🧵 1/ In light of @Polymarket's recent explosive growth, the ParaFi team has been analyzing on-chain data to understand two critical questions:

1) What factors are driving Polymarket’s recent traction?

2) To what degree is Polymarket’s growth driven by the U.S. election?

As context, ParaFi has been studying and investing in prediction markets since 2018. Today, ParaFi is the single largest investor in Polymarket, having invested in the seed round in 2020 and doubling down in subsequent years.

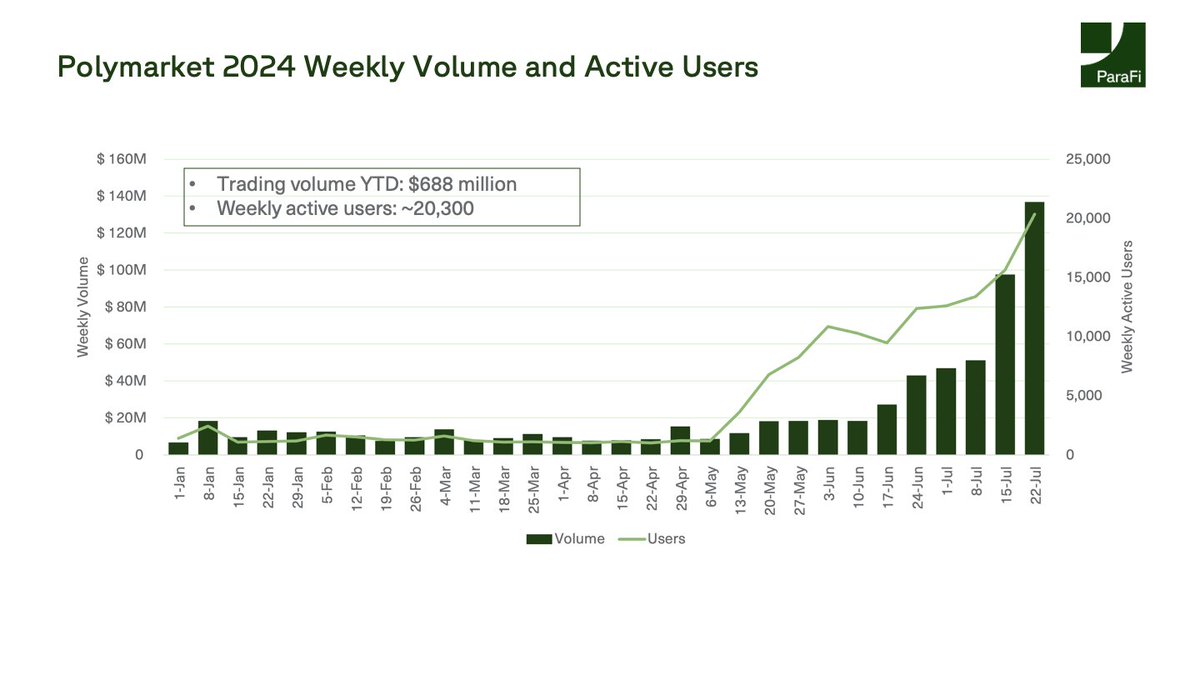

With the 2024 U.S. election approaching, Polymarket has seen $688 million in trading volume year to date and weekly active users grow ~14x from around 1,400 to 20,000+.

However, volumes only tell part of the story. There’s much more to unpack under the hood. ⬇️⬇️⬇️

1) What factors are driving Polymarket’s recent traction?

2) To what degree is Polymarket’s growth driven by the U.S. election?

As context, ParaFi has been studying and investing in prediction markets since 2018. Today, ParaFi is the single largest investor in Polymarket, having invested in the seed round in 2020 and doubling down in subsequent years.

With the 2024 U.S. election approaching, Polymarket has seen $688 million in trading volume year to date and weekly active users grow ~14x from around 1,400 to 20,000+.

However, volumes only tell part of the story. There’s much more to unpack under the hood. ⬇️⬇️⬇️

2/ Polymarket is ubiquitously referenced as a "source of truth" to understand the world’s most critical events in real time, cited by presidential candidates and media sources such as Bloomberg and The Wall Street Journal.

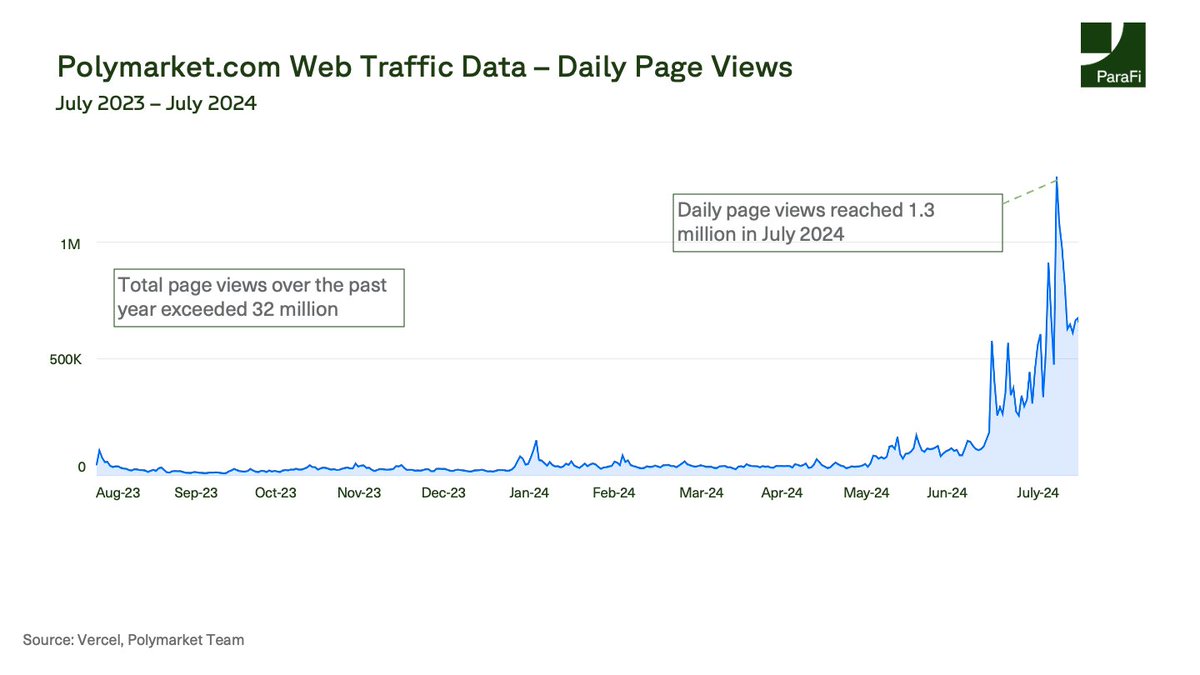

has seen an exponential growth in web traffic. Over the past 12 months, daily page views have grown 10x with cumulative page views crossing 32 million. In the back half of July, daily page views peaked at 1.3 million and daily visitors peaked at 185,000.

With this data, we can see the number of people visiting is several orders of magnitude larger than the number of users actually trading. The popularity of Polymarket shows the platform’s emerging status as a powerful alternative to traditional media.Polymarket.com

Polymarket.com

has seen an exponential growth in web traffic. Over the past 12 months, daily page views have grown 10x with cumulative page views crossing 32 million. In the back half of July, daily page views peaked at 1.3 million and daily visitors peaked at 185,000.

With this data, we can see the number of people visiting is several orders of magnitude larger than the number of users actually trading. The popularity of Polymarket shows the platform’s emerging status as a powerful alternative to traditional media.Polymarket.com

Polymarket.com

3/ Is the election the sole driver of Polymarket adoption? Not quite.

Of the almost 70,000 total addresses that have used Polymarket, only 42% made their first trade in an election-related market. The other 58%, or ~40,000 users, initially traded in non-election markets, including culture, business, science, and macro.

Some of our favorite markets include: Olympic medal count, Taylor Swift’s engagement timeline, and GPT-5 launch date.

Of the almost 70,000 total addresses that have used Polymarket, only 42% made their first trade in an election-related market. The other 58%, or ~40,000 users, initially traded in non-election markets, including culture, business, science, and macro.

Some of our favorite markets include: Olympic medal count, Taylor Swift’s engagement timeline, and GPT-5 launch date.

4/ While first trade activity is more balanced, 70%+ of daily trading volume in dollar terms has been tied to election-related markets in recent weeks. This is not surprising given the proximity and volatility of events surrounding the election.

But other markets have also managed to capture the public’s attention. For instance, in May 2024, the spike in non-election related trading volume was driven by the Ethereum ETF approval market, a market which saw over $13 million in cumulative volume.

Volume in non-election related markets has also surged this year, growing 391% year-to-date.

But other markets have also managed to capture the public’s attention. For instance, in May 2024, the spike in non-election related trading volume was driven by the Ethereum ETF approval market, a market which saw over $13 million in cumulative volume.

Volume in non-election related markets has also surged this year, growing 391% year-to-date.

5/ Of the 28,000+ users who made their first bet in an election-related market, 56% subsequently traded in a different market.

Essentially, almost half of all users who first traded in an election-related market moved on to markets covering topics such as the economy, sports, and crypto.

Essentially, almost half of all users who first traded in an election-related market moved on to markets covering topics such as the economy, sports, and crypto.

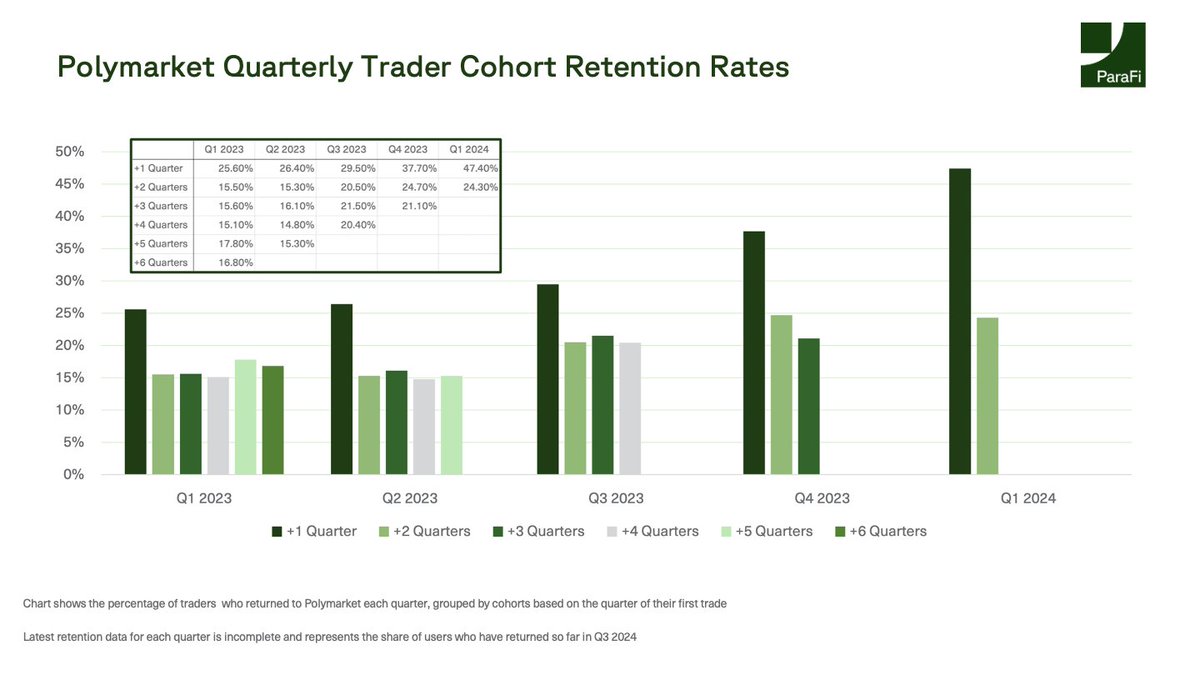

6/ Another testament to the fact that users are sticking around on the platform is the quarterly retention rate of different cohorts. Of the users who joined the platform in Q1 2023, at least 15% of that cohort have used the platform in each of the subsequent quarters.

Perhaps more importantly, there is no sharp deterioration in the retention rate as quarters progress. Roughly the same share of the Q1 2023 cohort returned in Q3 2023 as in Q3 2024 so far.

And with the hype around election related trading, there have actually been slight boosts to retention in more recent quarters as traders from earlier cohorts are motivated to return to the platform.

Retention for more recent cohorts has also been much stronger. Over 45% of users who made their first trade on Polymarket in Q1 2024 made a trade in the following quarter, compared to just 25% of those who first traded in Q1 2023.

Perhaps more importantly, there is no sharp deterioration in the retention rate as quarters progress. Roughly the same share of the Q1 2023 cohort returned in Q3 2023 as in Q3 2024 so far.

And with the hype around election related trading, there have actually been slight boosts to retention in more recent quarters as traders from earlier cohorts are motivated to return to the platform.

Retention for more recent cohorts has also been much stronger. Over 45% of users who made their first trade on Polymarket in Q1 2024 made a trade in the following quarter, compared to just 25% of those who first traded in Q1 2023.

7/ Trading volume also only tells part of the overall trading activity picture. In line with the trends we’ve seen in dollar amount traded and number of users, the number of matched trades on Polymarket has also skyrocketed over the past few months. Daily matched trades have jumped over 3,000% since the start of the year, surpassing 40,000 in the tail end of July.

The higher number of matched trades is not shocking given the rise in other metrics, but it does show that the growth in volume is not just due to users placing higher dollar value bets. The amount of trades actually being facilitated by Polymarket has also been climbing.

Also notable is the recent upward trend in the number of matched trades per day divided by the number of daily active users. While the trend has shown volatility year-to-date, the ratio signals that on average users are more engaged with the platform each day.

The higher number of matched trades is not shocking given the rise in other metrics, but it does show that the growth in volume is not just due to users placing higher dollar value bets. The amount of trades actually being facilitated by Polymarket has also been climbing.

Also notable is the recent upward trend in the number of matched trades per day divided by the number of daily active users. While the trend has shown volatility year-to-date, the ratio signals that on average users are more engaged with the platform each day.

8/ Looking at volume data, power users do not necessarily dominate the platform. We define a power user as someone who has done over $250,000 in trading volume a day at least once. Throughout Q1 and Q2 2024, power users accounted for 51% of daily trading volume on average. But their market share has been declining recently as Polymarket’s user base transitions towards smaller traders.

9/ The ParaFi team is excited to continue monitoring and working with Polymarket in the years ahead. We believe that prediction markets are a valuable tool for humanity – serving as “truth machines” – by leveraging the wisdom of the crowds. Our sense is this is just the beginning for Polymarket.

Thank you so much to @shayne_coplan, @LiamKovatch, @niraek, and the @Polymarket team for their help and feedback on this post!

Thank you so much to @shayne_coplan, @LiamKovatch, @niraek, and the @Polymarket team for their help and feedback on this post!

10/ Disclaimers:

All data is taken from November 21, 2022 through July 29th, 2024 based on the Polymarket central limit order book (excludes automated market maker data).

Election related markets cover sizable (over $1 million in volume) markets related to the outcome of the 2024 U.S. presidential election that were identified by the ParaFi team. Non-Election related markets do include smaller markets tied to politics.

A “user” is defined to be any address that was a maker or a taker for an order on Polymarket.

While all queries utilized for this post were developed by the ParaFi team, we appreciate the existing Dune dashboards by @richardchen3 and @/lifewillbeokay which served as useful inspiration.

The above thread is provided for informational purposes only. It should not be construed as investment advice. Please see for more informationparafi.com/disclosure

All data is taken from November 21, 2022 through July 29th, 2024 based on the Polymarket central limit order book (excludes automated market maker data).

Election related markets cover sizable (over $1 million in volume) markets related to the outcome of the 2024 U.S. presidential election that were identified by the ParaFi team. Non-Election related markets do include smaller markets tied to politics.

A “user” is defined to be any address that was a maker or a taker for an order on Polymarket.

While all queries utilized for this post were developed by the ParaFi team, we appreciate the existing Dune dashboards by @richardchen3 and @/lifewillbeokay which served as useful inspiration.

The above thread is provided for informational purposes only. It should not be construed as investment advice. Please see for more informationparafi.com/disclosure

• • •

Missing some Tweet in this thread? You can try to

force a refresh