Thinking, Fast and Slow is the best Behavioral Finance book ever.

Here are 10 things I learned from the book:

Here are 10 things I learned from the book:

1️⃣ Our brain uses two systems: System 1 and System 2

System 1 is fast, intuitive and automatic. It is prone to biases and errors such as overconfidence.

System 2 is slow, analytical, and deliberate. It is necessary for complex tasks requiring focused attention.

System 1 is fast, intuitive and automatic. It is prone to biases and errors such as overconfidence.

System 2 is slow, analytical, and deliberate. It is necessary for complex tasks requiring focused attention.

2️⃣ Irrationality

Humans are not rational. We all make a lot of irrational mistakes.

90% of Americans think they can drive better than average and 70% think they are smarter than average.

Humans are not rational. We all make a lot of irrational mistakes.

90% of Americans think they can drive better than average and 70% think they are smarter than average.

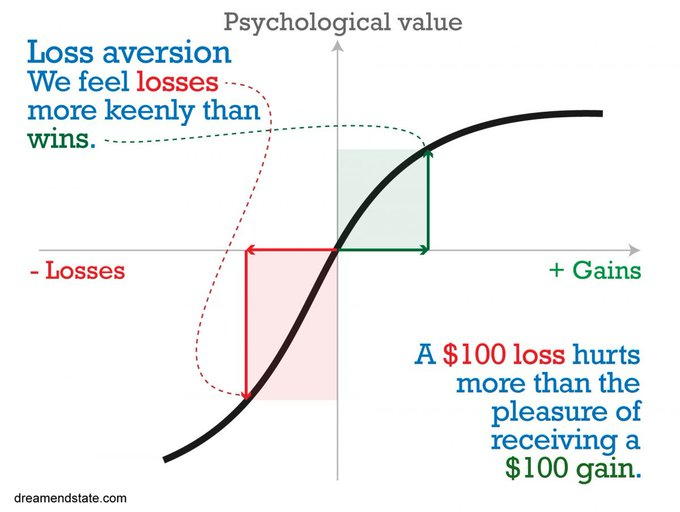

3️⃣ Prospect theory

The prospect theory suggests that people feel losses twice as hard as gains.

Many people don't want to play a Heads or Tails game where they can win $100 but risk losing $50.

You should take this bet every single day.

The prospect theory suggests that people feel losses twice as hard as gains.

Many people don't want to play a Heads or Tails game where they can win $100 but risk losing $50.

You should take this bet every single day.

4️⃣ The Halo Effect

The halo effect is a cognitive bias where your overall impression of a person influences your perception on their individual traits or qualities.

If you like someone, you'll overestimate their capabilities and vice versa.

The halo effect is a cognitive bias where your overall impression of a person influences your perception on their individual traits or qualities.

If you like someone, you'll overestimate their capabilities and vice versa.

5️⃣ Availability heuristic

The availability heuristic is a cognitive bias where you judge the likelihood of an event based on how easily it comes to mind.

A good example is 9/11 which made people afraid of flying.

The availability heuristic is a cognitive bias where you judge the likelihood of an event based on how easily it comes to mind.

A good example is 9/11 which made people afraid of flying.

6️⃣ Sunk cost fallacy

The sunk cost fallacy appears when you keep investing in something even if it's not worth it, simply because you've already invested resources in it.

Think about choosing to finish a boring movie because you already paid for the ticket.

The sunk cost fallacy appears when you keep investing in something even if it's not worth it, simply because you've already invested resources in it.

Think about choosing to finish a boring movie because you already paid for the ticket.

7️⃣ Confirmation bias

People tend to seek out information that confirms their existing beliefs and ignore information that contradicts it.

As an investor, always talk with people who have opposing views. It will be very insightful.

People tend to seek out information that confirms their existing beliefs and ignore information that contradicts it.

As an investor, always talk with people who have opposing views. It will be very insightful.

8️⃣ Hindsight bias

The tendency, after an event has occurred, to believe that one would have predicted or expected the outcome.

A good example is that after attending a baseball game, you might insist that you knew that the winning team was going to win beforehand.

The tendency, after an event has occurred, to believe that one would have predicted or expected the outcome.

A good example is that after attending a baseball game, you might insist that you knew that the winning team was going to win beforehand.

9️⃣ Framing effect

When the way information is presented influences your decisions and perceptions, we call it a framing effect.

For example: studies have shown that 75% lean meat is usually preferred over 25% fat meat, even though it's the same thing.

When the way information is presented influences your decisions and perceptions, we call it a framing effect.

For example: studies have shown that 75% lean meat is usually preferred over 25% fat meat, even though it's the same thing.

🔟 Anchoring effect

The anchoring effect is a bias where you rely too heavily on the first piece of information you receive when making a decision.

If you first see a car that costs $100k and then see a second one that costs $70k, you tend to see the second car as cheap.

The anchoring effect is a bias where you rely too heavily on the first piece of information you receive when making a decision.

If you first see a car that costs $100k and then see a second one that costs $70k, you tend to see the second car as cheap.

That's it for today.

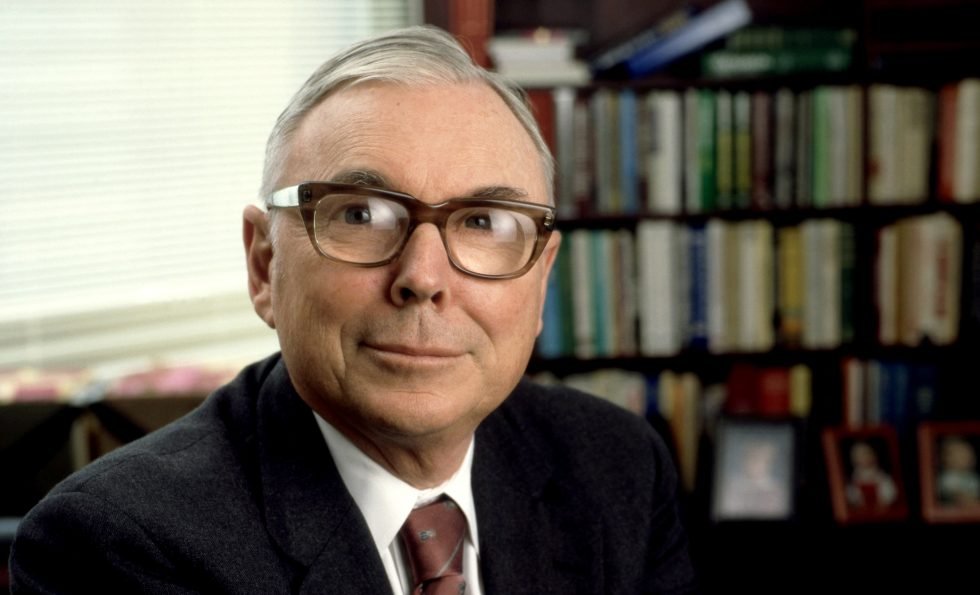

Want to learn more? Grab this PDF with ALL readings of Daniel Kahneman for free: compounding-quality.ck.page/2431dd253e

Want to learn more? Grab this PDF with ALL readings of Daniel Kahneman for free: compounding-quality.ck.page/2431dd253e

• • •

Missing some Tweet in this thread? You can try to

force a refresh