How could Rachel Reeves raise £22bn of tax, without breaking any of Labour's pre-election pledges?

Some thoughts/speculations:

Some thoughts/speculations:

The full article, with footnotes and links to sources is here taxpolicy.org.uk/2024/08/01/rac…

Rachel Reeves has said there is a £22bn "black hole" in the public finances, and that she'll have to raise tax to fill it. bbc.co.uk/news/articles/…

So let's park the piece I previously wrote about eight tax cuts that the new Chancellor could consider, and try to find £22bn thetimes.com/uk/politics/ar…

I won't go into the political and economic debate over whether these tax increases are necessary or desirable. Other people can cover that much better than me.

First question: how much room for manoeuvre does Rachel Reeves have?

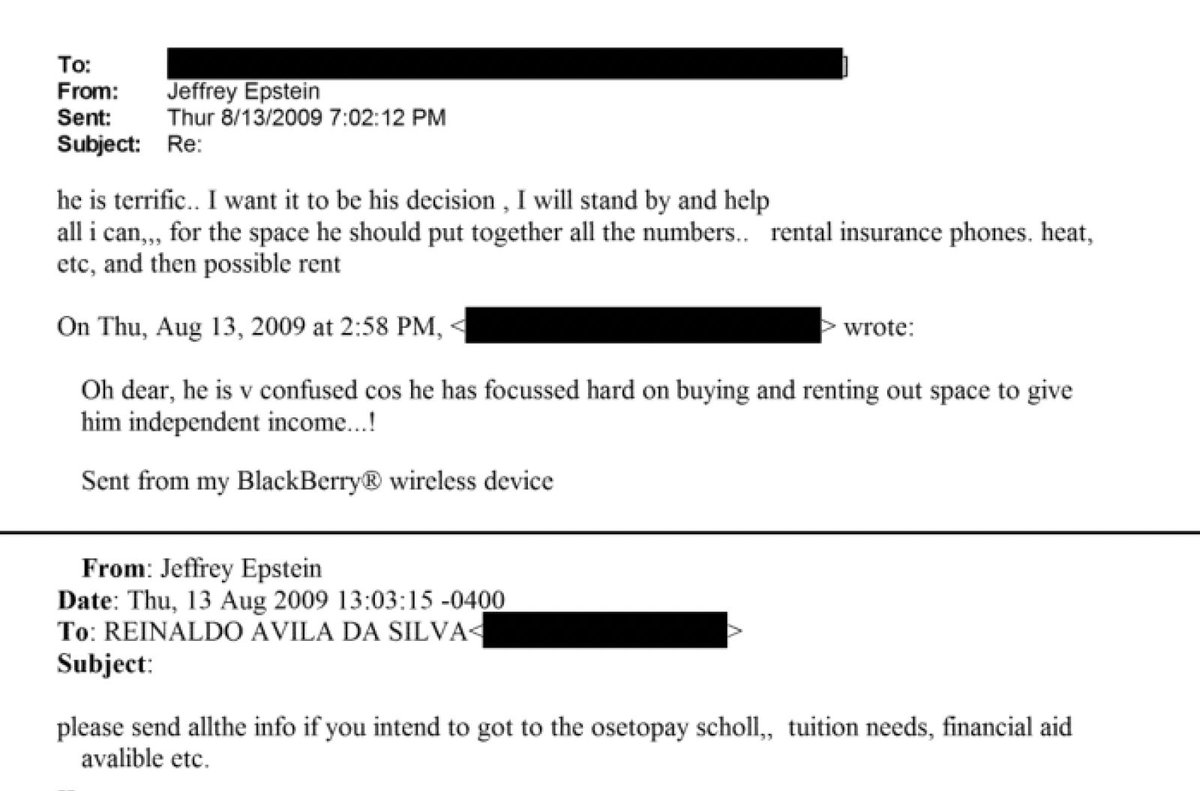

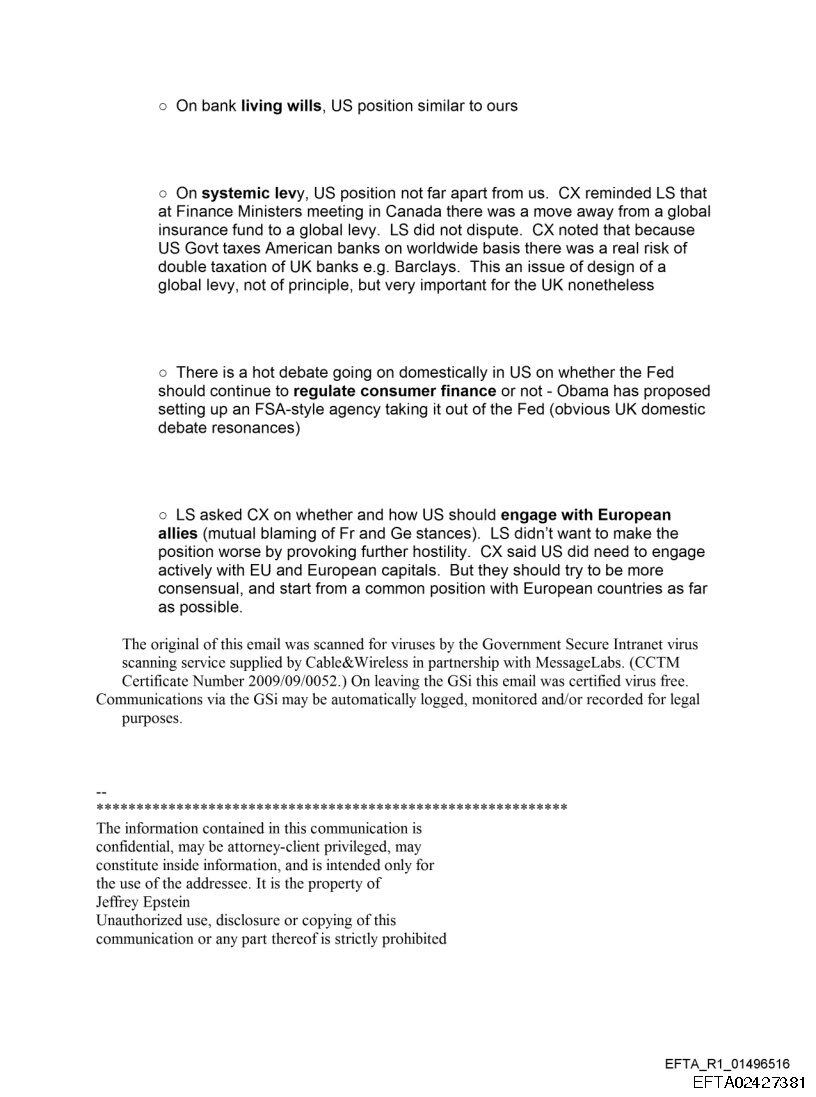

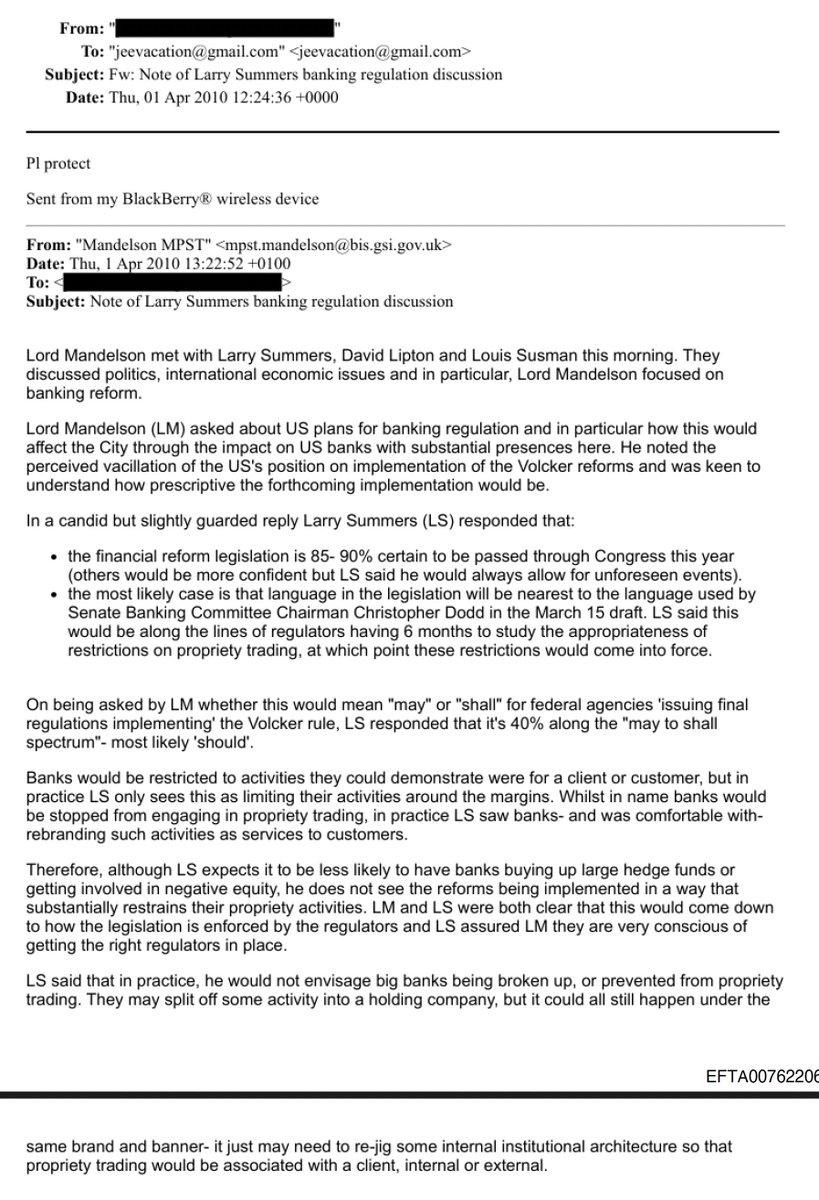

Here's how UK tax receipts looked in 2023/24 - about a trillion pounds in total:

Here's how UK tax receipts looked in 2023/24 - about a trillion pounds in total:

But now the long list of taxes that Labour has either ruled out increasing, already increased, or realistically won't be touched: income tax, national insurance, VAT, corporation tax, business rates, stamp taxes, bank taxes, customs duties, IPT, alcohol duty, oil/gas tax.

It's going to be hard to find £20bn there - particularly when it's dominated by council tax and fuel duties, which are politically challenging to increase.

One answer would be radical tax reform - for example replacing business rates, stamp duty land tax and council tax with a land value tax. Most people would pay broadly the same tax as before, but those owning valuable land would pay a lot more. taxpolicy.org.uk/2024/06/09/sta…

Sadly I don't think this is likely to happen - the poll tax casts a long shadow over anything that affects local government taxation, and some would say (not unreasonably) that the Government has no mandate for such radical change. bbc.co.uk/news/uk-383824…

Absent radical tax reform, it's a matter of scrabbling for relatively small tax increases here and there. Here are some ideas, in rough order of likeliness:

1. Pension tax relief - £3-15bn.

Contributions to a pension are fully tax-deductible. If you're a high earner, paying 45% tax, you get 45% tax relief on pension contributions. Some view this as unfair, and suggest limiting relief to 30%, or even 20%. thisismoney.co.uk/money/pensions…

Contributions to a pension are fully tax-deductible. If you're a high earner, paying 45% tax, you get 45% tax relief on pension contributions. Some view this as unfair, and suggest limiting relief to 30%, or even 20%. thisismoney.co.uk/money/pensions…

That could raise significant amounts - £3bn (if limited to 30%) or up to £15bn (if limited to 20%). ifs.org.uk/publications/b…

But withdrawals from a pension, after the tax free lump sum, are taxable at your marginal rate at the time. Offering a 20% or 30% tax deduction for pension contributions, but taxing withdrawals at 40%, isn't a great deal.

High earners may shift their investments to other products. There could be complex second and third order effects.

Nothing comes for free. But IMO this is streets ahead of all other tax raising candidates given the large amounts that can be raised & ease of implementation,

Nothing comes for free. But IMO this is streets ahead of all other tax raising candidates given the large amounts that can be raised & ease of implementation,

2. Limiting inheritance tax reliefs - £2bn.

It's daft that my estate would pay 40% inheritance tax on my share portfolio, but if I move it into AIM shares and live for two more years, there would be no inheritance tax at all.

It's daft that my estate would pay 40% inheritance tax on my share portfolio, but if I move it into AIM shares and live for two more years, there would be no inheritance tax at all.

Commercial providers sell portfolios designed solely to take advantage of this. octopusinvestments.com/our-products/b…

But it's not just AIM shares - if, like Rishi Sunak's wife, I hold shares in a foreign company that's listed on an exchange that isn't a "recognised stock exchange" then those shares would also be entirely exempt. gov.uk/guidance/recog…

It's similarly daft that a private business of any size is exempt from inheritance tax - protecting small businesses and farms makes sense, but why should the estate of the Duke of Westminster pay almost no tax? theguardian.com/money/2016/aug…

There's potential for £2bn or more here, for a measure that could fairly be presented as closing loopholes.

3. Pensions inheritance tax reform - £1bn

If you inherit the pension of someone who died before age 75, it's completely tax free.

But if they died aged 75 or over, the pension provider deducts PAYE, which generally means 45% tax.

gov.uk/tax-on-pension…

If you inherit the pension of someone who died before age 75, it's completely tax free.

But if they died aged 75 or over, the pension provider deducts PAYE, which generally means 45% tax.

gov.uk/tax-on-pension…

This is a very odd result.

Simply applying the usual 40% inheritance tax rules could raise about £1bn (and would be a small tax cut for the over-75s).

Simply applying the usual 40% inheritance tax rules could raise about £1bn (and would be a small tax cut for the over-75s).

4. Increase capital gains tax - £1-2bn.

The Lib Dems proposed equalising the rate with income tax, and said it would raise £5bn. At the time I said that, on the basis of HMRC figures, this would cost around £3bn in lost tax. taxpolicy.org.uk/2024/06/10/202…

The Lib Dems proposed equalising the rate with income tax, and said it would raise £5bn. At the time I said that, on the basis of HMRC figures, this would cost around £3bn in lost tax. taxpolicy.org.uk/2024/06/10/202…

There is potential to raise some tax from capital gains tax, but it would have to be a modest increase, probably raising no more than around £2bn.

A more significant increase would make the UK look like an outlier, and would realistically have to be accompanied by the return of relief for inflationary gains, which would wipe out much of the revenue.

More about the international comparisons here taxpolicy.org.uk/2024/02/28/oec…

And a key point - any CGT increase should be implemented immediately, at the moment it's announced, or people will "accelerate" disposals and take their gain while the old rate still applies.

5. Eliminate the stamp duty "loophole" for enveloped commercial property - £1bn+.

It's common for high value commercial property to be sold by selling the single-purpose company in which it's held (or "enveloped").

It's common for high value commercial property to be sold by selling the single-purpose company in which it's held (or "enveloped").

So instead of stamp duty land tax at 5%, the buyer pays stamp duty reserve tax at 0.5% of the equity value or if (as is common) an offshore company is used, no stamp duty at all.

This practice has been accepted by successive Governments for decades. It would be technically straightforward to apply 5% SDLT to such transactions, and this would raise a large amount - over £1bn. taxpolicy.org.uk/2022/10/25/sdl…

6. Increase ATED - £200m+.

The "annual tax on enveloped dwellings" is an obscure tax that was introduced to deter people from holding residential property in single purpose companies to avoid stamp duty.

The "annual tax on enveloped dwellings" is an obscure tax that was introduced to deter people from holding residential property in single purpose companies to avoid stamp duty.

As I wrote here, it's currently failing because it's been set too low, and raises a derisory £111m. There's a good case for tripling it. taxpolicy.org.uk/2022/11/04/ate…

7. Increase inheritance tax on trusts - £500m.

When UK domiciled individuals settle property on trust, the trust is subject to a 6% tax every ten years, and another 6% charge when property leaves the trust.

When UK domiciled individuals settle property on trust, the trust is subject to a 6% tax every ten years, and another 6% charge when property leaves the trust.

This all seems rather a good deal if we compare it to the 40% inheritance tax paid by estates on property that isn't in trust.

These taxes currently raise £1.3bn (on top of the 20% "entry charge" when property goes into trust).

So there's an argument for increasing the rate from 6% to 9% - and that should raise somewhere north of £500m.

So there's an argument for increasing the rate from 6% to 9% - and that should raise somewhere north of £500m.

8. Reverse the Tories' cancellation of the fuel duty rise - £3bn.

For years, Governments have been cancelling scheduled (and budgeted) rises in fuel duty. Most recently, the Conservative Government did that in March, forgoing £3n of revenue. gov.uk/government/new…

For years, Governments have been cancelling scheduled (and budgeted) rises in fuel duty. Most recently, the Conservative Government did that in March, forgoing £3n of revenue. gov.uk/government/new…

It would be easy to reverse that - but (unlike the other tax changes listed here) it would impact people on median/lower incomes.

9. Abolish business asset disposal relief - £1.5bn.

This is a capital gains tax relief supposedly for the benefit of entrepreneurs. But the Treasury officials forced to create it named it "BAD" for a reason.

This is a capital gains tax relief supposedly for the benefit of entrepreneurs. But the Treasury officials forced to create it named it "BAD" for a reason.

The benefit for genuine entrepreneurs is limited (a 10% rather than 20% rate). It's widely exploited. Abolition would raise £1.5bn

10. Council tax increases for valuable property - £1-5bn.

It's indefensible that an average property in Blackpool pays more council tax than a £100m penthouse in Knightsbridge.

It's indefensible that an average property in Blackpool pays more council tax than a £100m penthouse in Knightsbridge.

The obvious answer is to "uncap" council tax so that it bears more relation to the value of the property - either by adding more bands, or applying say 0.5% to all property value over £2m.

Depending on how it was done, this could raise several £1bn. The argument seems compelling for any Government, and particularly a Labour government.

11. Increase vehicle excise duty - £200m+.

VED currently applies at various rates for different vehicles, depending on the type of vehicle, registration date and engine sizes. The average for a car is about £200.

VED currently applies at various rates for different vehicles, depending on the type of vehicle, registration date and engine sizes. The average for a car is about £200.

A £5 increase would raise £200m, and raising £1bn wouldn't be terribly challenging. However it again would impact people on median/lower incomes.

12. End the pension tax free lump sum - £5.5bn.

On retirement, we can withdraw 25% of our pension pot, up to £268k, as a tax free lump sum. The argument for abolition is that most of the benefit goes to people on higher incomes paying a higher marginal rate.

On retirement, we can withdraw 25% of our pension pot, up to £268k, as a tax free lump sum. The argument for abolition is that most of the benefit goes to people on higher incomes paying a higher marginal rate.

The argument against is that people have been paying into their pensions for decades on the promise of the rules working a certain way, and it's unfair to now change that. I agree.

Limiting the benefit to £100,000 would raise £5.5bn. As with the other pension measure, it's a large sum raised with little difficulty. But IMO if the Government decides to raise tax from pensions, changing relief is the better approach.

13. Reduce the VAT registration threshold - £3bn+.

There is compelling evidence that the current £90k threshold acts as a brake on the growth of small businesses, as they manage their turnover to stay under the threshold. taxpolicy.org.uk/vat_brake2

There is compelling evidence that the current £90k threshold acts as a brake on the growth of small businesses, as they manage their turnover to stay under the threshold. taxpolicy.org.uk/vat_brake2

Reducing the threshold so everyone except hobby businesses are taxed would raise at least £3bn, and in the view of many people across the political spectrum, could increase growth. adamsmith.org/blog/is-vat-to…

The economy as a whole would benefit, and small businesses would benefit in the long term. But in the short term there would be many unhappy small businesspeople. I fear this is, therefore, too difficult for any Government to touch.

14. Raise the top rate of income tax - <£1bn. The top rate of income tax (outside Scotland) is currently 45%. The rate was briefly 50% under Gordon Brown - could we return to that?

I would be surprised. It raises very little - raising the top rate is a political signal more than it is a fiscal policy. And any increase would probably break Labour's campaign pledge not to increase income tax.

15. Wealth tax - £1bn to £26bn.

Many campaigning groups are keen on a wealth tax targeted at the very wealthy - e.g. people with assets of more than £10m.

Many campaigning groups are keen on a wealth tax targeted at the very wealthy - e.g. people with assets of more than £10m.

But the practical experience of wealth taxes is that they've been failures, with only a handful of countries retaining a wealth tax.

The recent Spanish tax - which adopted the modish idea of only hitting the very wealthy - raised a pathetic €630m. Another failed wealth tax.

The recent Spanish tax - which adopted the modish idea of only hitting the very wealthy - raised a pathetic €630m. Another failed wealth tax.

The academics on the Wealth Tax Commission recommended against an annual wealth tax, but supported a one-off retrospective tax raising up to £260bn over ten years. ukwealth.tax

My feeling is that such an extraordinary tax would require a specific political mandate, which Labour do not have. And one-off taxes have a habit of not in fact being one-offs

The last four in this list seem unlikely to me. The others are various shades of "plausible" - and they'd together raise around £22bn (if pension tax relief was capped at 25%).

HEALTH WARNING. I am not a political pundit. I have no inside knowledge. My most recent attempt to predict Labour's tax policy was a dismal failure.

So please take the above with a pinch of salt!

So please take the above with a pinch of salt!

The full article is here, with footnotes and links to sources: taxpolicy.org.uk/2024/08/01/rac…

And if you made it this far through a wonkish tax thread and haven't subscribed to free updates from Tax Policy Associates then (1) congratulations, (2) click here.

taxpolicy.org.uk/subscribe

taxpolicy.org.uk/subscribe

• • •

Missing some Tweet in this thread? You can try to

force a refresh