Exploring AI x Crypto 🤖

This sector has seen explosive growth, with numerous projects now valued over a billion dollars with $230M invested in July 2024 alone.

Let's dive into the intersection of decentralized AI and blockchain technology.

🧵⬇️

This sector has seen explosive growth, with numerous projects now valued over a billion dollars with $230M invested in July 2024 alone.

Let's dive into the intersection of decentralized AI and blockchain technology.

🧵⬇️

First, let's break down some key components in AI x Crypto:

1. Decentralized Compute Networks: Networks of GPUs for model training and inference.

2. Model Coordination Platforms: Incentivizing model development and specialized inference settings.

1. Decentralized Compute Networks: Networks of GPUs for model training and inference.

2. Model Coordination Platforms: Incentivizing model development and specialized inference settings.

(continued)

3. AI Tools and Services: Marketplaces for AI models and services.

4. Apps: Consumer and enterprise products leveraging AI models.

Now that we understand the various components, the question remains: what is really going on at the intersection of AI and Crypto?

3. AI Tools and Services: Marketplaces for AI models and services.

4. Apps: Consumer and enterprise products leveraging AI models.

Now that we understand the various components, the question remains: what is really going on at the intersection of AI and Crypto?

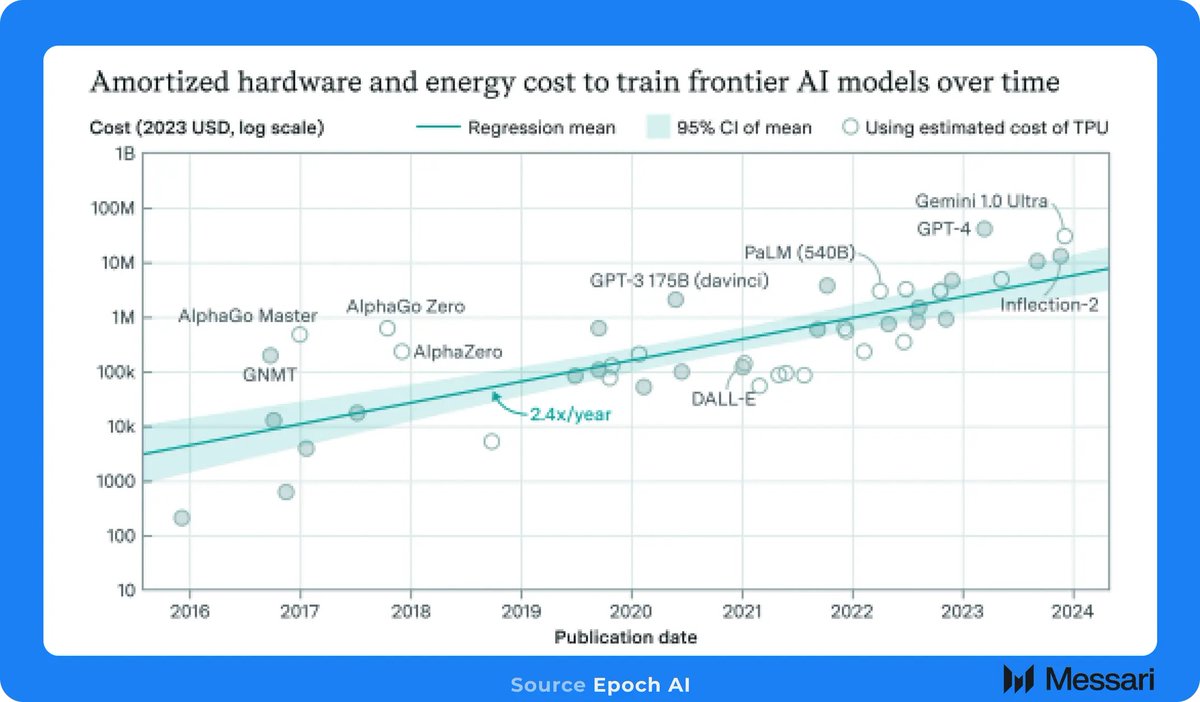

Decentralized AI leverages GPU networks and model coordination to drive innovation.

This approach allows for broad experimentation, contrasting with the centralized, resource-heavy methods of companies like OpenAI and Google DeepMind.

This approach allows for broad experimentation, contrasting with the centralized, resource-heavy methods of companies like OpenAI and Google DeepMind.

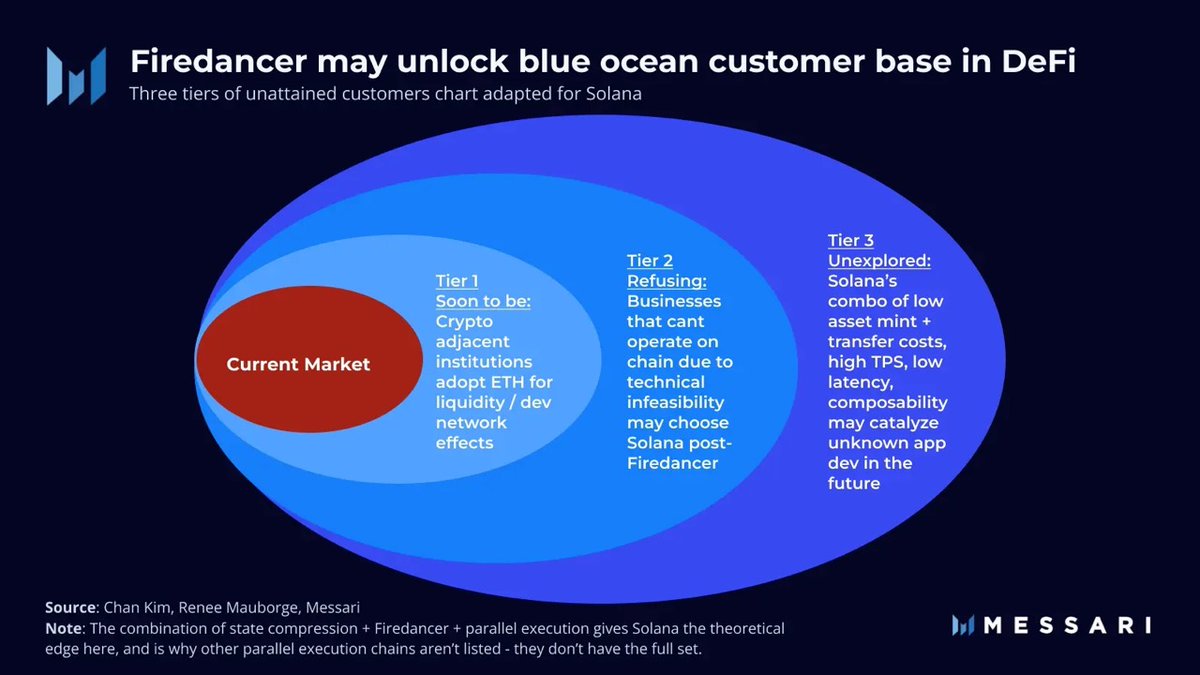

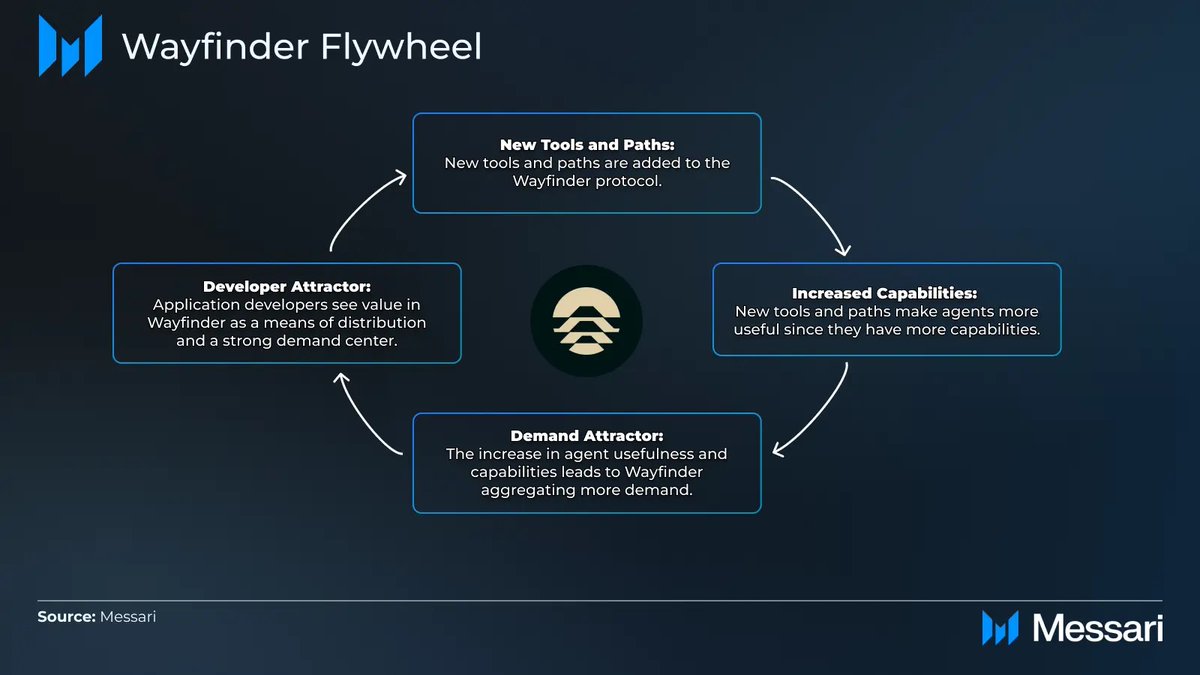

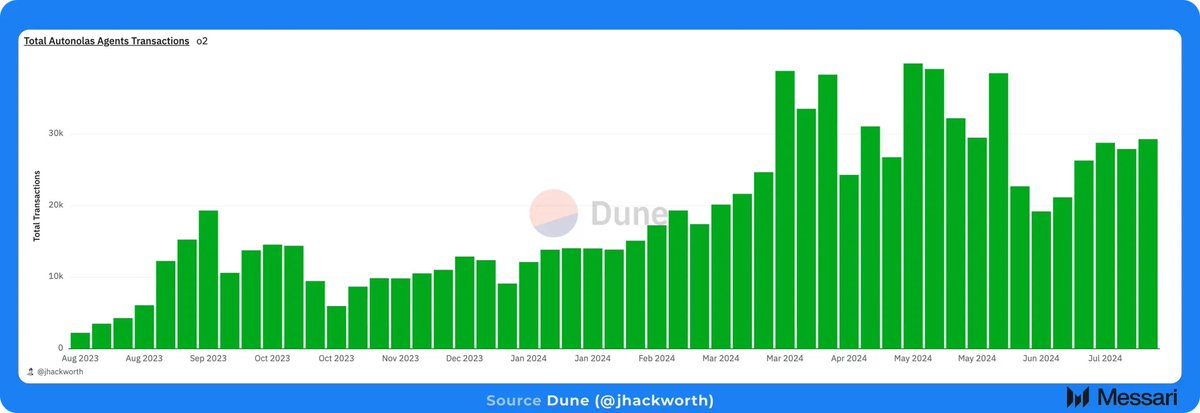

AI agents will soon become autonomous, specialized in tasks, and utilize crypto for transactions.

Platforms like @AIWayfinder will enable AI agents to perform secure onchain actions, such as token swaps and staking, thus integrating AI more deeply into the blockchain ecosystem.

Platforms like @AIWayfinder will enable AI agents to perform secure onchain actions, such as token swaps and staking, thus integrating AI more deeply into the blockchain ecosystem.

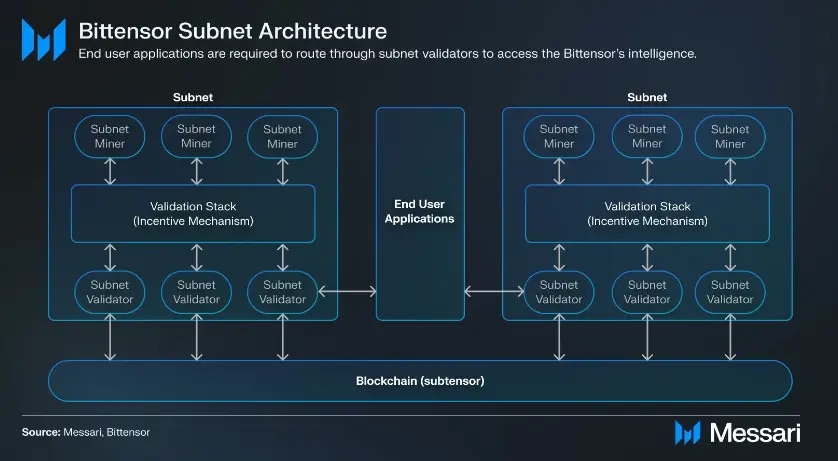

Open-source AI coordination, as seen with Bittensor, provides a sandbox for AI model experimentation. Using token incentives like TAO, these projects foster innovation and collaboration, pushing the boundaries of decentralized AI development.

We believe the future of decentralized AI is bright. As AI agents gain more capabilities, they will significantly increase onchain economic activity.

This evolving intersection of AI and Crypto is poised to transform how we think about and use technology as a whole.

This evolving intersection of AI and Crypto is poised to transform how we think about and use technology as a whole.

For a deeper understanding of the intersection of AI x Crypto, read the full report by @bloomberg_seth ⬇️

messari.co/4dq42L9

messari.co/4dq42L9

• • •

Missing some Tweet in this thread? You can try to

force a refresh