Home builders now have 102,000 completed, unsold homes sitting on their builder lots.

This is the highest level since 2009.

Indicating a huge ramp up in supply that is likely to get worse in the second half of 2024 as buyer demand remains subdued.

Watch the builders. They are flashing lots of warnings right now about economy/housing market.

This is the highest level since 2009.

Indicating a huge ramp up in supply that is likely to get worse in the second half of 2024 as buyer demand remains subdued.

Watch the builders. They are flashing lots of warnings right now about economy/housing market.

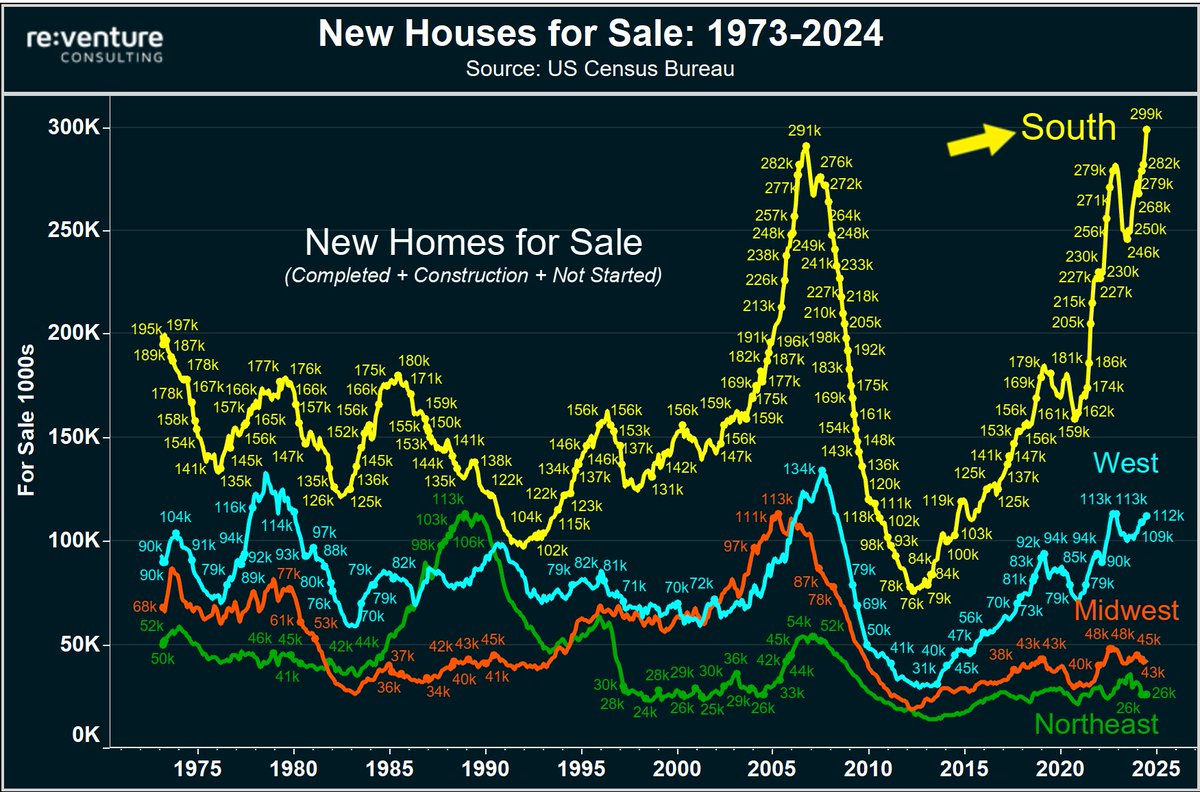

1) We know that this builder unsold supply will increase because the amount of homes they have UNDER CONSTRUCTION is still near the highest level in decades.

These under construction for sale homes are going to continue to convert to completed ones over the next 6-12 months.

These under construction for sale homes are going to continue to convert to completed ones over the next 6-12 months.

2) And these homes for sale are disproportionately located in the South.

South - 299,000

West - 112,000

Midwest - 43,000

Northeast - 26,000

Nearly 65% of the entire builder inventory is located in the South. Mostly in Florida/Texas/Tennessee/Georgia/South Carolina.

South - 299,000

West - 112,000

Midwest - 43,000

Northeast - 26,000

Nearly 65% of the entire builder inventory is located in the South. Mostly in Florida/Texas/Tennessee/Georgia/South Carolina.

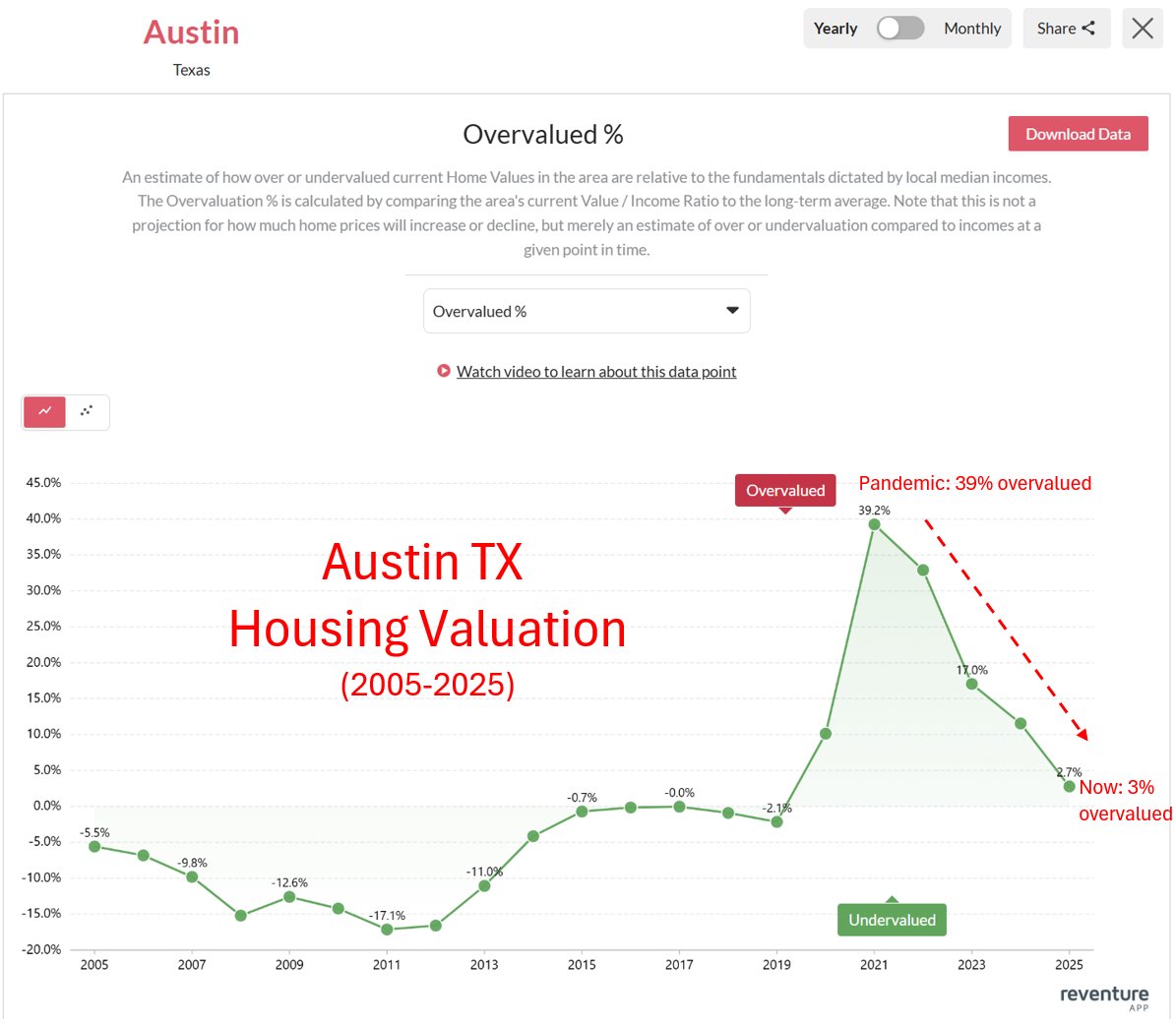

3) Southern housing markets are facing a big risk of home prices declines in the second half of 2024, and into 2025.

Particularly in Florida/Texas, where the bubble might already be popping.

Particularly in Florida/Texas, where the bubble might already be popping.

4) Check out the housing inventory in Florida right now. This is all active listings.

We spiked from a low of 47,000 in 2021, all the way up to 140,000 today.

That's the highest level going back to 2017.

Access the inventory data here: map.reventure.app/dashboard?geo=…

We spiked from a low of 47,000 in 2021, all the way up to 140,000 today.

That's the highest level going back to 2017.

Access the inventory data here: map.reventure.app/dashboard?geo=…

5) Check out Texas.

Housing inventory is up to over 108,000 in the lone star state.

That's the highest level since 2017. Indicating downward price pressure.

Access inventory data here: map.reventure.app/dashboard?geo=…

Housing inventory is up to over 108,000 in the lone star state.

That's the highest level since 2017. Indicating downward price pressure.

Access inventory data here: map.reventure.app/dashboard?geo=…

• • •

Missing some Tweet in this thread? You can try to

force a refresh