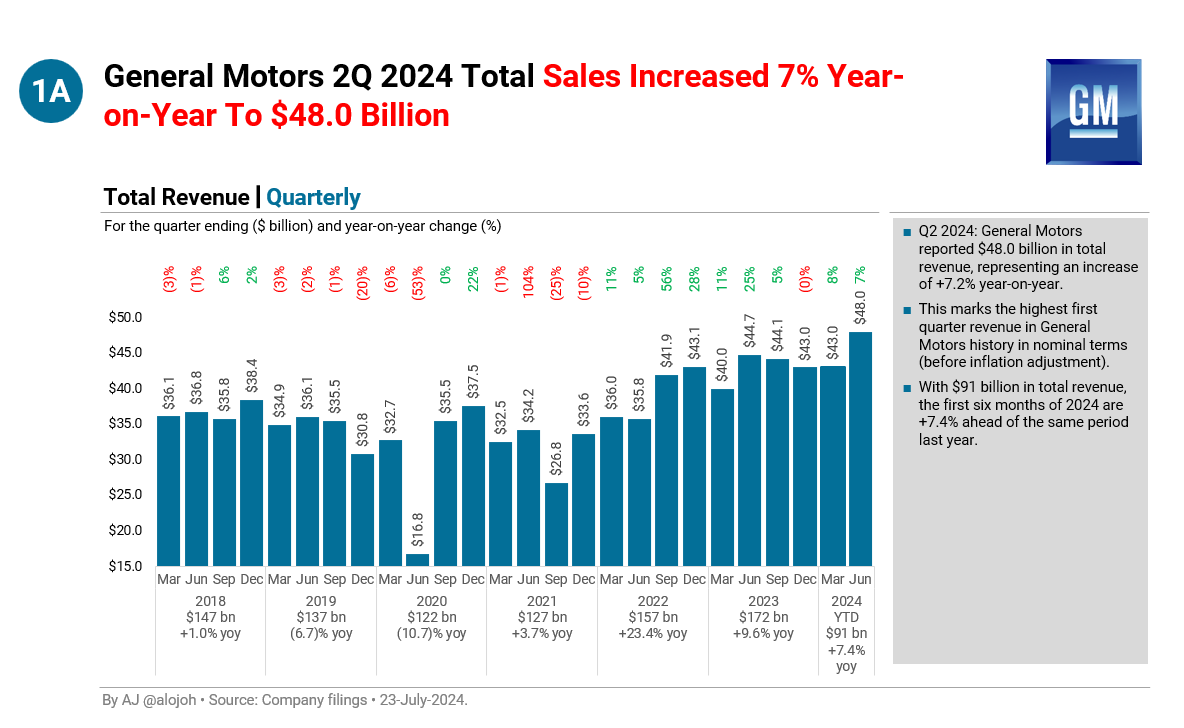

1A. General Motors 2Q 2024 Total Sales Increased 7% Year-on-Year To $48.0 Billion.

Key takeaway: the numbers and trend looks good until you look at cash flow.

I'll provide a more indepth analysis once the 10-Q filings is out.

GM is up +2.5% pre-market (market is flat).

1A. General Motors 2Q 2024 Total Sales Increased 7% Year-on-Year To $48.0 Billion.

1B. General Motors Lost All Growth Delivered In The 15 Years Post 2009 Bankruptcy. Current Revenu Level Remains Near The Level 15 Year Ago Adjusted For Inflation.

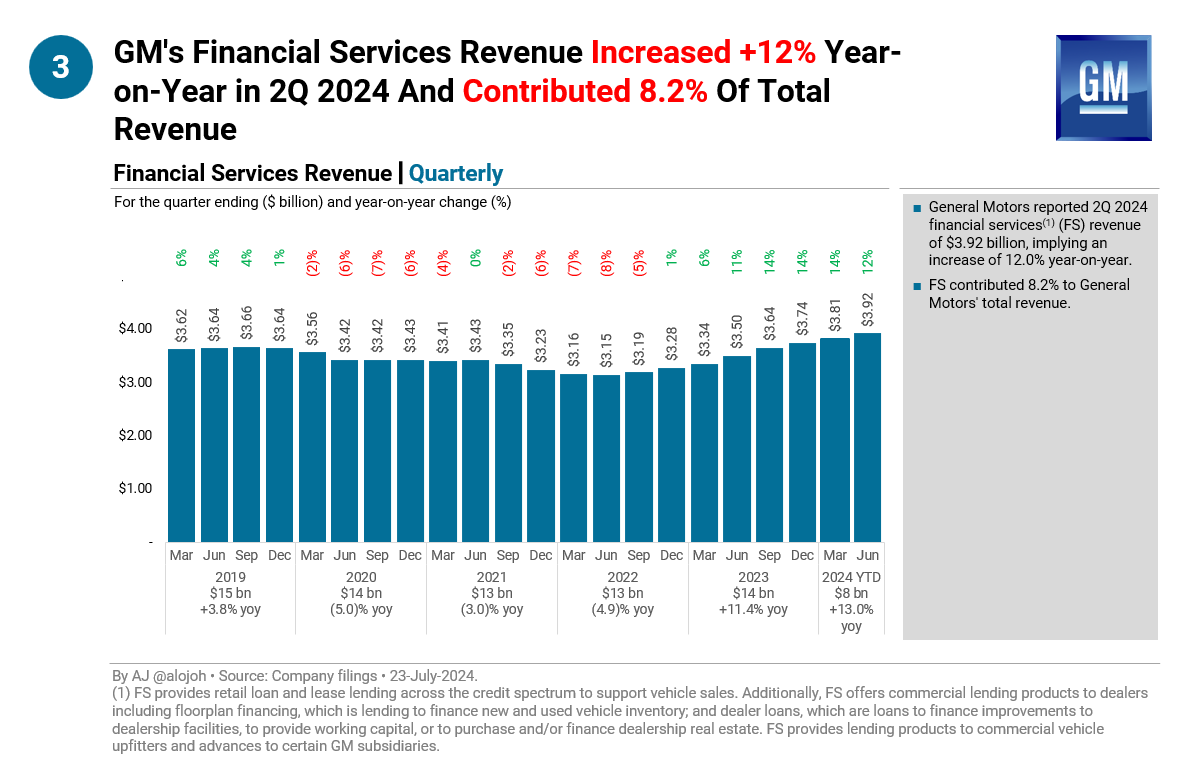

3. GM's Financial Services Revenue Increased +12% Year-on-Year in 2Q 2024 And Contributed 8.2% Of Total Revenue.

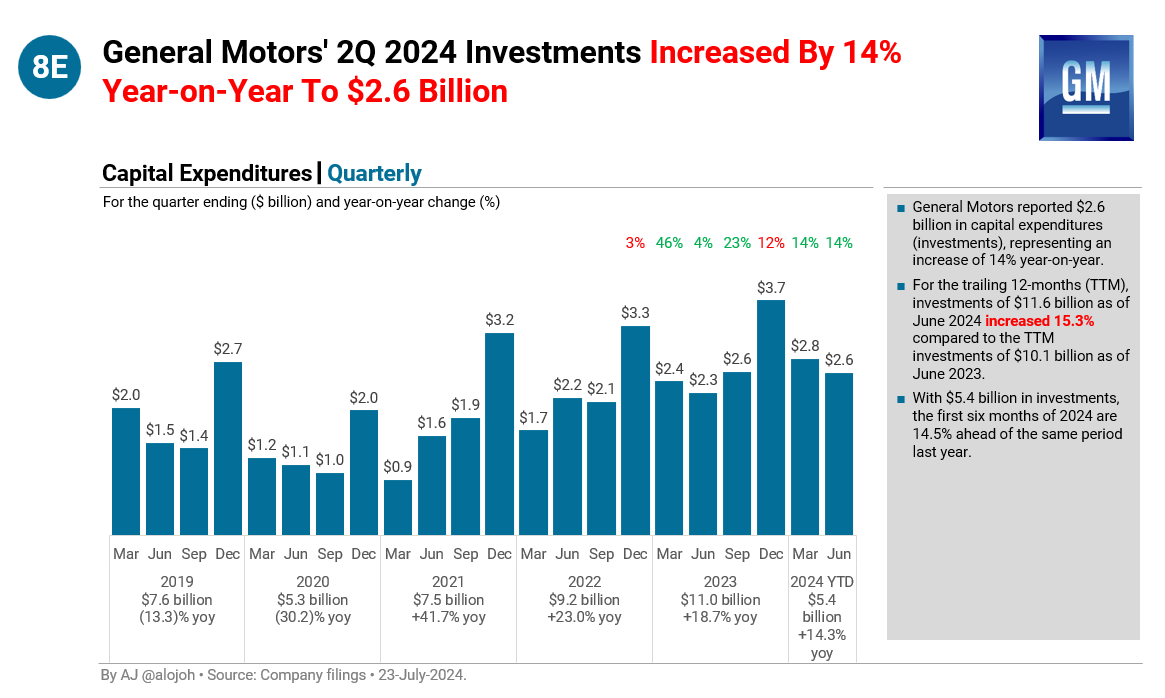

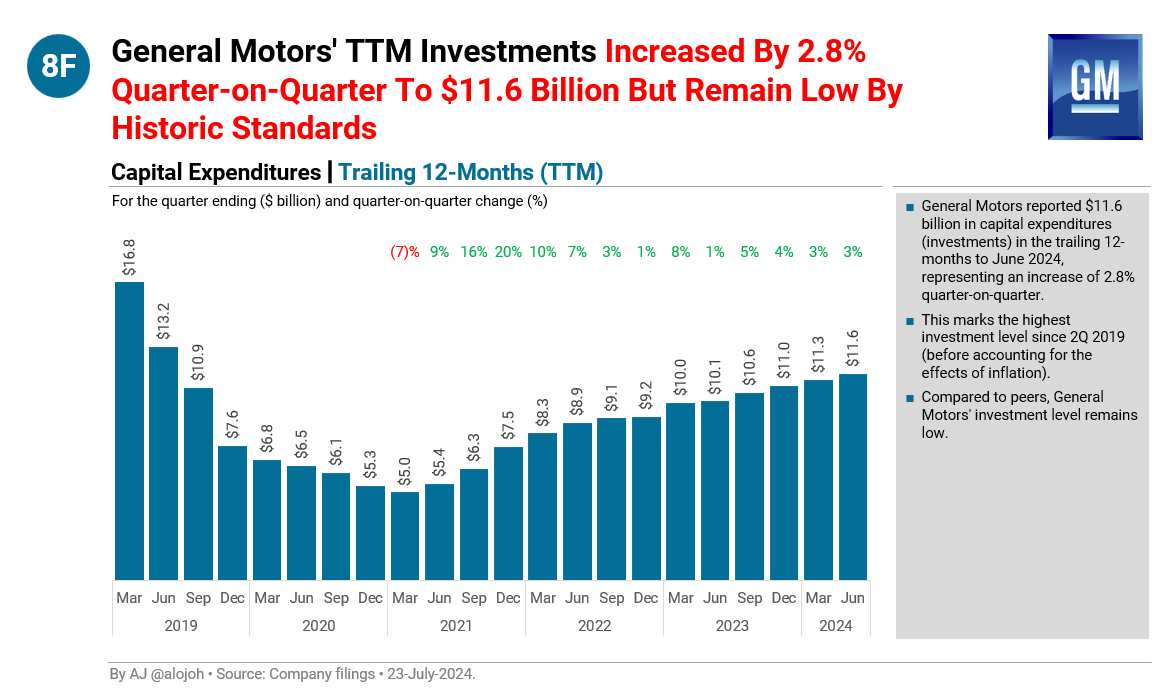

8F. General Motors' TTM Investments Increased By 2.8% Quarter-on-Quarter To $11.6 Billion But Remain Low By Historic Standards.

• • •

Missing some Tweet in this thread? You can try to

force a refresh