DePIN continues to grow 🌐

With fundraising volume up 296% year over year, the total market cap grew 400% to $20 billion.

It’s Time for a #DePIN Sector Update 🧵⬇️

With fundraising volume up 296% year over year, the total market cap grew 400% to $20 billion.

It’s Time for a #DePIN Sector Update 🧵⬇️

1/ Since our last Sector Map, we’ve added four DePIN sub-sectors:

• Decentralized Gaming Infrastructure (DeGIN) - Compute Network

• AI Data Layer - Bandwidth Network

• Robotics - Mobility Network

• Manufacturing - Mobility Network

• Decentralized Gaming Infrastructure (DeGIN) - Compute Network

• AI Data Layer - Bandwidth Network

• Robotics - Mobility Network

• Manufacturing - Mobility Network

2/ Seven of the top eight DePIN protocols by market cap are Digital Resources Networks (DRNs), worth a combined $12.2 billion.

@Helium is the only Physical Resource Network (PRN) that made the top 8.

@Helium is the only Physical Resource Network (PRN) that made the top 8.

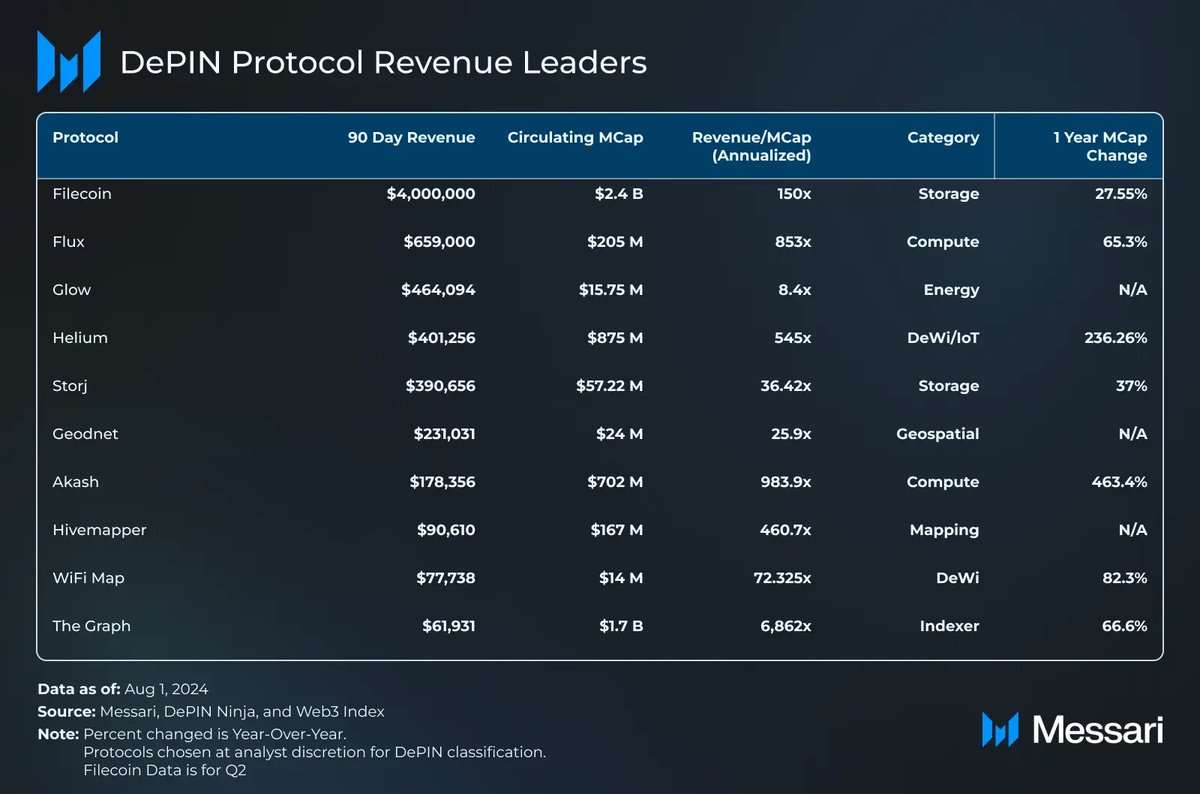

@Filecoin @onlyarweave @graphprotocol @akashnet_ @Theta_Network 3/ However, the growth in market cap did not correlate to an increase in revenue.

Revenue is still significantly low across all of DePIN, with only four of the largest DePIN protocols ranking in the top 8 by revenue.

Revenue is still significantly low across all of DePIN, with only four of the largest DePIN protocols ranking in the top 8 by revenue.

4/ The overall lackluster revenue growth reflects the DePIN sector continuing to be primarily demand-constrained.

Centralized platforms continue to offer more integrated solutions that combine raw resources with customized services.

Centralized platforms continue to offer more integrated solutions that combine raw resources with customized services.

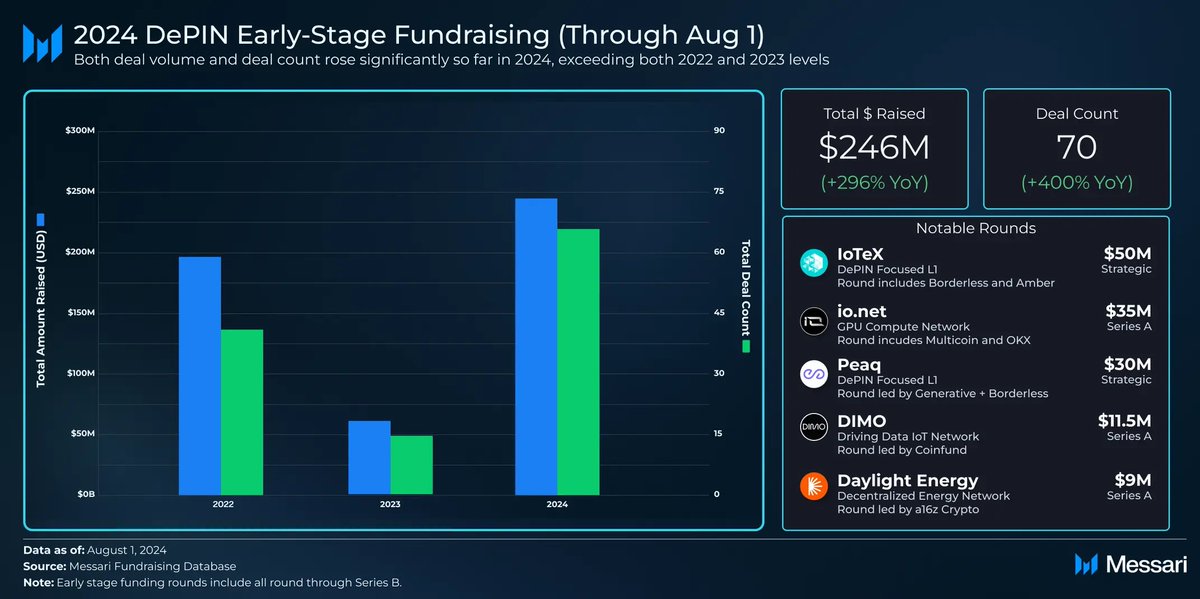

5/ Examining the earliest stage fundraises may point us to where investors see the most potential.

Two of the three largest deals in 2024 are investments in DePIN-tailored L1s, including @iotex_io, which raised a $50 million round, and @peaqnetwork, which raised a $30M round.

Two of the three largest deals in 2024 are investments in DePIN-tailored L1s, including @iotex_io, which raised a $50 million round, and @peaqnetwork, which raised a $30M round.

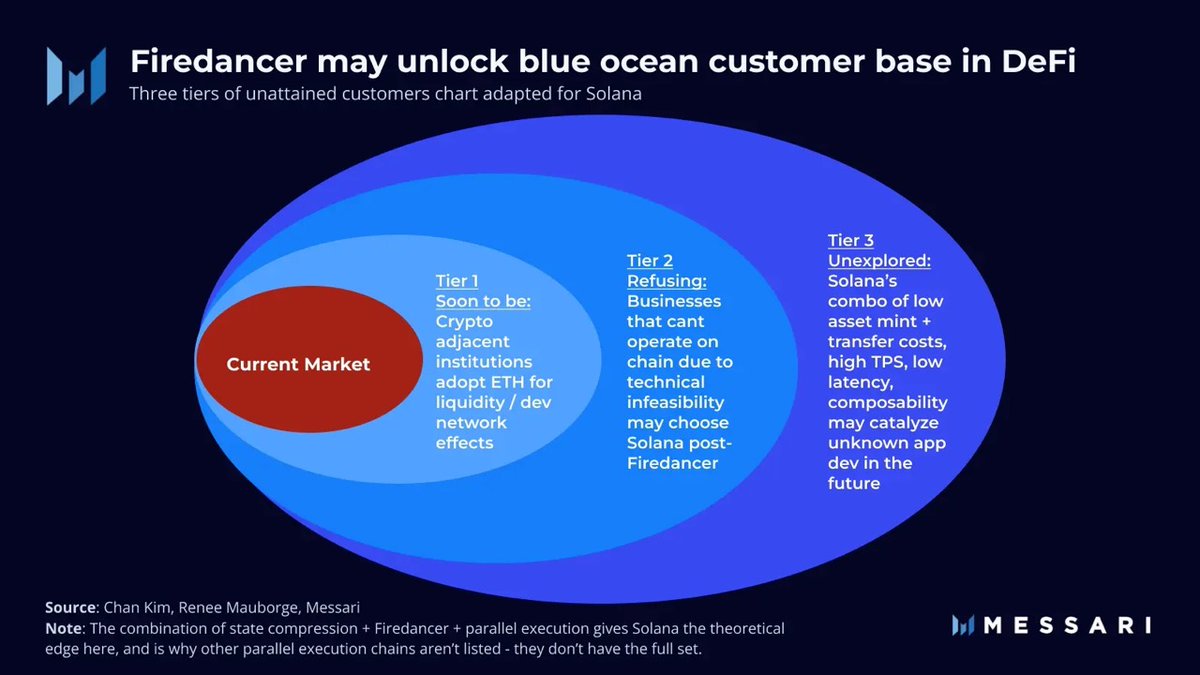

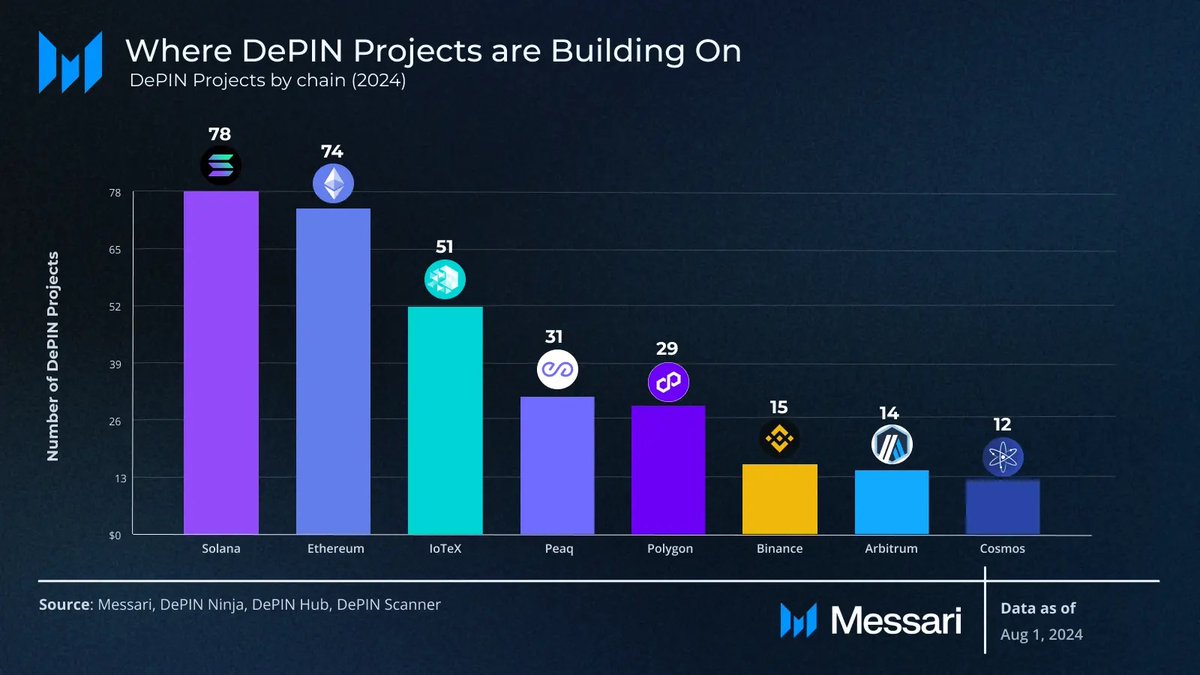

6/ So, what chains are DePIN projects building on?

For now, @Solana leads with an estimated 78 projects built on the network. Meanwhile, DePIN-focused L1s like IoTeX and Peaq are also growing their ecosystems.

For now, @Solana leads with an estimated 78 projects built on the network. Meanwhile, DePIN-focused L1s like IoTeX and Peaq are also growing their ecosystems.

@ethereum @iotex_io @peaqnetwork @0xPolygon @BNBCHAIN @cosmos 7/ Enjoyed the thread?

Explore the latest DePIN report by @dylangbane for a detailed analysis of the growing sector.

messari.co/3LWpgVh

Explore the latest DePIN report by @dylangbane for a detailed analysis of the growing sector.

messari.co/3LWpgVh

• • •

Missing some Tweet in this thread? You can try to

force a refresh