Introducing the Ethena reward-bearing asset proposals, with entities pitching for an allocation from Ethena's liquid cash backing

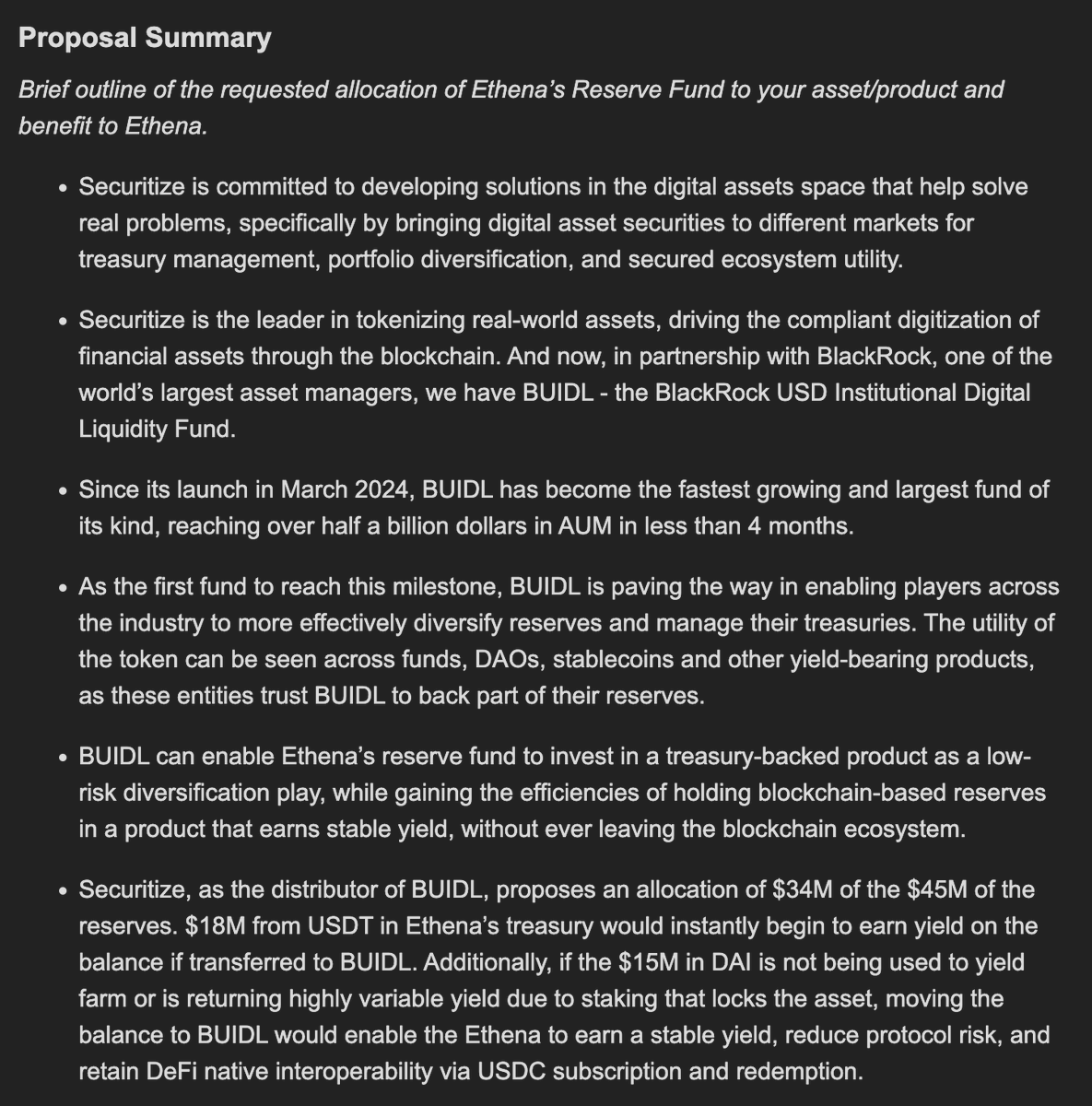

One of the early applications is from Securitize, the distributors of @BlackRock's BUIDL, for an allocation from Ethena's Reserve Fund

Details below

One of the early applications is from Securitize, the distributors of @BlackRock's BUIDL, for an allocation from Ethena's Reserve Fund

Details below

Issuers are invited to pitch Ethena for an allocation of their RWA, or reward bearing asset

As long as the asset is USD denominated, and accrues rewards, it may be eligible for an allocation from:

i) Ethena's $45m Reserve Fund

ii) USDe's liquid cash backing of ~$250m

As long as the asset is USD denominated, and accrues rewards, it may be eligible for an allocation from:

i) Ethena's $45m Reserve Fund

ii) USDe's liquid cash backing of ~$250m

Another early application comes from @SteakhouseFi , proposing an allocation to Steakhouse USDC

gov.ethenafoundation.com/t/reserve-fund…

gov.ethenafoundation.com/t/reserve-fund…

Entities can apply at where they will find a template to use for the application that aims to allow for a transparent approval processgov.ethenafoundation.com

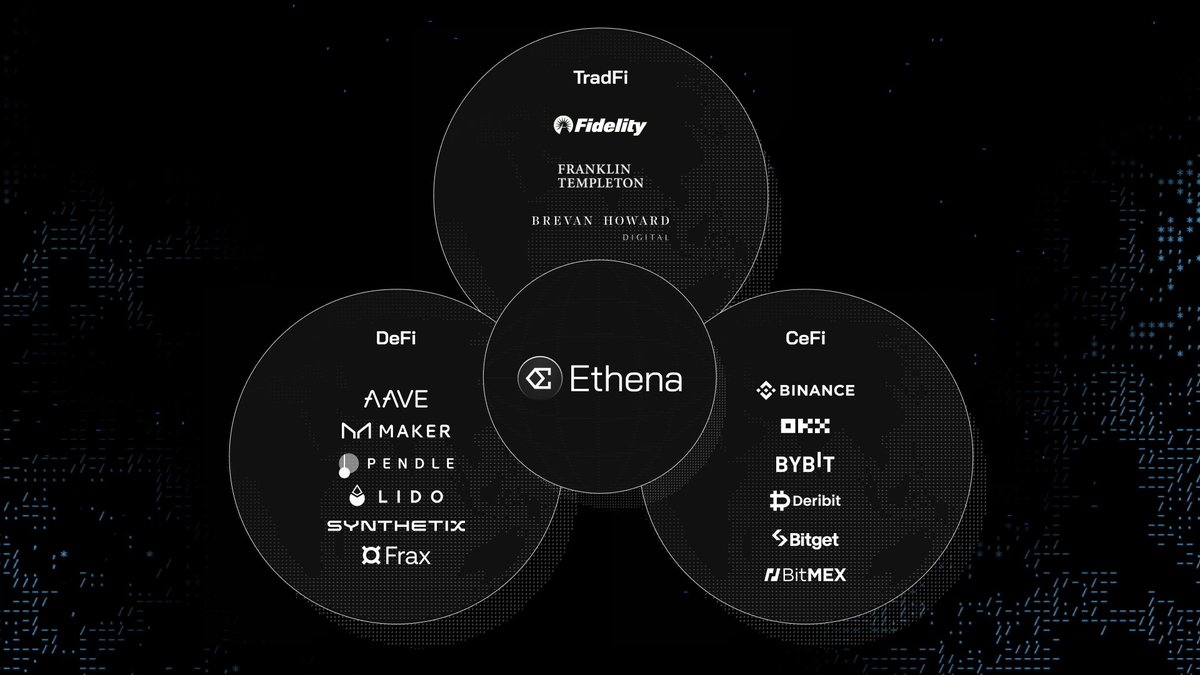

We're also happy to announce today marks the launch of ENA governance by committee

As of today, critical risk decisions related to the Ethena protocol will be made by a committee of industry-leading, professional risk advisory firms that will be governed by ENA token holders

As of today, critical risk decisions related to the Ethena protocol will be made by a committee of industry-leading, professional risk advisory firms that will be governed by ENA token holders

The Risk Committee's mandate is to generally identify, evaluate, and manage risk within the Ethena ecosystem.

We are happy to announce the members for the first 6 month term are:

@gauntlet_xyz

@SteakhouseFi

@BlockAnalitica

@blockworksres

@LlamaRisk

+ Ethena Labs Research

We are happy to announce the members for the first 6 month term are:

@gauntlet_xyz

@SteakhouseFi

@BlockAnalitica

@blockworksres

@LlamaRisk

+ Ethena Labs Research

The Risk Committee will provide input and oversight on topics such as:

• Diversification across hedging venues

• Types of backing assets to accept

• Vetting and approving new venues for delta hedging

• Approving new custody providers

• Reserve Fund sizing and allocation

• Diversification across hedging venues

• Types of backing assets to accept

• Vetting and approving new venues for delta hedging

• Approving new custody providers

• Reserve Fund sizing and allocation

Risk Committee members are required to recuse themselves from decisions that implicate conflicts of interest - for example, if a member makes a proposal incorporating a product or service offered by the member

The first role of the Risk Committee will be deciding on the reward-bearing asset allocation proposals for the reserve fund.

At the end of the initial term, all 6 Risk Committee member seats will be up for confirmation or replacement by ENA holders.

Following this initial vote, 3 of 6 members seats will be up for confirmation or replacement every 6 months as voted on by ENA holders

Following this initial vote, 3 of 6 members seats will be up for confirmation or replacement every 6 months as voted on by ENA holders

Ethena Labs Research will sit on the committee initially as a nonvoting member (though it may make proposals) and will receive no compensation

Its seat will be subject to confirmation or replacement at the conclusion of its term as any other member

Its seat will be subject to confirmation or replacement at the conclusion of its term as any other member

A member of a committee wishing to make a specific change is required to propose the particular changes or decisions in the governance forums located at gov.ethenafoundation.com

Following posting, a 7 day deliberation period begins, during which the members of the relevant Committee discuss the merits of the proposal

At the end of the period, a vote will be held amongst all voting members of the Committee

All changes require unanimous approval

At the end of the period, a vote will be held amongst all voting members of the Committee

All changes require unanimous approval

With this framework, ENA governance token holders are able to delegate everyday decision-making in key aspects of the ecosystem to sophisticated, expert-level stakeholders - most of whom provide advisory and similar services to other projects and protocols in the industry

For more information on ENA Governance, please refer to the introductory sections on our governance forum

gov.ethenafoundation.com

gov.ethenafoundation.com

• • •

Missing some Tweet in this thread? You can try to

force a refresh