🚨🚨 New from me, joint with @Nouriel 🚨🚨

ATI: Activist Treasury Issuance and the Tug-of-War over Monetary Policy

How Treasury's issuance policies have stimulated markets and the economy and blocked the Fed's efforts to restrain growth and inflation

/1 tinyurl.com/ykmpps49

ATI: Activist Treasury Issuance and the Tug-of-War over Monetary Policy

How Treasury's issuance policies have stimulated markets and the economy and blocked the Fed's efforts to restrain growth and inflation

/1 tinyurl.com/ykmpps49

Summary: changes to Treasury's issuance policies have provided similar economic stimulus as a 1% cut in the Fed Funds rate, usurping core functions of monetary policy and blocking the Fed's efforts to restrain inflation and growth.

/2

/2

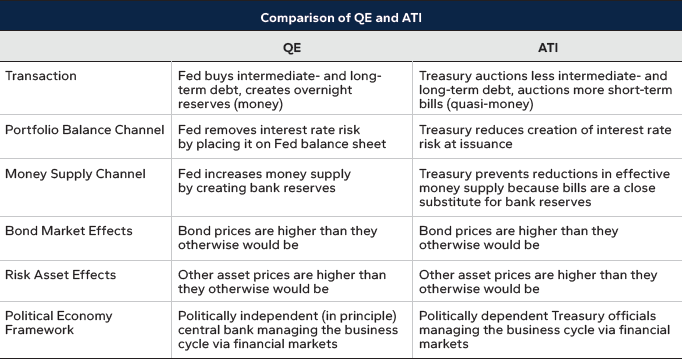

One criticism of QE was that it eroded the barrier between monetary and fiscal policy. It turns out that if the Fed can cross this barrier, Treasury can as well. Activist Treasury Issuance (ATI) works through similar channels as Fed QE.

/3

/3

We expect that ATI, when it is unwound, will have a temporary contractionary effect on the economy equivalent to 2% of hikes in the Funds rate, before settling into a permanent 1.2% hike's worth of restriction.

/4

/4

If ATI is not quickly unwound, we are likely to transition into a world of more emphatic political business cycles, where core monetary management of the business cycle is performed by political operatives at Treasury.

/5

/5

Let’s get into the mechanics:

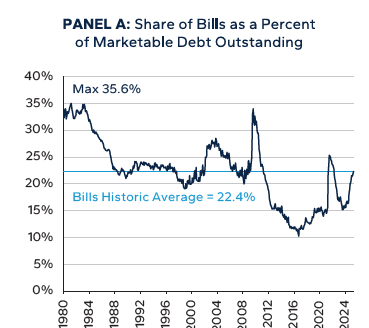

Treasury has an established rule of issuing 15% to 20% of debt in short-term bills rather than interest-rate-risk bearing intermediate/long-term debt (“coupons”).

They're violating this rule materially of late, issuing more bills and fewer coupons.

Treasury has an established rule of issuing 15% to 20% of debt in short-term bills rather than interest-rate-risk bearing intermediate/long-term debt (“coupons”).

They're violating this rule materially of late, issuing more bills and fewer coupons.

The critical economic channel for both QE and ATI is that bills bear similar credit, duration, regulatory and return characteristics as money and therefore are close substitutes for money. Coupons, by contrast, have significant risk and return differences from money.

/7

/7

Changes in the relative shares of money (i.e., bank reserves) and bills don't have strong economic consequences. By contrast, changes between money/bills vs. coupons will have strong consequences, as the public must absorb interest rate risk and changes in money supply.

/8

/8

Both QE and ATI function by manipulating the public’s holdings of money/nonmoney and assets that are duration riskbearing/nonriskbearing.

/9

/9

QE functions by hiding bonds and interest rate risk away on the Fed’s balance sheet, and ATI functions by limiting the creation of bonds and interest rate risk at the source, instead skewing Treasury issuance toward moneylike short-term bills

/10

/10

Treasury has a rule for issuing 15% to 20% of debt in short-term bills, and the balance in interest-rate-risk bearing intermediate- and long-term debt (called coupons). The rule moves very infrequently over the long-term based on market structure and regulations.

/11

/11

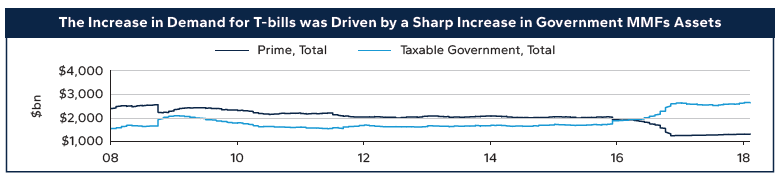

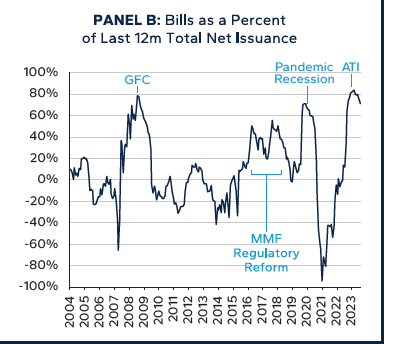

For instance, Treasury increased the bills share in 2016 to accommodate a surge in bill demand as regulatory reform drove money market fund assets from prime (commercial paper) money funds to government-only money funds.

/12

/12

Violations of the stated rule occur during market/economic crises, when a sudden and temporary spike in financing needs is accommodated by bills issuance. For instance, in a war or economic crisis, you raise money in the easiest, fastest and most liquid form possible.

/13

/13

We consider violations outside of such a crisis "activist" in the same way monetary policy deviations from a rule are considered activist. And over the last year, amid an inflationary economic boom and soaring markets, Treasury has been violating its rules in size.

/14

/14

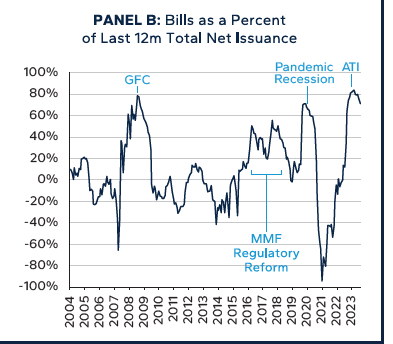

You can see the scope of recent bills issuance here. The overreliance on bills issuance matches experiences in the GFC and Covid. (The period 2014-16 saw a raised bills issuance target accommodate regulatory-driven money market fund demand for bills and was not "activist".)

/15

/15

In this case, ATI is the Treasury's alteration of its issuance profile to reduce the auctions of intermediate- and long-term securities, in favor of bills. We calculate this "stealth QE" as being over $800 billion in size over the last year.

/16

/16

To make this number useful, we employ a range of estimates from the monetary policy, asset pricing and fiscal policy literatures. We calculate this reduced term premia by 14 to 40 basis points, with a central guess at 25 basis points.

/17

/17

Mapping this to monetary policy, we calculate Activist Treasury Issuance produced an equivalent amount of economic accommodation as between 50 and 160 basis points of Fed Funds rate cuts, with a central guess at 100 bps.

/18

/18

Combined with higher estimates of the neutral rate from various studies and bond markets, we calculate the accommodation provided from ATI has brought combined issuance and monetary policy to just about neutral.

/19

/19

In other words, the Fed is not as restrictive as they think they are. ATI has blocked the Fed's attempts to restrain growth and inflation, offsetting all hikes in 2023 and helping to explain persistently strong nominal growth over the last two years.

/20

/20

Treasury has further taken the unprecedented step of providing forward guidance for its issuance outlook, promising that the suppression of coupon issuance will continue for “several quarters”—conveniently, to the other side of the election.

/21

/21

We expect that over coming quarters, the total amount of ATI will be in excess of $1 trillion. Such overreliance on bills comes with significant costs, as the inverted yield curve makes borrowing in bills much more expensive.

/22

/22

Moreover, bills issuance comes with heightened rollover risk. If some shock should push borrowing rates higher, Treasury is increasingly exposed to those higher rates. That's why Greenwood, Hanson and Stein (2015) argue that higher debt/GDP loads should come with reduced,

/23

/23

not increased reliance on bills issuance. Finally, moving away from regular and predictable issuance will, over time, result in higher term premia as the market has to price increased risk of variation in issuance patterns.

/24

/24

This analysis invites the critical question: what is to be done with all those bills? There is a chance ATI is never unwound, because Treasury officials find it useful to stimulate the economy throughout the political cycle.

/25

/25

In this case, we'll be pulled into a world of more volatile political business cycles of the type studied in Alesina, Roubini and Cohen (1997), as stimulus provided to the economy becomes synchronized with the political cycle.

/26

/26

This would be extremely dangerous for all the reasons economists think independent central banks will deliver superior outcomes to politically motivated central banks. We find it deeply troubling.

/27

/27

If Treasury is managing the business cycle through financial markets, it will lead over time to higher average inflation and term premium as households and firms come to expect more stimulus than the economy merits.

/28

/28

If ATI is used by one party to stimulate the economy, there's little reason to expect the other party to unilaterally disarm. That's why it's so important to end ATI quickly, before it becomes a permanent policy tool.

/29

/29

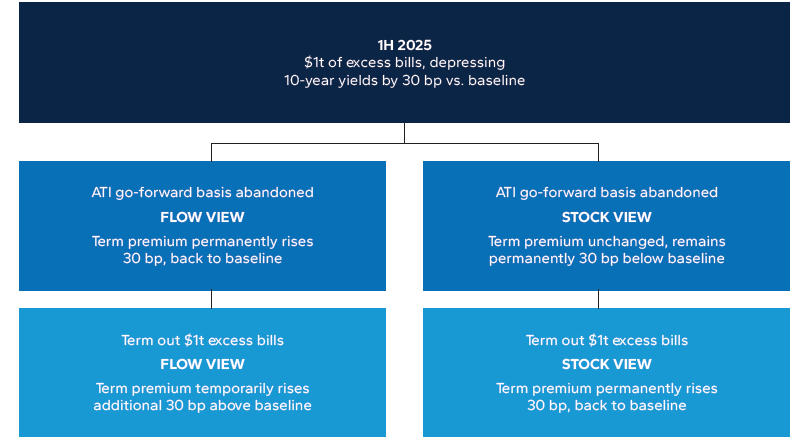

Therefore, we expect it to eventually be unwound. The terming out of an extra $1 trillion of bills will have significant market and economic effects. Those effects vary based on whether one adopts a "flow" or "stock" view, just as in studies of QE.

/30

/30

If the flow view is correct, we expect term premia to rise temporarily by 60 bp, before settling back into a permanent 30 bp rise. If the stock view is correct, we expect term premia to permanently rise 30 bp and then stay put.

/31

/31

Assigning 2/3 odds to the flow view being “correct” and 1/3 odds to the stock view, we expect term premia to temporarily rise by 50 bp, before settling back into a permanent rise of 30 bp.

/32

/32

For context, a 50 bp increase in term premia will have similar economic effects as a 2-point hike in the Fed Funds rate. This is enough to be material for risk assets, but hardly a financial crisis.

/33

/33

There are other avenues for ATI as well which give the Secretary the ability to exert profound influences on financial conditions, and through them, the economy. Treasury can also manipulate the size of its General Account, changing the total amount of issuance.

/34

/34

And the new buybacks program gives the Secretary the ability to "twist" the issuance profile, buying back old off-the-run coupons and replacing them, at least for a time, with bills. This is a significant degree of discretion.

/35

/35

We have focused on the issuance split, but there are other paths to ATI, with material consequences. ATI affects markets, the economy, inflation, and the Fed. There are significant political economy concerns around central bank independence and political business cycles.

/36

/36

To conclude: our calculations are the first attempt to rigorously study the consequences of Treasury's recent issuance policies. We view this study as a first attempt at staking out terrain, and invite additional research by academics, policymakers, and market participants.

/37

/37

We recognize the enormous deal of uncertainty in mapping monetary policy to economic outcomes, and the even greater uncertainty with fiscal policy. We expect this to be fertile ground for future work.

END

END

• • •

Missing some Tweet in this thread? You can try to

force a refresh