Member, Board of Governors of the Federal Reserve System // Personal account

9 subscribers

How to get URL link on X (Twitter) App

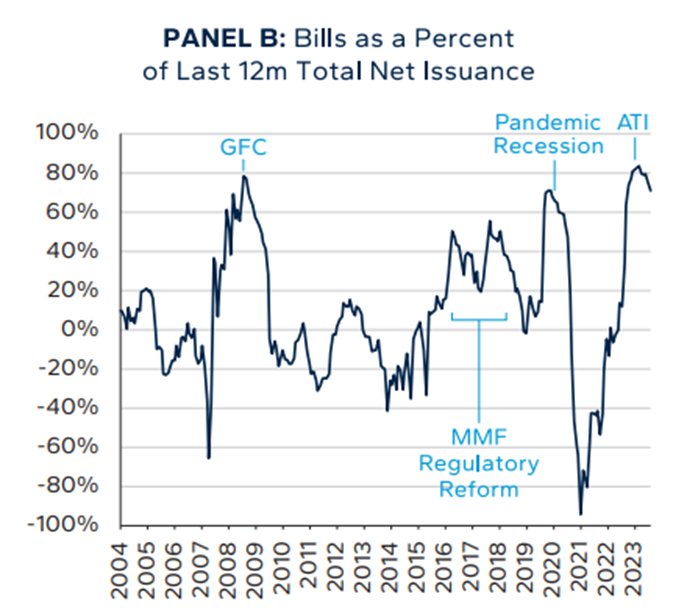

Summary: changes to Treasury's issuance policies have provided similar economic stimulus as a 1% cut in the Fed Funds rate, usurping core functions of monetary policy and blocking the Fed's efforts to restrain inflation and growth.

Summary: changes to Treasury's issuance policies have provided similar economic stimulus as a 1% cut in the Fed Funds rate, usurping core functions of monetary policy and blocking the Fed's efforts to restrain inflation and growth.

@mtkonczal has given a beautiful decomposition, but I have a somewhat different interpretation

@mtkonczal has given a beautiful decomposition, but I have a somewhat different interpretationhttps://twitter.com/mtkonczal/status/1746341779400532319

https://twitter.com/SteveMiran/status/1674209041386553346As I've written numerous times elsewhere, a doubling of the deficit from $1 to $2 trillion was unprecedented, and not yet obvious that it wouldn't mean revert. And Treasury's interference in monetary policy by adjusting the share of its bill issuance--

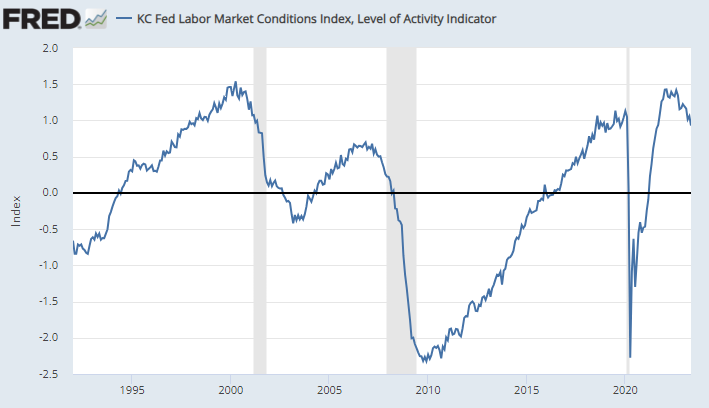

Unemployment is a useful indicator, but it's not the only one. In fact, there are hundreds of labor market series. A particularly helpful tool is the Fed's "Labor Market Conditions Index," which takes 24 important data series and reduces the dimensionality via PCA. (Summarizes)

Unemployment is a useful indicator, but it's not the only one. In fact, there are hundreds of labor market series. A particularly helpful tool is the Fed's "Labor Market Conditions Index," which takes 24 important data series and reduces the dimensionality via PCA. (Summarizes)

https://twitter.com/GautiEggertsson/status/1654646002018598913If so, it means bringing down inflation is relatively costless.

https://twitter.com/dampedspring/status/16526262975400386581. The Fed's shift from a "scarce reserves" to "abundant reserves" regime (in order to accommodate QE and the menagerie of bank regulations outlined recently by @concodanomics ) resulted in a large number of banks' persistent ability to offer near 0-yield for deposits

https://twitter.com/DannyDayan5/status/1646890288290451456TP isn't really observable, the models are models, and the thing doesn't really exist.