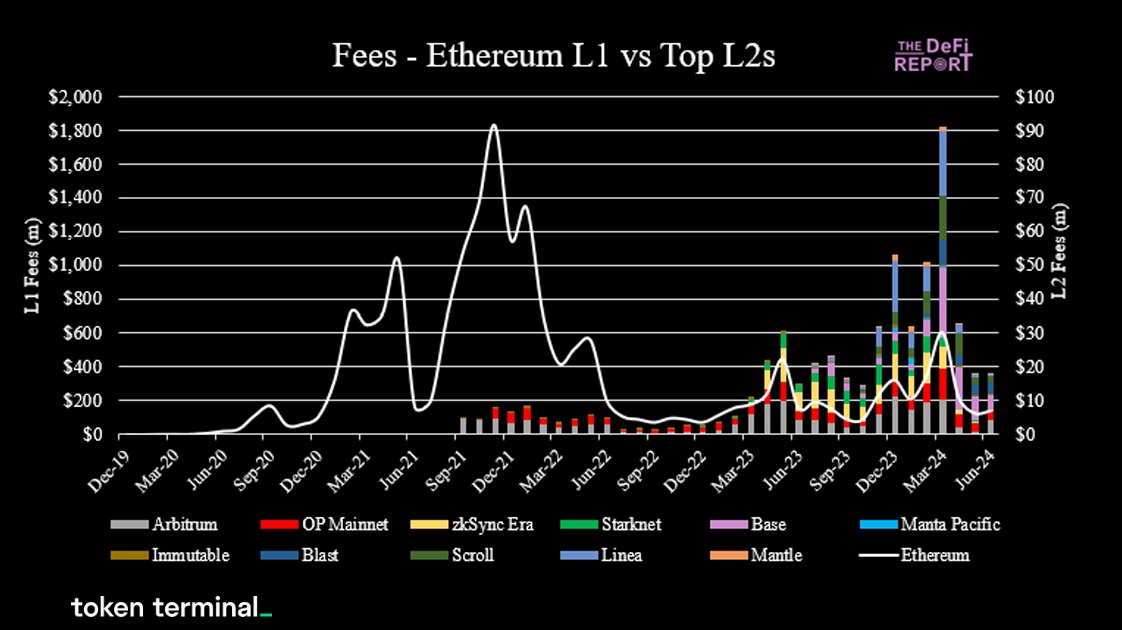

Ethereum fees were down $679m in Q2 (57%), while the network turned inflationary. If you want to understand why, you need to understand this chart.

Here's what's going on:

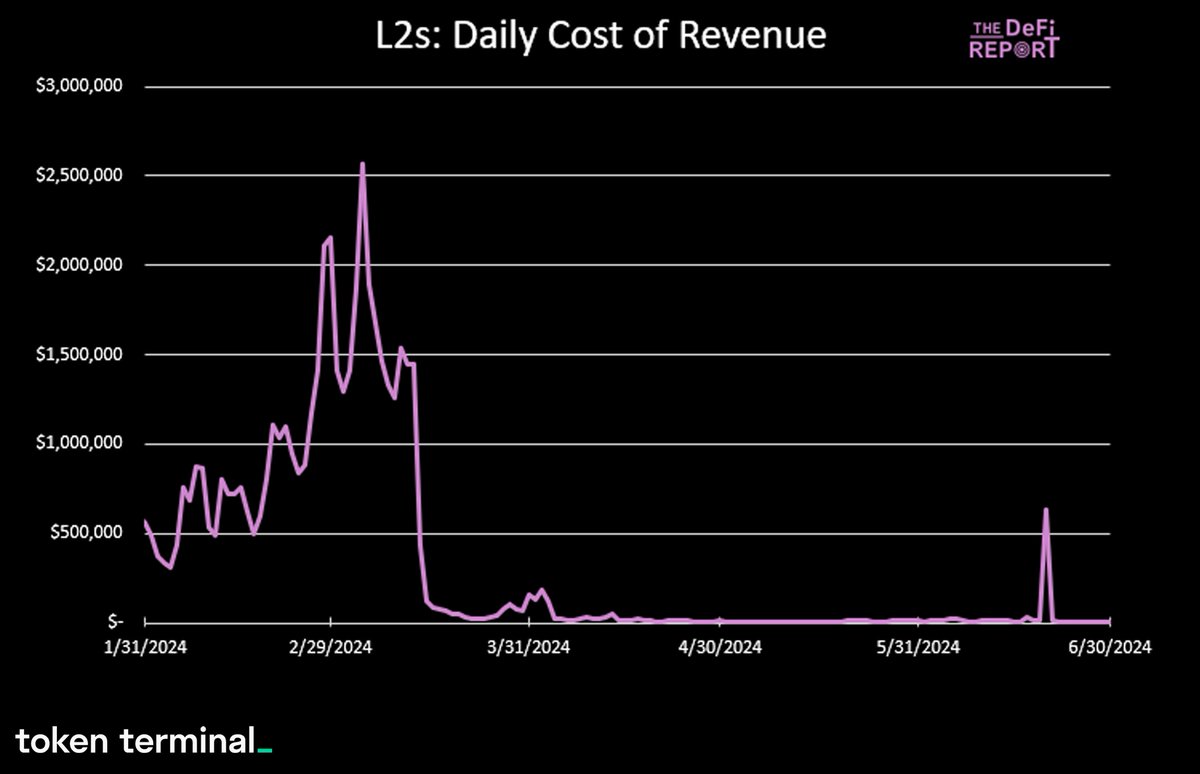

Ethereum Improvement Proposal (EIP) 4844 was implemented on March 13th. It was the most important network upgrade since The Merge as it dramatically increased the scalability of L2s, while lowering fees for users.

You can think of it as the "broadband moment" for Ethereum.

Essentially, what EIP4844 did is improve the way that data is handled on Ethereum by introducing "blobs" — which is just a term for "more data availability."

In essence, the Ethereum Foundation created a new glut of block space — which is the product that blockchains sell.

By increasing the supply of the product, fees dropped.

The result?

L2 margins improved dramatically. L1 fees dropped dramatically.

----

This is all really good for Ethereum. The network is scaling. The UX is improving. The Ethereum Foundation continues to execute.

But if you don't appreciate the nuance, you might look at the financials and think that Ethereum had a really bad quarter.

That's not the case. The reality is that:

- Transactions on L2s were up 63% in Q2.

- Active users on L2s were up 81% in Q2.

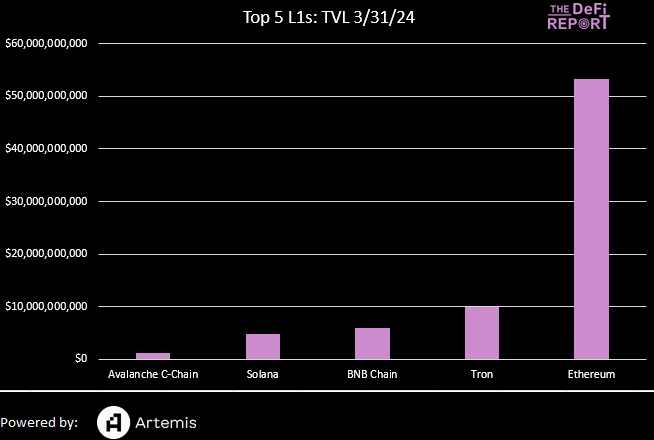

Ethereum's network effects and demand for ETH are growing.

But fees on L2 were down 61% as user activity grew.

----

The takeaway?

Ethereum "disrupted itself" by improving the UX while reducing its economics in the short run.

If past computing movements are any indication, the new supply of block space enabled by EIP4844 will create new use cases (new demand) for developers.

As new demand flocks to the EVM, I would expect Ethereum's economics to improve with it.

Data: L2 combined cost of revenue posted EIP4844 powered by @tokenterminal

[L2s included: @arbitrum , @Optimism , @zksync , @Starknet , @base , @Immutable , @blast , @Scroll_ZKP , @LineaBuild , @0xMantle , @MantaNetwork ]

----

P.S. we covered these concepts in detail in The ETH Report and The Ethereum Investment Framework.

If you'd like to download a free copy, see the link in the first comment 👇

Here's what's going on:

Ethereum Improvement Proposal (EIP) 4844 was implemented on March 13th. It was the most important network upgrade since The Merge as it dramatically increased the scalability of L2s, while lowering fees for users.

You can think of it as the "broadband moment" for Ethereum.

Essentially, what EIP4844 did is improve the way that data is handled on Ethereum by introducing "blobs" — which is just a term for "more data availability."

In essence, the Ethereum Foundation created a new glut of block space — which is the product that blockchains sell.

By increasing the supply of the product, fees dropped.

The result?

L2 margins improved dramatically. L1 fees dropped dramatically.

----

This is all really good for Ethereum. The network is scaling. The UX is improving. The Ethereum Foundation continues to execute.

But if you don't appreciate the nuance, you might look at the financials and think that Ethereum had a really bad quarter.

That's not the case. The reality is that:

- Transactions on L2s were up 63% in Q2.

- Active users on L2s were up 81% in Q2.

Ethereum's network effects and demand for ETH are growing.

But fees on L2 were down 61% as user activity grew.

----

The takeaway?

Ethereum "disrupted itself" by improving the UX while reducing its economics in the short run.

If past computing movements are any indication, the new supply of block space enabled by EIP4844 will create new use cases (new demand) for developers.

As new demand flocks to the EVM, I would expect Ethereum's economics to improve with it.

Data: L2 combined cost of revenue posted EIP4844 powered by @tokenterminal

[L2s included: @arbitrum , @Optimism , @zksync , @Starknet , @base , @Immutable , @blast , @Scroll_ZKP , @LineaBuild , @0xMantle , @MantaNetwork ]

----

P.S. we covered these concepts in detail in The ETH Report and The Ethereum Investment Framework.

If you'd like to download a free copy, see the link in the first comment 👇

If you're interested, you can download a copy of The ETH Report and Investment Framework here: thedefireport.io/eth-report

• • •

Missing some Tweet in this thread? You can try to

force a refresh