1/ A New International Money: $ORE v2

“Every new thing creates two new questions and two new opportunities.”

- Jeff Bezos

With metas on the verge of exhaust, a new international money emerges.

“Every new thing creates two new questions and two new opportunities.”

- Jeff Bezos

With metas on the verge of exhaust, a new international money emerges.

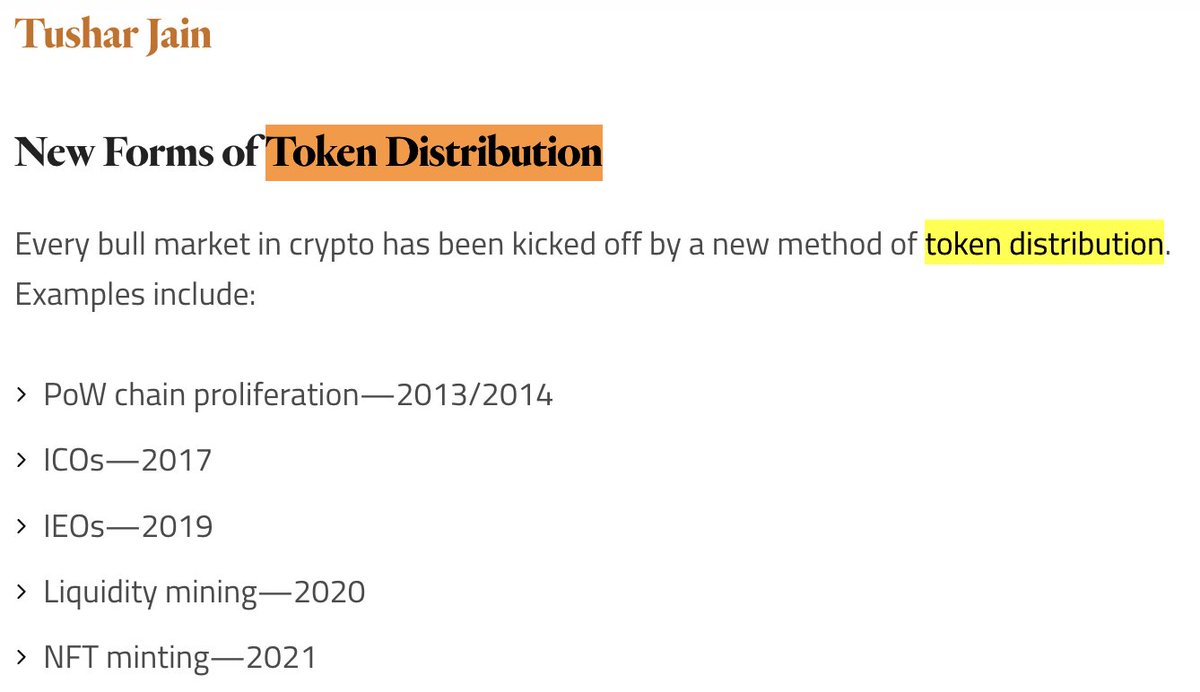

2/ new token distribution mechanisms are always overlooked or even ridiculed at the onset

using proof of work for distribution atop a performant proof of stake chain has the potential to be the next such faded mechanism

using proof of work for distribution atop a performant proof of stake chain has the potential to be the next such faded mechanism

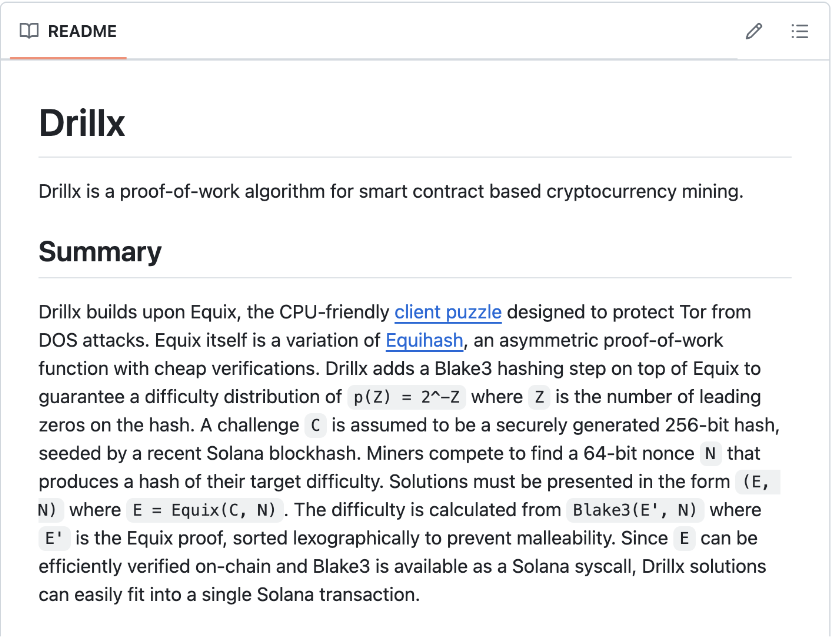

3/ novel distribution alone isn’t enough. Ore innovates at the cryptography level with DrillX, a new mining algorithm allowing anyone the ability to mine – forever.

Compare that to everything else, where asic miners have priced out regular people – forever.

Compare that to everything else, where asic miners have priced out regular people – forever.

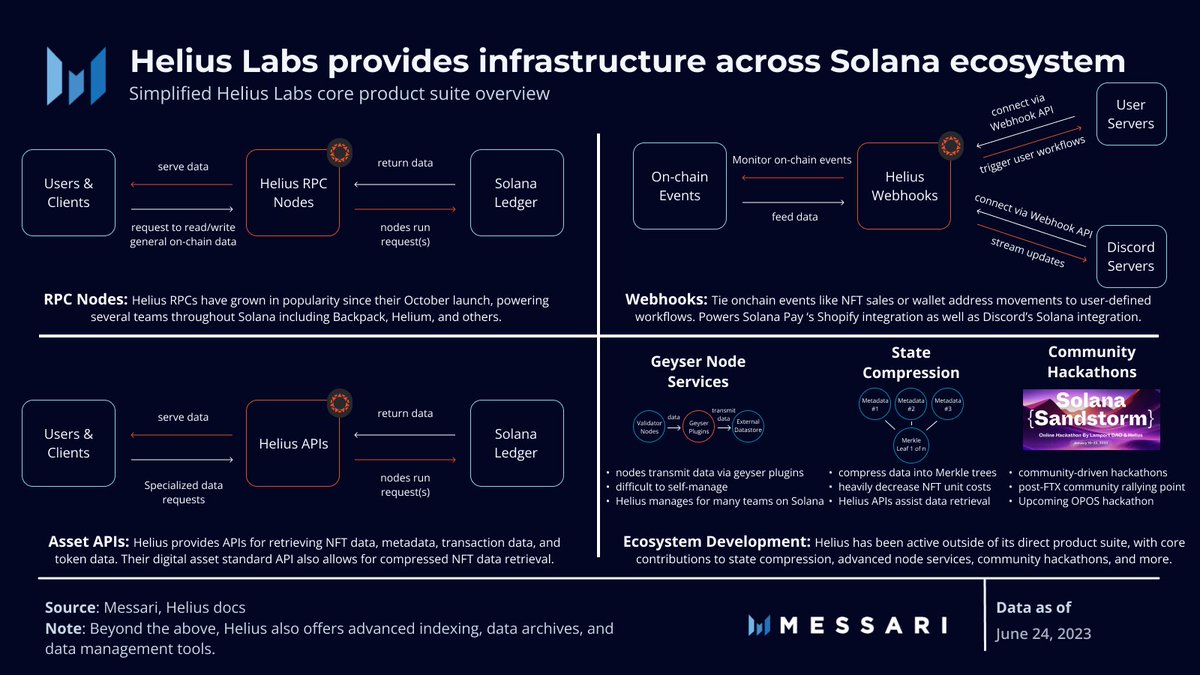

4/ combine that with Solana’s superior speed and cost to transact, and a picture for Ore superiority begins to paint itself

5/ on the other side of this bullish picture is inflation. the top-cited risk for this contender money.

with mining emissions extending to the 2060s or 2070s, Ore inflation will be steep upon the v2 launch.

chart via @N8Solomon

with mining emissions extending to the 2060s or 2070s, Ore inflation will be steep upon the v2 launch.

chart via @N8Solomon

6/ inflation is a valid concern, but:

the point of maximum opportunity for crypto assets has historically been at the point of maximum marginal inflation.

In order to achieve atypical returns, one must accept atypical risks

the point of maximum opportunity for crypto assets has historically been at the point of maximum marginal inflation.

In order to achieve atypical returns, one must accept atypical risks

7/ there’s much more nuance and details to this thesis - please check it out (linked next zeet)

comment or dms open for feedback

huge thanks to the @heliuslabs fam for having me on as a guest! its like seal team solana research over there

comment or dms open for feedback

huge thanks to the @heliuslabs fam for having me on as a guest! its like seal team solana research over there

8/ check out da piece here helius.dev/blog/solana-bu…

• • •

Missing some Tweet in this thread? You can try to

force a refresh